7 Best Payment Options Similar to Affirm for 2025

Buy Now, Pay Later (BNPL) services have revolutionized how we shop, offering the flexibility to get what we need now and pay over time. Affirm is a major player, but the market is filled with excellent alternatives tailored to different needs, from travel financing to credit-building opportunities. Whether you're a consumer seeking more payment freedom or a merchant looking to offer flexible checkout options, understanding the landscape of services similar to Affirm is key. This guide breaks down the top 7 BNPL services, comparing their features, fee structures, and unique benefits to help you make an informed choice.

We'll dive into the specifics of each platform, from interest-free installment plans to longer-term financing for big-ticket items, so you can find the perfect fit for your financial style and goals. Our detailed review covers everything you need to know, including direct links and screenshots for each option, ensuring you have all the information necessary to select the right service. For those with specific needs, exploring broader financial products such as personal loan options for ITIN holders can offer additional flexibility beyond traditional BNPL. This article will help you navigate the top platforms available today, so you can find a payment solution that works for you.

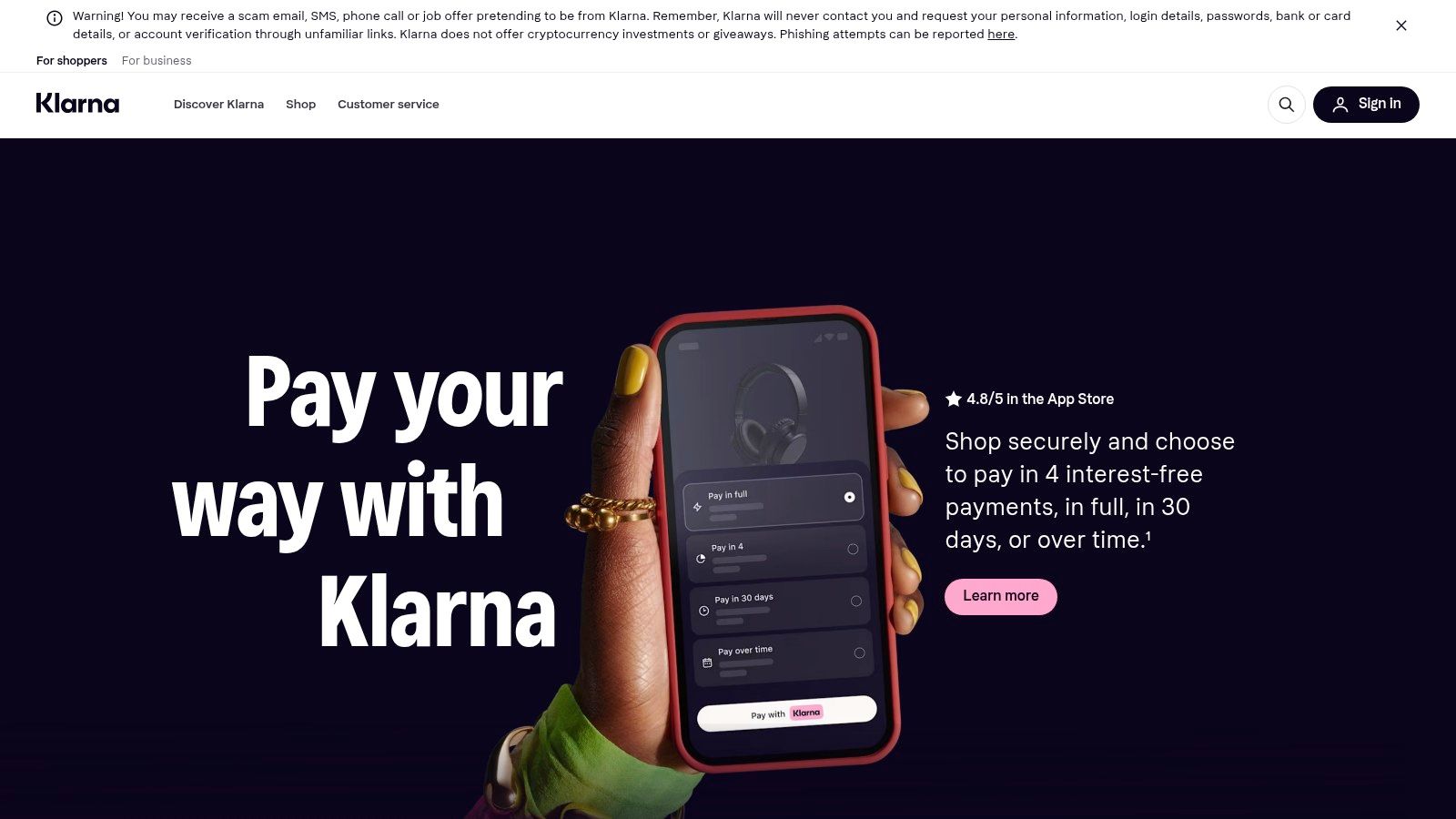

1. Klarna

As a major player in the "Buy Now, Pay Later" (BNPL) space, Klarna presents a highly flexible and feature-rich platform for businesses and consumers looking for payment options similar to Affirm. It offers a suite of payment solutions designed to integrate seamlessly into existing checkout processes, enhancing customer purchasing power and boosting conversion rates. For merchants, particularly those in high-turnover industries, this means offering customers immediate gratification while managing payment collection through a trusted third party.

Core Features and Merchant Benefits

Klarna's standout quality is its variety of payment structures, which caters to different purchase sizes and customer preferences. This adaptability is crucial for businesses aiming to reduce cart abandonment.

- Pay in 4: This option splits a purchase into four equal, interest-free installments paid every two weeks. It's ideal for smaller, everyday purchases and encourages impulse buys without the commitment of long-term debt.

- Pay in 30 Days: Customers can try items before they buy, paying the full amount up to 30 days later with no interest. This is particularly effective for apparel and other industries where returns are common.

- Financing: For larger-ticket items, Klarna provides longer-term financing options, typically ranging from 6 to 24 months. While this may involve interest (APR), it makes high-cost products more accessible.

Integration is straightforward, with plugins and APIs available for major e-commerce platforms like Shopify, Magento, and WooCommerce. The merchant dashboard provides clear insights into transaction data and settlement reports.

User Experience and Uniqueness

From the consumer's perspective, Klarna is more than just a payment service; it's a comprehensive shopping app. It includes a shopping directory, price drop alerts, and exclusive deals. A key differentiator is the Klarna Card and the one-time virtual card feature, which allows users to leverage Klarna's payment plans even at merchants who haven't directly integrated the service, essentially expanding its use to any retailer that accepts Visa.

Practical Tip: Merchants can leverage Klarna's marketing tools and shopping app to get their products featured, driving traffic and reaching a user base actively looking for flexible payment solutions.

This app-centric ecosystem creates a loyal user base, which partner merchants can tap into. For businesses, this means not just offering a payment method, but gaining access to a new marketing channel.

- Website: https://www.klarna.com/us

2. Afterpay

Afterpay is a prominent service offering payment solutions similar to Affirm, built around a straightforward "Pay in 4" model. It empowers customers to split their purchases into manageable installments, making it an excellent tool for merchants aiming to increase order values and reduce cart abandonment. The platform's core philosophy is to provide a simple, interest-free option for everyday spending, which resonates strongly with consumers who prefer budgeting over long-term credit commitments.

Core Features and Merchant Benefits

Afterpay's primary strength lies in its simplicity and transparency, which helps build consumer trust and drives conversions. Merchants benefit from taking the full payment upfront while Afterpay handles the collection process, assuming all fraud and repayment risk.

- Pay in 4: The flagship feature splits a purchase into four equal, interest-free payments. The first installment is due at checkout, with the remaining three paid every two weeks over a six-week period.

- Monthly Payments: For higher-value items, select merchants can offer Afterpay's monthly financing. This option extends repayment over 6 or 12 months but does involve interest, positioning it for larger, considered purchases.

- In-Store and Online: Afterpay offers a seamless omnichannel experience. Customers can use the Afterpay Card in their digital wallet (Apple Pay or Google Pay) for tap-to-pay transactions in physical stores, bridging the gap between online and brick-and-mortar retail.

Integration is simple with dedicated plugins for platforms like Shopify, BigCommerce, and Wix, allowing merchants to get started quickly.

User Experience and Uniqueness

From a user standpoint, Afterpay is designed for ease and responsible spending. Its mobile app is central to the experience, allowing users to shop, manage orders, track payments, and even reschedule a due date if needed. A key differentiator is the Pulse Rewards program, which incentivizes on-time payments with benefits like exclusive offers and the ability to postpone payments.

Practical Tip: Merchants should prominently display the Afterpay logo on product pages and at checkout. Highlighting the installment amount (e.g., "or 4 interest-free payments of $25") can significantly lift conversion rates by making the price point seem more attainable.

The platform’s simple fee structure, with late fees capped at 25% of the order value in the US, is clear and predictable for consumers. This transparency and user-centric approach have helped Afterpay build a large, loyal network of shoppers that merchants can directly access.

- Website: https://www.afterpay.com/en-us

3. PayPal Pay Later

Leveraging one of the world's most ubiquitous payment networks, PayPal Pay Later integrates "Buy Now, Pay Later" (BNPL) functionality directly into its existing, trusted ecosystem. This makes it an incredibly accessible option for both merchants and consumers seeking solutions similar to Affirm. For the millions of businesses that already accept PayPal, enabling these flexible payment options is often a simple, seamless process, providing an immediate way to boost conversions by offering customers more ways to pay.

Core Features and Merchant Benefits

PayPal Pay Later's strength lies in its familiar and straightforward payment structures, which are designed to cover a wide range of purchase values and reduce friction at checkout. The clear terms are a significant benefit for merchants aiming to build customer trust.

- Pay in 4: This plan splits purchases between $30 and $1,500 into four equal, interest-free payments made every two weeks. It's a powerful tool for increasing sales on lower-priced goods and services.

- Pay Monthly: For larger purchases from $49 up to $10,000, customers can select financing plans lasting from 3 to 24 months. These plans come with a fixed APR (ranging from 9.99% to 35.99%), making high-ticket items more manageable for shoppers.

Because it's part of the PayPal suite, integration is native for merchants already using the platform. For new merchants, setting up PayPal checkout automatically includes the potential to offer these BNPL solutions. The platform also offers Purchase Protection on eligible items, adding another layer of security for consumers.

User Experience and Uniqueness

For consumers, the primary advantage is convenience and trust. Anyone with a PayPal account can see their Pay Later options during checkout without needing a separate signup or approval process. The approval decision is typically instantaneous. A key differentiator is its sheer merchant acceptance. Since it's built into the standard PayPal button, Pay Later is available at millions of online stores globally, far exceeding the reach of many standalone BNPL providers.

Practical Tip: Merchants can highlight the "No Late Fees" policy for Pay in 4 plans in their marketing materials. This can be a significant motivator for customers who are wary of the potential hidden costs associated with some BNPL services.

The service's transparency, with clear published limits and APRs, combined with its widespread availability, makes it a reliable and powerful alternative in the flexible payments landscape.

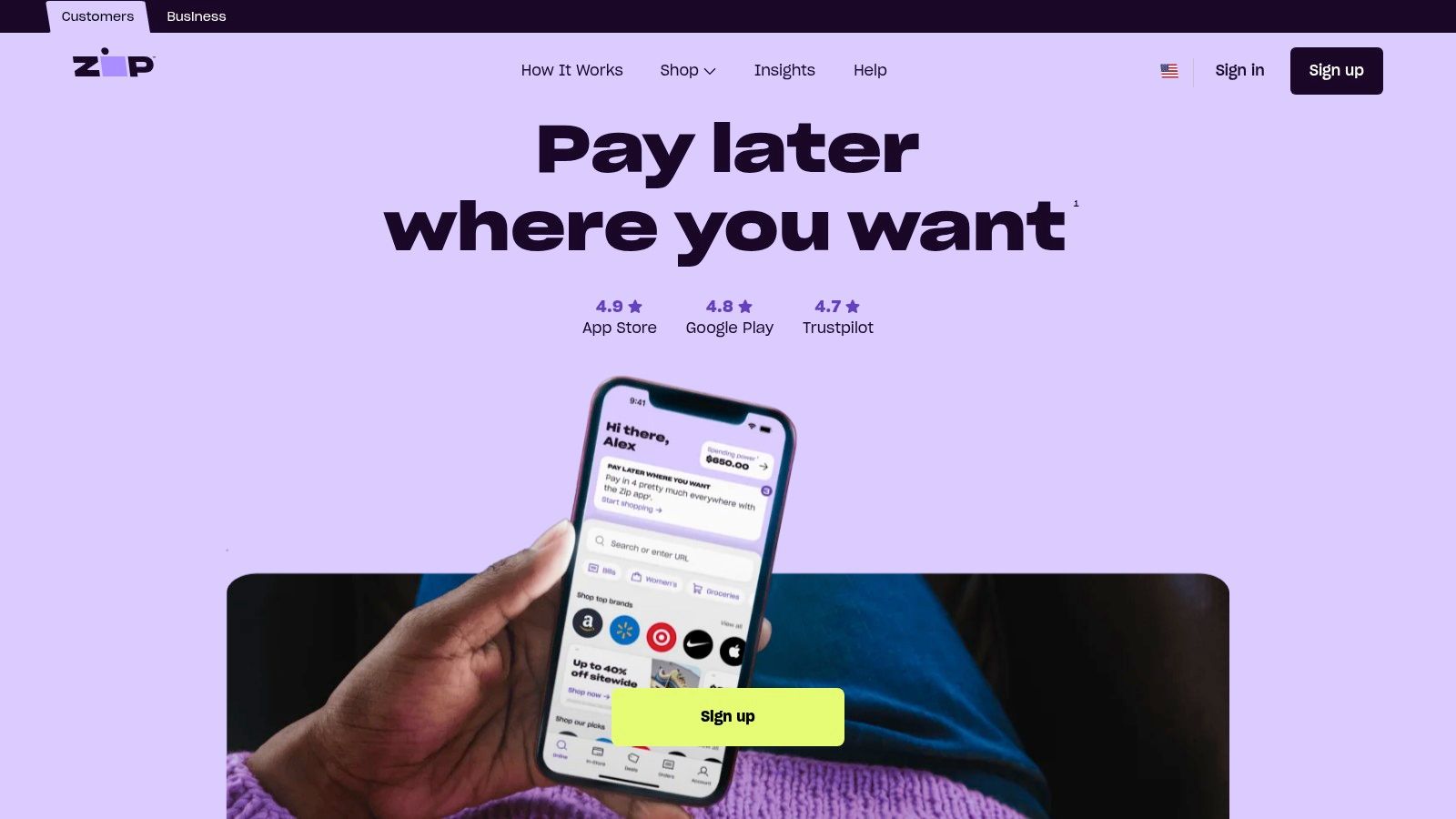

4. Zip (formerly Quadpay)

As another strong contender for businesses and shoppers looking for services similar to Affirm, Zip (formerly Quadpay) carves out its niche with a straightforward and highly accessible "Pay in 4" model. It empowers consumers to split any purchase into four interest-free installments over six weeks, significantly lowering the upfront cost barrier for everyday and larger-ticket items. For merchants, integrating Zip means offering a simple, transparent payment solution that can capture sales that might otherwise be lost due to price sensitivity.

Core Features and Merchant Benefits

Zip's core strength lies in its simplicity and universal applicability, which benefits both integrated partners and retailers who are not formally partnered. This flexibility is a key advantage for expanding customer reach.

- Pay in 4: The standard offering splits the total cost into four equal payments. The first is due at checkout, and the remaining three are automatically charged every two weeks. This predictable schedule is easy for customers to manage.

- Virtual Card Technology: Zip’s app allows users to generate a single-use virtual Visa card, which can be used to pay almost anywhere online or in-store where Visa is accepted. This feature dramatically expands the service's utility beyond a closed network of partner merchants.

- Increased Spending Power: Zip rewards responsible usage by gradually increasing a user's spending limit, encouraging repeat business and larger purchases over time.

For businesses, implementation is streamlined with support for major e-commerce platforms. The primary benefit is offering a well-known, trusted BNPL option that simplifies the checkout process and encourages higher order values.

User Experience and Uniqueness

Zip’s user experience is heavily centered around its mobile app. The app is not just a payment tool but a comprehensive shopping assistant that includes a store directory, exclusive deals, and cashback offers. A standout feature is the ability for users to reschedule a payment date for a small fee, offering a degree of flexibility that is not always available with other BNPL services.

The platform's key differentiator is its virtual card, which untethers the user from a specific network of partner stores. This universal acceptance means a merchant's customer can use Zip at their store even without a direct integration, though formal partnership provides better marketing exposure and a smoother checkout flow.

Practical Tip: Merchants should highlight Zip's virtual card usability in their marketing. Letting customers know they can use their existing Zip account at your store, even without a formal checkout button, can be a powerful way to attract savvy BNPL users.

This app-driven, flexible approach makes Zip a compelling alternative for consumers who value convenience and broad usability.

- Website: https://zip.co/us

5. Sezzle

Sezzle positions itself as a purpose-driven "Buy Now, Pay Later" solution, offering a straightforward and often interest-free way for consumers to manage purchases. For merchants, Sezzle provides a reliable tool to increase basket sizes and customer loyalty by breaking down costs into manageable installments. As an alternative similar to Affirm, its core value lies in providing financial empowerment to users while driving incremental sales for businesses.

Core Features and Merchant Benefits

Sezzle’s primary offering is its classic split-payment model, which is highly effective for converting shoppers who might be hesitant about upfront costs. The platform is designed for easy integration and immediate impact on key sales metrics.

- Pay in 4: The flagship feature splits a purchase into four interest-free payments spread over six weeks. This simple, transparent structure is ideal for everyday items and helps reduce cart abandonment at checkout.

- Pay in 2: A shorter-term option for smaller purchases, splitting the cost into two interest-free payments over two weeks.

- Pay Monthly: For larger, more considered purchases, Sezzle offers longer-term financing that may include interest (APR), making high-ticket products more affordable for a wider audience.

Merchants benefit from a straightforward integration process with major e-commerce platforms. The service pays the merchant the full purchase amount upfront, minus a fee, completely removing the risk of customer non-payment.

User Experience and Uniqueness

Sezzle's key differentiator is its focus on building consumer credit. The Sezzle Up program allows users to opt-in to have their payment history reported to credit bureaus, offering a tangible path to improving their credit score through responsible spending. This unique benefit creates a strong incentive for consumers to choose Sezzle over competitors.

The Sezzle Anywhere virtual card further enhances its utility, allowing users to shop with Sezzle's payment plans at nearly any online store that accepts Visa, even if the merchant isn't a direct partner. This massively expands the platform's reach and convenience for the end user.

Practical Tip: Merchants can highlight the Sezzle Up credit-building feature in their marketing to attract financially savvy customers who are looking for more than just a payment plan. This can be a powerful conversion tool.

This combination of flexible payments and a unique credit-building opportunity makes Sezzle a compelling option for both consumers seeking financial control and merchants aiming to attract a loyal, responsible customer base.

- Website: https://sezzle.com

6. Uplift

Carving out a specific niche within the Buy Now, Pay Later industry, Uplift offers a compelling financing solution for businesses and consumers focused exclusively on travel. As an alternative similar to Affirm, it allows travelers to book their dream vacations, flights, and cruises today and spread the cost over manageable monthly payments. This model is particularly powerful for travel merchants, as it helps convert high-consideration purchases by removing the immediate financial barrier, turning lookers into bookers.

Core Features and Merchant Benefits

Uplift’s strength lies in its deep integration with the travel booking ecosystem, partnering directly with major airlines, cruise lines, hotels, and vacation package providers. This specialized focus provides a seamless checkout experience for a typically high-ticket sector.

- Travel-Specific Financing: The platform is purpose-built to handle the complexities of travel purchases, including flights, hotel stays, cruises, and all-inclusive packages.

- Fixed Monthly Payments: Customers receive a clear, simple loan with a fixed interest rate (APR based on credit) and predictable monthly payments over terms ranging from 3 to 24 months.

- No Hidden Fees: Uplift is transparent about its costs, with a standout policy of no late fees or prepayment penalties, which builds consumer trust and reduces friction.

- Simple Integration: For travel partners, Uplift integrates directly into the booking path, offering financing as a payment option right at the point of sale, which is proven to increase average order value.

By making large travel expenses more digestible, merchants can significantly boost conversion rates and encourage customers to upgrade their travel plans.

User Experience and Uniqueness

From the user’s perspective, Uplift’s application process is quick and non-intrusive, providing an instant decision without leaving the travel partner's website. Its uniqueness comes from being entirely dedicated to travel, meaning its risk models and user journey are optimized for this specific type of purchase. Unlike general BNPL providers, Uplift understands the travel booking cycle. A key differentiator is that it reports payments to credit bureaus, allowing responsible users to potentially build their credit history while financing their trips.

Practical Tip: Travel agencies and tour operators can leverage Uplift to create more appealing, high-value packages. By advertising a low monthly payment instead of a large lump sum, you make premium experiences feel much more attainable to a wider audience.

While its APR can be high depending on credit, the platform’s transparency and focus on a single vertical make it an essential tool for any business in the travel and tourism industry.

- Website: https://www.uplift.com

7. Bread Pay (Bread Financial)

Targeting businesses with higher average order values, Bread Pay offers a robust white-label financing solution that stands as a compelling alternative for merchants seeking options similar to Affirm. Unlike platforms that direct customers to a branded app, Bread Pay embeds directly into the merchant's site, providing a seamless checkout experience that keeps the customer journey within the retailer's ecosystem. It focuses on longer-term installment loans for larger purchases, making it an ideal choice for industries like home goods, fitness equipment, and healthcare.

Core Features and Merchant Benefits

Bread Pay's primary strength lies in its ability to handle big-ticket items through straightforward, longer-term financing. This helps merchants increase conversion rates on expensive products by making them more affordable over time. The platform is backed by a reputable U.S. lender, Comenity Capital Bank, which adds a layer of trust and reliability.

- Embedded Pre-Qualification: Customers can check their eligibility for financing early in the shopping process with a simple, soft credit check that doesn’t impact their credit score. This upfront clarity helps build purchasing confidence.

- Long-Term Installment Loans: The platform typically offers financing terms ranging from 12 to 36 months, which is well-suited for high-cost products that need to be broken down into manageable monthly payments.

- Promotional 0% APR: A key marketing tool for merchants, Bread Pay allows for promotional 0% APR offers on select purchases, which can be a powerful incentive to close a sale.

Integration is facilitated through APIs and pre-built plugins for major e-commerce platforms. Bread Pay is also expanding its in-store presence through partnerships with POS systems like Clover, creating an omnichannel financing solution.

User Experience and Uniqueness

From the customer's perspective, the experience is designed to be frictionless and native to the merchant’s website. There is no redirection to a third-party site, which maintains brand consistency and reduces checkout friction. The lack of prepayment penalties gives customers flexibility, allowing them to pay off their loan early without extra fees.

A key differentiator is its white-label nature. While other BNPL services promote their own brand, Bread Pay allows the merchant’s brand to remain front and center. This is crucial for businesses focused on building long-term customer loyalty and maintaining full control over their brand experience.

Practical Tip: Merchants in the home improvement or jewelry sectors can use Bread Pay's 0% APR promotions during peak seasons to significantly boost sales of high-margin items, framing the offer as an exclusive brand-sponsored financing deal.

This merchant-centric approach makes Bread Pay a strategic tool not just for payment processing but for brand reinforcement and customer retention.

Buy Now Pay Later Services Comparison

| Service | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| Klarna | Moderate (app, virtual card) | Moderate (app development, partnerships) | Flexible short & long-term payments | Everyday shopping, large purchases | Wide acceptance, mix of payment options |

| Afterpay | Low (simple Pay in 4 & card) | Low (payment plan management) | Interest-free short-term payments | Small to medium purchases, in-store & online | Transparent fees, easy in-store usability |

| PayPal Pay Later | Low (integrates with PayPal) | Low (existing PayPal accounts) | Interest-free and monthly options | Broad online shopping | Massive acceptance, no late fees on Pay in 4 |

| Zip | Moderate (virtual card app) | Moderate (app & card issuance) | Flexible payment date adjustments | Online & in-store purchases | Virtual card usability, cashback offers |

| Sezzle | Moderate (virtual card, credit) | Moderate (credit reporting) | Flexible short & long-term financing | Shopping with credit building option | Credit building, diverse payment plans |

| Uplift | Moderate (travel partners) | Moderate (travel integrations) | Fixed monthly payments, no late fees | Travel expenses | Travel-focused, no late fees, credit reporting |

| Bread Pay | Moderate (merchant integrations) | Moderate (financing setup) | Longer-term financing with promos | Large ticket items like home, fitness, healthcare | Promotional 0% APR, clear payment schedules |

Choosing the Right BNPL Service For Your Needs

Navigating the landscape of "Buy Now, Pay Later" (BNPL) services can feel complex, but understanding the core differences between providers is the first step toward making an informed decision. We've explored a range of top-tier services, from global giants like Klarna and Afterpay to specialized options like Uplift, each offering unique benefits for both merchants and consumers. The key takeaway is that the best solution hinges entirely on your specific business model, target audience, and operational priorities.

While traditional BNPL services excel at boosting conversion rates by offering consumer credit at the point of sale, they come with their own set of considerations. These often include integration complexities, transaction fees, potential chargebacks, and the necessity of Know Your Customer (KYC) compliance. For many businesses, especially those in high-risk or privacy-focused sectors, these factors can introduce significant friction and operational overhead.

Key Factors in Your Decision-Making Process

As you evaluate which service is the right fit, move beyond a simple fee comparison. Consider the complete picture of how a payment solution will integrate into your ecosystem. Here are the critical factors to weigh:

- Audience Demographics: Does your customer base prefer traditional credit options, or are they more inclined toward privacy-centric, digital-native payment methods like cryptocurrency? Services like Sezzle may appeal to a younger demographic, while your audience might be ready for more innovative solutions.

- Risk and Chargebacks: For industries targeted by fraud, such as gaming, online casinos, or hosting providers, the finality of crypto transactions offers a powerful defense against chargebacks. Traditional BNPL services still operate within the legacy financial system, leaving you exposed.

- Global Reach and Accessibility: Are you serving an international customer base? Crypto payments are borderless by nature, eliminating the complexities of cross-border fees and currency conversions that can complicate services like PayPal Pay Later or Zip.

- Operational Sovereignty: Do you want immediate access to your funds, or are you comfortable with settlement delays? Crypto gateways deposit funds directly into your wallet, giving you complete control and liquidity without waiting for bank transfers.

Bridging Traditional Convenience with Modern Efficiency

The evolution of payment technology means you no longer have to choose between offering customer convenience and achieving operational efficiency. While platforms similar to Affirm provide a valuable tool for consumer financing, the rise of crypto payment gateways presents a compelling alternative for the merchant side of the equation.

For businesses like DAOs, VPN providers, and online pharmacies, a no-KYC, decentralized payment rail is not just a preference-it's a necessity. By embracing this technology, you can significantly reduce transaction fees, eliminate chargeback risks, and provide a secure, private checkout experience. The ideal strategy may involve a hybrid approach: offering a traditional BNPL option for one customer segment while leveraging a crypto gateway like ATLOS to streamline your core payment infrastructure. Ultimately, empowering your business with financial sovereignty and operational agility is the most powerful choice you can make.

Ready to move beyond the limitations of traditional payment systems? While options similar to Affirm focus on consumer credit, ATLOS Crypto Payment Gateway empowers your business with direct, secure, and instant crypto payments. Take control of your revenue, eliminate chargebacks, and accept global payments without KYC by visiting the ATLOS Crypto Payment Gateway website today.