7 Best Companies Like PayPal for Your Business in 2025

PayPal has long been a dominant force in online payments, offering a familiar and relatively straightforward way for businesses to send and receive money. However, the digital commerce landscape is complex. High fees, account limitations, and the rise of new payment technologies like cryptocurrency mean that relying solely on one provider might not be the most strategic choice. For businesses seeking lower costs, better international transaction support, or the ability to tap into the growing crypto market, exploring companies like PayPal is no longer just an option, it's a necessity for growth and resilience.

This guide will compare seven top-tier alternatives, helping you identify the perfect payment solution to match your specific business needs, whether you're a high-risk merchant, a global freelancer, or a cutting-edge DAO. We'll dive deep into what makes each one stand out, from Stripe's developer-centric tools to ATLOS's seamless no-KYC crypto payments, providing you with the actionable insights needed to make an informed decision. For many online businesses, it's also crucial to evaluate how payment alternatives integrate with popular e-commerce platforms like Shopify to ensure a smooth checkout experience. Each option in our list includes screenshots, direct links, and a clear breakdown of features to simplify your evaluation process.

1. ATLOS: The No-KYC Gateway for Modern Crypto Payments

For businesses seeking companies like PayPal but with a focus on cryptocurrency and autonomy, ATLOS presents a compelling, forward-thinking solution. It’s a crypto payment gateway designed for the modern web, directly addressing the pain points of traditional processors by eliminating mandatory Know Your Customer (KYC) requirements and lengthy account approvals. This design is particularly beneficial for high-risk or emerging sectors such as online gaming, VPN services, and DAOs, allowing them to accept a wide range of cryptocurrencies almost instantly.

ATLOS operates on a core philosophy of 'your keys, your crypto.' This non-custodial approach means funds are sent directly to your personal wallet, giving you complete and immediate control without a third-party intermediary holding your assets. This model significantly enhances security and removes the risk of a platform freezing your account, a common concern for businesses that face scrutiny from conventional payment systems.

Standout Features and Use Cases

- Instant Onboarding: The absence of KYC and account approvals means you can integrate ATLOS and start processing payments in minutes, not weeks.

- Broad Crypto Support: ATLOS supports a wide spectrum of cryptocurrencies, offering flexibility for both merchants and their global customer base.

- White-Label Solution: Businesses can fully customize the checkout experience to match their branding, providing a seamless and trust-building process for customers.

- Recurring Payments: The platform includes functionality for recurring billing, making it ideal for subscription-based models common in software, content, and service industries.

Key Insight: The lack of KYC is not just about speed; it's a fundamental feature for privacy-centric businesses and their customers, fostering trust and reducing onboarding friction to near zero.

Practical Implementation

An online subscription service for a privacy-focused software can integrate ATLOS to accept recurring monthly payments in Bitcoin or Ethereum. Using the white-label solution, they customize the checkout to match their brand. When a customer pays, the funds arrive directly in the company's hardware wallet, bypassing intermediary risks.

| Feature | ATLOS Advantage |

|---|---|

| Account Approval | Instant, no KYC required |

| Fund Custody | Non-custodial (direct to your wallet) |

| Business Types | Ideal for high-risk, privacy-focused, and DAOs |

| Customization | Full white-label branding for checkout |

While pricing details are not public and require direct contact, the platform’s value lies in its security, speed, and autonomy. However, businesses without in-house developers may need technical support for optimal integration.

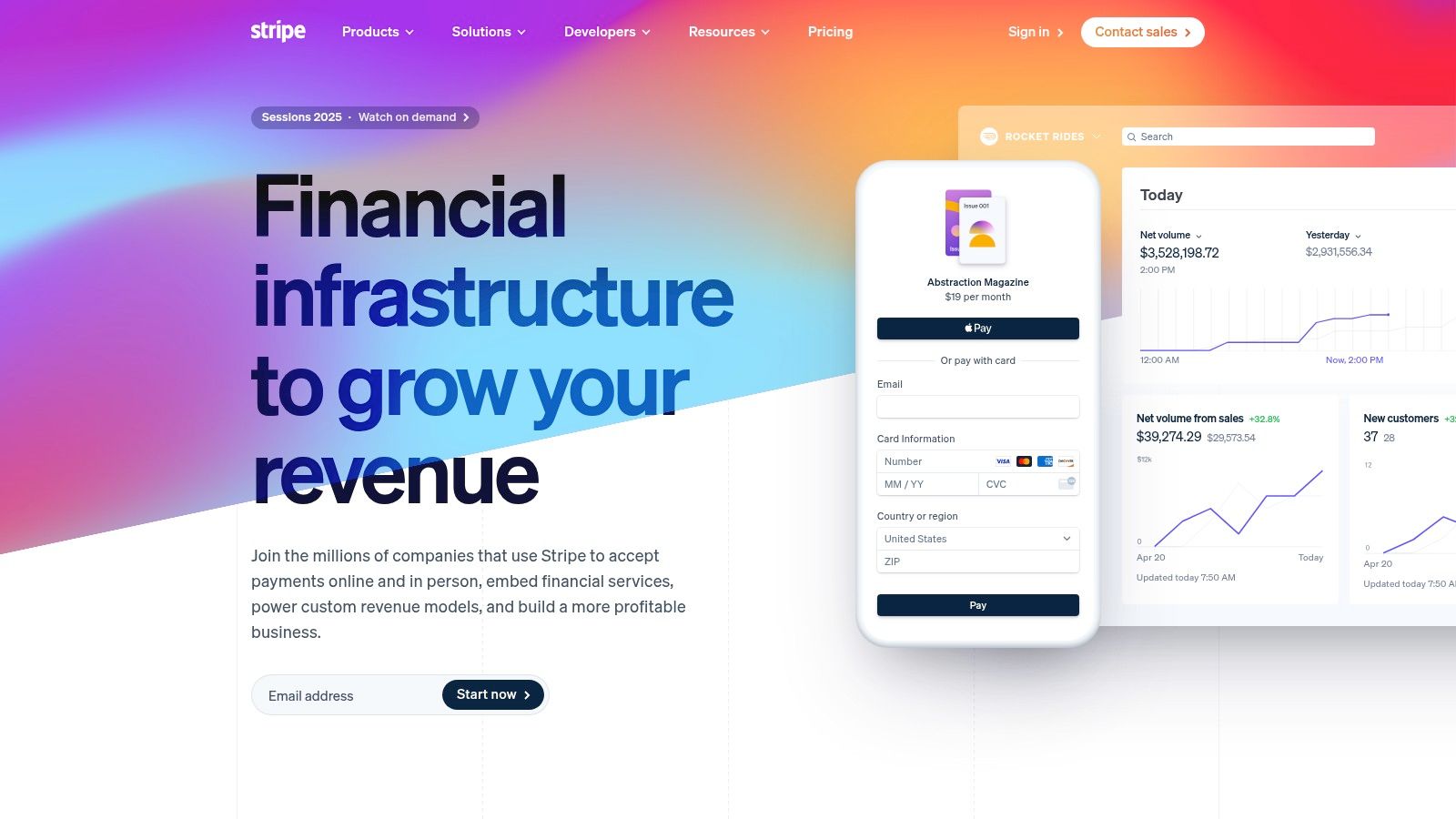

2. Stripe: The Developer-First Global Payments Platform

For businesses prioritizing flexibility, scalability, and robust developer tools, Stripe stands as a premier alternative among companies like PayPal. It provides a comprehensive, full-stack payment infrastructure designed to power online and in-person commerce globally. Stripe is renowned for its clean APIs and extensive documentation, making it the go-to choice for tech-savvy businesses that want to build custom payment flows and integrate deeply with their existing software stack.

Stripe's core philosophy centers on providing developers with the building blocks to create unique and powerful commerce experiences. Unlike more rigid, out-of-the-box solutions, Stripe offers a modular suite of products that handle everything from simple one-time charges and subscriptions to complex marketplace payouts and fraud prevention. This approach empowers businesses to tailor their payment systems precisely to their needs, supporting growth from a small startup to a large enterprise without switching providers.

Standout Features and Use Cases

- Developer-Centric APIs: Stripe’s well-documented APIs and SDKs are its main draw, allowing for deep customization and seamless integration into any application.

- Global Payment Methods: It supports over 100 payment methods, including credit cards, digital wallets (Apple Pay, Google Pay), and local options, enabling businesses to sell to customers worldwide.

- Integrated Product Suite: Beyond payments, Stripe offers tools for billing, invoicing, fraud detection (Radar), and issuing corporate cards, creating a unified financial ecosystem.

- Transparent Pricing: Its standard pricing is a clear, pay-as-you-go model with no monthly fees, setup costs, or long-term contracts for the basic plan.

Key Insight: Stripe’s true power is its API-first design. This allows businesses to treat payments as a programmable part of their infrastructure, enabling sophisticated, automated financial operations that competitors cannot easily match.

Practical Implementation

A SaaS company can use Stripe Billing to manage complex subscription tiers, prorated charges, and free trials automatically. By integrating Stripe's API, they can build a custom checkout flow directly within their application. When a customer signs up, Stripe handles the recurring payments, and its fraud tool, Radar, automatically screens transactions for risk, minimizing manual review and chargebacks.

| Feature | Stripe Advantage |

|---|---|

| Account Approval | Quick online setup, typically within 1-2 business days |

| Fund Custody | Custodial, with payouts on a standard T+2 day schedule |

| Business Types | Ideal for SaaS, e-commerce, platforms, and marketplaces |

| Customization | Highly customizable via robust APIs and developer tools |

Standard pricing is 2.9% + $0.30 per successful card charge in the US, with additional fees for international cards and currency conversions. While its developer-focused nature requires technical resources for custom implementations, the platform’s scalability and comprehensive feature set provide immense long-term value.

3. Square: The Omnichannel Solution for Modern Commerce

For businesses looking for companies like PayPal that seamlessly bridge online and in-person sales, Square offers an incredibly robust and user-friendly ecosystem. It’s an all-in-one payment processor designed for speed and simplicity, especially for small to midsize businesses that need a unified system for their physical storefront, e-commerce site, invoices, and mobile payments. Square eliminates the need for a traditional merchant account, allowing businesses to start accepting payments almost immediately with transparent, flat-rate pricing.

Square's strength lies in its cohesive hardware and software integration. From a simple magstripe reader for your phone to a sophisticated point-of-sale (POS) terminal, the hardware works in perfect sync with its powerful software suite. This creates a single source of truth for all sales data, whether a customer pays online via a payment link, in-person with a tap, or through an invoice. This unified approach simplifies reporting, inventory management, and customer relationship management.

Standout Features and Use Cases

- Fast Onboarding: Like many modern processors, Square allows you to sign up and begin processing payments the same day without a lengthy merchant account application.

- Unified Commerce Tools: The platform supports a wide range of payment methods including payment links, subscriptions, an online store builder, and QR code payments. It also integrates popular options like Cash App Pay and Afterpay.

- Robust POS System: Square's POS hardware and software are top-tier, making it an ideal choice for businesses with a physical presence, such as retail shops, cafes, or service providers.

- Flexible Fund Access: Standard transfers arrive the next business day, but for a 1.75% fee, you can access your funds instantly or on the same day.

Key Insight: Square’s true power is its omnichannel capability. A business can manage its entire sales operation-from a brick-and-mortar store to its e-commerce checkout-within a single, integrated platform, drastically reducing complexity.

Practical Implementation

A local coffee shop can use a Square POS system for in-store orders and also build an online store using Square Online to sell coffee beans nationwide. They can send Square Invoices to corporate clients for catering orders. All sales, whether in-person, online, or invoiced, are tracked in one central dashboard, simplifying their accounting and inventory management.

| Feature | Square Advantage |

|---|---|

| Account Approval | Instant, no separate merchant account needed |

| Fund Custody | Custodial with next-day, same-day, or instant transfers |

| Business Types | Ideal for retail, restaurants, services, and e-commerce |

| Customization | Strong POS and online store builder integrations |

Square’s transparent pricing is a major draw: 2.6% + $0.10 for in-person and 2.9% + $0.30 for online transactions in the US, with no monthly fees for basic processing. However, high-volume businesses might find interchange-plus pricing models more cost-effective.

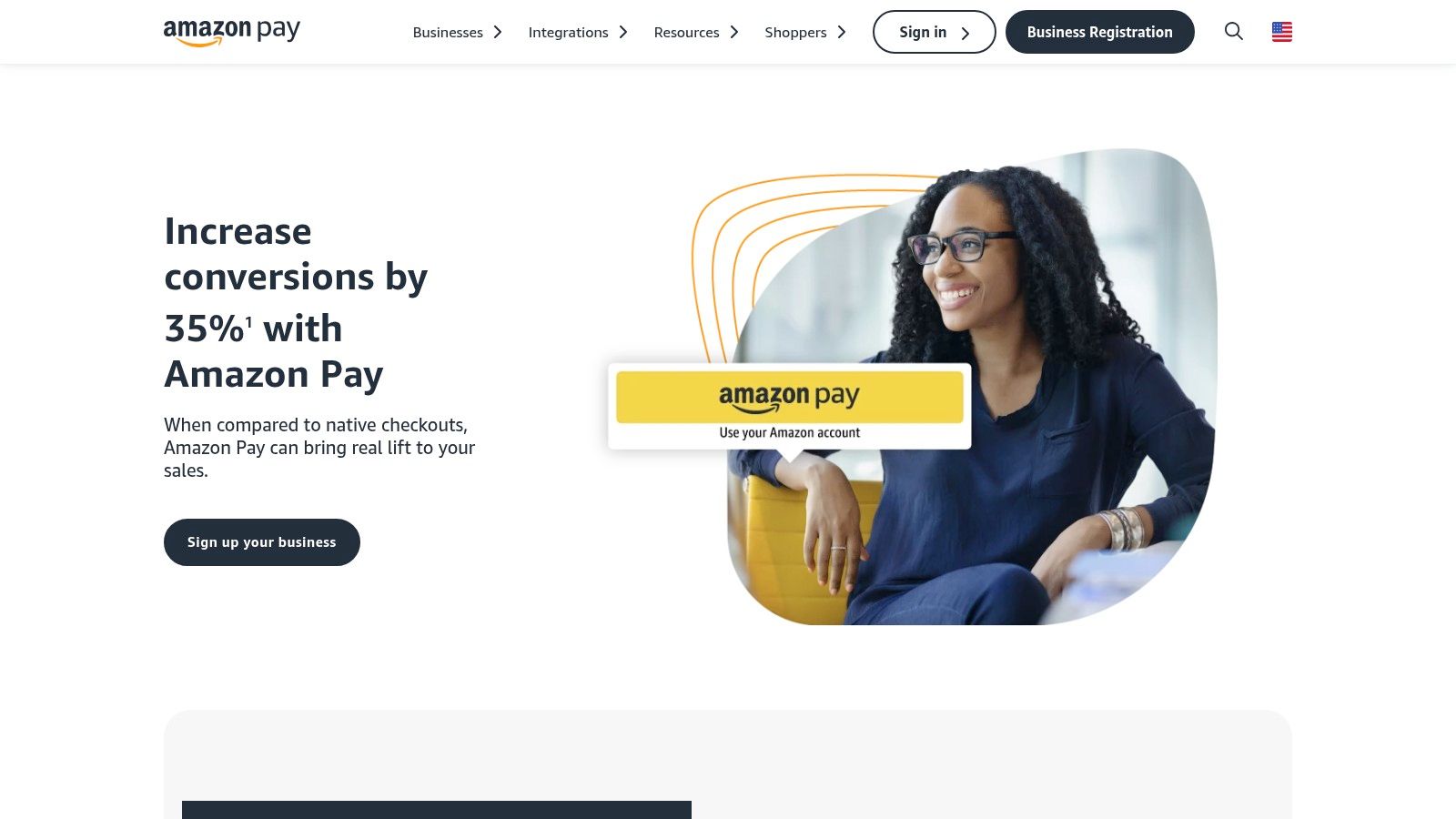

4. Amazon Pay: Leveraging Trust to Streamline Checkout

For businesses looking for companies like PayPal that can instantly boost conversion rates by leveraging brand familiarity, Amazon Pay offers a powerful solution. It isn’t a full-fledged payment processor but rather a streamlined checkout method that allows hundreds of millions of Amazon customers to pay on third-party websites using the payment details already stored in their Amazon accounts. This removes a major point of friction in the sales funnel: manual entry of shipping and credit card information.

By adding a "Pay with Amazon" button to your checkout process, you tap into the immense trust and security associated with the Amazon brand. This can be particularly effective for mobile shoppers, where typing in long forms is cumbersome and leads to higher cart abandonment rates. The system also supports innovative use cases like voice-based payments through Alexa, opening new channels for frictionless commerce for eligible merchants.

Standout Features and Use Cases

- Frictionless Checkout: Customers complete purchases in a few clicks by logging into their Amazon account, dramatically speeding up the process.

- No Setup or Monthly Fees: Merchants only pay a per-transaction fee, making it a cost-effective addition to an existing payment stack.

- Leveraged Brand Trust: The Amazon logo can significantly increase customer confidence, leading to higher conversion rates.

- Alexa Integration: Eligible businesses can enable customers to make purchases or pay for services using voice commands, a unique feature for recurring orders or simple transactions.

Key Insight: Amazon Pay's primary value is not as a standalone processor but as a conversion-boosting tool. It seamlessly integrates with your existing setup to capture sales from customers who trust the Amazon ecosystem.

Practical Implementation

An e-commerce store selling consumer electronics can add Amazon Pay as a checkout option alongside their primary processor. A customer shopping on their mobile device sees the familiar button, logs into their Amazon account, and confirms the purchase without ever needing to pull out their credit card. This simple addition helps capture an audience that values speed and security.

| Feature | Amazon Pay Advantage |

|---|---|

| Account Approval | Integrates with your existing merchant account |

| Fund Custody | Funds are processed and subject to a rolling reserve (e.g., 7 days) |

| Business Types | Ideal for e-commerce, retail, and subscription services |

| Primary Benefit | Increased conversion and trust through a familiar checkout flow |

Pricing is transparent, with domestic US transactions costing 2.9% + $0.30. However, new merchants should be aware of the tiered reserve policy, which can temporarily hold a portion of funds to manage risk, potentially impacting cash flow in the short term.

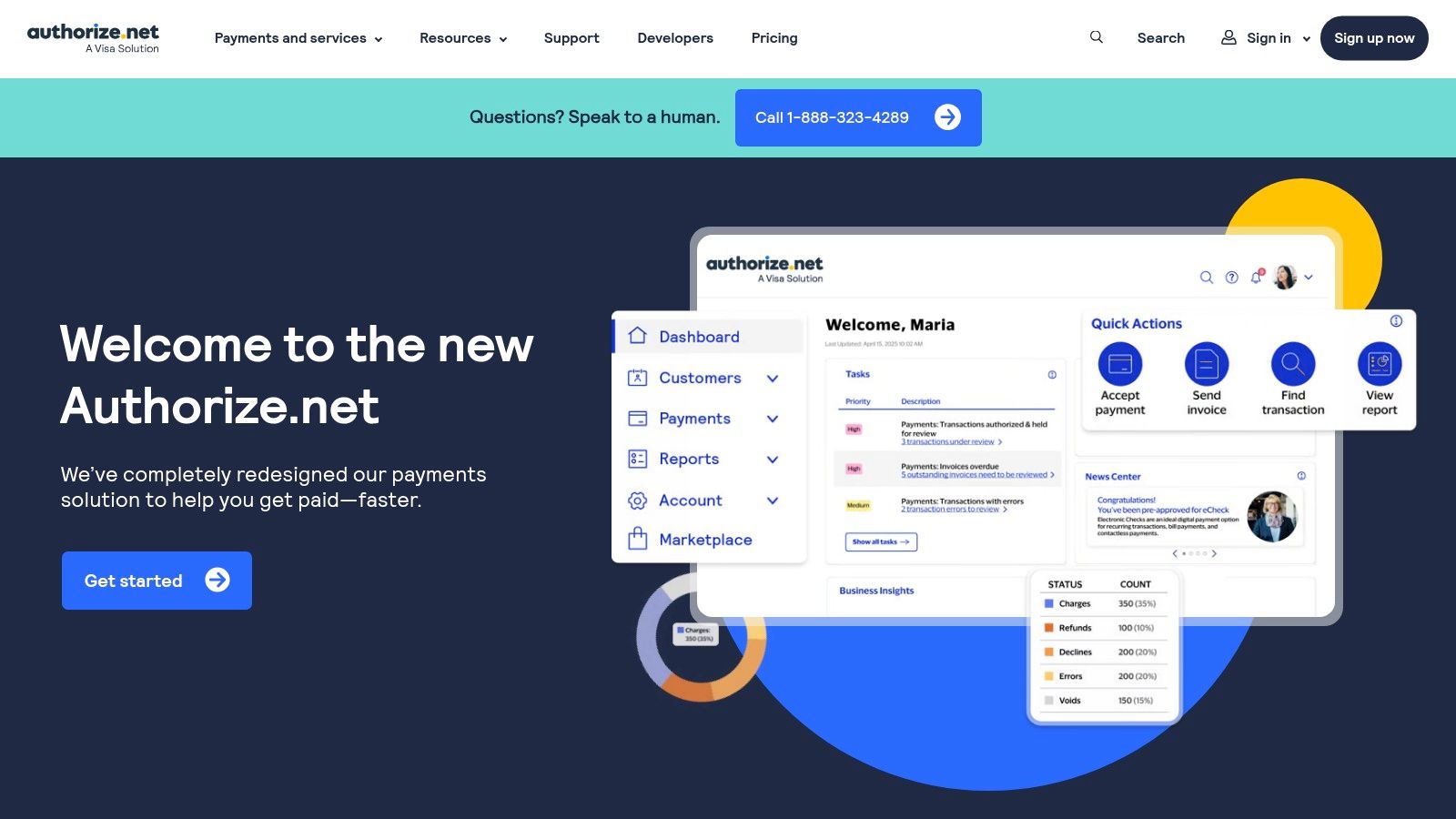

5. Authorize.Net (by Visa): The Veteran Gateway for Integrated Commerce

For established businesses searching for companies like PayPal that offer robust, traditional payment processing, Authorize.Net is a foundational name in the industry. As one of the oldest and most widely recognized payment gateways, it provides a reliable bridge between a business’s website and the payment processing networks required to authorize credit card and eCheck transactions. It's designed for merchants who need a powerful, customizable solution that integrates with an existing merchant account.

Authorize.Net operates primarily as a payment gateway, meaning its core function is to securely transmit transaction data. This model gives businesses the flexibility to choose their own merchant account provider, allowing them to shop for the best rates. For those seeking simplicity, an All-in-One option bundles the gateway with a merchant account from its parent company, Visa, offering a more streamlined, PayPal-like experience.

Standout Features and Use Cases

- Advanced Fraud Detection Suite™: A key differentiator is its set of customizable, rules-based filters and tools to help merchants identify, manage, and prevent suspicious transactions.

- Broad Integration: The platform boasts compatibility with a vast ecosystem of shopping carts, CRM systems, and business tools, making it easy to slot into existing operational workflows.

- Recurring Billing: Includes robust support for automated recurring payments, ideal for subscription services, membership sites, and software-as-a-service (SaaS) businesses.

- Multiple Payment Methods: Accepts all major credit cards, debit cards, and electronic checks (ACH), providing comprehensive options for customers.

Key Insight: Authorize.Net's strength lies in its flexibility. It empowers businesses to unbundle their payment gateway from their merchant account, creating opportunities for cost savings and custom-fit processing relationships.

Practical Implementation

A mid-sized e-commerce store with an established banking relationship can use Authorize.Net's Gateway-Only plan. They connect it to their existing merchant account to leverage pre-negotiated processing rates. Using the platform’s extensive API and shopping cart integrations, they can offer a secure, branded checkout experience while utilizing the Advanced Fraud Detection Suite to minimize chargebacks from high-value orders.

| Feature | Authorize.Net Advantage |

|---|---|

| Account Model | Gateway-Only or All-in-One options |

| Pricing Structure | Monthly gateway fee plus per-transaction costs |

| Business Types | Ideal for established e-commerce, retail, and B2B |

| Key Strength | Extensive integrations and advanced fraud prevention tools |

The All-in-One plan is typically priced at $25 per month plus 2.9% + $0.30 per transaction. However, the pricing can become complex with gateway-only plans, as rates depend on the chosen merchant account provider. Its setup is more involved than instant solutions like PayPal, but its maturity and reliability make it a trusted choice for serious businesses.

6. Wise: The Financial Hub for Global Business Operations

For businesses and freelancers looking for companies like PayPal to manage international funds without the high markup on exchange rates, Wise (formerly TransferWise) is a dominant force. It functions less as a direct checkout processor and more as a powerful multi-currency financial hub, designed to simplify receiving and sending money across borders. Its core value is offering the real mid-market exchange rate, making it an essential tool for anyone paying global suppliers, contractors, or receiving payments from international marketplaces.

Wise solves a critical pain point in global commerce: hidden fees and poor exchange rates that erode profits. By providing local bank details in major currencies (like USD, EUR, GBP), it allows businesses to receive payments like a local entity, completely avoiding costly international transfer fees. This makes it an indispensable backend tool that works in tandem with a primary payment gateway, streamlining the financial operations of a global business.

Standout Features and Use Cases

- Multi-Currency Account: Hold, manage, and convert between 40+ currencies in a single account, optimizing cash flow and hedging against currency fluctuations.

- Local Bank Details: Get local account numbers and routing details for multiple countries, enabling fee-free payments from clients in those regions.

- Transparent, Low-Cost Transfers: Send money abroad with a small, upfront fee and the real mid-market exchange rate, a stark contrast to the inflated rates often used by banks and other providers.

- Batch Payments: A crucial feature for businesses paying multiple international freelancers or suppliers, allowing them to execute numerous transfers in one go.

Key Insight: Wise is not a PayPal checkout replacement. It's a replacement for the expensive, slow international banking system that PayPal and traditional banks rely on for cross-border settlements.

Practical Implementation

A US-based software company hires developers in Poland and the UK. Instead of using expensive wire transfers, the company uses its Wise Business account to pay invoices. They fund their account in USD and convert it to PLN and GBP at the mid-market rate, sending payments directly to their developers' local bank accounts with a minimal, transparent fee, saving significantly compared to traditional methods.

| Feature | Wise Advantage |

|---|---|

| Account Approval | Straightforward business verification process |

| Fund Custody | Custodial, but heavily regulated and safeguarded |

| Business Types | Ideal for freelancers, SMBs, and enterprises with global operations |

| Primary Function | Cross-border payments, multi-currency accounts, and payouts |

Wise operates on a pay-as-you-go model with no monthly fees. Sending fees are variable but highly competitive, often between 0.33% and 0.57%. While it isn't a customer-facing payment gateway for your website, its radical transparency on fees and exchange rates makes it a superior alternative for managing the backend finances of an international business.

7. Payoneer: The Global Standard for Freelancers and Marketplaces

For businesses, freelancers, and online sellers looking for companies like PayPal that excel in cross-border B2B payments, Payoneer is an established and powerful alternative. It specializes in simplifying international commerce by providing users with local receiving accounts in multiple currencies (like USD, EUR, GBP, JPY), enabling them to get paid by global clients and marketplaces as if they had a local bank account. This eliminates the high fees and complexities typically associated with international wire transfers.

Payoneer acts as a financial bridge for the global workforce, integrating directly with thousands of leading marketplaces like Upwork, Fiverr, and Airbnb. This allows professionals and businesses to receive mass payouts directly into their Payoneer account, centralizing their international earnings. From there, funds can be withdrawn to a local bank, spent using a Payoneer card, or used to pay other Payoneer users, often for free.

Standout Features and Use Cases

- Global Receiving Accounts: Get local bank details for major currencies to receive payments without expensive SWIFT fees.

- Marketplace Integration: A vast network of integrated marketplaces makes it the default payout method for millions of gig economy workers.

- Mass Payouts: Ideal for companies that need to pay hundreds of international contractors or affiliates efficiently.

- Free Peer-to-Peer Transfers: Sending and receiving funds between Payoneer accounts is typically free, fostering a closed-loop payment ecosystem.

Key Insight: Payoneer's strength isn't in being a customer-facing checkout processor but in facilitating the backend financial logistics of global B2B and marketplace transactions, making it indispensable for the modern remote workforce.

Practical Implementation

A marketing agency in India works with clients in the US and Europe. They use their Payoneer USD and EUR receiving accounts to invoice clients, who can pay via a simple bank transfer. The agency also hires freelancers from the Philippines through Upwork, receiving their project earnings directly into their Payoneer account. They can then use that balance to pay their own international contractors instantly and for free.

| Feature | Payoneer Advantage |

|---|---|

| Account Approval | Standard verification required, focused on business identity |

| Fund Custody | Custodial; funds are held in your Payoneer balance |

| Business Types | Freelancers, B2B services, marketplace sellers, affiliates |

| Primary Use Case | Receiving international payments and managing mass payouts |

Fees vary by transaction type: receiving payments from other Payoneer users is free, while client payments via credit card can cost up to 3.99% and ACH bank debits are around 1%. Withdrawing to a local bank can incur a fee of up to 3%, depending on the currency conversion. While highly effective for its niche, it is not a traditional online payment gateway for e-commerce checkouts.

Top 7 Payment Services Comparison

| Payment Solution | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| ATLOS Crypto Payment Gateway | Moderate (developer support advised) | Web3 knowledge, crypto wallets | Instant crypto payments, full fund control | High-risk, niche sectors; subscription models | No KYC, broad crypto support, white-label option |

| Stripe | Moderate (developer integration needed) | Developer resources, API usage | Reliable multi-method payments globally | Online commerce, subscriptions, invoicing | Transparent pricing, strong developer tools |

| Square | Low (plug-and-play setup) | Minimal, POS hardware optional | Fast launch, unified online/in-person payments | Small/midsize US businesses | No merchant account needed, transparent fees |

| Amazon Pay | Low (easy checkout integration) | Minimal | Increased conversion using Amazon accounts | E-commerce sites leveraging Amazon trust | No setup fees, trusted brand, mobile friendly |

| Authorize.Net (by Visa) | Moderate to High (requires setup) | Merchant account, possible reseller fees | Compatible with many acquirers, robust features | Businesses with existing accounts, card payments | Broad shopping cart support, mature features |

| Wise (formerly TransferWise) | Low (account setup) | Account management, FX handling | Low-cost cross-border transfers, multi-currency | Freelancers, SMBs with international payouts | Transparent FX rates, local bank details |

| Payoneer | Low to Moderate | Account setup, marketplace integration | Cross-border payments, client payouts | Freelancers, agencies, marketplace sellers | Free Payoneer transfers, broad marketplace support |

Making the Right Choice for Your Payment Needs

Navigating the crowded landscape of digital payment solutions can seem daunting, but this variety signifies a powerful opportunity for your business. Moving beyond a one-size-fits-all approach is no longer just an option; it's a strategic imperative for growth, especially for merchants in high-risk or specialized sectors like gaming, hosting, and online dating. The era of relying on a single, legacy payment processor is fading, making way for a more flexible, resilient, and customized financial infrastructure. The key is to shift your perspective from finding a single PayPal replacement to building a dynamic payment toolkit tailored to your specific operational needs and customer preferences.

The diverse array of companies like PayPal we've explored each carves out a unique niche. Stripe excels with its developer-centric API and extensive customization options, making it a powerhouse for tech-savvy businesses and subscription models. Square provides an unparalleled, seamlessly integrated ecosystem for merchants who operate both online and in-person, bridging the physical and digital retail worlds. Meanwhile, platforms like Wise and Payoneer have revolutionized international commerce by drastically simplifying cross-border payments and reducing exorbitant currency conversion fees, empowering businesses with global ambitions.

How to Choose Your Payment Stack

Making the right decision requires a clear-eyed assessment of your business's core requirements. Don't just look at transaction fees; consider the entire value proposition. Here are the critical factors to guide your selection process:

- Business Model: Does your revenue come from e-commerce sales, recurring subscriptions, in-person transactions, or a combination? Your model dictates whether you need the versatility of Square, the subscription tools of Stripe, or the global reach of Payoneer.

- Target Audience: Where are your customers located? If you have a significant international base, platforms like Wise are essential for minimizing friction and cost. For tech-forward or privacy-conscious demographics, accepting cryptocurrency through a gateway like ATLOS can be a major competitive advantage.

- Risk Profile: High-risk merchants, including those in online gaming, VPN services, and adult entertainment, often face challenges with traditional processors. Specialized solutions and crypto gateways offer more stable and supportive alternatives, mitigating the risk of sudden account freezes.

- Technical Resources: Evaluate your team's development capabilities. A platform like Stripe offers limitless customization but requires technical expertise, whereas Amazon Pay provides a simpler, plug-and-play implementation.

Ultimately, the most effective strategy may not involve choosing just one provider. A modern, robust payment system often involves a multi-processor approach. You might use Stripe for standard credit card transactions, Wise for paying international contractors, and a crypto gateway to tap into a new, global customer segment. This diversification not only provides flexibility but also builds resilience, ensuring that a problem with one provider doesn't halt your entire operation. By carefully selecting from the best companies like PayPal available, you can assemble a powerful financial engine that not only meets today's needs but also scales for tomorrow's growth.

Ready to future-proof your payment system and cater to a growing global audience? Explore how ATLOS Crypto Payment Gateway can provide a secure, fast, and low-cost alternative to traditional payment rails, especially for high-risk merchants. Discover the power of decentralized payments and see why it's a critical component for any modern business by visiting ATLOS Crypto Payment Gateway today.