How to Accept Recurring Payments with Crypto

The way we pay for things is changing fast, and the subscription economy is absolutely exploding. If you're running a SaaS platform, a membership site, or creating content, this shift is a massive opportunity. We're going to walk through how you can start accepting recurring payments using cryptocurrency, turning those one-off sales into a steady, predictable revenue stream.

This isn't just a trend. It’s about gaining a real competitive edge with benefits like global reach, much lower fees, and a system that's resistant to censorship. By setting up crypto subscriptions, you're not just adding a payment option; you're future-proofing your business for a growing global audience that already prefers digital currency. Let’s dive into how to make it happen.

The Unstoppable Rise of Subscription Models

It's clear that we've moved away from one-time purchases toward ongoing relationships with the services we use. Customers today almost expect a subscription option for everything, whether it's software, entertainment, or exclusive content. For a business, this model is a game-changer, creating predictable cash flow and building real, long-term customer loyalty.

And this isn't some passing fad; it's a fundamental shift in how we do business. The subscription economy has grown by an eye-watering 435% in the last nine years. It's on track to be worth over $1.5 trillion globally by 2025. That kind of growth sends a clear message: people want continuous value, not just a single transaction. If you want to dig deeper, you can explore more statistics on the subscription economy and see just how big this shift really is.

Where Traditional Payments Stumble

As powerful as the subscription model is, old-school payment systems can create a ton of friction. I’ve seen it countless times—high processing fees, painful chargebacks, and arbitrary geographic restrictions chipping away at profits and limiting who you can sell to. These hurdles are especially tough for businesses in what are considered "high-risk" industries or those trying to break into emerging markets.

This is exactly where cryptocurrency comes in. It offers a modern, practical solution to these long-standing problems and opens the door to a more efficient and inclusive way of doing business.

Think about it: by using blockchain technology, you can automate your billing, slash your overhead costs, and tap into a global customer base without all the usual headaches of the legacy financial system.

The Crypto Edge for Recurring Billing

Adding cryptocurrency for subscriptions is more than just checking a box for a new payment method. It’s a strategic move that gives your business more freedom and makes it run leaner.

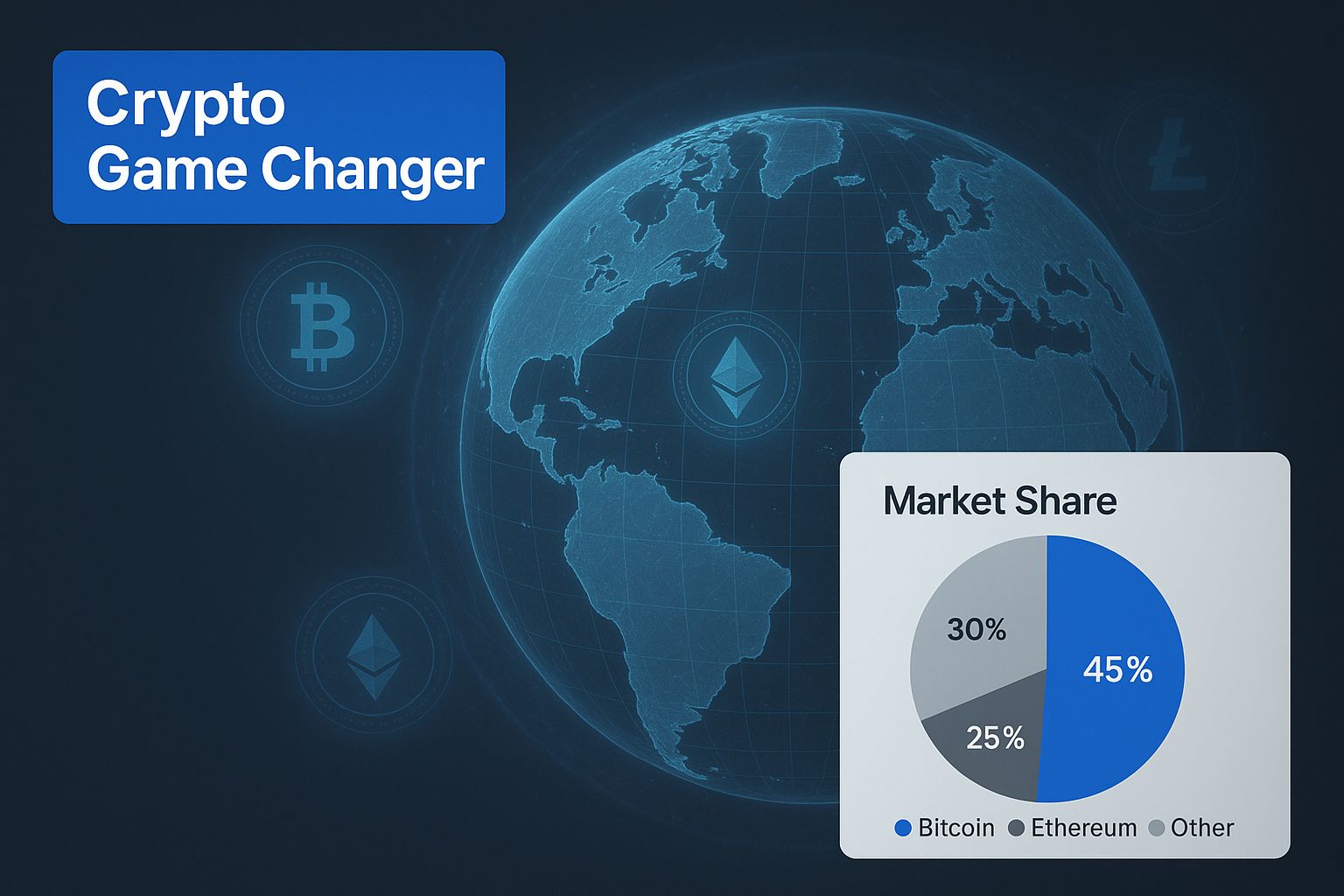

This infographic really captures how crypto is changing the game for businesses that want to operate globally and have more financial control.

The big takeaway here is that crypto cuts out the middlemen. It connects you directly with a worldwide audience that's ready and willing to pay for what you offer. The benefits are hard to ignore:

- Dramatically Lower Fees: You can expect to pay a fraction of the typical 2-3% that credit card processors take from every single transaction.

- True Global Reach: Accept payments from anyone, anywhere on the planet, instantly. No more worrying about failed cross-border transactions or bank declines.

- Zero Chargebacks: This is a big one. Blockchain transactions are final, which means the risk of fraudulent chargebacks that plague so many online merchants completely disappears.

- Lightning-Fast Settlement: Funds land directly in your wallet in minutes, not days. This can make a huge difference to your business's cash flow.

Choosing the Right Crypto Payment Gateway

To accept recurring payments in crypto, you need a specialized tool. It's a common mistake to think any crypto payment processor will do, but the reality is that most are built for simple, one-off transactions. They just aren't equipped for the complexities of subscription billing.

Picking the wrong gateway can quickly turn into a nightmare of failed payments, frustrated customers, and a mountain of manual work for your team. The right gateway, on the other hand, becomes the reliable engine powering your subscription model, ticking along in the background without needing your constant attention. It has to handle billing cycles, gracefully manage payment failures, and create a smooth experience for subscribers authorizing ongoing charges.

Core Features for Subscription Billing

When you start comparing options, there are a few non-negotiable features that are absolutely essential for running a subscription-based service. Think of this as your must-have checklist.

- Multi-Chain Support: Your customers aren't all on the same blockchain. A gateway that supports popular networks like Ethereum, Solana, and TRON lets people pay with their preferred crypto. This flexibility is a huge factor in boosting conversion rates.

- Stablecoin Compatibility: Pricing your service in a volatile asset like Bitcoin is a recipe for disaster. One month's revenue could be drastically different from the next. Your gateway must let you price and receive payments in stablecoins like USDT and USDC. That way, your $50/month subscription is always worth $50.

- Automated Dunning Management: What happens when a customer's payment fails? A basic system just marks it as "failed" and moves on. A smart gateway automatically retries the payment and notifies the customer. This process, known as dunning, is critical for recovering revenue that would otherwise be lost for good.

You can see how a modern, decentralized gateway like ATLOS presents these features in a clean, straightforward way.

A dashboard like this proves that you don't need to be a blockchain expert to manage your business. Clear analytics and intuitive navigation are key to monitoring revenue and handling subscriptions efficiently.

Comparing Your Gateway Options

When it's time to choose, you'll generally find yourself going down one of three paths. Each has its own distinct set of pros and cons related to control, setup complexity, and overall cost. Making the right choice upfront will save you a lot of headaches later.

Crypto Payment Gateway Feature Comparison

This table breaks down how the different types of gateways stack up on the features that matter most for a recurring revenue business.

| Feature | Decentralized Gateway (e.g., ATLOS) | Centralized Exchange Gateway | Self-Hosted Solution |

|---|---|---|---|

| Fund Control | You hold your own keys; non-custodial | Exchange holds funds until withdrawal | You have full control, but also full responsibility |

| Setup Time | Very fast; often no KYC required | Slower; typically requires full KYC/AML | Can be very slow and complex to deploy |

| Recurring Tools | Built-in subscription and dunning features | Often limited to one-time payments | Requires custom development from scratch |

| Fees | Low, transparent transaction fees | Higher fees, including withdrawal charges | No processing fees, but high development and maintenance costs |

As you can see, the differences are significant. A self-hosted solution offers ultimate control but comes with a massive technical burden, while centralized gateways often lack the specialized tools needed for subscriptions.

For most businesses, a decentralized gateway like the one from ATLOS hits the sweet spot. It provides the self-custody and low fees of a self-hosted setup without the crushing technical overhead, making it a practical and scalable choice for growing a subscription service.

Alright, let's get our hands dirty and turn that subscription idea into a real, cash-flowing system. It's time to walk through setting up and launching your recurring crypto payments.

We'll keep things practical with a real-world example. Imagine you're a developer who wants to sell premium access to a private Discord server. The goal is simple: charge a monthly fee that automatically gives members a special role and access to exclusive content. We'll use this scenario to build our setup from the ground up.

First Things First: Account and Wallet Setup

Before you can get paid, you need a place for the money to go. The first move is to sign up with your chosen payment gateway, like ATLOS. One of the big perks of a decentralized gateway is how quick this is. They usually don't bog you down with the lengthy KYC (Know Your Customer) checks you find elsewhere.

Once your account is live, you’ll connect your own crypto wallet. This isn't like depositing funds into a third-party account; it's more like telling the system where to send your earnings. You're simply authorizing the gateway to forward payments directly to a wallet that you—and only you—control. This is that "your keys, your crypto" principle in action, a core idea in decentralized finance.

Getting Your Systems to Talk: Generating API Keys

To connect your website or app to the payment gateway, you’ll need API keys. Think of them as a secure handshake between your platform and theirs, ensuring that all payment instructions are legitimate and secure.

You'll find the option to generate these keys in your account dashboard. It's usually a one-click process that gives you two keys:

- A Public Key: This one is safe to use on the front end of your site (what your users see and interact with). It identifies your account.

- A Secret Key: Guard this one carefully. It lives on your server and is used for sensitive actions like creating subscription plans or checking on payment statuses behind the scenes.

Here’s a quick look at how you might use the public key in some simple JavaScript to kick off the payment process:

This bit of code tells the gateway which account is making the request (YOUR_PUBLIC_API_KEY) and where to send the user after the payment succeeds or fails.

Defining Your Offer: Creating the Subscription Plan

With the technical plumbing in place, it’s time to actually build the product you're selling. Inside your gateway’s dashboard, you’ll set up a new subscription plan. This is where you lay down the rules for your recurring billing.

For our Discord server example, the setup would be straightforward:

- Product Name: Premium Discord Access

- Price: $10

- Currency: USDC (a stablecoin tied to the US dollar)

- Billing Cycle: Monthly

Using a stablecoin like USDC is critical for predictable revenue. It means you’ll get the equivalent of $10 every single month, protecting your business from the wild swings of crypto prices. You could also set up other options, like a quarterly or yearly plan, maybe with a small discount to encourage longer sign-ups.

Once you save this, the system will give you a unique product ID—that’s the prod_premium_discord_access we saw in the code snippet.

The best part? You can start selling immediately with shareable checkout links. Just drop the link in your Discord announcements, post it on social media, or send it in an email. It gives people a direct path to subscribe without needing a full-blown website integration.

The gateway automatically generates a hosted payment page for this plan. It's a clean, secure checkout that lets customers connect their wallet and approve the recurring payment in just a few clicks. This is a massively useful tool that lets you go from idea to accepting payments in minutes.

Best Practices for Managing Crypto Subscriptions

Getting your crypto subscription service off the ground is a huge win. But the real work begins now. Building a sustainable business means shifting your focus from the initial setup to smart, ongoing management. This is what truly separates a flash-in-the-pan project from a long-term revenue engine.

It’s about more than just collecting payments. You need to create a smooth experience that anticipates and handles the inevitable bumps in the road, like failed payments, while giving your customers the flexibility they need to stick around.

Master the Art of Dunning Management

Payments fail. It’s a fact of life in any subscription business. A customer’s wallet might be a few dollars short of covering both the subscription fee and the network gas fees. How you handle these moments is what counts.

This is where dunning management—the process of communicating with customers to recover failed payments—becomes your secret weapon.

A robust crypto payment gateway should automate this entire process for you. Instead of a payment just failing and abruptly canceling a customer's access, a smart system can:

- Automatically retry the payment at strategic intervals, like once a day for the next three days.

- Send automated email notifications to the customer, letting them know what happened and prompting them to top up their wallet.

This automated safety net does more than just recover revenue you would have otherwise lost; it prevents frustrating your customers and stops unnecessary churn in its tracks.

Offer Flexible and Attractive Plans

The one-size-fits-all model is dead. Your customers expect choices, and offering flexible subscription tiers can have a massive impact on your conversion rates. You need to think about how different users will get value from your service and price accordingly.

For instance, you could roll out:

- Tiered Pricing: A "Basic" plan with core features and a "Pro" plan that unlocks advanced functionality for your power users.

- Free Trials: Give people a taste of your service for 7 or 14 days before their paid plan kicks in. This is one of the most effective ways to lower the barrier to entry and get people hooked.

The goal is to make it incredibly simple for a customer to find a plan that feels right for them. Just as importantly, you need to let them easily upgrade or downgrade as their needs evolve. That kind of flexibility is a powerful retention tool.

Prioritize Transparency and Stability

When you accept recurring payments in crypto, clear communication and financial stability are everything. One of the most critical things you can do is price your services exclusively in stablecoins like USDT or USDC.

Doing this means your $20/month subscription fee will always be worth $20. It gives you predictable Monthly Recurring Revenue (MRR) and protects both you and your customers from crypto's infamous price swings.

You also need to be upfront about network costs. Gas fees are just part of the deal when transacting on most blockchains. A quick note on your checkout page explaining that users need enough funds for the subscription plus a small network fee can prevent a world of headaches and build trust.

This kind of focus on a smooth, predictable user experience isn't happening in a vacuum. By 2025, digital payment technology is poised to completely reshape e-commerce, with mobile payments expected to account for 51% of all global transactions. The total value processed by payment gateways is projected to reach an incredible $2.78 trillion, fueled by things like frictionless wallet integrations. If you want to see where this is all headed, check out these payment gateway statistics on coinlaw.io.

What's Next? The Future of Subscription Billing is Already Here

When you look at the bigger picture, accepting recurring crypto payments isn't just a tech upgrade. It's a genuine shift in how you run your business. We've walked through how it builds predictable revenue, slashes your overhead, and opens your doors to a global customer base that's eager to pay this way. This is about so much more than adding another button at checkout; it's about fundamentally building a smarter, more resilient business.

We're at a really interesting intersection right now—the subscription economy is exploding, and at the same time, decentralized finance is maturing. This creates a perfect environment for new ideas to flourish. By getting on board now, you're not just following a trend. You're getting ahead of it.

Grabbing a Piece of a Fast-Growing Market

The demand for subscription services isn't slowing down. In fact, it's accelerating. The entire market for subscriptions and recurring payments is projected to hit around $158.54 billion in 2025. That's a huge number, but it's expected to jump to $257.93 billion by 2032. This growth is being driven by the massive consumer shift toward digital-first services in pretty much every industry you can think of. You can dig into the full report over at Coherent Market Insights to see the breakdown.

This massive expansion really puts a spotlight on why modern payment solutions are so crucial. Old-school banking and payment systems are struggling to keep up with a global, always-on customer base. Crypto recurring payments are the answer to that problem. They offer a flexible and borderless alternative that’s built for how the market operates today, not how it operated a decade ago. It’s the financial plumbing needed to support this growth without all the usual friction.

When you embrace recurring crypto payments, you're essentially future-proofing your revenue. You're building a system that is global by default, incredibly efficient, and ready for the next phase of the internet.

Moving in this direction gives you the tools and the knowledge to build a stronger business. It's about taking back control of your finances, cutting out the middlemen, and fostering a direct connection with customers, no matter where they are in the world. The technology is here, the market is ready for it, and the benefits are too good to ignore. The future of subscriptions is decentralized, and it's happening right now.

Got Questions? We've Got Answers

Stepping into recurring crypto payments for the first time? It's natural to have a few questions. We've been there. Here are some of the most common things people ask, broken down into simple, practical answers.

"How Do I Deal With All the Price Swings?"

This is probably the biggest concern we hear, and the solution is surprisingly simple: price everything in stablecoins.

Think about it. If you set your plan at $25/month using a stablecoin like USDT or USDC, you’re locking in that value. Your revenue becomes predictable because it's pegged to a stable asset like the US Dollar. A good payment gateway handles this seamlessly, letting you price and receive payments in stablecoins without any extra work.

"What If a Customer's Payment Fails?"

It happens. Maybe their wallet is low on funds or they forgot to account for gas fees. This is where a smart system for "dunning management" saves the day. Instead of just letting that subscription lapse, a robust gateway will automatically jump into action.

What does that look like in practice?

- It will retry the payment a few times over the next few days.

- It will simultaneously send automated reminders to your customer, letting them know they need to top up their wallet.

This little bit of automation makes a huge difference in preventing churn and recovering revenue you might have otherwise lost for good.

"Is This Whole Process Actually Secure?"

Absolutely, and in some ways, it's more secure than traditional methods. Every single transaction is etched onto the blockchain, creating a permanent, transparent record. But the real security boost comes from using a non-custodial gateway.

Non-custodial is a key term to know. It means the payment service never holds your private keys or your funds. Money moves directly from your customer’s wallet to yours. You—and only you—are in control 100% of the time. For your customers, this is great too, as they never have to hand over credit card details.

"What Kind of Customer Support Do I Need to Offer?"

Honestly, most of your support will be educational. You're not troubleshooting failed bank transfers; you're guiding people through a new process.

Your team should be prepped to answer basic questions about connecting a wallet, explaining what gas fees are, and showing customers how to look up a transaction on a block explorer. Putting together a quick FAQ or a short video tutorial can solve 90% of these issues before they even become support tickets. A solid payment partner will also provide resources you can pass along, lightening the load on your team.

Ready to unlock predictable revenue and tap into a global market? With ATLOS, you can start accepting recurring crypto payments in minutes, not days. Get started today at ATLOS.io.