Your Guide to Payment Gateway Subscription Models

If you've ever tried to manage a subscription business, you know the headache. Manually sending out invoices, chasing down late payments, and dealing with expired credit cards for hundreds of customers every single month... it's a nightmare.

That’s where a payment gateway subscription model comes in. Think of it as the automated financial engine for your business. It’s designed to handle the entire recurring revenue cycle without you having to lift a finger.

The Automated Engine of Your Subscription Business

A subscription payment gateway is far more than a simple tool for collecting money; it’s the central nervous system for your recurring revenue. This system is the lifeblood for any modern business that relies on predictable income—think SaaS platforms, monthly subscription boxes, or streaming services.

Without it, you're stuck in a loop of tedious manual work. Someone on your team has to generate every invoice, send out payment reminders, and follow up with customers whose cards have expired. This isn't just a massive time-sink; it’s a process riddled with potential for human error, which can easily lead to lost revenue and frustrated customers.

Why Automation Is Critical for Growth

A dedicated payment gateway for subscriptions gets rid of these manual bottlenecks. It works quietly in the background, making sure payments are processed on time, every time. This frees up your team to focus on what actually grows the business—like improving the product or finding new customers—instead of getting bogged down in administrative tasks.

This kind of automation has a direct impact on your bottom line by:

- Reducing Involuntary Churn: It automatically handles payment failures, which is one of the biggest (and most preventable) reasons customers accidentally drop off.

- Improving Customer Experience: A smooth, hands-off payment process for your subscribers builds trust and keeps them happy.

- Providing Predictable Revenue: When billing is consistent and automated, you get a stable financial forecast, making it much easier to plan for the future.

A solid subscription payment gateway isn't just about getting paid. It’s a strategic asset that secures your revenue, improves customer retention, and gives you the financial stability you need to scale.

Ultimately, by taking over the entire subscription lifecycle—from the initial sign-up to recurring billing and even recovering failed payments—the gateway becomes an essential engine for sustainable growth. It ensures your revenue stream is both reliable and incredibly efficient.

How Subscription Gateways Put Payments on Autopilot

So, how does a subscription payment gateway actually work? Think of it less like a gate and more like a smart conveyor belt for your revenue. Instead of manually packing and shipping every single order, you set up a system that just runs on its own. This is the secret to scaling any subscription business without getting buried in busywork.

It all kicks off the second a customer decides to subscribe. The gateway grabs their payment details—like a credit card number—and instantly swaps them out for a secure token. This token is just a random string of characters that acts as a stand-in for the real, sensitive data. Your servers never have to touch the actual card details, which is a huge win for security.

This process, called tokenization, is what makes recurring billing possible. With that token on file, the system can automatically charge the customer on schedule—weekly, monthly, quarterly, you name it—without them having to lift a finger.

The Automated Billing Cycle in Action

Once that token is created, the gateway becomes the engine driving your revenue. It talks to the customer's bank, gets the green light for the transaction, and pings both you and the customer to let you know the payment went through. It’s a smooth, professional experience that builds a ton of trust.

But what about when a payment doesn't go through? A good gateway has a plan for that, too. Instead of just letting a failed payment turn into lost revenue, the system can be set up to automatically retry the charge a few times. It can also send a gentle reminder to the customer if their card is about to expire, helping you tackle churn before it even starts.

This kind of automation is a big deal. The global payment gateway market was valued at around USD 27.0 billion and is expected to balloon to USD 106.06 billion by 2033, growing at a rate of 16.43% each year. Why the massive jump? Because everyone from tiny startups to massive enterprises is moving online, and customers now expect subscriptions to be completely seamless. You can dive deeper into these market trends over at StraitsResearch.com.

For example, a platform like ATLOS gives you a straightforward dashboard to manage all your recurring payment schedules.

As you can see, it’s easy to set the billing cycle, amount, and start date, taking all the guesswork out of the process.

Cutting Down Your Admin Headaches

At the end of the day, the real magic of a subscription gateway is how much manual work it takes off your plate. It handles all the little communications that eat up so much time: renewal reminders, payment confirmation emails, and alerts when something goes wrong.

Automating these touchpoints saves a staggering amount of admin time, but it also creates a consistent, reliable experience for your customers. That consistency is what keeps subscribers happy and loyal for the long haul.

Your gateway basically becomes your digital accounts receivable team, working 24/7 to ensure your cash flow is steady and predictable. This frees you and your team up to stop chasing down payments and start focusing on growing the business.

The Must-Have Features of a Modern Subscription Gateway

Not all payment platforms are cut from the same cloth, especially when you’re dealing with recurring revenue. A basic payment tool can handle a simple, one-time transaction, but a true payment gateway subscription platform is a different beast altogether. It's packed with specialized features designed to keep your customers happy and your revenue flowing predictably. These aren't just bells and whistles; they're the core components of any successful subscription business.

At the very heart of it all is automated recurring billing. Think of this as the engine of your subscription model. It works quietly in the background, charging subscribers on schedule without you lifting a finger. Imagine manually chasing every single payment each month—it’s just not scalable. Automation handles it all.

Protecting Your Revenue and Keeping Customers

But what happens when a payment fails? That's where a modern gateway really proves its worth. It has to be smart about recovering revenue that might otherwise disappear. This is where a feature called dunning management steps in. It’s an automated system that intelligently retries failed payments, often catching temporary hiccups like a brief network error or a temporary dip in a customer's account balance. It’s a small thing that makes a huge difference—studies suggest automated retries can recover as much as 15% of failed payments on their own.

Of course, sometimes the problem is more permanent, like an expired credit card. In that case, the dunning system automatically sends a friendly, customized email nudging the customer to update their details. This simple, proactive step is critical for preventing "involuntary churn"—when you lose a customer not because they wanted to leave, but because their payment information was out of date.

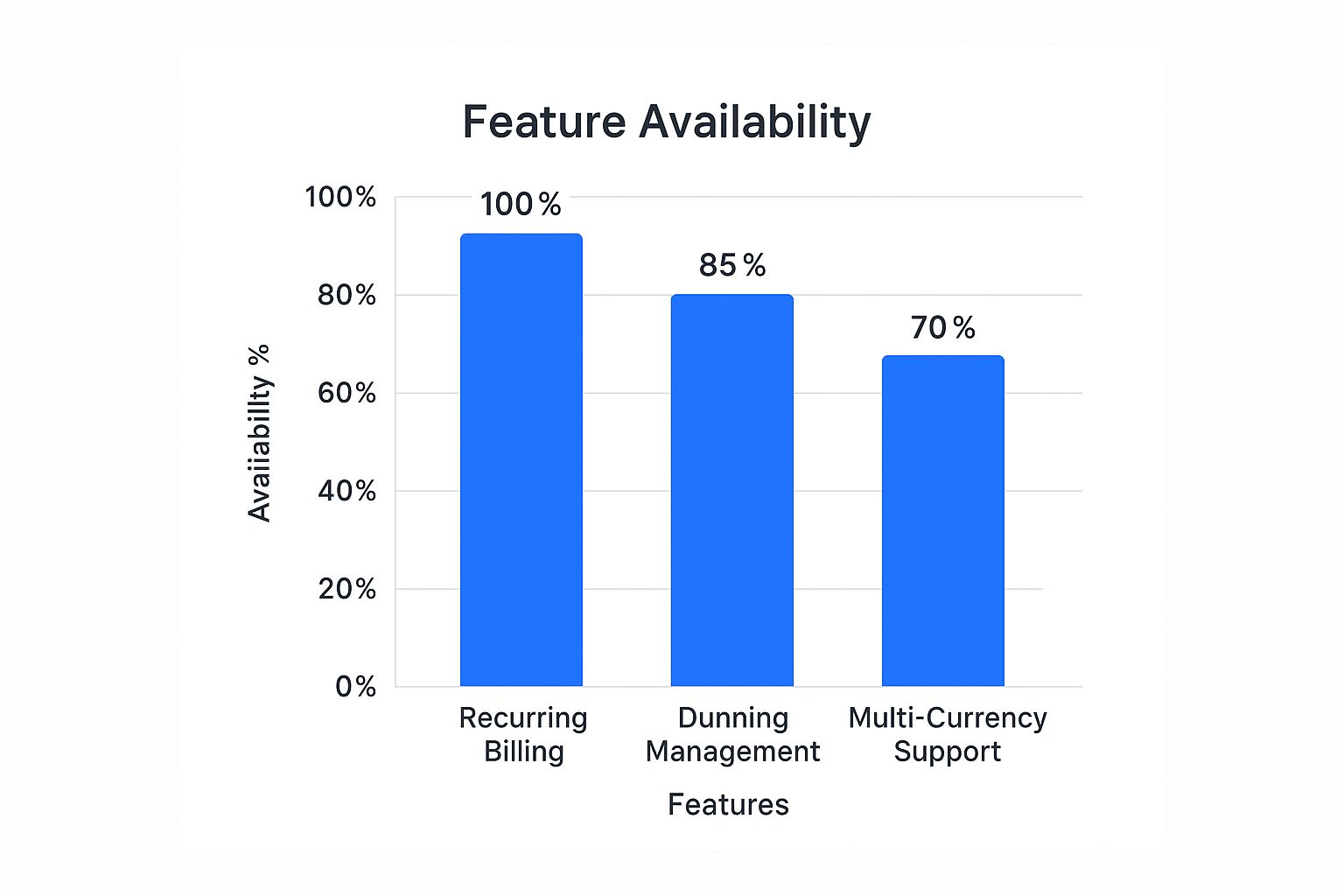

The chart below shows how common these essential features are among the top subscription platforms.

As you can see, almost everyone offers basic recurring billing. The real differentiators are the more advanced tools like dunning management and multi-currency support, which are what truly set a growth-oriented platform apart.

Built for Flexibility and a Global Reach

If you have ambitions to sell globally, multi-currency support is an absolute must. It’s all about meeting customers where they are. Billing people in their local currency builds immediate trust and dramatically boosts conversion rates. After all, someone in Europe is going to feel a lot more comfortable seeing a price in Euros than in US Dollars.

Just as important are flexible billing cycles. A one-size-fits-all approach rarely works. A great subscription gateway gives you the freedom to cater to different types of customers with a variety of plans. You should be able to easily set up:

- Weekly, monthly, or annual plans for pricing variety.

- Free or paid trial periods so customers can try before they buy.

- Usage-based or metered billing for services where customers only pay for what they consume.

These features don't just exist in a vacuum; they work together to create a powerful, resilient system. Automated billing provides the foundation, dunning management acts as your safety net, and flexible options let you adapt and grow. Together, they form the backbone of a subscription model that can truly scale.

Comparing Payment Gateway Subscription Models

Picking the right payment gateway isn't just about cool features. The way they charge you can make or break your profit margins, so you really need to get under the hood and understand their pricing. It’s a classic case of what works for a tiny startup becoming a massive cost drain for a company doing serious volume.

You’ll generally run into three main ways these gateways structure their fees: Flat-Rate, Interchange-Plus, and Tiered pricing. Each one calculates your transaction costs differently, making this a genuinely strategic decision for your business.

The Simplicity of Flat-Rate Pricing

Flat-rate pricing is about as straightforward as it gets. You pay a single, predictable percentage plus a small fixed fee on every transaction, no matter what kind of card your customer uses. A common example you’ll see is 2.9% + $0.30 for every payment that comes through.

The beauty of this model is its simplicity. You always know exactly what you’re paying, which makes financial forecasting a breeze, especially when you're just starting out.

But that simplicity can come with a higher price tag. The flat rate is often padded to cover the processor's risk for all the different card types they have to handle. If you're processing a lot of sales, this can end up being a much more expensive route over the long haul.

Interchange-Plus for Maximum Transparency

Often called Cost-Plus, the Interchange-Plus model is the most transparent option out there. It separates your fee into two clear parts: the interchange fee, which goes straight to the bank that issued the credit card, and the processor's markup, which is what your gateway actually earns.

A typical fee structure might look like this: "Interchange + 0.20% + $0.10." The interchange rate will change based on the card (a basic debit card costs less to process than a premium rewards card), but your processor’s cut stays the same.

This is where businesses with high sales volume or a good mix of transaction types can really save money. You're paying a rate much closer to the actual wholesale cost of the transaction, and you can see exactly where every penny is going.

The demand for these payment services is massive. Recently, the total value of transactions zipping through payment gateways hit an incredible $2.78 trillion. North America was a huge part of that, clocking in at over $1.08 trillion alone. This boom is fueled by everyone from SaaS companies to streaming services embracing subscription billing. You can dive deeper into these payment trends on Coinlaw.io.

The Complexity of Tiered Pricing

Tiered pricing lumps transactions into different buckets, usually called Qualified, Mid-Qualified, and Non-Qualified. The payment processor decides which tier a transaction belongs to based on things like the card type and whether it was swiped, dipped, or keyed in manually.

For example, a standard debit card transaction might land in the cheapest "Qualified" tier. But a customer using a fancy corporate rewards card that you had to enter by hand? That’s probably getting tossed into the expensive "Non-Qualified" tier.

The biggest issue here is the lack of transparency. It's nearly impossible to know ahead of time which tier a sale will fall into, making your costs unpredictable. While it looks simple on the surface, it often just hides higher fees.

For a deeper dive, especially if you're in the subscription game, this guide on choosing a payment gateway for SaaS offers some great, tailored advice.

Payment Gateway Pricing Models Compared

So, how do you decide? This table breaks down the three main models to help you see which one might be the best fit for your business.

| Pricing Model | How It Works | Typical Fees | Best For |

|---|---|---|---|

| Flat-Rate | A single, fixed percentage + a flat fee for every transaction. | 2.9% + $0.30 per transaction | Startups, businesses with low transaction volume, or those prioritizing predictable costs. |

| Interchange-Plus | The wholesale interchange rate + a fixed processor markup. | Interchange + 0.2% + $0.10 | High-volume businesses and anyone seeking full transparency and lower overall costs. |

| Tiered | Transactions are grouped into "tiers" with different rates (e.g., Qualified, Non-Qualified). | Varies widely by tier, often looks low initially but has hidden costs. | Generally not recommended due to its lack of transparency and unpredictable expenses. |

Ultimately, choosing a pricing model isn't just about finding the lowest number. It’s about finding a structure that scales with you and doesn’t penalize you for your own success.

Weaving a Subscription Gateway into Your Business

The idea of plugging a new payment system into your business can sound intimidating, but modern gateways are built to make it a surprisingly straightforward process. Most of the time, you have two main roads to choose from, and the right one just depends on your team's technical skills and what you want to achieve.

The fastest way to get started is by using hosted payment pages. Think of these as ready-made, secure checkout pages that your gateway provider manages for you. You just add a link from your site, and your customers are whisked away to a secure page to complete their purchase. It's a fantastic no-code solution if you're just starting out or don't have a developer on standby.

The other route, which offers a lot more control, is an API integration. This approach gives your development team the building blocks to construct a checkout experience that lives directly on your website or app. You have total command over the design and flow, which means you can create a completely branded and smooth payment process for your customers.

Choosing Your Integration Path

So, which path is right for you? It really boils down to your resources and your vision for the customer experience. Hosted pages are all about speed and simplicity, while an API gives you ultimate creative freedom.

- Hosted Payment Pages: This is your best bet if you need to start accepting payments fast and don't have a development team. Security and compliance are already baked in.

- API Integrations: This is the way to go if you want full ownership over the customer journey and have the technical know-how to build and manage a custom solution.

For those looking at specific processors, you’ll find that providers offer incredibly detailed guides. For example, the Stripe documentation is a goldmine for developers, walking them through every step of building a custom integration.

Security and Compliance Are Not Optional

No matter which path you take, security is the one thing you can't compromise on. This is where PCI DSS (Payment Card Industry Data Security Standard) compliance enters the picture. It’s a set of rigorous security standards created to keep customer card data safe from theft and fraud.

Using a PCI-compliant payment gateway isn't just a good idea—it's an absolute must for earning customer trust and protecting your business from massive liability. These gateways do the heavy lifting on security so you don't have to.

The huge growth of secure, scalable payment systems shows just how critical this is. For instance, platforms like Stripe saw their global payment volume skyrocket to over $1.4 trillion, which was a massive 40% jump from $1 trillion the previous year. A big driver for that growth was the relentless demand for reliable subscription billing. When you choose a compliant gateway, you're not just getting a powerful tool; you're getting peace of mind.

Got Questions About Subscription Gateways? We've Got Answers.

Jumping into the world of recurring payments can feel a little overwhelming. You're probably wondering about security, how the tech actually works, and what happens when things don't go as planned. Let's break down some of the most common questions business owners ask before picking a payment gateway subscription service.

Think of this as your quick-start guide to understanding the essentials. We'll give you straight, simple answers to help you get the core concepts down.

What's the Difference Between a Payment Gateway and a Payment Processor?

This one trips a lot of people up, but a simple analogy makes it clear.

Imagine you're at a coffee shop. The payment gateway is the credit card terminal you tap your card on. It’s the device that securely grabs your payment info and zips it off to get approved. It’s the customer-facing part of the transaction.

The payment processor is the network operating in the background, completely invisible to you. It's the system that connects the gateway to your bank and the shop's bank, checking for funds and giving the final thumbs-up or thumbs-down on the charge.

A complete subscription platform bundles both of these roles. Even better, it adds specialized tools built for recurring billing—things like automated payment schedules and ultra-secure customer data storage. Many modern services, including ATLOS, handle all of this in one neat, integrated package.

How Does a Gateway Handle Failed Subscription Payments?

This is where a good gateway really earns its keep. It uses an automated process called dunning management to deal with failed payments, which often happen for simple reasons like an expired card or a temporary lack of funds.

Instead of just canceling the subscription and losing a customer, the system springs into action. It will intelligently try the charge again at specific times over the next few days. At the same time, it can send out automated emails to the customer, letting them know there's an issue and giving them a secure link to update their payment information.

This automatic recovery system is a game-changer for reducing what's called "involuntary churn." It actively saves revenue you would have otherwise lost, protecting your customer relationships and keeping your cash flow steady—all without you lifting a finger.

Is It Secure to Store Customer Card Details for Subscriptions?

Yes, but only if your gateway is PCI compliant and uses a technology called tokenization. Let's be crystal clear: you should never, ever store raw credit card numbers on your own servers.

Here’s how tokenization works its magic. When a customer signs up, the gateway snatches their sensitive card details and instantly converts them into a unique, unbreakable code called a token. This token is all your system ever sees or uses to process future payments.

The actual credit card number is locked away in the payment gateway's secure, encrypted vault. So, in the worst-case scenario of your website being hacked, all the attackers would find are a bunch of useless tokens, not valuable financial data. This smart separation is the foundation of secure subscription billing.

Can I Offer Different Subscription Plans and Trials?

Of course. Any decent payment gateway subscription service is built for flexibility. Modern platforms are designed to handle all sorts of business models, giving you total freedom to create and manage your offerings.

You can easily set up a variety of options to appeal to different customers:

- Multiple Tiers: Create plans with different prices and billing cycles (like a basic monthly plan vs. a premium annual one).

- Trial Periods: Let new users test-drive your service with a free or discounted trial. The gateway automatically handles the switch to a paid plan when the trial ends.

- Freemium Models: Run a free plan alongside paid tiers. The gateway will even calculate prorated charges for customers who upgrade in the middle of a billing cycle.

This level of control means every customer is billed perfectly for their specific plan. The gateway handles all the tricky math for upgrades, downgrades, and trial conversions on its own, letting your pricing grow and change with your business.

Ready to automate your recurring revenue with a secure, no-KYC crypto solution? ATLOS provides a powerful payment gateway designed for subscriptions, giving you full control over your funds while offering your customers a seamless payment experience. Start accepting crypto subscriptions today at https://atlos.io.