How to Accept Crypto Payments as a Business in 2024

Diving into crypto for your business might seem like a huge step, but it's quickly shifting from a niche experiment to a real strategic advantage. I'm going to walk you through how to accept crypto payments as a business, breaking it all down into simple, actionable steps.

Why Accepting Crypto Is a Smart Business Move

Let's get past the hype and look at the real-world benefits that are convincing thousands of businesses to start accepting crypto. This isn't just about catering to a small group of tech enthusiasts anymore; it’s about fundamentally changing how you handle transactions, manage your cash flow, and reach customers around the globe.

A big driver behind this shift is the sheer growth in a dedicated user base. Just look at the United States, where consumer crypto ownership is exploding. By 2025, an estimated 28% of American adults—that's roughly 65 million people—will own cryptocurrencies. And it's not a passing fad; a solid 67% of current owners say they plan to buy more, showing a real commitment to digital assets like Bitcoin and Ethereum. If you want to dig deeper, you can explore more about consumer crypto adoption trends to really understand this growing market.

Tapping Into a New Generation of Customers

When you start accepting crypto, you're opening a direct channel to a growing, tech-savvy crowd that actively looks for businesses that match their financial habits. These aren't just early adopters anymore; they're a significant slice of the global economy.

By integrating crypto payments, you're sending a clear signal that your business is innovative and ready for the future. In a competitive market, that kind of reputation can make all the difference, helping you pull in and keep customers who want modern, flexible financial options.

Adopting crypto payments is no longer just a technological upgrade—it’s a strategic move. Early adopters signal innovation, attracting clients and talent who value cutting-edge solutions in a competitive landscape.

Gaining a Financial Edge

Putting customer appeal aside for a moment, the financial reasons to make the switch are just as strong. Traditional payment systems are full of fees and roadblocks that crypto simply bypasses. The advantages here hit your bottom line and make your operations run smoother.

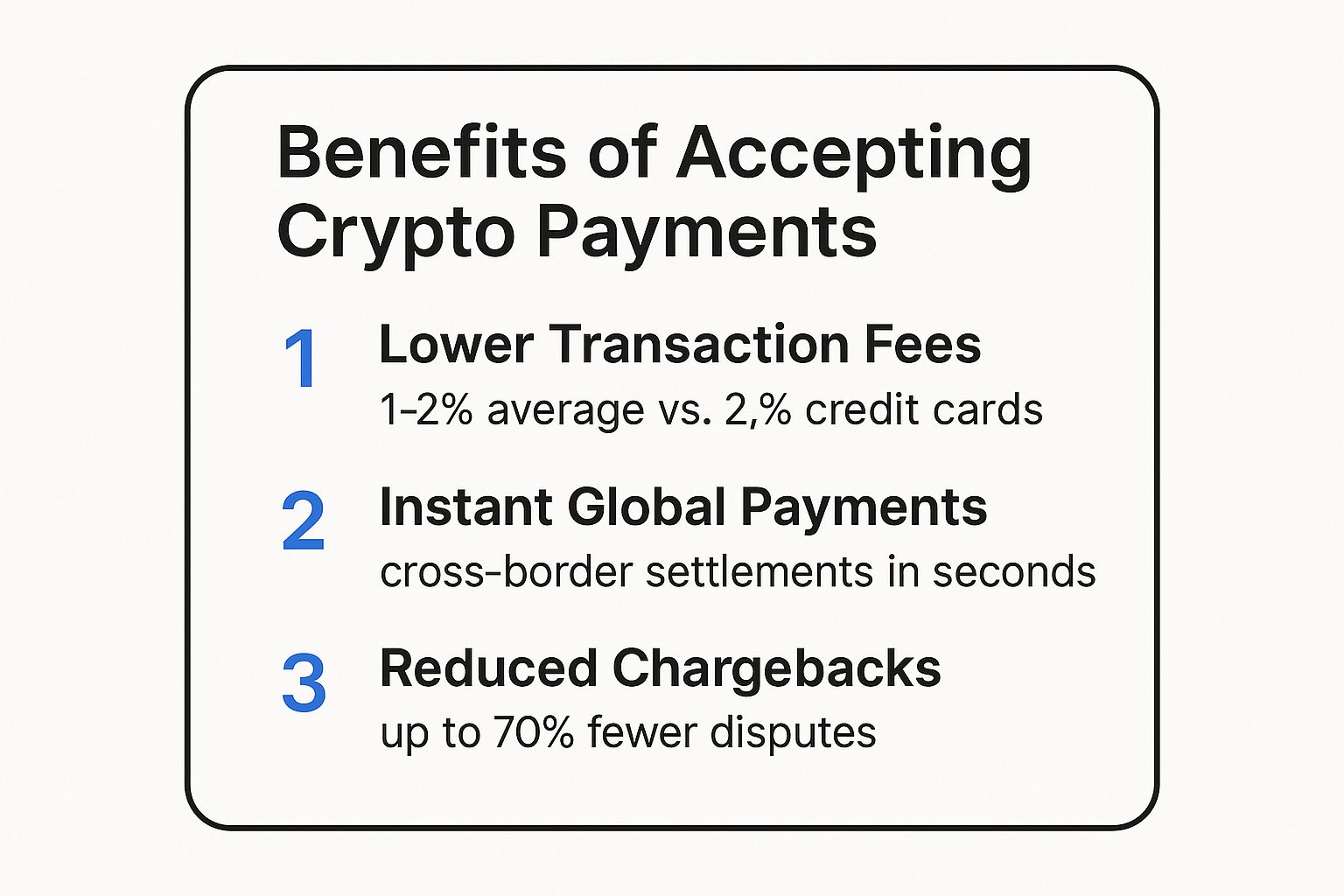

This infographic lays out three of the biggest wins businesses see when they embrace digital currency payments.

The numbers don't lie. Lower fees plus faster, more secure global transactions give you a real financial leg up over the old way of doing things.

Here are some of the most immediate benefits you can expect:

- Lower Transaction Fees: Credit cards can skim 2-4% off the top of every sale. Crypto transaction fees? They're often under 1%. That difference goes straight to your profit margin.

- Reduced Chargeback Fraud: Crypto transactions are final. This practically wipes out the risk of fraudulent chargebacks, which is a massive headache and expense for many merchants.

- Faster Settlement Times: An international wire transfer can leave you waiting 3-5 business days for your money. Crypto payments, on the other hand, usually settle in minutes. This dramatically improves cash flow.

- Access to Global Markets: Crypto is borderless. You can take payments from anyone, anywhere in the world, without dealing with currency conversions or exorbitant cross-border fees.

When you see these advantages laid out, it becomes clear that learning how to accept crypto payments as a business is a practical move toward a more efficient and profitable future.

Choosing Your Crypto Payment Gateway

Picking the right crypto payment gateway is easily the most important decision you'll make when you decide to start accepting crypto. This isn't just about grabbing the first name you see. It's about finding a partner that truly fits your business model, customer base, and technical comfort level. Get this part right, and everything that follows becomes much, much easier.

The first big choice you'll face is whether to go with a custodial or a non-custodial solution.

Think of a custodial gateway like a traditional bank. They handle the heavy lifting—managing the wallets, securing the private keys, and usually offering a simple user interface. This makes them a great entry point if you're new to the space. The trade-off? You're trusting them with your money.

A non-custodial gateway, on the other hand, puts you firmly in the driver's seat. You hold your own private keys, which means you have absolute control over your funds. This is the essence of the "your keys, your crypto" philosophy, and it offers unmatched security for anyone comfortable managing their own assets.

Comparing Crypto Payment Gateway Models

To help you visualize the difference, let's break down how these two models stack up against each other. Your choice really boils down to how much control you want versus how much convenience you need.

| Feature | Custodial Gateway (e.g., BitPay, Coinbase Commerce) | Non-Custodial Gateway (e.g., BTCPay Server) |

|---|---|---|

| Key Management | The provider holds and secures your private keys. | You maintain full control over your private keys. |

| Onboarding | Often requires Know Your Business (KYB) verification. | Typically no KYB is needed, allowing for instant setup. |

| Fund Control | You rely on the provider to release your funds. | Funds are sent directly to your wallet, no middleman. |

| Best For | Businesses seeking simplicity and hands-off management. | Businesses prioritizing security, control, and decentralization. |

So, what does this mean in the real world? A small ecommerce store might love the simplicity of a custodial service. But a business in a high-risk industry, like a VPN provider, would probably lean toward a non-custodial gateway to avoid account freezes and maintain total control over their revenue.

Core Factors to Evaluate in a Gateway

Beyond the custodial-versus-non-custodial debate, a few other key factors should be on your checklist. A gateway that's perfect for a freelance graphic designer might be a terrible fit for a global SaaS company.

Here’s what I always tell people to look for:

- Transaction Fees: Most processors charge a fee, usually around 1%, which is way better than typical credit card rates. But you need to read the fine print. Are there extra charges for converting to fiat or for withdrawals? Don't get caught by surprise.

- Supported Cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH) are the basics, but what do your customers actually want to use? Check if the gateway supports stablecoins like USDT or other altcoins that are popular with your audience.

- Integration and Ease of Use: How well does this thing actually plug into your store? Look for ready-made plugins for platforms like WooCommerce or Shopify. If you have a custom site, you'll need solid API documentation. The checkout experience has to be seamless—no exceptions.

- Settlement Options: Crypto volatility is no joke. The best gateways give you the option to instantly convert crypto payments into fiat currency (like USD or EUR). This feature is a lifesaver, as it locks in the value of your sale the moment it happens and protects you from market swings.

Key Takeaway: The goal isn't just to accept crypto; it's to make it work for your business. I always recommend prioritizing gateways that offer automatic fiat settlement. It eliminates volatility risk and makes your accounting a whole lot simpler.

The move toward B2B crypto payments is happening fast. By 2025, it's estimated that around 35% of small businesses in the U.S. will accept crypto for B2B transactions. We're already seeing crypto invoicing jump by nearly 50% in fields like tech and logistics.

It's also worth thinking about whether your business might need a more specialized partner. A guide on choosing a high risk payment processor can provide valuable perspective on features like fraud protection, which is especially important in industries facing more scrutiny. Your choice of a gateway sets the foundation for your entire crypto payment strategy, so take the time to get it right.

Getting Crypto Payments Live in Your Workflow

Alright, you've picked a gateway. Now for the fun part: getting it all hooked up and ready to accept payments. It might sound technical and intimidating, but you'll be surprised at how straightforward it's become. We'll walk through exactly what it takes to go from sign-up to a live "Pay with Crypto" button on your site.

First things first, most custodial gateways will ask you to complete a Know Your Business (KYB) check. Think of it like opening a business bank account. It's a standard compliance step where you provide some documentation to verify your business. It’s all about keeping things secure and above board.

While it adds a small step to the process, it creates a secure ecosystem for everyone. It's worth noting that some non-custodial solutions, like ATLOS, can skip this entirely, which means you can get set up almost instantly.

For E-commerce Stores: It's All About Plugins

If you're running your store on a major platform, you're in luck. The days of needing to hire a developer for weeks of custom coding are long gone.

For a WordPress site using WooCommerce, the process is as simple as installing an app on your phone. Most gateways, ATLOS included, offer a dedicated plugin. You just head to the plugin directory, search for it, and click "Install" and "Activate."

A simple configuration wizard will then pop up. It’ll ask you to connect your gateway account, which usually just means pasting in an API key they give you. Honestly, you can have the entire thing done in less than 15 minutes.

The experience is just as user-friendly on platforms like Shopify, Magento, or BigCommerce, which all have their own app stores and extensions.

Real-World Scenario: Let's say you sell custom graphic t-shirts on a WooCommerce store. After you sign up for your gateway and install the plugin, you see an option for "auto-conversion." You want to avoid any crypto price swings, so you check the box to instantly convert all payments to USD. That's it. Now, when a customer pays in Ethereum, the system handles the conversion behind the scenes, and you see US dollars land in your account.

For Custom-Built Websites: Working with APIs

What if your website is a custom job? The process is a bit more hands-on, but it's still a well-trodden path. This is where API (Application Programming Interface) keys enter the picture.

An API is just a secure bridge that lets your website talk to the payment gateway's systems. Here’s how that works in practice:

- Grab Your API Keys: Log in to your payment gateway's dashboard. You'll find a section to generate your unique API keys—usually a public key and a secret key.

- Pass Them to Your Developer: Your developer will take these keys and the gateway’s documentation to build the payment option into your checkout. They'll write the code that sends payment requests and listens for the "payment successful" confirmation.

- Run a Few Tests: Before you go live, you’ll use special "test" keys to run simulated transactions. This lets you make sure everything works perfectly without actually moving any real money.

Even for a custom site, a good developer can typically get this done in just a few hours. The documentation provided by modern gateways is usually crystal clear.

Simple Invoicing for Freelancers and Agencies

Not everyone is running a massive e-commerce operation. What if you're a consultant or a small agency and you just need to get an invoice paid? You don't need a whole shopping cart system for that.

This is where the simpler tools offered by many gateways shine:

- Payment Buttons: You can generate a snippet of HTML code for a "Pay with Crypto" button. Just copy and paste that code onto any page of your site, and it'll create a button that takes customers to a secure checkout page.

- Payment Links: This is the easiest method of all. You can create a unique payment link for a specific invoice amount. Send that link to your client in an email, Slack message, or text. They click it, pay, and you get notified.

These tools are perfect for service-based businesses that want to offer a crypto payment option without any technical setup at all.

Setting Your Settlement Preferences

The last piece of the puzzle—and maybe the most important—is deciding what happens to the crypto after a customer pays you. This is all about setting your settlement preferences.

You really have two main paths to choose from:

- Hold the Crypto: You can have the payment land in your account and stay in its original form (like BTC or ETH). This is a solid choice if you're a crypto bull or plan on paying your own suppliers or contractors in crypto.

- Instant Fiat Conversion: To sidestep volatility, you can have the gateway automatically convert every incoming payment into a stable currency like USD or EUR. The fiat currency is then deposited directly into your bank account.

For most businesses just starting out, instant fiat conversion is the way to go. It gives you every single benefit of accepting crypto—the low fees, the global reach, the lack of chargebacks—but completely removes the risk of price fluctuation. It keeps your revenue predictable and your accounting simple.

Dealing with Volatility, Security, and Compliance

Once your crypto payment gateway is up and running, your focus will naturally shift to managing the day-to-day realities. For most businesses diving into crypto, three big questions come up time and again: How do you handle the wild price swings? How do you keep the funds secure? And what about the maze of financial regulations?

Tackling these head-on is what separates a smooth crypto operation from a stressful one.

Let’s hit the biggest worry first: price volatility. We’ve all seen the charts. The value of Bitcoin or Ethereum can swing wildly, and the thought of a $100 sale being worth $90 just minutes later is enough to give anyone pause. It's a real concern, but it's one you don't have to carry on your own shoulders.

This is exactly why modern crypto payment gateways were created. The best platforms, including ATLOS, offer instant, automatic conversion to traditional fiat currency. The moment a customer pays, the system locks in the value and converts it to your currency of choice, whether that’s USD, EUR, or something else. You get the exact amount you charged, every single time. The volatility rollercoaster becomes someone else's ride.

Keeping Your Digital Assets and Operations Safe

With volatility handled, let's talk security. This goes way beyond just preventing a hack. It’s about building solid, everyday practices to protect your money and your customers. Security is a shared responsibility between you and your payment gateway.

Your provider does the heavy lifting, securing the core payment infrastructure. But you’re in charge of the keys to the kingdom. Think of it this way: the bank builds a fortress-like vault, but you're still responsible for keeping your debit card and PIN safe.

Here are a few security habits that are absolutely non-negotiable:

- Guard Your API Keys: These keys are the digital equivalent of the key to your cash register. Treat them that way. Store them securely, never, ever commit them to a public code repository, and restrict access to only the people who absolutely need it.

- Mandate Two-Factor Authentication (2FA): Turn on 2FA for every account tied to your payment gateway and e-commerce store. It’s a simple step that adds a massive layer of protection against unauthorized logins.

- Know Your Gateway’s Security Game: Dig into your provider's security protocols. Do they keep funds in cold storage? Are they insured? A good partner will be completely transparent about how they protect you.

In the world of crypto, security is something you do proactively, not after something goes wrong. By locking down your access points and picking a gateway that takes security seriously, you can operate with a whole lot more confidence.

Making Sense of Compliance and Accounting

Finally, there’s the paperwork. Compliance can feel like a monster, but with the right tools, it’s perfectly manageable. It really boils down to two things: accounting for taxes and following financial regulations.

For tax purposes, most countries (including the U.S.) treat crypto as property. This just means you need to record the fair market value of the crypto in your local currency at the exact moment you received it. This is another area where a gateway with automatic fiat conversion is a lifesaver—the platform does the math for you, and the converted amount becomes your recorded income. Simple.

Your payment processor should give you detailed transaction reports that you can easily export for your accountant. Keeping clean, detailed records isn’t just a good idea; it’s a must.

The other piece of the puzzle is regulation, like Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. Custodial gateways usually handle this for you when you sign up. If you opt for a non-custodial solution that gives you more control, more of that responsibility might fall on you, depending on your business and where you operate. It's always smart to talk to a legal expert who gets the digital asset space to make sure you're checking all the right boxes.

The trend is clear: businesses are getting on board. A 2025 Deloitte survey of CFOs at major North American companies found that only 1% saw no long-term role for crypto in their business. While 43% still pointed to price fluctuations as a key concern, the momentum is undeniable. You can discover more insights about corporate crypto sentiment from the Deloitte report. The data shows that while the risks are real, the strategic upside is pushing more and more companies to figure out how to manage them effectively.

How to Market Your New Crypto Payment Option

Flipping the switch on your crypto gateway is just the beginning. Now comes the important part: letting the world know you’re open for business. Simply having the option isn't enough; you have to market it effectively to turn this new feature into a genuine competitive advantage. Your goal is to get the word out, build trust, and start attracting a new wave of customers.

The quickest win is adding visual cues right on your website. Drop the logos of the cryptocurrencies you accept—think Bitcoin, Ethereum, etc.—into your site's footer and, most importantly, on your checkout page. For anyone who regularly uses crypto, these logos are an instant welcome mat. It signals that you get it and that they can easily do business with you.

Announce It to Your Existing Audience

Your current customers and followers are your low-hanging fruit. They already know and trust you, so start by sharing the news with them. Draft a clear, exciting announcement for your email list and social media.

But don't just say, "We accept crypto now." You need to explain why you've done it and what's in it for them.

Frame it as a direct benefit:

- More Choice: Let them know you're giving them more flexibility and control over how they pay.

- Innovation: Position your brand as forward-thinking and committed to modern, convenient solutions.

- Global Access: Highlight how this makes it easier than ever for your international customers to make a purchase.

To really kick things off, consider a launch promotion. Learning how to use urgency psychology to increase email conversions can be a game-changer here. A small, limited-time discount for the first wave of customers who pay with crypto can drive immediate adoption and generate some serious buzz.

Create a Dedicated Information Hub

A simple blog post or a dedicated landing page is perfect for centralizing all the important information. This not only serves as a resource for curious customers but also becomes a valuable asset for SEO.

On this page, you can go into more detail about the benefits, list the specific coins you accept, and walk people through the checkout process with a simple step-by-step guide. Being transparent like this builds confidence and demystifies the process for anyone on the fence or new to crypto payments.

Pro Tip: Your announcement is really a story about innovation. Frame it around customer convenience and security. Messaging like, "We're embracing the future of finance to make your checkout experience faster and more secure," connects much better than a dry, technical update.

Engage with Crypto Communities

To find brand new customers, you have to meet them where they are. And crypto enthusiasts are incredibly active on platforms like X (formerly Twitter), Reddit, and Telegram. Find the relevant subreddits (like r/bitcoin or others related to your niche) and start engaging authentically.

This isn’t about just dropping a link to your store and running. That never works. Instead, join conversations, answer questions, and share that your business is now crypto-friendly when it naturally fits. For instance, if you see someone asking where they can spend their crypto, that’s your opening.

This kind of grassroots marketing is powerful. It helps you build a loyal following from a community that is actively searching for businesses just like yours. These early adopters can easily become your biggest advocates.

Here are some of the most common questions we hear from business owners who are thinking about diving into crypto payments. Getting these cleared up from the start will give you the confidence to move forward.

Let's demystify the process and show you just how simple and secure modern tools have made it to get paid in crypto.

Do I Have to Hold Cryptocurrency to Accept It?

This is the big one, and the short answer is no. You don't have to become a crypto trader or lose sleep over market fluctuations.

Most payment gateways today are built to shield you from that volatility completely. They offer instant conversion, which means the moment a customer pays you in something like Bitcoin, the platform immediately swaps it for your local currency, whether that's USD, EUR, or something else. That money lands right in your business bank account.

This setup lets you get all the perks of crypto—lower fees, zero chargebacks, and a global customer base—without ever holding a volatile asset yourself.

How Do I Handle Taxes for Crypto Payments?

Taxes are always a top concern, but it's not as complicated as it sounds. For the most part, tax authorities like the IRS treat crypto as property, not currency.

So, what does that mean for you? You just need to report the fair market value of the crypto at the moment you received it as part of your gross income. A good payment processor makes this incredibly easy.

When a gateway automatically converts the crypto to fiat for you, the amount of USD or EUR you get is the amount you report. It's that simple. Plus, these platforms provide detailed transaction reports you can hand straight to your accountant, which makes tax season a whole lot less stressful.

I always tell people to chat with a tax professional who knows their way around digital assets. They'll give you advice specific to your business and make sure you're staying on the right side of local laws.

What Are the Typical Fees Involved?

This is where crypto really shines. We all know that traditional credit card processors can take a big bite out of your revenue, often charging between 2% and 4% per transaction, not to mention other hidden fees.

Crypto payment processors are a different story. They typically charge a straightforward, flat fee of 1% or less. For any business, but especially those with high volume or slim margins, switching can mean saving thousands of dollars a year. The math just makes sense.

Are Crypto Transactions Reversible Like Credit Cards?

Here's a game-changer for merchants: cryptocurrency transactions are final. Once a payment is confirmed on the blockchain, it's done. It can't be reversed or charged back.

This completely eliminates the headache and financial loss that comes from fraudulent chargebacks—a constant battle for anyone accepting credit cards. This finality gives you a level of security that traditional payment methods can't offer. When you get paid, that money is yours, period. It's a major reason why so many businesses are looking into how to accept crypto payments.

Ready to unlock global markets and reduce your transaction fees? With ATLOS, you can start accepting crypto payments in minutes, with no KYC and full control over your funds. Our secure, non-custodial gateway makes it simple. Learn more and get started with ATLOS today.