Recurring Payment Solutions for Modern Business

Subscription models are everywhere these days, from streaming services and software to your favorite coffee delivery. This guide dives into the world of recurring payment solutions—the systems that put billing on autopilot and create the predictable revenue streams businesses dream of. We'll start with the basics, break down why these systems are so powerful, and then look at how modern platforms like ATLOS are bringing these concepts into the Web3 and digital asset space.

The Engine Behind Predictable Revenue

At its core, a recurring payment solution is a system that automatically processes customer payments on a set schedule. Think about your Netflix or Spotify subscription. You don't have to remember to log in and pay the bill every month; it just happens.

That simple, automated transaction is the lifeblood of the subscription economy. It ensures you get uninterrupted service, and the company gets a steady, predictable flow of income. This model isn't just for media anymore, either. It has taken over e-commerce with subscription boxes, service industries with gym memberships, and is now making waves in digital asset management.

Why Subscriptions Are Dominating

The subscription model is a classic win-win. For customers, it’s all about convenience and continuous access. For businesses, it’s a game-changer for growth and stability.

Here’s why it works so well:

- Predictable Cash Flow: When you know roughly how much revenue is coming in each month, you can plan, budget, and invest with confidence. No more guesswork.

- Increased Customer Lifetime Value: Keeping a customer is far cheaper than finding a new one. Automated payments remove a major point of friction, helping you retain subscribers for the long haul.

- Improved Efficiency: Think of all the time saved by not having to manually send invoices or chase down late payments. Automation frees up your team to focus on what really matters—growing the business.

The numbers tell the same story. The global recurring payments market was valued at $152.3 billion in 2023 and is on track to hit $166.7 billion in 2024. Projections show it could reach a staggering $262.6 billion by 2029.

For businesses eager to tap into this growth, finding the right technology is the first step. You can learn more about the different options out there by checking out this guide on the best subscription ecommerce platforms.

How Do Recurring Payments Actually Work?

At its heart, a recurring payment solution puts your revenue on autopilot. It’s the same magic behind your Netflix subscription or gym membership. You sign up once, provide your payment info, and then you’re billed automatically every month. No fuss, no reminders, no missed payments.

The whole point is to remove the friction. Instead of making a customer pull out their card every single time, the system securely saves a representation of their payment details—called a token—and uses that to process future payments on an agreed-upon schedule. This is how you turn a simple one-off purchase into a predictable, long-term revenue stream.

The Moving Parts Behind the Automation

So, what’s happening in the background to make that automatic charge go through? It’s a bit of a dance between a few key technologies, all working together seamlessly. A good system handles this complexity so you don't have to.

Here are the main players involved:

- Payment Gateway: Think of this as the secure courier. It takes the customer's payment details from your website, encrypts them, and safely delivers them to the bank to ask for approval.

- Subscription Logic: This is the brains of the whole operation. It keeps track of who needs to be charged, how much, and when. It knows if a customer is on a monthly or yearly plan and when their next bill is due.

- Customer Vault: This is a super-secure digital locker. Instead of storing raw credit card numbers (a huge security no-no), it holds the tokenized versions of that data, which is essential for staying compliant and protecting your customers.

This setup is built to slash manual work and prevent the kind of simple mistakes that cost businesses money. It's also getting smarter. Recent studies show that 47% of businesses are now using AI-powered tools in their payment stacks to spot and block fraud, adding another layer of security to the automation.

A great recurring payment solution isn't just about collecting money. It’s about creating a frictionless customer journey that builds trust and encourages loyalty from the very first transaction.

A Step-by-Step Look at a Transaction

Let's break it down. Imagine a new customer just signed up for your monthly software service. Here’s what happens next:

- The First Handshake (Authorization): The customer types in their card details for the very first time. Your payment gateway grabs this info, securely sends it to their bank for an initial approval, and gets a unique authorization token back.

- Locking It Up (Tokenization): Your system doesn't save the actual card number. Instead, it stores that secure token in its vault. This token acts as a stand-in for all future transactions, so the real, sensitive data is never exposed again.

- The Automatic Charge (Scheduled Billing): When the next month rolls around, the subscription logic wakes up. It automatically tells the payment gateway, "Hey, it's time to charge this customer again," and sends the stored token to initiate the payment.

- All Clear (Confirmation): The bank approves the charge, and the gateway sends a "success" message back. Your system then marks the invoice as paid, updates the customer's subscription, and usually fires off an automated receipt to their email.

This whole cycle takes just a few seconds and requires zero human effort. That kind of efficiency is what makes subscription models work, whether you're dealing with dollars and cents or managing crypto invoices with a platform like ATLOS.

Must-Have Features in a Payment Solution

When you're picking a recurring payment solution, you're choosing more than just a tool to process transactions. A great platform is designed to solve real-world business headaches—think everything from stopping customer churn to freeing up dozens of hours wasted on admin tasks. The difference between a system that just works and one that actively grows your business is all in the details.

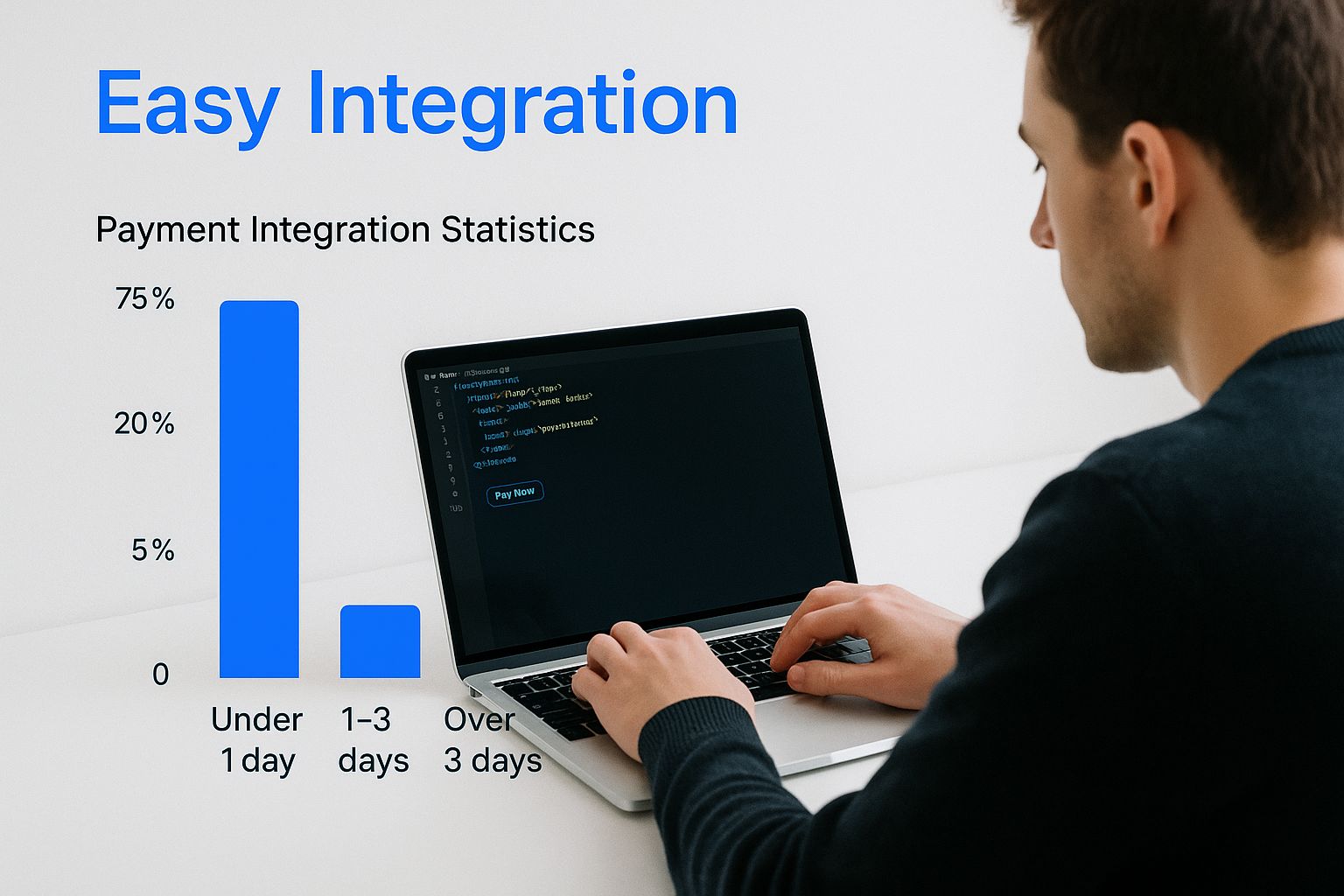

This image lays out some of the core features you should be looking for.

As you can see, things like easy integration are non-negotiable. They let you get started quickly without a massive IT project. But let’s dig a little deeper into what truly makes a platform stand out.

To help you sift through the options, I’ve put together a quick comparison table. It breaks down the essential features, what they actually do, and why they should matter to your bottom line.

Key Features of Recurring Payment Platforms

| Feature | What It Does | Why It Matters for Your Business |

|---|---|---|

| Automated Billing & Invoicing | Automatically generates and sends invoices based on customer-specific billing cycles and plans. | Saves a massive amount of time, eliminates human error in billing, and ensures you get paid on schedule, every time. |

| Smart Dunning Management | Intelligently retries failed payments and sends automated reminders to customers to update their card information. | This is your secret weapon against involuntary churn. It recovers revenue you'd otherwise lose to simple issues like expired cards. |

| Multi-Currency Support | Allows you to bill customers and accept payments in their local currency, handling conversions automatically. | Makes your business truly global. It boosts trust and conversion rates by giving international customers a familiar, seamless checkout experience. |

| Robust Analytics & Reporting | Provides a clear dashboard with key metrics like MRR, churn rate, and customer lifetime value (LTV). | You can't fix what you can't see. Good data gives you the power to make smart decisions and steer your business toward growth. |

This table gives you a high-level view, but let's explore why these specific features are so critical for any subscription-based business.

Automated Invoicing and Billing Logic

Let's be honest, nobody enjoys creating and sending invoices manually. It's tedious, slow, and a recipe for mistakes. A top-tier solution takes this entire workflow off your plate, automatically generating professional invoices and dispatching them based on each customer's specific billing cycle.

But it goes beyond just sending a bill. The real power is in the billing logic. Your platform needs to handle whatever you throw at it—tiered pricing, usage-based models, or one-time add-ons. It should instantly calculate prorated charges when a customer upgrades or downgrades, ensuring the billing is always accurate and fair.

Dunning Management for Revenue Recovery

Failed payments are a fact of life in any subscription business. A customer's card expires, or their bank has a temporary issue. But these small hiccups don't have to turn into lost revenue. This is where dunning management comes in.

A smart dunning system works behind the scenes to:

- Automatically retry failed charges: It doesn't just hammer the card over and over. It retries payments at strategic times when they're most likely to go through.

- Send custom notifications: It can trigger a friendly email or SMS, letting the customer know there's an issue and making it easy for them to update their payment info.

- Prevent involuntary churn: By catching these problems early, a dunning system stops subscriptions from being canceled by accident.

This one feature is a game-changer. It directly protects your revenue and customer relationships, making it absolutely essential for long-term growth.

Global Reach With Multi-Currency Support

As your business expands, you’ll naturally want to reach customers all over the world. But if you force international buyers to pay in a foreign currency, you're creating friction. They have to guess at conversion rates and often get hit with extra fees from their bank.

A great payment solution should let you price your products in local currencies and accept payments from anywhere without a hitch. This simple step makes international customers feel right at home, which can do wonders for your conversion rates.

When looking at different platforms, it’s always a good idea to compare various payment gateways to make sure they can handle your global ambitions.

Robust Analytics and Reporting

Finally, you can't improve what you don't measure. Your payment platform shouldn't be a black box; it should be a source of crucial business intelligence. A clear, intuitive dashboard is a must.

Make sure you can easily track the metrics that matter most, including:

- Monthly Recurring Revenue (MRR): The lifeblood of your subscription business.

- Customer Churn Rate: The percentage of customers who leave each month.

- Customer Lifetime Value (LTV): The total revenue you can expect from a single customer.

These numbers tell the story of your business's health. They show you what's working, what's not, and where your biggest opportunities for growth are hiding.

The Strategic Edge of Billing Automation

Let’s be honest, manual billing is a drag. It’s not just an inconvenience—it's a bottleneck that can seriously stifle your company's growth. When you switch to an automated system for recurring payments, you’re not just saving a few hours. You're building a strategic foundation that changes how you handle everything from revenue and resources to the way you interact with your customers.

Think about it. At its core, automation gets rid of the monotonous, error-prone tasks of generating invoices one by one, sending awkward "your payment is late" emails, and trying to make sense of your accounts. This immediately cuts down on administrative costs and, more importantly, frees up your team to focus on what actually moves the needle: improving your product and talking to your customers.

More Than Just a Time-Saver

The real magic of automation happens when you start seeing its impact on your financial stability. When billing runs like clockwork, your cash flow becomes predictable. This isn't just a small win; it's a game-changer.

Suddenly, you can forecast with more accuracy, create budgets that make sense, and invest in growth without crossing your fingers. You're no longer stuck in a reactive cycle, constantly plugging holes in your revenue stream. Instead, you're proactively planning for the future.

This sense of reliability also makes a huge difference to your customers. A smooth, no-hiccups billing process builds a ton of trust. People love the "set it and forget it" convenience, and it drastically cuts down on churn that happens accidentally—like when a credit card expires or a payment is simply forgotten. A great billing experience is one of your best, and quietest, customer retention tools.

Billing automation turns your finance department from a cost center obsessed with collections into a strategic partner focused on growth. It’s the engine that powers a scalable subscription business.

Why Everyone Is Getting on Board

This move toward automation isn't just a niche trend; it's a massive market shift. Automated recurring billing is quickly becoming the default for businesses everywhere. The market is projected to hit around $15 billion in 2025 and is expected to grow at a blistering 15% CAGR, rocketing to nearly $45 billion by 2033.

These numbers tell a clear story: if you're running a subscription-based model, automation is no longer optional. You can dig deeper into these figures by checking out the full research on automated recurring billing trends.

Ultimately, automating your billing cycles does a lot more than just save you time. It helps you build a more resilient, efficient, and customer-focused business. That operational polish becomes your competitive advantage, letting you scale up without sacrificing the quality that keeps your customers coming back.

Navigating Payment Security and Compliance

Handling customer payments is a massive responsibility. It goes way beyond just moving money from point A to point B. When customers hand over their financial details, they're placing a huge amount of trust in you to keep that information safe. This is why security and regulatory compliance are the bedrock of any solid recurring payment system.

Think of payment security like a bank vault in the digital world. A bank’s job is to protect physical cash, and your payment system's job is to protect sensitive cardholder data. The absolute gold standard here is the Payment Card Industry Data Security Standard (PCI DSS).

What is PCI DSS?�

PCI DSS isn't just a friendly suggestion—it's a mandatory set of rules for any business that accepts, processes, stores, or transmits credit card information. Following these standards is non-negotiable. It’s how you guard against costly data breaches and build the kind of trust that keeps customers coming back.

The good news is that a modern recurring payment solution takes this heavy lifting off your plate. It’s designed to handle all the sensitive data within its own secure, PCI-compliant environment. Many use a process called tokenization, which ensures raw card details never even touch your servers. This massively reduces your risk and makes your compliance journey a whole lot simpler.

Security in recurring payments isn't just a feature—it's the foundation of customer trust. A single breach can erase years of brand loyalty, making compliance an essential part of your business strategy.

Keeping Up with Evolving Regulations

Beyond the core security standards, the regulatory landscape is always shifting. New rules are constantly emerging to balance innovation with consumer protection, which can create operational headaches for businesses.

For instance, major markets like Europe have introduced enhanced authentication requirements under regulations like PSD3. There are also stricter data privacy rules that dictate how payment credentials can be stored and processed. To get a better handle on these challenges, many companies are turning to Regtech solutions. You can learn more about how regulations are shaping the subscription economy on cashfree.com.

These changes introduce complex rules like Strong Customer Authentication (SCA), which often requires two-factor authentication for online payments. Trying to navigate these requirements on your own can quickly turn into a nightmare.

This is where a great payment partner proves its worth. The top solutions build compliance right into their platforms. They automatically adapt to new rules and often integrate with Regtech (Regulatory Technology) tools to automate monitoring and reporting. This keeps your billing processes compliant without forcing you to become a legal expert.

Ultimately, choosing the right platform isn't just about getting a payment tool. It's about finding a partner that helps you manage risk and maintain the confidence of your customers.

Time to Get ATLOS Up and Running

Alright, let's move from theory to practice. Setting up recurring payments can feel a bit daunting, but tools like ATLOS are built to make this whole process surprisingly simple, even if you're just dipping your toes into crypto subscriptions.

Let’s walk through what it actually takes to get your automated revenue engine humming.

First thing’s first: you need to define your subscription plans. This is the bedrock of your entire model. What are you offering? How much will it cost, and how often will you bill for it—monthly, quarterly, yearly? Think of it like creating the menu at a restaurant; each plan is a different dish with a clear price and set of ingredients (features).

Once you've mapped out your plans, you'll plug them into the ATLOS dashboard. This is where you tell the system when to actually charge your customers. The beauty of the platform is that it handles all the complicated timing stuff. Whether someone signs up on the 5th or the 25th, their billing cycle is managed perfectly without you having to lift a finger.

Tying It All Into Your Website

With your subscription logic in place, the next big step is connecting it to your website. ATLOS makes this part straightforward with simple tools and clear guides, so you can integrate a professional-looking checkout experience for your customers.

You've got a couple of ways to do this:

- Payment Links: Just generate a simple link for a specific plan. These are perfect for dropping into an email, posting on social media, or sending directly to a potential customer.

- API Integration: If you want a completely seamless feel, you can use the ATLOS API. This lets you build the checkout directly into your own website's design, keeping everything on-brand.

The real goal here is to make signing up completely painless. A smooth, intuitive integration means fewer people abandoning their carts and a much better first impression.

Managing Subscriptions in Crypto

This is where ATLOS really shines. It’s built from the ground up to handle recurring payments in crypto. The process feels a lot like a traditional subscription, but it’s all happening with digital assets.

Customers simply authorize recurring payments from their crypto wallets one time. From then on, ATLOS takes over, managing the automated billing just as it would with dollars or euros. This is how you build a predictable, stable revenue stream in the Web3 world, putting you ahead of the curve and opening your doors to a massive market of crypto users.

Suddenly, your revenue is on autopilot.

Frequently Asked Questions

It's only natural to have questions when you're exploring recurring payment solutions, especially when you throw crypto into the mix. To clear things up, we've put together answers to a few of the questions we hear most often from business owners just like you.

This section is all about tackling those lingering uncertainties. We'll break down the difference between common terms, explain what happens when a payment doesn't go through, and show how these tools work in the world of Web3.

Recurring Payments Versus Subscriptions

People often use "recurring payments" and "subscriptions" as if they mean the same thing, but there's a key difference. A recurring payment is the actual mechanism—the automated transaction that happens on a set schedule. It’s the engine doing the work behind the scenes.

A subscription is the business model you're offering. It's the agreement you have with a customer to provide a product or service in exchange for those regular payments. Simply put, recurring payments are the how, and subscriptions are the what.

Think of it this way: your Netflix plan is the subscription. The automatic charge that hits your bank account each month is the recurring payment that keeps the movies streaming.

How Systems Handle Failed Payments

A common worry with automated billing is simple: what if a payment fails? The best recurring payment systems have a smart process built right in to handle this, often called dunning management.

Instead of a single failure causing a customer to churn, a good system will jump into action. It will typically:

- Automatically retry the payment at specific, optimized times when it's more likely to be successful.

- Send friendly, automated reminders to the customer, letting them know there's an issue and giving them a secure way to update their payment info.

- Give you clear reports on at-risk accounts, so you can see who might be about to churn because of a payment problem.

This automated recovery process is a lifesaver for minimizing accidental customer loss and keeping your revenue flowing.

Using These Solutions For Crypto

Absolutely. This is where modern platforms are really starting to shine. Solutions like ATLOS were built from the ground up to handle recurring payments for both traditional money (fiat) and cryptocurrencies.

This opens the door for Web3 companies, NFT projects, and crypto-native SaaS platforms to build the same predictable revenue streams that have been the backbone of the subscription economy for years. Customers can easily authorize recurring crypto payments directly from their wallets, creating a smooth and stable billing cycle with digital assets.

Ready to bring predictable, automated revenue to your business? With ATLOS, you can set up crypto and fiat recurring payment solutions in minutes, not days. Start accepting global payments without KYC and take control of your cash flow. Get started at atlos.io.