Choosing a Recurring Payment Processor

A recurring payment processor is the automated system that handles subscription payments for businesses. It's the financial engine behind everything from your favorite streaming service to a monthly software subscription or a gym membership. This guide breaks down exactly how these processors work, why your business needs one, the essential features to look for, and how innovations like AI and crypto are reshaping the subscription landscape.

Essentially, it securely stores a customer's payment information and automatically charges them on a set schedule—whether that's weekly, monthly, or yearly. This eliminates the need for manual invoicing and ensures a predictable, steady stream of revenue.

The Core of Subscription Business Models

For any business built on subscriptions, a recurring payment processor is absolutely essential. Imagine trying to manually bill every single customer at the start of each new cycle. It would be a logistical nightmare, soaking up countless hours and creating a huge potential for missed payments and angry customers.

This technology is about much more than just charging a card on time. It manages the entire financial side of the customer relationship. By automating these crucial touchpoints, businesses can drastically improve their cash flow and cut down on administrative work. This frees them up to focus on what really matters: building a great product and fostering trust with their customers. A great example of this in action is Chargebee's platform for recurring billing, which handles the complexities of the subscription lifecycle.

How Recurring Billing Actually Works

Think of a recurring payment processor as the automated financial heart of your subscription business. Its main job is to grab a customer's payment details just once and then automatically bill them at regular intervals—whether that's weekly, monthly, or yearly. This "set it and forget it" approach is what drives predictable revenue, but how does it all happen behind the curtain?

Let's break it down with a simple example: a digital subscription box service. When a new customer decides to sign up, they land on a secure payment page. This is where the magic begins.

The Initial Handshake: Customer Sign-Up and Tokenization

The customer punches in their credit card details. Now, instead of you storing that highly sensitive information on your own servers (which is a huge security nightmare), the recurring payment processor takes over. It converts the credit card number into a unique, unbreakable string of random characters called a token.

This token is essentially a secure stand-in for the customer's card. It can’t be traced back to the original number, but it gives you a way to charge them in the future. The processor stores this token, linking it to the customer’s subscription plan, and you never have to touch the raw financial data.

This is a massive trust-builder. Customers are understandably cautious about who they give their payment info to. Using a processor with tokenization shows them you’re serious about protecting their data with bank-level security.

Key Takeaway: Tokenization is the engine of secure recurring billing. It swaps out sensitive payment data for a non-sensitive "token," letting you process future payments without the risk of storing vulnerable credit card numbers.

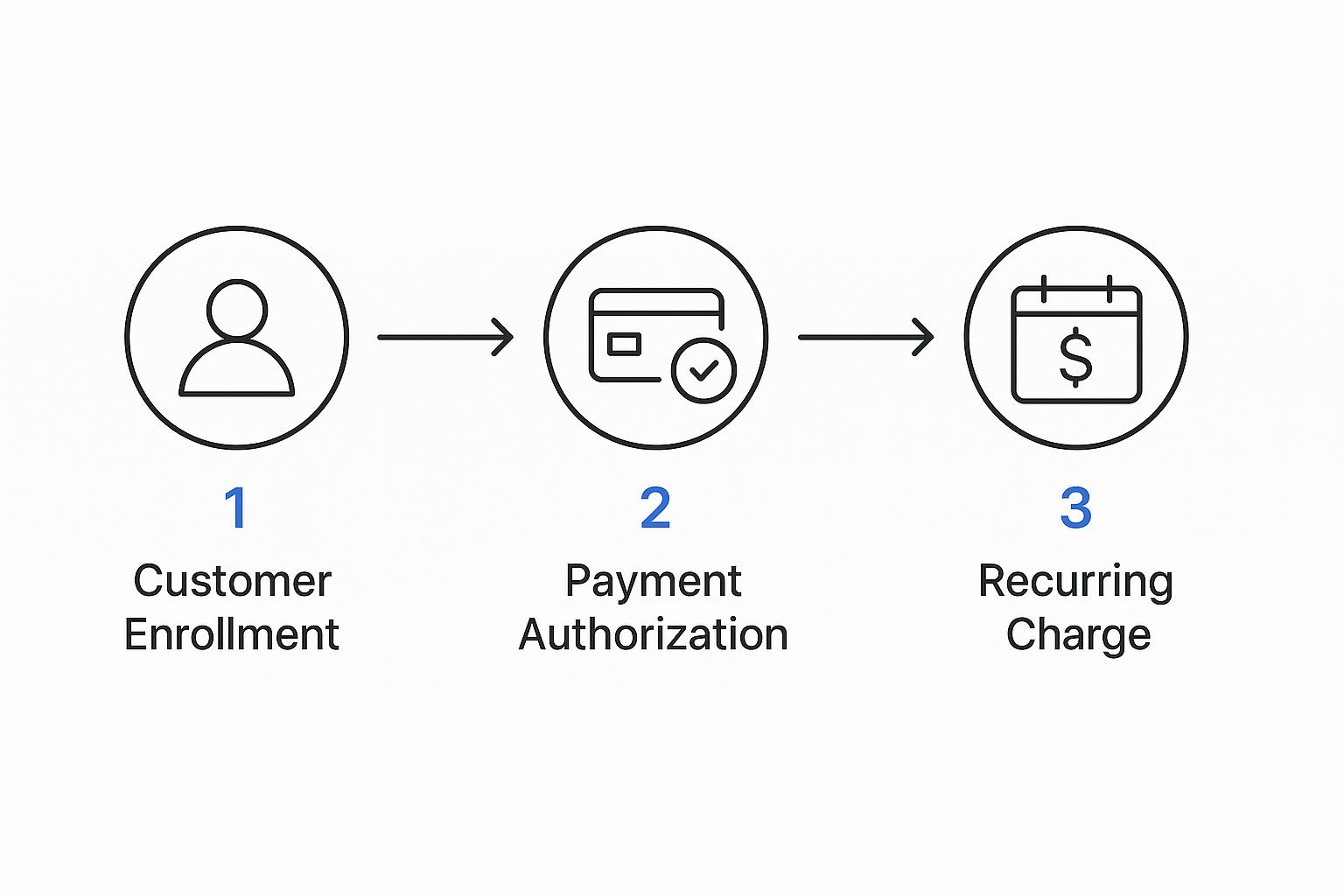

The diagram below maps out this straightforward, three-step process.

As you can see, the initial sign-up and authorization pave the way for every future charge to happen on autopilot.

The Automated Conversation in the Background

Once that token is safely stored, the processor’s real work starts. It becomes your digital scheduler, managing the entire payment lifecycle for you. When the next billing date rolls around—let’s say the first of the month—the system automatically kicks off a new transaction request using that token.

This request travels through the payment gateway to the customer's bank (like Chase or Bank of America). The bank quickly checks for sufficient funds and verifies the card is still active. If it’s all good, the bank approves the charge and sends a confirmation back to the processor. Boom. The money moves from their account to yours.

This entire back-and-forth happens in a matter of seconds, completely hands-off. It’s this kind of efficiency that has propelled the global payment processing industry toward a projected $139.9 billion by 2030. You can dig deeper into these trends over at Paycompass.com.

A solid processor handles this complex communication flawlessly every single time, giving your subscription business the consistent cash flow it needs to thrive.

Why Your Business Needs Automated Payments

Chasing down invoices every month isn't just a time sink—it's a genuine drag on your business's potential. In a world where subscriptions are king, sticking to manual billing is like trying to row a boat with a single oar. You'll go in circles. A recurring payment processor isn't a luxury; it’s a core piece of infrastructure for any business looking for stability and growth.

Chasing down invoices every month isn't just a time sink—it's a genuine drag on your business's potential. In a world where subscriptions are king, sticking to manual billing is like trying to row a boat with a single oar. You'll go in circles. A recurring payment processor isn't a luxury; it’s a core piece of infrastructure for any business looking for stability and growth.

This kind of system flips your operations from reactive (chasing payments) to proactive (predicting income). It puts the entire billing cycle on autopilot, making sure you get paid on time, every time. The downstream effects on your company's financial health and even your customer relationships are huge.

Create Predictable Revenue Streams

The number one reason to automate payments? Predictable revenue. Simple as that. When you know almost exactly how much cash is hitting your account each month, financial planning stops being a guessing game and becomes a reliable roadmap.

Think about a local gym. With recurring payments set up, the owner can be confident that on the first of the month, 95% of membership fees will land in the bank. That certainty means they can budget for new equipment or run a marketing campaign without sweating their cash flow.

Predictable revenue is the bedrock of a scalable business. It gives you the stability to invest in growth, manage costs, and plan for the future with real confidence.

Without that predictability, you're always flying a bit blind, which makes long-term planning next to impossible. Automated billing clears the fog and gives you a solid foundation to build on.

Drastically Cut Administrative Work

Let’s be honest, the hours spent creating, sending, and then chasing invoices add up fast. This isn't just a time-suck; it's a massive opportunity cost. Every hour your team spends on billing is an hour they aren't spending on improving your product or talking to your customers.

Take a SaaS company, for instance. A small team can easily support thousands of customers because a recurring payment processor handles all the billing in the background. This frees up the team to focus on what actually grows the business—building great features and providing top-notch support.

By putting this critical but repetitive task on autopilot, you let your team focus on the work that truly matters.

Enhance the Customer Experience

A smooth payment process is an underrated but critical part of the customer journey. Making your customers manually pay an invoice every month creates friction. It's an extra thing for them to remember, and it opens the door for accidental churn when they forget. Today's customers expect a "set-it-and-forget-it" option.

This hands-off approach does wonders for customer retention. When payments are automatic, customers avoid late fees and their service is never interrupted because of a forgotten bill. It’s a seamless experience that keeps them happy and subscribed for longer.

Automated billing is a cornerstone for any subscription-based model. If you're looking for more ways to keep your customers around, it's worth exploring other effective strategies to reduce subscription churn.

This applies beyond for-profit businesses, too. Imagine a non-profit that depends on monthly donations. A recurring payment system makes it incredibly easy for supporters to give consistently. Trust is everything for donors, and a secure, reliable payment system builds that trust. They can set up a recurring gift once and know their support is making a difference month after month, no reminders needed.

Evaluating Essential Processor Features

Not all recurring payment processors are built the same. Honestly, picking the right one feels a lot like choosing a business partner—you need someone reliable, capable, and ready for the road ahead. A basic system will get the job done, but a great one will actively help you protect and grow your revenue.

This isn't a decision to take lightly. The payment processing market is on track to hit $147 billion by 2032, and with that growth comes a ton of sophisticated new features. Sure, PayPal might have the biggest slice of the pie, but focusing on market share alone can be misleading. To find the best fit for your business, you have to dig into the specific features. You can get a better feel for the big picture by checking out these payment processing industry statistics.

When you're shopping around, you have to look past the monthly fee and get into the nitty-gritty of what a platform can actually do. That’s what sets you up for success down the line.

Critical Feature Checklist for Recurring Payment Processors

When you start comparing different recurring payment solutions, it's easy to get lost in the details. This table cuts through the noise and highlights the absolute must-have features you should be looking for. Think of it as your essential checklist to make sure you're choosing a processor that will support your business as it grows.

| Feature | Why It's Important | Look For This |

|---|---|---|

| Robust Security | This is table stakes. A security breach can destroy customer trust and lead to massive fines. Your processor handles incredibly sensitive data. | PCI DSS compliance is non-negotiable. Also, look for built-in tokenization and end-to-end encryption. |

| Billing Flexibility | Your business model might change. You don't want your processor to be the thing holding you back from offering new pricing structures. | Support for fixed, tiered, usage-based, and hybrid billing models. The more options, the better. |

| Multiple Payment Methods | Customers expect to pay how they want. Limiting options to just credit cards creates friction and can cost you sales. | Look for support for credit/debit cards, ACH transfers, and popular digital wallets like Apple Pay and Google Pay. |

| Dunning Management | Failed payments are a silent revenue killer. Without an automated system, you're just letting customers slip away for no good reason. | An automated system that retries failed payments intelligently and sends customizable reminders to customers. |

| Analytics & Reporting | You can't fix problems you can't see. Good data helps you understand the health of your subscription business and make smarter decisions. | A clear dashboard that tracks key metrics like MRR, Churn Rate, and Customer Lifetime Value (CLV). |

Ultimately, a processor with these core features isn't just a tool for collecting money—it's a strategic asset that protects your business, improves customer experience, and provides the insights you need to grow.

Robust Security and PCI Compliance

Okay, let's start with the absolute deal-breaker: security. Your processor is handling your customers' most sensitive financial information. One slip-up, one data breach, and the trust you've worked so hard to build can evaporate overnight.

The gold standard here is PCI DSS (Payment Card Industry Data Security Standard) compliance. This isn't just a fancy acronym; it's a mandatory set of security rules for any business that touches credit card data. A compliant processor ensures everything is encrypted, networks are locked down, and access is controlled. This is your first line of defense against fraud and costly breaches.

Key Insight: Choosing a PCI-compliant processor offloads a massive security burden from your business. It means you don't have to handle or store raw credit card numbers, which drastically reduces your risk and liability.

Look for tokenization, which we talked about earlier. It's one of the clearest signs that a processor takes security seriously.

Flexible Billing and Multiple Payment Methods

Your customers want choices—in how they're billed and how they pay. A modern recurring payment processor has to be flexible enough to handle different business models and customer preferences. Otherwise, you're leaving money on the table.

This flexibility really breaks down into two key areas:

- Varied Billing Models: Can the processor do more than just a simple, fixed monthly charge? You'll want support for things like usage-based billing (where customers pay for what they use), tiered pricing (with different feature levels), or even hybrid plans.

- Diverse Payment Options: Credit cards are a given, but they're far from the only game in town. Supporting ACH bank transfers, digital wallets like Apple Pay and Google Pay, and other popular methods opens you up to a much wider audience and makes paying you easier.

A processor that boxes you into one billing model or a handful of payment types will eventually become a roadblock to your growth.

Automated Dunning Management

So, what happens when a recurring payment fails? It’s more common than you think. An expired card or a temporary lack of funds can cause "involuntary churn"—when a customer leaves not because they're unhappy, but because a payment simply didn't go through. This is where dunning management becomes your revenue-saving superhero.

A smart dunning system automates this entire recovery process. Instead of just giving up after one failed charge, it will intelligently retry the payment at strategic times over the next few days.

At the same time, it can send out automated, polite emails asking the customer to update their payment info. This proactive approach salvages revenue that would otherwise be lost and keeps good customers from churning out over a simple, fixable issue.

Detailed Analytics and Reporting

Finally, you can't improve what you don't measure. A top-tier recurring payment processor won't just move money; it will give you a powerful analytics dashboard that turns all that raw transaction data into real business intelligence.

This is about so much more than just seeing your total sales for the month. It’s about truly understanding the health and trajectory of your entire subscription model.

You need a dashboard that puts these critical metrics front and center:

- Monthly Recurring Revenue (MRR): The predictable, stable income your business generates every month.

- Churn Rate: The percentage of subscribers who cancel or leave during a specific period.

- Customer Lifetime Value (CLV): The total amount of revenue you can reasonably expect from a single customer over their entire relationship with you.

These numbers help you spot trends, figure out why customers stay (or leave), and make data-backed decisions that actually grow your business. Without good analytics, you're just flying blind.

The Rise of AI in Payment Processing

Artificial Intelligence isn't just a tech buzzword anymore; it's actively re-wiring the very foundation of how we process payments. For any business built on recurring revenue, AI and machine learning are turning standard payment processors into smart, proactive partners that secure and fine-tune every single transaction.

Artificial Intelligence isn't just a tech buzzword anymore; it's actively re-wiring the very foundation of how we process payments. For any business built on recurring revenue, AI and machine learning are turning standard payment processors into smart, proactive partners that secure and fine-tune every single transaction.

The goal isn't to replace the core function of a recurring payment processor. It's to make it exponentially smarter.

Instead of just following a strict set of pre-programmed rules, AI-powered systems learn from data, adapt on the fly, and make decisions in real time. This is a massive deal in the subscription world, where the constant flow of payments presents both unique challenges and huge opportunities for optimization. Two areas, in particular, are seeing incredible advancements: fraud detection and payment routing.

Enhanced Fraud Detection

In a subscription business, a single compromised account isn't just a one-time problem. It can lead to a steady stream of fraudulent charges, month after month. Traditional fraud systems try to stop this with fixed rules, like flagging transactions from certain locations or blocking a card after a few failed attempts. They help, but they're often clumsy and can easily block legitimate customers (false positives).

This is where AI completely changes the game.

Machine learning algorithms can sift through thousands of data points for every single transaction—all in the blink of an eye. They spot the subtle red flags that a simple rule-based system would never catch, like weird login times, a sudden change in device, or spending habits that just don't match a customer's history. This dynamic approach lets an AI-powered processor pinpoint sophisticated fraud with incredible accuracy, protecting your revenue without annoying your good customers.

Intelligent Payment Routing

Behind the scenes, not all payment paths are created equal. When a customer's payment goes through, it travels through a complex network of acquiring banks and gateways. Sometimes, a transaction fails not because of an issue with the customer's card, but because of a temporary hiccup with one of the banks in that chain.

This is where intelligent payment routing comes in. An AI system monitors real-time data on everything from gateway performance and bank approval rates to network latency.

If it notices a specific gateway is struggling, it can instantly reroute the transaction through a healthier, more reliable path to boost the chances of success. It’s a tiny adjustment that happens invisibly, but it makes a world of difference for your bottom line.

Key Takeaway: Think of AI-driven payment routing as a GPS for your transactions. It finds the fastest, cheapest, and most reliable route for each payment, maximizing successful recurring charges and trimming down processing fees.

This kind of smart decision-making is what separates a basic processor from a tool that actively works to grow your business. With global digital payment volume expected to reach $10 trillion by 2025, even small percentage gains translate into serious revenue. AI-powered systems are on track to save merchants over $40 billion a year by cutting down on fraud, and they can lift approval rates by up to 15% with smart routing alone.

The integration of AI is a fundamental shift in managing recurring payments. For a closer look at the bigger picture, including the ethical side of this technology, check out this article on AI innovation and responsibility. By making billing systems smarter and safer, AI is helping build a far more stable foundation for any subscription company.

How Crypto Gateways Are Shaking Up the Subscription World

For years, subscription businesses have relied on the same old payment processors. They work, sure, but they’re built on financial plumbing that’s decades old. Now, a new contender is rewriting the rules: cryptocurrency. While credit cards and bank transfers are the familiar standard, crypto gateways like ATLOS offer a completely different approach—one designed from the ground up for a global, internet-native economy.

Think of these platforms as a specialized recurring payment processor for digital currencies. Instead of plugging into the traditional banking system, they use blockchain technology to put subscription billing on autopilot. This isn't just a minor upgrade; it's a fundamental change that directly addresses the headaches and high costs that businesses have put up with for far too long.

For any business running on recurring revenue, this shift means faster payments, lower costs, and the ability to reach a truly worldwide audience.

Slashing Fees and Keeping More of Your Revenue

Let’s talk about the biggest, most immediate win: a massive drop in transaction fees. Traditional processors nibble away at your revenue with every single payment, typically taking a percentage plus a flat fee. A common rate is 2.9% + $0.30 for every charge. When you have hundreds or thousands of subscribers, those little bites turn into a huge chunk of your income.

Crypto gateways just operate on a different financial model. They don’t have to deal with the web of intermediary banks and card networks, so their fees are drastically lower. Using a solution like ATLOS means you can save a significant amount on every subscription payment, which goes straight to your bottom line. This isn’t about pinching pennies; it’s a strategic move that can seriously boost your company's profitability.

Picture a software company with 1,000 customers each paying $50 a month. With old-school payment fees, they’d be giving up close to $1,750 every single month. A crypto gateway could slash that cost by over 80%, funneling thousands of dollars back into the business year after year.

That’s money you can pour back into building a better product, ramping up your marketing, or hiring more support staff—the things that actually fuel growth.

Getting Paid in Minutes, Not Days

Another major frustration with the traditional system is the waiting game. When a customer's card is charged, that money doesn't just show up in your account. You’re often left waiting two to five business days for the funds to settle, which can create a real drag on your cash flow.

Cryptocurrency transactions, on the other hand, are incredibly fast. They pretty much settle in real-time.

- Better Cash Flow: Your money is typically available in your wallet within minutes. This gives you immediate access to your capital to run your business.

- No More Holding Periods: Say goodbye to those frustrating multi-day waits. You get your money when your customers pay it, giving you far more financial agility.

- Easier Bookkeeping: When payments and deposits happen almost simultaneously, reconciling your accounts becomes a whole lot simpler.

This speed is a game-changer. It turns your cash flow from a slow, unpredictable trickle into a steady, reliable stream you can count on.

Unlocking a Truly Global Customer Base

If you have any ambition to sell internationally, you know how painful cross-border payments can be. Traditional processors grapple with currency conversions, sky-high international fees, and a patchwork of regional banking rules. All that complexity can make it nearly impossible to serve customers in certain parts of the world.

Cryptocurrency, by its very nature, is borderless. It runs on a global network, so a payment from Tokyo is handled exactly the same as one from Toronto.

This opens up some incredible advantages:

- No More Cross-Border Fees: You can accept payments from anyone, anywhere, without getting hit with extra charges just because they live in another country.

- No Currency Conversion Headaches: Customers pay in a digital asset, and you receive that same digital asset. This eliminates the cost and complexity of swapping between currencies.

- Reach the Unbanked: Crypto gives you a direct line to customers in emerging markets where traditional banking might be less common, opening up massive new audiences.

By adopting a crypto gateway like ATLOS, you can build a subscription model that’s truly global from day one. It instantly positions your business as a modern, accessible choice for customers all over the planet, tearing down the financial walls that used to hold you back.

Frequently Asked Questions

Jumping into subscription billing can feel like you're learning a new language. You've got gateways, processors, dunning management—it's a lot to take in. As you hunt for the right recurring payment processor, it's completely normal to have questions about how these systems work and what really matters.

Let's clear up some of the most common questions business owners have. We'll unpack the difference between key payment tools and look at how a modern processor deals with real-world problems like failed payments and security.

What Is the Difference Between a Payment Gateway and a Recurring Payment Processor?

It helps to think of a payment gateway as the digital version of a credit card reader you’d see at a coffee shop. Its one and only job is to securely grab payment details for a single transaction and pass them along to the payment network. It's a one-way, one-time messenger.

A recurring payment processor is the whole engine, not just a single part. It has a payment gateway built-in, but its real power lies in managing subscriptions. It safely stores a customer's payment info (using a technique called tokenization) and then automatically bills them on the schedule you set. Most platforms you see today, from traditional players like Stripe to crypto-native solutions like ATLOS, wrap all of this into one package.

How Does a Processor Handle Failed Recurring Payments?

This is where a good processor really earns its keep. The feature that handles this is called dunning management. When a payment fails—maybe a card expired or there weren't enough funds—a smart processor doesn’t just throw its hands up. It gets to work trying to recover the sale.

Instead of just one attempt, the system will automatically try to charge the card again a few times over the next few days. It can also send out polite, automated emails to the customer asking them to update their payment details. It’s all done behind the scenes.

This automated recovery process is a lifesaver for cutting down on involuntary churn—that’s when you lose a customer over a simple payment hiccup, not because they actually wanted to cancel. It's a must-have feature for protecting your monthly revenue.

Without it, you could be losing a chunk of your subscribers every month to problems that are completely fixable.

Are Recurring Crypto Payments Secure?

Absolutely. When you use a well-built gateway, they are incredibly secure. Solutions like ATLOS are built on blockchain technology, which means every transaction is locked with powerful cryptography and stored on a public ledger that can’t be altered. That alone creates a transparent and bulletproof record.

But the real security win is how payment information is handled. Your customers approve payments directly from their own crypto wallets, so they never have to share sensitive credit card numbers or bank information with you. This simple step nearly eliminates the risk of data breaches and fraud, giving both you and your customers peace of mind.

Ready to bring your subscription billing into the modern age with the security and efficiency of crypto? ATLOS offers a powerful, no-KYC gateway that helps you accept recurring payments from anywhere in the world, with tiny fees. You can be up and running in minutes, taking back control of your revenue.