Top Crypto Payment Gateway Without KYC – Secure & Easy

Think of a crypto payment gateway without KYC as a direct digital cash register for your business. It’s a system that lets you accept cryptocurrency payments from customers, but with a key difference: it skips the intense identity verification process you see with traditional banks. This creates a much smoother, more private way for merchants and their customers to transact.

Why Businesses Are Choosing Privacy First Payments

Let's be honest, data privacy is on everyone's mind these days. We're all more aware of how our information is being used, and the idea of anonymous, secure transactions has never been more appealing. Traditional payment systems can feel clunky and slow, with long approval times and mandatory "Know Your Customer" (KYC) checks that create a ton of friction.

A crypto payment gateway without kyc simply cuts through all that red tape.

For any online business, the benefits are immediately obvious:

- Instant Onboarding: You can literally start accepting payments in minutes. Forget waiting days or even weeks for approval.

- Enhanced Privacy: You're not forced to collect and store sensitive customer data, which dramatically lowers your risk of becoming a target for data breaches.

- Global Reach: Suddenly, you can accept payments from anyone, anywhere in the world, without worrying about traditional banking borders or restrictions.

By moving past invasive identity checks, businesses are finding a more efficient and inclusive way to operate. This guide will walk you through exactly how these gateways work, the real-world advantages they offer, and how you can safely get one up and running.

So, What Exactly Is a No-KYC Crypto Gateway?

Think about the difference between a traditional bank wire and just handing someone cash. A bank wire is a whole ordeal—IDs, endless forms, and waiting days for approval. It’s a process loaded with friction and demands a ton of your personal data.

A no-KYC crypto gateway is the digital equivalent of that direct cash payment. It’s built for instant, peer-to-peer transactions that put privacy first. When a business uses this kind of gateway, customers can pay directly to the merchant's wallet. The transaction gets its seal of approval from the blockchain itself, not some central bank.

How Does It Actually Work?

When a customer gets to your checkout and picks the crypto option, he or she sends the funds from their personal wallet to your wallet, and the blockchain quickly confirms the payment.

The entire exchange happens without anyone needing to hand over names, addresses, or passport photos. The gateway's only job is to smooth out the transfer from one wallet to another. Of course, to really get a handle on how these gateways work, it helps to understand the assets they're moving. For a great primer on that, you can explore what crypto tokens are. This foundational knowledge makes it much clearer how different digital currencies flow through these systems.

A no-KYC gateway is just a simple, automated facilitator. It doesn't hold your money or your data; it just makes sure the payment instructions are correct and that the transaction gets confirmed on the network.

Custodial vs. Non-Custodial: The Key Difference

This is probably the most important thing to understand: who actually controls the funds? Crypto payment gateways fall into two main camps, and for anyone who cares about privacy, this distinction is everything.

-

Custodial Gateways: These services operate a lot like a traditional bank. They hold onto your private keys and your cryptocurrency for you. While they can be user-friendly, they bring a third party right back into the middle of things, creating a single point of failure. If they get hacked, your funds are at risk.

-

Non-Custodial Gateways: This is the heart and soul of the no-KYC philosophy. With a non-custodial solution, you always keep control of your private keys and your funds. Payments go directly into a wallet that only you can access. This model truly lives up to the mantra of "your keys, your crypto," delivering genuine financial self-sovereignty.

For any business that puts a premium on privacy and security, a non-custodial gateway is the only real choice. It eliminates the need to trust a third party—which is the entire reason KYC was created in the first place. By opting for a non-custodial crypto payment gateway, you and your customers can transact with the highest level of autonomy and security possible.

What Are the Real Benefits of Skipping KYC?

So, why would a business deliberately sidestep the usual identity verification song and dance? It's not about cutting corners; it's about tackling some of the biggest headaches in modern commerce head-on. Choosing a crypto payment gateway without KYC is a strategic decision aimed squarely at boosting speed, enhancing privacy, and opening up access for everyone.

At its core, this approach puts the merchant first. Instead of treating every business like a potential suspect who needs to be thoroughly vetted, it fosters a payment environment that runs on efficiency and trust. The upsides are immediate and obvious for both your payment processing experience.

Protecting User Privacy by Default

We live in an age of constant data breaches. Asking for less sensitive information isn't just a feature—it's a massive competitive advantage. Traditional payment systems force merchants to become guardians of a huge amount of personal data, from names and addresses to copies of government IDs. This effectively paints a giant target on your back for hackers.

A crypto payment gateway without kyc sidesteps this risk entirely. By simply not collecting that data in the first place, you're not just protecting your customers from identity theft; you're safeguarding your business's hard-earned reputation.

Think about a freelance graphic designer who needs to keep her client list confidential. A no-KYC gateway lets her take payments from anywhere in the world without building a database of sensitive client info that could be hacked or leaked.

Getting Started in Minutes, Not Weeks

Anyone who's applied for a traditional merchant account knows the pain. It's a bureaucratic marathon of paperwork, underwriting reviews, and just waiting around for a bank to finally give you the green light. This kind of delay can completely derail a business launch or stop you from jumping on a new market opportunity.

No-KYC gateways slash this multi-week nightmare down to a few minutes.

- No endless forms: All you need is an email and a password to get going.

- Instant setup: You can generate API keys right away and have the payment option live on your site the very same day.

- No waiting for approval: Start accepting crypto payments the moment you're done, with no underwriting required.

This kind of speed gives your business a level of agility that was previously unthinkable.

Opening Your Doors to the World

Billions of people on this planet simply don't have access to traditional banking. They might lack a permanent address, a government ID, or the specific documents needed to open a bank account. For this massive group, buying something online through normal channels is often impossible.

A crypto payment gateway without kyc demolishes these barriers. It lets anyone with an internet connection and a crypto wallet buy your products or services. This move can open your business up to entirely new customer segments that your competitors can't reach, fostering genuine financial inclusion on a global scale.

This is more than just a niche idea; it's driving serious market growth. The global crypto payment gateway market was valued at $1.69 billion and is on track to hit $4.07 billion, largely because more and more people are demanding private and inclusive ways to pay. You can learn more about this trend by reading the full crypto payment gateway market outlook.

KYC vs. No-KYC Gateways: A Direct Comparison

Choosing between a standard KYC-compliant gateway and a crypto payment gateway without KYC can feel like picking a route for a road trip. One is the main highway—well-lit, heavily monitored, with regular checkpoints. The other is a scenic backroad—faster, more direct, and with a lot more freedom. Both get you to your destination, but the experience and the trade-offs are worlds apart.

To really get a feel for which one fits your business, you need to see them side-by-side. The best choice hinges on what you value most: regulatory peace of mind, speed and efficiency, or user privacy.

Onboarding Speed and User Experience

Getting started with a typical KYC gateway is a deliberate, often slow, process. Merchants have to hand over a mountain of documents for verification, a process that can easily drag on for days or even weeks. This hassle often trickles down to your customers, who might get hit with requests to upload IDs and personal info just to make a purchase, creating a perfect opportunity for them to abandon their cart.

On the other hand, a no-KYC gateway is all about speed. You can usually sign up with just an email and start accepting payments almost immediately. For businesses that need to move quickly, this frictionless setup is a massive win. It also smooths out the customer experience by cutting out the intrusive and time-consuming data collection steps.

Privacy and Data Security

KYC, at its core, is all about verifying identity. This means these gateways are built to collect and hoard huge amounts of sensitive user data. While they have security measures in place, this system creates a centralized treasure chest for hackers. If a breach happens, your customers' most personal information is at risk.

A crypto payment gateway without KYC sidesteps this problem entirely by simply not collecting that personal data. This "privacy by design" approach is a core feature, protecting both you and your customers. Transactions stay pseudonymous and secure on the blockchain, which is much more in line with the original spirit of crypto.

The bottom line is this: KYC gateways trade user privacy for a sense of security within the old-school financial system. No-KYC gateways, however, treat user privacy and data minimization as fundamental security features from the get-go.

To help you see the differences in a more concrete way, let's lay it all out in a simple table.

KYC vs. No-KYC Crypto Gateways at a Glance

| Feature | KYC Gateway | No-KYC Gateway |

|---|---|---|

| Onboarding | Slow, requires extensive document verification (days/weeks). | Fast, often requires only an email (minutes). |

| Customer Experience | Can be cumbersome; may require ID uploads at checkout. | Seamless and frictionless; no personal data needed. |

| Data Privacy | Collects and stores sensitive personal data, creating a risk. | Collects minimal to no personal data, enhancing privacy. |

| Transaction Limits | Often starts with low limits, requires more verification to raise. | Typically higher or no limits from the start. |

| Regulatory Compliance | Built-in compliance with AML/KYC laws. | Responsibility falls on the merchant to navigate local laws. |

| Global Access | Limited by geographic and banking regulations. | Accessible globally without banking restrictions. |

As you can see, the choice isn't just about features; it's about philosophy. One prioritizes control and compliance, the other freedom and privacy.

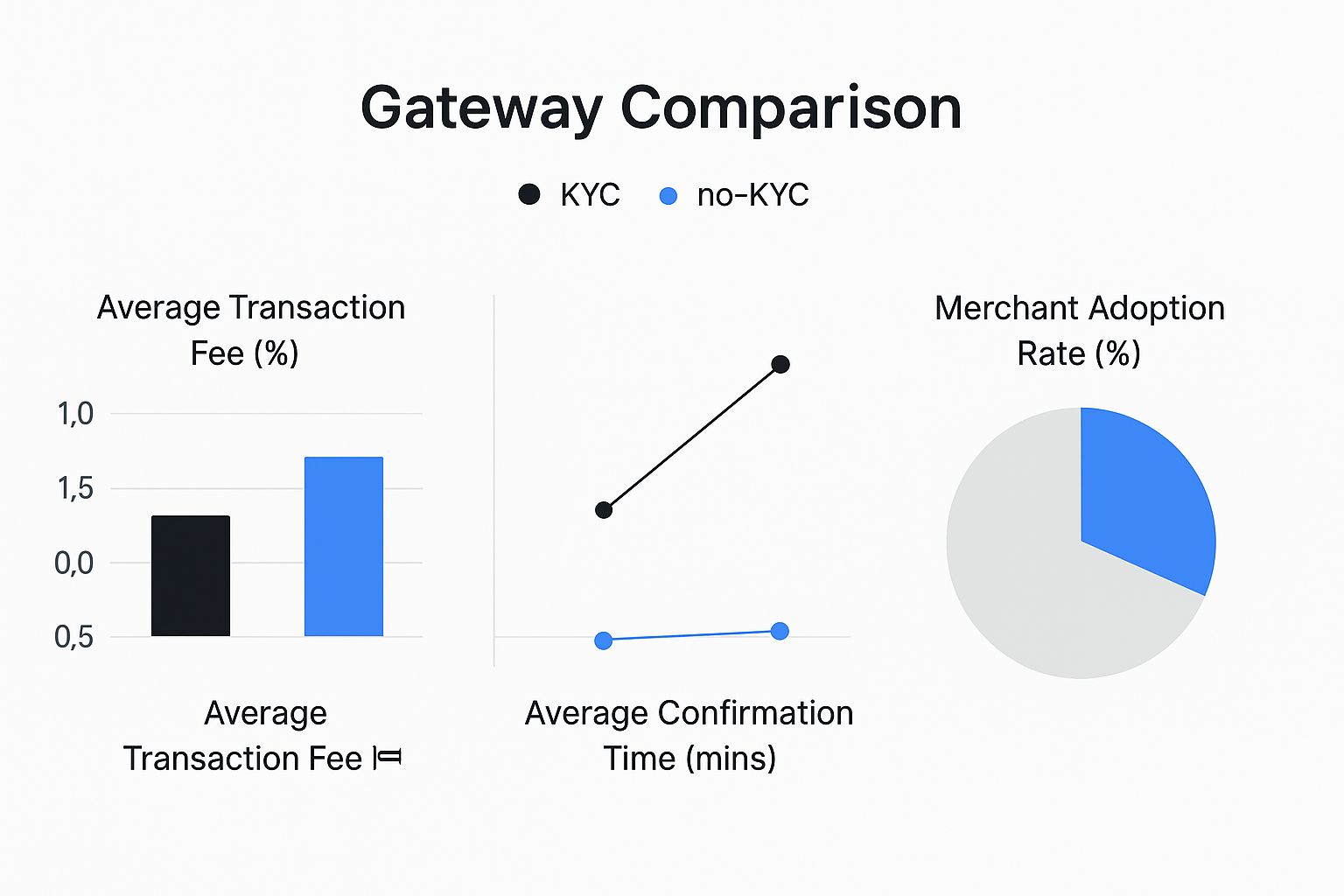

This chart paints a clearer picture of the operational differences you can expect.

The numbers don't lie. No-KYC options often come with lower transaction fees and much faster settlement times, which helps explain why more and more merchants are making the switch.

Navigating the Risks and Legal Landscape

Opting for a crypto payment gateway without KYC opens up a world of speed and privacy, but it's not a path you should walk down with your eyes closed. When you operate a business, the ball is firmly in your court to manage risk and navigate a legal world that’s constantly in flux.

This isn't to scare you off. It's about making sure you’re prepared to run your business safely and smartly. The major hurdles really boil down to three things: regulatory heat, the risk of bad actors, and the fact that crypto payments are a one-way street.

Mitigating Misuse and Fraud

The anonymity that makes a crypto payment gateway without kyc so appealing to legitimate customers can, unfortunately, also attract the wrong crowd. Without the usual identity verification, it's up to you to build your own fences to prevent illegal activity and protect your business.

Here are a few practical steps you can put in place right away:

- Internal Monitoring: Keep an eye on transaction patterns. Set up alerts to flag a sudden, high volume of payments coming from a single wallet or IP address in a short amount of time.

- Transaction Limits: It’s wise to set some sensible limits on how much can be sent in a single transaction, particularly for new customers. This can cap your potential losses from any shady payments.

- Blockchain Analysis Tools: You can use services that scan a wallet’s transaction history to see if it’s been connected to known scams or other illicit funds.

These simple measures add a crucial layer of security, protecting your operations without sacrificing the privacy that your honest customers value.

The good news is that the entire crypto payments industry is getting smarter about security as e-commerce adoption explodes. Many gateways are now adding features like biometric security and cross-chain support to find that sweet spot between ease of use and safety.

Finally, remember that crypto transactions are permanent. There’s no "chargeback" button to hit if something goes wrong. Be crystal clear with your customers at checkout that once they send the payment, it’s final. Managing expectations upfront is the best way to avoid disputes later.

How to Choose and Integrate Your Gateway

Picking the right crypto payment gateway without KYC isn't just a technical decision; it's a business one. Think of it like choosing a foundational partner for your online operations. You need a system that's not only reliable and secure but also fits perfectly with how you already do things.

The right choice can create a smooth, private checkout experience that your customers will love. But getting there means looking past just the transaction fees. You have to dig into the technical architecture, see which coins are on the menu, and figure out how much work it'll take to get everything up and running.

Key Criteria for Your Evaluation

Before you even start looking at providers, it's smart to have a checklist. Not all no-KYC gateways are built the same, and the subtle differences can have a massive impact on your business down the road. A little homework now will save you a world of hurt later.

Here are the four big areas to focus on:

- Security Architecture: Is the gateway non-custodial? This is the absolute most important question to ask. A non-custodial setup means you—and only you—control your private keys and your funds. It’s the entire point of a no-KYC approach.

- Coin Support: Does it accept the cryptocurrencies your customers actually use? Bitcoin is a given, but support for stablecoins like USDT and USDC is critical these days if you want to sidestep price swings.

- Integration Ease: How painful is it to set up? If you're using something like Shopify or WooCommerce, look for pre-built plugins. For a custom build, you'll want clear, well-written API documentation that your developer won't want to throw across the room.

- Community Reputation: What are real merchants and developers saying about it? Check out forums and communities. You're looking for signs of active development, transparency, and a solid reputation for being secure and dependable.

Understanding Your Coin Options

The coins you choose to accept aren't just a list on your website; they directly impact your financial strategy. We've seen a huge shift toward stablecoins in merchant payments, which tells you that businesses are starting to treat crypto as a serious, practical tool, not just a speculative gamble. For example, Tron's TRC-20 is popular for high-volume transactions, while Ethereum remains a go-to for many B2B payments.

A Typical Integration Process

So, you've picked a winner. What's next? The good news is that the technical part is often much less intimidating than it sounds. While every provider is a little different, the general steps for integrating a crypto payment gateway without kyc are pretty standard. For businesses that want total control over their data and infrastructure, looking into self-hosting options is a logical next step that complements the no-KYC philosophy.

The real goal here is to make paying with crypto feel as normal as swiping a credit card. A good gateway hides all the blockchain complexity, giving your customer a simple, clean checkout.

Here’s a quick rundown of what you can expect:

- Account Creation: You'll sign up, usually just with an email. No ID scans, no selfies.

- Generate API Keys: Dive into your new dashboard and find the developer section. You’ll generate a set of API keys, which act as a secure password between your website and the gateway.

- Install a Plugin or Use the API: If you're on a platform like WooCommerce, this is easy. Just install their plugin and paste in your API keys. For a custom site, your developer will use the API docs to wire it into your checkout page.

- Configure Payment Settings: This is where you tell the system what you want to accept and, most importantly, the wallet address where you want to get paid.

- Test and Go Live: Always run a few small test payments first. Make sure everything flows smoothly before you flip the switch for all your customers.

Frequently Asked Questions

Diving into the world of no-KYC crypto payments can feel like a big step. It’s natural to have questions. Here, we'll tackle some of the most common ones to give you the clarity and confidence you need.

What's the Core Difference Between Custodial and Non-Custodial?

It all comes down to a single, critical question: Who controls the private keys?

Think of a custodial gateway like a traditional bank. They hold your funds and your keys for you. This convenience comes at a cost—you're trusting a third party, which creates a single point of failure.

A non-custodial gateway is what no-KYC is all about. With this model, you and only you hold your private keys and have full control over your money. Payments go straight to a wallet that only you can access. It’s the very definition of financial self-sovereignty.

Can I Accept Stablecoins Without KYC?

Yes, absolutely. Any decent no-KYC crypto payment gateway will support a range of digital currencies, and popular stablecoins like USDT and USDC are almost always on the list.

In fact, accepting stablecoins is a brilliant move for any merchant. It protects your business from the price swings of cryptocurrencies like Bitcoin, ensuring the $100 you charge is the $100 you receive. No surprises.

How Do I Prevent Fraud Without KYC?

Just because you aren't collecting personal data doesn't mean you have to be vulnerable. You just need to shift your security strategy. Here’s how you can protect your business effectively:

- Set Transaction Limits: Put sensible caps on payment sizes, especially for new customers. This is a simple way to limit your risk if something goes wrong.

- Use Blockchain Analysis: These tools are like a background check for crypto wallets. They can flag transactions coming from addresses known for shady activity.

- Implement 2FA: For any action involving moving funds, require two-factor authentication. It adds a powerful layer of security to your accounts.

- Educate Your Customers: Make it crystal clear that all crypto payments are final. A simple reminder upfront can prevent a world of headaches and disputes down the line.

Ready to unlock global payments with unmatched privacy and speed? ATLOS Crypto Payment Gateway offers a non-custodial solution that lets you accept crypto directly to your wallet, with no KYC required. Start accepting private payments in minutes with ATLOS.