How to Accept Crypto Payments A Merchant Guide

So, you’re thinking about letting customers pay with crypto? It’s a smart move. Getting set up is all about integrating a crypto payment gateway, like ATLOS, into your checkout. This simple step can open your business up to a whole new world of customers, giving them a fast, secure way to pay with digital currencies and saving you money on fees in the process.

Why Accepting Crypto is a Smart Business Move

Adding crypto to your payment options isn't just about jumping on the latest tech trend. It's a genuine business strategy that can open up new revenue streams and seriously improve your profit margins. We're seeing more and more merchants realize that stepping beyond traditional payment methods connects them with a global, tech-forward audience that actually looks for businesses that accept their preferred currency.

The benefits are real, and you'll see them almost immediately. Let's talk numbers. Transaction fees for most crypto payments hover around 1%. Compare that to the 2.9% or more you’re likely paying for credit card processing. That difference goes straight back into your pocket on every single sale.

Tapping Into a Global Marketplace

One of the biggest wins here is how easily you can handle international payments. They happen almost instantly, without the usual headaches of currency conversions or waiting on slow cross-border bank transfers. This isn't just a nice-to-have feature; it’s a real engine for growth.

I’ve seen this play out firsthand. An online store I know that sells digital art saw its international sales jump by 20% just three months after adding a crypto payment option. They used to constantly fight with declined cards from certain countries and get hit with big fees on international wires. Crypto wiped those problems out completely.

Crypto is borderless. It lets you take payments from anyone, anywhere, without sweating currency exchange rates or expensive international transfer fees. It effectively turns your business into a truly global storefront.

And this isn't a one-off story. The whole crypto payments world is exploding, thanks to interest from everyday shoppers and big institutions alike. The total transaction volume is on track to hit $10.8 trillion, and there are now over 32,000 online merchants worldwide accepting digital assets. That represents a 38% increase in businesses getting on board, which tells you everything you need to know about where things are headed. You can find more stats on this trend over at Coinlaw.io.

The Foundational Technology Driving Growth

What makes all this work so reliably is the technology behind it. To really appreciate why accepting crypto is such a solid move, it helps to have a basic understanding of blockchain development. That’s the system that makes every transaction secure, transparent, and final, giving you and your customers total confidence.

Ultimately, deciding to accept crypto is about future-proofing your business. It's about connecting with a new generation of consumers, cutting your operating costs, and making global commerce simple. Now that we've covered the 'why,' let's get into the 'how.'

Choosing Your Crypto Payment Gateway

So, you're ready to start accepting crypto. The first, and most important, decision you'll make is choosing the right tool for the job. While you could technically have customers send crypto directly to your personal wallet, that’s a manual, risky, and frankly, unscalable way to do business. A dedicated crypto payment gateway, like ATLOS, is the essential bridge between your store and the world of digital currency.

Think of it as the crypto version of a credit card terminal. It automates the entire process, making everything secure and straightforward for both you and your customer. Instead of just rattling off a list of features, let's look at what a gateway actually does for your business and why it’s a non-negotiable for any serious merchant.

Protection from Market Volatility

Let's address the elephant in the room: price swings. This is the number one concern I hear from businesses thinking about crypto. A quality payment gateway completely solves this with instant fiat conversion. When a customer pays you in Bitcoin, ATLOS can immediately convert it into your local currency, like USD or EUR.

This means you get the exact amount you charged, every single time. You get all the perks of accepting crypto—like low fees and access to a global customer base—without any of the market risk. The gateway handles all the complex conversion work behind the scenes, so you can treat a crypto sale just like any other transaction.

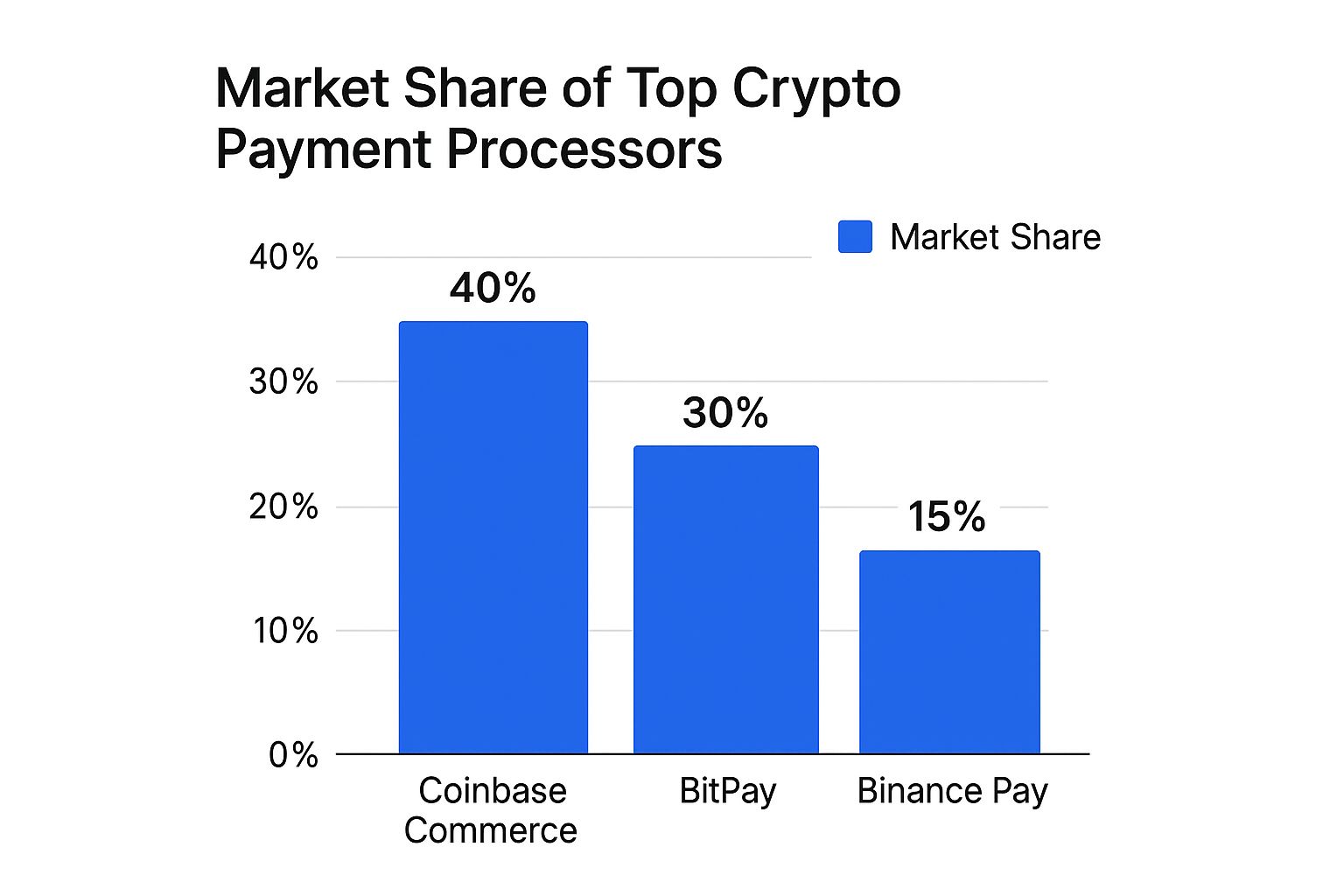

The market for these processors is definitely heating up. A few key players have emerged, but there's plenty of room for competition.

This data shows that while a few established names hold a big piece of the pie, it’s still a dynamic space where different platforms bring unique strengths to the table.

Lower Fees and Simpler Integration

Another massive win is the cost savings. Most crypto payment gateways charge a simple processing fee of around 1%. Compare that to the 2.9% + $0.30 you're likely paying for credit card transactions. Those savings go straight to your bottom line on every single sale.

A dedicated gateway isn't just a tool; it's a strategic asset. It removes volatility, cuts costs, and simplifies the technical hurdles, making it possible for any business to confidently step into the crypto economy.

Better yet, platforms like ATLOS are built to be incredibly easy to implement. A simple API (Application Programming Interface) allows for a painless connection to your existing website or e-commerce platform. You absolutely do not need to be a blockchain developer to get this running. In many cases, it’s as simple as installing a plugin.

To really put it in perspective, let's break down how using a gateway like ATLOS stacks up against other common methods.

Comparing Crypto Payment Methods

Here's a side-by-side look at the key features of the ATLOS gateway versus other common ways to accept crypto payments. This should make the advantages crystal clear.

| Feature | ATLOS Payment Gateway | Direct Wallet-to-Wallet | Exchange Payment Button |

|---|---|---|---|

| Ease of Use | Fully automated checkout integrated into your site | Manual process; requires copying addresses and confirming | Redirects customers off-site; can be confusing |

| Volatility Risk | Eliminated with optional instant fiat conversion | Full exposure to market fluctuations | Often limited to holding crypto on the exchange |

| Transaction Fees | Typically a flat 1% | Variable network fees only (can be high) | Often 1%, plus potential withdrawal fees |

| Customer Support | Dedicated merchant support and technical help | Zero support; you're entirely on your own | Limited to the exchange's general support |

| Integration | Simple API and e-commerce plugins | No integration; completely separate from checkout | Basic buttons, but limited customization |

| Transaction Records | Centralized dashboard for easy tracking & reporting | Manual tracking required for all accounting | Records kept within the exchange account |

Ultimately, while other methods exist, a dedicated payment gateway provides the professional, secure, and efficient framework you need to run your business properly. It transforms a potentially complicated process into a seamless part of your daily operations.

Alright, let's get into the nitty-gritty. Now that you understand the "why," we can dive into the "how." I'm going to walk you through what it actually looks like to integrate a crypto payment gateway into your business, using ATLOS as our real-world example.

My goal here is to pull back the curtain and show you that getting started is much less intimidating than you might think. You don't need to be a developer to make this happen.

The whole process is built to be intuitive. From the moment you sign up to when you customize your checkout, every step flows logically. Let's break it down so you feel comfortable from start to finish.

Getting Your Merchant Account Set Up

First things first: you need an ATLOS merchant account. A big advantage right off the bat is their no-KYC (Know Your Customer) approach. This is a game-changer because it lets you get set up and start accepting payments almost immediately, skipping the weeks of back-and-forth verification you often face with traditional payment companies.

With your account live, the next step is to generate your unique API keys. Think of these as a secure, digital handshake between your website and the ATLOS gateway. You'll want to copy these and keep them somewhere safe—they're the keys to the kingdom for connecting your store and processing payments securely.

Customizing Payments and Settlements

Now for the fun part. Once your account is ready, you get to configure your payment settings. This is where you decide which cryptocurrencies you're willing to accept. ATLOS supports a pretty wide variety, from the big players like Bitcoin and Ethereum to many others, so you can easily cater to what your customers are using.

One of the most critical settings you'll want to look at is your settlement preference. If you're worried about crypto's infamous price swings, you can enable auto-conversion to fiat. This feature is a lifesaver. It automatically converts any crypto payment you receive into your chosen currency (like USD), so you get the exact dollar amount you charged. No surprises.

The ATLOS dashboard makes all of this incredibly straightforward. As you can see below, it’s a clean interface where you can manage your account and integrations without getting lost in a sea of options.

This is your mission control. It gives you a complete overview of transactions, settings, and API connections all in one spot.

A Real-World Shopify Integration

To make this less abstract, let's say you run a store on Shopify. Getting ATLOS up and running is as simple as adding any other app. Just head over to the Shopify App Store, search for the ATLOS plugin, and click install.

During the setup, the plugin will ask for those API keys you generated earlier. You’ll just paste them in, and that one action securely links your entire store to your ATLOS account. From there, you can tweak the settings right inside the plugin.

- Payment Method Title: You can call it something clear and simple, like "Pay with Crypto," so customers know exactly what it is.

- Coin Selection: Pick and choose which of your enabled cryptocurrencies you want to show up as options on your checkout page.

- Checkout Instructions: You can even add a little helpful note for your customers, like "Scan the QR code with your crypto wallet to pay."

Once you save your settings, the crypto payment option appears right alongside your other methods like credit cards and PayPal. The whole experience feels native to your store—no weird redirects to a third-party site that might make a customer nervous.

When a customer chooses "Pay with Crypto," a simple payment box appears directly on your checkout page, showing a QR code and a wallet address. They just scan the code with their mobile wallet, confirm the payment, and they're done. On your end, the order is instantly marked as paid, just like any other transaction. This kind of smooth, familiar process is the key to successfully figuring out how to accept crypto payments without overhauling your entire workflow.

Managing Your Crypto Transactions Day to Day

https://www.youtube.com/embed/hXuK6FxD2bo

Once you're set up and live, your focus naturally shifts from integration to daily operations. The great thing about a well-built gateway like ATLOS is that this part feels surprisingly familiar, almost like managing traditional online payments. Your command center for everything crypto is the merchant dashboard.

This is where you'll keep an eye on incoming funds, look up transaction histories, and pull the reports your accountant needs. Forget about juggling different wallet addresses or manually logging payments in a spreadsheet. Instead, you get a clean, unified view of all your crypto activity, which is a huge time-saver and essential for keeping things running smoothly.

Navigating the ATLOS Merchant Dashboard

We designed the ATLOS dashboard to give you a clear picture at a glance. You can instantly see successful payments, check their confirmation status on the blockchain, and dive into crucial details like the transaction ID or which cryptocurrency was used. This kind of transparency is a lifesaver for both customer support and bookkeeping.

A big part of daily management is keeping an eye on costs. For anyone accepting Ethereum, for example, it’s a good idea to monitor Ethereum gas fees, as they can fluctuate and affect transaction costs. While ATLOS handles the heavy lifting, knowing the basics helps you understand the environment you're operating in.

The goal of a great payment gateway is to make a crypto transaction feel just as routine as a credit card sale. Your dashboard should provide all the tools you need for oversight, reporting, and customer service without requiring deep technical knowledge.

Getting these operational details right is becoming more important every day. Projections show that crypto payment usage among existing owners is expected to jump by 82.1% in the near future. This means merchants need solid, reliable processes for handling volatility, refunds, and daily reconciliations. Having a smooth day-to-day workflow isn't just a "nice-to-have"—it's quickly becoming a necessity.

Handling Unique Customer Service Scenarios

From time to time, you'll run into customer service questions specific to crypto, with refunds being the most common. While crypto transactions themselves are irreversible on the blockchain, a gateway like ATLOS gives you a simple, controlled way to process refunds on your end.

Let’s walk through a common scenario. A customer buys a $100 item with Bitcoin but later needs to return it. Here’s how you'd handle that inside ATLOS:

- Locate the Transaction: First, you’d pull up the original $100 order in your dashboard, likely by searching for the order ID or the customer's email.

- Initiate the Refund: Inside the transaction details, you'll find a clear refund option. You can typically choose whether to refund the original crypto amount or its equivalent fiat value at the time of the refund.

- Process the Payment: ATLOS then helps you send the correct amount back to the customer's wallet address. Crucially, the entire process is logged right there in your dashboard, creating a clear record for your books.

This kind of straightforward process is key to building customer trust. It shows that even in the world of crypto, returns and refunds don't have to be complicated, giving you the confidence to manage these payments for the long haul.

Keeping Your Crypto Payments Secure and Compliant

Stepping into the world of crypto payments isn't just about adding a new button to your checkout. It's about taking a serious approach to security and compliance to protect both your business and your customers. Getting a few fundamentals right from the start can save you a world of headaches down the road.

Think of your ATLOS account as the keys to your new digital vault. The absolute first thing you should do is enable two-factor authentication (2FA). It’s a simple click, but it adds a massive layer of protection by requiring a code from your phone for logins or important changes.

And those API keys? They're the secure handshake between your website and the ATLOS gateway. Treat them like your bank account password. Never share them publicly, store them somewhere safe, and only give access to trusted team members who truly need it.

Making Sense of Crypto Compliance

Compliance in the crypto space can feel like a maze of acronyms, but it doesn't have to be overwhelming. The two big ones you’ll see are AML (Anti-Money Laundering) and KYC (Know Your Customer). These are just standard regulatory checks designed to prevent illegal financial activity.

A good gateway like ATLOS handles much of the heavy lifting here. It provides a clean, transparent record of all your transactions, which is exactly what you need for a solid audit trail. This built-in framework helps you operate above board without needing a law degree.

You're responsible for securing your own account and business practices. The gateway's job is to provide a secure and compliant highway for your transactions. It's a true partnership in security.

For most businesses I talk to, price volatility is a big concern. That's why stablecoins—which are pegged to currencies like the US dollar—have become so popular. They now account for over 91% of daily crypto transaction volume because they offer the stability merchants need for everyday business. They're especially great for simplifying cross-border payments.

Getting a Handle on Tax Reporting

Finally, let's talk taxes. Yes, crypto transactions are taxable, and the rules can vary quite a bit depending on where you operate. The key is to keep meticulous records of every single sale and conversion.

ATLOS helps immensely by giving you detailed transaction reports that you can export. But let’s be honest, crypto tax law is a moving target and can get complicated fast.

This is one area where you don't want to guess. I always advise merchants to talk to a tax professional or accountant who actually has experience with digital assets. They can give you advice that fits your specific business and ensures you stay on the right side of the law. As a good rule of thumb, you should also review your company's overall data security best practices to ensure all sensitive financial information is properly protected.

Got Questions? Let's Talk About Accepting Crypto Payments

Even after mapping out the process, you probably still have a few questions bouncing around. That's completely normal. Deciding to accept crypto is a big move for any business, so let's clear up some of the common concerns we hear from merchants just before they dive in.

"What About Crypto's Price Swings? I Can't Risk That."

This is, without a doubt, the number one concern we hear. The idea of getting paid $100 for a product, only to have it be worth $90 an hour later, is terrifying for any business owner.

The solution is actually quite simple: use a payment gateway like ATLOS that provides instant fiat conversion. Here’s how it works: a customer pays you in Bitcoin, and the gateway instantly converts that payment into your local currency, like US Dollars or Euros.

You get the exact sale amount, every single time. This completely insulates your business from the notorious ups and downs of the crypto market. You get all the benefits of accepting crypto payments without any of the speculative risk.

"Are the Transaction Fees Really That Much Lower?"

Yes, and the difference can be substantial. Most crypto payment processors charge a simple flat fee, typically around 1%.

Now, compare that to the 2.9% + a fixed fee you’re likely paying for every single credit card transaction. For businesses doing significant volume or serving a global customer base, those savings add up fast and go straight to your bottom line. It's often the most compelling financial reason to make the switch.

The checkout process with modern crypto gateways is often as simple as scanning a QR code. They're built to be incredibly intuitive, so even customers who aren't crypto experts can sail through payment.

"But What If My Customers Aren't Crypto-Savvy?"

A fair point. But you’d be surprised how straightforward the experience is. When a customer opts to pay with crypto, they aren't faced with a complex technical interface. They just see a QR code and a wallet address.

From there, all they do is scan the code with their crypto wallet app, confirm the amount, and the payment is sent. It's often faster than digging a credit card out of a wallet.

If you want to be extra helpful, you can always add a small "How to Pay with Crypto" section on your payment page. As digital currencies become more common, this process is becoming just as routine as typing in card numbers.

Ready to tap into a new global market and cut down on those pesky transaction fees? ATLOS offers a secure, no-KYC payment gateway that makes it incredibly easy to start accepting crypto. See how simple it can be over at https://atlos.io.