Your Guide to White Label Crypto Payment Gateways

This guide explains what a white-label crypto payment gateway is and how it works, breaking down how these platforms let businesses accept crypto under their own brand without the massive headache and cost of building a payment system from scratch. Whether you’re a startup or a large company, this guide will show you how to get your crypto payment solution to market fast, covering the core ideas, essential features, and what to look for when choosing a partner to offer your customers a secure and smooth payment experience.

Put Your Brand on Crypto Payments

So, what is a white-label crypto payment gateway? In simple terms, it’s a ready-made payment processing system that a company can buy and rebrand as its own.

Think of it like this: instead of building a car from scratch—designing the engine, sourcing the parts, and assembling it all—you get a fully-built, high-performance vehicle. All you have to do is add your own paint job and logo.

This model is a game-changer for businesses that want to get into the crypto space. It sidesteps the biggest obstacles: the time, the money, and the technical know-how. You avoid spending months, or even years, bogged down in development, security protocols, and regulatory compliance. You just plug in a solution that already works.

The benefits are immediate and clear:

- Go to Market Faster: You can launch your own crypto payment service in a matter of weeks, not years.

- Keep Your Brand Front and Center: The entire payment experience feels like it's yours, creating a consistent and trustworthy journey for your customers.

- Slash Development Costs: You skip the enormous expense of hiring a specialized development team, building secure infrastructure, and maintaining it all.

Understanding the White Label Gateway Model

Imagine you want to start your own line of high-end coffee. You could spend years and a small fortune buying land, building a roasting facility, and sourcing the perfect beans. It's a massive undertaking.

Or, you could find a world-class roaster who has already perfected the entire operation. They handle the complex machinery and quality control, and you simply put your brand—your logo, your packaging, your name—on the finished product. This is the essence of white-labeling.

A white label crypto payment gateway works the exact same way. It's a complete, secure, and ready-to-go payment system built by a specialized tech company. Instead of building your own crypto payment infrastructure from the ground up—a massively expensive and complex project—you license their technology and rebrand it as your own.

The Core Partnership Dynamic

This model is all about a smart partnership. On one side, you have the technology provider, the silent partner working behind the scenes. They do all the heavy lifting that most businesses simply can't or don't want to do.

This includes things like:

- Core Infrastructure: Building and maintaining the complex software and secure servers that make transactions happen.

- Blockchain Integration: Connecting to different crypto networks like Bitcoin, Ethereum, and others so you can accept various coins.

- Security Protocols: Implementing tough security measures like multi-signature wallets and advanced fraud detection to keep funds safe.

- Ongoing Maintenance: Taking care of all the software updates, bug fixes, and performance tuning so the system runs smoothly.

Your business, meanwhile, gets to focus on what you're good at: building your brand and taking care of your customers. You control the entire customer-facing experience, offering a sleek, branded payment solution without ever writing a single line of code. It's a strategic division of labor that makes the whole thing work.

At its heart, the white label model is about leverage. It lets you tap into a provider's multi-million dollar investment in technology and expertise for a tiny fraction of the cost. You get an enterprise-grade solution without the enterprise-level headaches.

From Blank Canvas to Your Branded Service

When you sign on with a provider, they hand you what is essentially a "blank canvas"—a powerful, unbranded platform. It has all the features you need, like payment processing and merchant dashboards, but none of the provider's branding. Your job is to make it yours.

This is where the magic happens. The end-user, your customer, sees a payment checkout with your logo, your colors, and your messaging. They get a professional and seamless transaction that builds trust in your brand, all while being completely unaware of the tech provider powering it all in the background.

This creates a true win-win. The provider licenses their technology to multiple businesses, and you get to offer a sophisticated service that would otherwise be far out of reach. It opens the door for businesses of all sizes to compete in the growing world of digital currency.

Key Business Benefits of a White Label Solution

Opting for a white label crypto payment gateway instead of building one from scratch is more than a technical choice—it's a powerful strategic move. It gives you a clear and rapid path to entering the market, letting you sidestep the massive costs and headaches that come with in-house development.

When you use a ready-made solution, you're tapping into a platform that's already secure, tested, and reliable. This frees up your team to focus on what they do best: marketing, winning over customers, and delivering great service, instead of getting lost in the complex world of blockchain engineering.

Drastically Reduce Your Time to Market

Let's be blunt: building a crypto payment gateway from the ground up is a huge undertaking. You’re looking at months, if not years, of planning, coding, relentless testing, and security hardening before you have anything close to a market-ready product. In the fast-moving crypto space, that kind of delay means leaving money on the table.

A white label solution changes the game entirely, shrinking that timeline from years down to just a few weeks. The heavy lifting is already done. The core infrastructure is built, audited, and running. All you need to do is handle the branding, customization, and integration—a far simpler and faster process.

The ability to launch quickly is a massive competitive advantage. While your competitors are still tangled up in development hell, you can be out there signing up merchants and processing transactions, cementing your brand's position from the get-go.

Achieve Significant Cost Savings

Building a payment gateway from scratch is expensive, and the costs don't stop once the initial development is done. The ongoing operational expenses of a custom-built system are often a nasty surprise for businesses.

Here’s a quick look at the major costs you completely avoid with a white label partner:

- Specialized Talent: You don't have to find, hire, and pay a team of expensive blockchain developers, security analysts, and compliance specialists.

- Infrastructure Overhead: Forget about the costs of setting up and maintaining secure servers, data centers, and all the required network infrastructure.

- Regulatory Compliance: Your provider handles the incredibly complex and costly job of keeping up with ever-changing financial regulations.

- Continuous R&D: You aren't on the hook for funding the research and development needed to add new features or integrate the next big blockchain.

This approach effectively turns a huge, risky capital investment into a predictable, manageable operating expense. That frees up cash you can pour back into growing your business.

To put it in perspective, let's compare the two paths side-by-side.

In-House Development vs. White Label Gateway Comparison

This table breaks down the core differences when you're deciding between building it yourself or buying a ready-made solution.

| Factor | In-House Development | White Label Solution |

|---|---|---|

| Time to Market | 12-24+ months | 2-6 weeks |

| Initial Cost | Very High (Development, Staff, Infrastructure) | Low (Setup fees, subscription) |

| Ongoing Costs | High (Maintenance, Security, Compliance) | Predictable (Monthly/Transactional fees) |

| Required Expertise | Deep technical, security, and legal knowledge | Minimal technical skills needed for integration |

| Brand Control | Full control, but requires significant effort | Full branding on a pre-built platform |

| Security & Compliance | Full responsibility and liability | Handled by the expert provider |

| Focus | Diverted to technical development and maintenance | Concentrated on business growth and customers |

As you can see, the white label model offers a much more efficient route for most businesses, preserving capital and allowing for a sharper focus on core objectives.

Maintain Brand Consistency and Trust

Think about the last time you made a purchase online. When it’s time to pay, a smooth, familiar experience is crucial. If you're suddenly redirected to a generic, third-party payment page with a brand you don't recognize, it can be jarring and even feel untrustworthy.

A white label crypto payment gateway solves this problem completely. Every step of the checkout process—from the payment fields to the confirmation screen—features your logo, your colors, and your messaging. This creates a seamless, professional experience that reinforces your brand's identity and reassures customers that they're in a safe, secure environment. That consistency can have a direct, positive impact on your conversion rates.

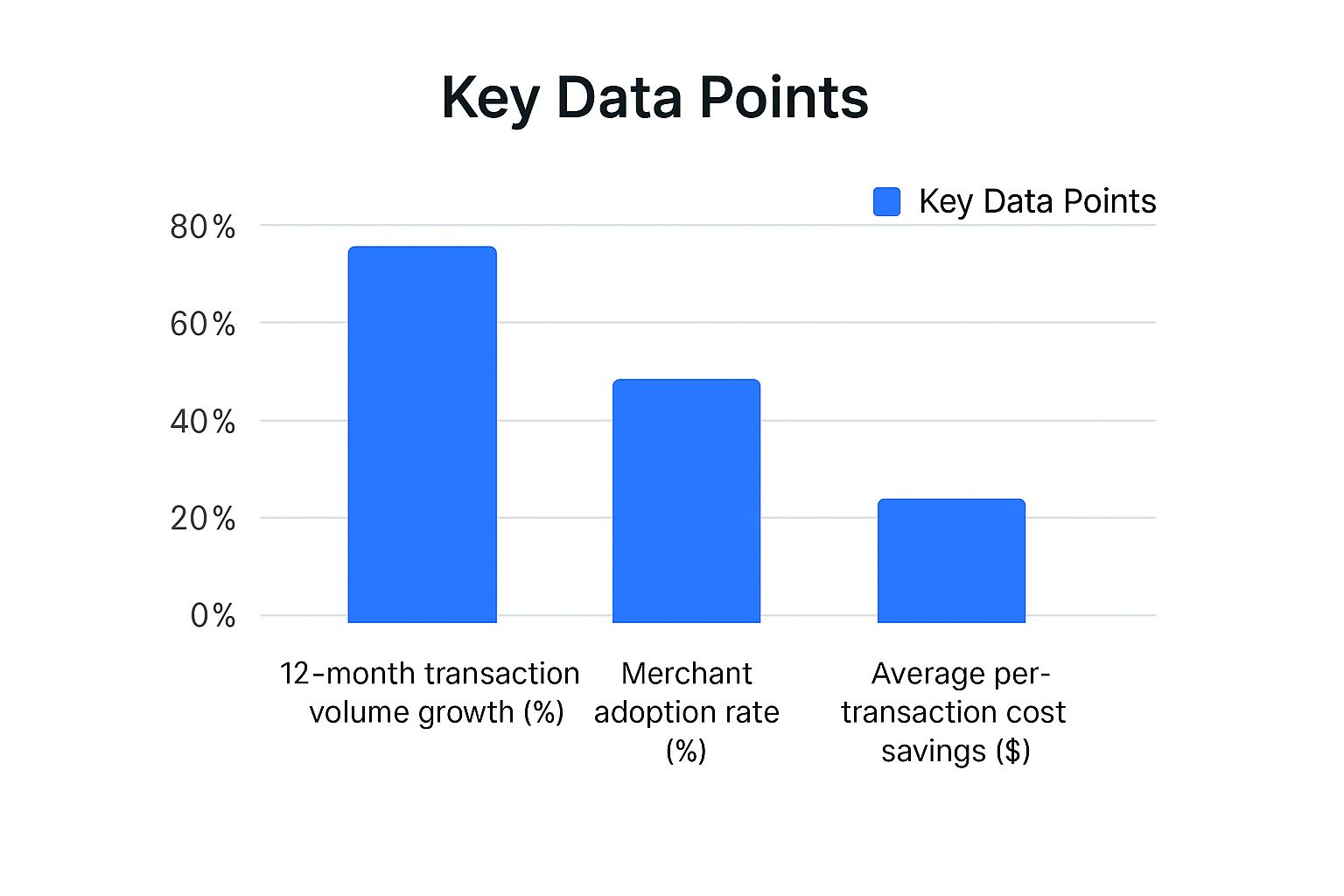

This chart shows the kind of growth businesses often experience after switching to a white label payment solution, tracking key metrics like transaction volume, merchant adoption, and cost savings per transaction.

The numbers speak for themselves. Using a white label framework can be a powerful catalyst for faster growth and better financial performance.

Leverage Built-In Expertise and Security

Finally, when you partner with a white label provider, you’re not just buying software—you’re gaining access to their entire team of specialists. These are people who live and breathe payment technology. They ensure the gateway is constantly updated with the latest security patches, performance upgrades, and crucial regulatory changes.

The market for these solutions is booming for a reason. Valued at roughly USD 5.4 billion in 2024, the global White Label Payment Gateway market is on track to hit USD 12.7 billion by 2033. This incredible growth shows just how many businesses are looking for secure, customizable payment solutions that take the burden of development off their shoulders. You can read the full research on white label market growth to dig deeper into the trend.

The Non-Negotiable Features Your Payment Gateway Needs

When you start shopping for a white-label crypto payment gateway, it's easy to get lost in the noise. So many solutions look the same on the surface, but what's under the hood is what separates a clunky system from a true growth engine for your business.

Think of it like buying a car. Two models might look almost identical, but one has a high-performance engine and advanced safety features, while the other is just a basic shell. To make the right choice, you have to look beyond the shiny exterior.

So, let's pop the hood. This section is your practical checklist for what really matters. We’ll break down the features you absolutely can't compromise on, giving you a clear framework to evaluate partners and pick a solution that will actually help you succeed.

Multi-Currency and Multi-Chain Support

The crypto world is a lot bigger than just Bitcoin. A truly useful payment gateway has to be flexible enough to handle a wide range of digital assets across different blockchains. After all, your customers want to pay with the coins they already own, and your job is to make that easy for them.

At a minimum, your gateway needs to support:

- The Heavy Hitters: This means Bitcoin (BTC) and Ethereum (ETH). They're the most widely held assets, so this is non-negotiable.

- Popular Altcoins: Adding support for other well-known coins like Litecoin (LTC), Ripple (XRP), or Cardano (ADA) casts a wider net for potential customers.

- Stablecoins: For any merchant who wants to sidestep crypto's infamous price swings, stablecoins like USDT (Tether) and USDC (USD Coin) are essential. They're pegged to fiat currencies, which makes accounting a whole lot simpler.

Multi-chain support is just as critical. The ability to process transactions on networks like the BNB Smart Chain, Polygon, or Tron means your customers get faster, cheaper payments. That small detail can make a huge difference in the checkout experience.

Robust Security Protocols

In crypto, security isn’t just a feature—it’s the entire foundation. A single breach can shatter customer trust and bring a business to its knees. A good white-label provider handles this heavy lifting for you with battle-tested security measures.

Here’s what to look for on your security checklist:

- Cold Storage: The vast majority of funds should be kept in offline "cold" wallets. This makes them inaccessible to hackers and is the gold standard for securing crypto.

- Multi-Signature (Multisig) Wallets: These wallets require multiple approvals to authorize a transaction. This simple step prevents a single point of failure and protects against both internal theft and compromised keys.

- Advanced Fraud Detection: The system needs to be smart enough to monitor transactions in real-time, automatically flagging and blocking anything that looks suspicious before it becomes a problem.

A provider’s commitment to security is a direct reflection of their professionalism. Never compromise on these features; they are your first and best line of defense.

Seamless API and Integration

A payment gateway can't exist in a bubble. It needs to plug right into the tools you already use, whether that’s your e-commerce store, your accounting software, or a custom-built platform. This is where a powerful and well-documented Application Programming Interface (API) comes in.

A good API gives your developers the freedom to weave the payment gateway directly into your website or app. This creates a smooth, on-brand checkout process and connects to platforms like WooCommerce or Shopify with minimal fuss, cutting down on manual work.

Intuitive Admin Dashboard and Reporting

If you can't measure it, you can't manage it. A great admin dashboard is your command center, giving you a bird's-eye view of your entire payment operation in real time. It should deliver the kind of insights that help you make smarter business decisions.

Look for a dashboard that offers real-time transaction monitoring, detailed sales reports, and customer analytics. This data gives you the power to track revenue, spot payment trends, and make reconciliation a breeze.

Integrated KYC and AML Compliance Tools

Trying to keep up with financial regulations can feel like a full-time job. The best gateway providers take this headache away by building Know Your Customer (KYC) and Anti-Money Laundering (AML) tools right into their platform.

These features automate customer identity verification and monitor for suspicious activity, helping you stay on the right side of the law.

In 2025, these integrated compliance tools are no longer a "nice-to-have"—they're essential infrastructure. They don't just process payments; they also handle multi-chain settlements and smart-contract programmability, helping businesses move into the Web3 economy faster and with lower development costs. You can dig deeper into how top white label crypto gateways provide these tools and stay ahead of the curve.

How to Brand and Customize Your Gateway

The real magic of a white-label crypto payment gateway isn’t just using the tech—it’s making that tech completely yours. This is about taking a powerful engine and building a custom vehicle around it that perfectly fits your brand and your customers' needs.

You're not just a reseller; you're the owner of the solution. By customizing the payment experience, you create something that feels native to your platform. That builds a level of trust and brand loyalty that a generic, third-party checkout page just can't compete with.

Tailoring the User Interface and Experience

Think about the last time you were about to buy something online. If the checkout page looked clunky, unfamiliar, or just plain off, did you hesitate? Most people do. That moment of friction is a conversion killer.

Visual customization is your best tool to prevent this. The goal is to make the payment gateway a seamless, almost invisible extension of your brand. You want your customers to feel like they never left your site.

Here’s where you should focus your branding efforts:

- Logo and Branding: Your logo needs to be front and center on every payment screen. It's an immediate signal of trust and recognition.

- Color Palette: Match the colors of buttons, backgrounds, and text to your website's design. Consistency is key to a professional look.

- Fonts and Typography: Using the same fonts as the rest of your site ties the whole experience together beautifully.

These might seem like small details, but they have a massive impact. When the checkout process feels like a natural part of your brand, customers feel more secure handing over their money.

Customization is more than just making things look pretty. It's a strategic move to build customer confidence. A branded checkout reassures users that they're in a safe, professional environment—which is absolutely critical for any financial transaction.

Functional Customization for Your Business Model

Beyond just the look and feel, a truly powerful white-label crypto payment gateway lets you get under the hood and tweak how it actually works. This is where you align the payment system with your specific business strategy, setting up rules and workflows that make sense for you.

This is the kind of control that a one-size-fits-all solution simply can't offer. For instance, a gaming platform might want to accept specific tokens popular within its community. An e-commerce store, on the other hand, would likely prioritize stablecoins to sidestep price volatility.

These functional tweaks are typically handled through a dedicated admin panel or an API, putting you in the driver's seat of your payment operations.

Defining Your Payment Rules

Your ability to set specific payment rules is what really turns this from a generic tool into a bespoke business asset. You can configure the gateway to operate exactly how your business needs it to.

Here are a few of the most important functional customizations you can make:

- Setting Custom Transaction Fees: You get to decide your own fee structure. Whether it's a flat fee, a small percentage, or a hybrid model, you can create a new revenue stream or just cover your operational costs.

- Selecting Supported Cryptocurrencies: You’re not stuck accepting every coin under the sun. You can hand-pick the cryptocurrencies that your target audience actually uses and wants to spend.

- Defining Settlement Rules: You control how and when you get paid. You can opt for instant conversion to fiat to dodge volatility or choose to hold certain cryptocurrencies as part of your financial strategy.

A flexible API takes this even further, enabling deep integrations with the software you already use. Imagine connecting the gateway directly to your accounting platform, inventory system, or CRM. This kind of automation streamlines your entire workflow and frees up a ton of time.

Choosing the Right White Label Provider

Picking a partner for your white-label crypto payment gateway is easily the most critical decision you'll make. The right provider works like a silent extension of your own team, but the wrong one can bury you in technical headaches, security risks, and angry customers. Think of it like hiring an architect to build your dream home—their skill, reliability, and vision will quite literally shape the final product.

This choice is about much more than a feature list or a price tag. You're signing up for a long-term relationship. You need to be confident that their technology is solid, their support team is dependable, and their business practices are completely transparent. This guide will give you a clear framework to evaluate potential partners, making sure you ask the right questions to find one that truly sets you up for success.

Evaluating Technical Capabilities and Reliability

First things first: the tech has to be flawless. Your provider's technical foundation dictates the speed, efficiency, and flexibility of your entire payment system. Start by digging into their core infrastructure.

Ask them direct questions about system uptime and reliability. Any serious provider should offer a clear service-level agreement (SLA) guaranteeing a specific uptime percentage, ideally 99.9% or higher. Anything less is an open invitation for risk to your operations and revenue stream.

Just as important is their blockchain support. A good partner will support a wide range of networks and cryptocurrencies—not just the big names like Bitcoin and Ethereum, but also the popular stablecoins your customers actually use. This ensures you can serve a broad audience and adapt as the market shifts.

Scrutinizing Security and Compliance Records

In the crypto world, security isn't just a feature; it's everything. A single breach can torch your brand's reputation for good. Your provider must have an ironclad, demonstrable commitment to protecting funds and user data.

Go deep on their security protocols. Look for concrete features, not just vague promises:

- Cold Storage Solutions to keep the vast majority of funds offline, far away from hackers.

- Multi-Signature (Multisig) Wallets that require more than one person to approve a transaction.

- Regular Security Audits performed by well-known, independent firms.

Beyond their own walls, check their track record with regulatory compliance. A seasoned provider will already know how to navigate the maze of Know Your Customer (KYC) and Anti-Money Laundering (AML) rules in different countries. Their expertise here protects your business from massive legal and financial blowback.

A provider's security posture is a direct reflection of their professionalism. Don't just take their word for it—ask for proof of audits, certifications, and their incident response plan. Your business's survival could depend on it.

Demystifying the Pricing Structure

The pricing for white-label gateways can be confusing, and hidden fees are a classic "gotcha" that can quickly eat into your profits. A provider you can trust will have a completely transparent and straightforward pricing model that makes sense for your business.

Get a full breakdown of their costs. You’ll typically see a mix of these three:

- Setup Fees: A one-time charge to get the platform configured with your branding.

- Monthly or Annual Fees: A recurring subscription for software access and support.

- Transaction Fees: A percentage or flat fee skimmed off each payment you process.

Make sure you understand every single charge and how it might change as your transaction volume grows. A predictable cost structure is key to building a sustainable business without nasty financial surprises down the road.

Assessing Support and Service-Level Agreements

When something goes wrong—and at some point, it will—the quality of your provider’s support becomes paramount. Slow, unhelpful support translates directly to lost sales and frustrated users. Before you sign anything, put their support team to the test.

Open a support ticket with a real technical question or schedule a call to see how knowledgeable and responsive they are. A true partner will offer multiple support channels (email, phone, chat) and have clear SLAs for response times. That commitment to service is one of the best signs of a healthy, long-term partnership.

The market for these solutions is growing fast, and so are the expectations for top-tier service. Forecasts show the crypto payment gateway market is on track to blow past USD 5 billion by 2031. A major trend fueling this growth is the adoption of stablecoins, which give merchants the price stability they need. You can find more insights on crypto payment gateway trends at Coinsclone.com. Choosing a provider who gets these trends and backs it up with excellent support is absolutely vital.

Common Questions, Answered

Jumping into the world of white-label crypto payment gateways can feel like a big step. It’s smart to have questions—after all, this isn't just about adding a new feature. It’s about choosing a core piece of your financial infrastructure and a partner to help you run it.

Let's clear up some of the most common questions we hear from businesses just like yours. We’ll skip the dense technical talk and get straight to the practical answers you need to make a confident decision.

How Long Does It Take to Get Set Up?

This is probably the number one question, and the answer is one of the biggest draws of a white-label solution: it’s fast. Building a crypto payment gateway from the ground up is a massive undertaking, easily taking a year or more. With a white-label product, you're skipping all of that. The core engineering, security protocols, and blockchain integrations are already done and battle-tested.

So, how long are we talking? For most businesses, you can expect to go from signing the paperwork to processing live payments in about two to six weeks.

The exact timeline really boils down to three things:

- Your Customization Needs: If you just need to drop in your logo and match your brand colors, that’s quick. If you’re looking for deeper changes to the user interface or need a specific feature tweaked, that will naturally add a bit more time.

- Your Team's Readiness: How prepared is your tech team to plug into the provider's API? Good documentation from the provider helps a ton, but a ready and waiting development team on your end is what makes the integration process fly.

- Internal Housekeeping: Things like getting your branding assets over to the provider, making final decisions, and handling the legal side of things can also affect the launch date.

How Do I Actually Get My Money?

It’s a critical question, and with a non-custodial white-label crypto payment gateway, the answer is simple: you're always in control. The gateway provider never actually holds your funds. They just provide the rails to move the money from your customer directly into your wallet.

When it comes to settlements, you have a lot of flexibility to match your company’s financial strategy. Typically, you can choose from a few different models:

- Crypto-to-Crypto: The customer pays in Bitcoin, and you receive that Bitcoin right into your company’s wallet. This is perfect if you want to accumulate and hold digital assets.

- Instant Fiat Conversion: Worried about crypto’s price swings? Many businesses are. You can have payments automatically converted into a stablecoin (like USDT) or a traditional currency (like USD or EUR) the moment the transaction happens. The funds are then settled to your bank account.

- A Mix of Both: You can also set up rules. For example, maybe you decide to hold all Bitcoin payments but instantly convert any altcoin payments to fiat to minimize risk.

This level of control means your payment system works for your financial goals, not against them.

Who Handles Customer Support?

Customer support is a team effort, and any good provider will structure it as a partnership. The best way to think about it is in two layers, which makes sure your customers get the right answers from the right people, fast.

Tier 1 Support (That’s You): You are the face of your brand, so you handle all the frontline conversations with your users. This means answering questions about their orders, guiding them through a payment, or troubleshooting simple issues. It keeps your brand experience consistent and builds trust.

Tier 2 Support (That’s the Provider): When your team hits a wall with a technical problem—maybe an API isn't responding, a bug pops up, or something isn't processing correctly—they escalate it to the white-label provider. The provider’s team is responsible for the heavy lifting: maintaining the core technology and squashing any deep-seated software bugs.

This two-tiered system is the best of both worlds. You get to own the relationship with your customers, but you're backed by a team of technical experts whenever you need them. It’s like having an in-house team of blockchain engineers without the massive overhead.

Ready to offer seamless, branded crypto payments to your customers? With ATLOS, you can launch a secure, non-custodial white label crypto payment gateway that puts you in complete control. Start accepting crypto your way.