The Ultimate Payment Gateway SaaS Guide

Smooth online payments are the lifeblood of any modern business, but the technology powering them can feel complex. This guide pulls back the curtain on the Payment Gateway as a Service (SaaS) model—the invisible engine driving everything from a simple online purchase to a complex monthly subscription. We'll break down why this service-based approach has made older systems obsolete, explore how these gateways work, and provide practical tips on choosing and integrating one into your own business.

A payment gateway SaaS is essentially a cloud-based service that securely handles online payments for you. Think of it as a highly specialized digital cashier that sits between your customer and your bank, encrypting all the sensitive data and making sure the money gets routed correctly. The best part? You don't have to build or manage any of that complex infrastructure yourself.

Unpacking the Power of a Payment Gateway SaaS

At its heart, a SaaS payment gateway takes one of the biggest headaches of e-commerce off your plate. It wraps up all the heavy lifting of security, compliance, and technical upkeep into a neat subscription service, freeing you up to actually run your business.

This shift isn't just a small trend; it's a massive market movement. The global payment gateway market was valued at around $12.81 billion in 2025. It's expected to grow at a compound annual rate of 13.42% through 2033, fueled by the unstoppable rise of online shopping.

Why This Model Dominates Modern Commerce

Switching to a SaaS model for payment processing gives businesses real, tangible advantages that let them focus on growth instead of getting bogged down in technical details.

- Reduced Complexity: You can add sophisticated payment options to your site without hiring a team of engineers to manage servers, security updates, or compliance paperwork.

- Enhanced Security: These providers are experts in payment security. They manage PCI DSS compliance and use advanced fraud detection so you don't have to.

- Scalability on Demand: As your business takes off, a SaaS gateway scales with you. It can handle a huge increase in transactions without you needing to upgrade a single piece of hardware.

- Global Reach: The best gateways come with built-in support for multiple currencies and popular international payment methods, helping you open up new markets almost overnight.

As digital payments continue to evolve, it's also smart to keep an eye on what's next, like the emerging Web3 ecosystem. Brushing up on the basics with a good Web3 Dictionary can give you a solid foundation for understanding the future of transaction technology. This kind of forward-thinking is key in a field that changes so quickly.

What Is a Payment Gateway SaaS?

Let's break down what a payment gateway SaaS actually is. The simplest way to think about it is as the digital version of a credit card terminal—the kind you see in a physical store—but supercharged for the online world.

When a customer hits "buy now" on your site, the payment gateway is the secure middleman that jumps into action. It grabs the customer's payment details, encrypts them for safety, and then passes the information along to the banks and card networks.

This whole complicated dance happens in the blink of an eye, giving your customers the smooth, instant checkout they've come to expect.

The SaaS Difference: Subscribing vs. Building

The "SaaS" part of the name is what makes this so powerful for most businesses. It stands for Software-as-a-Service, and it means you're essentially renting a sophisticated payment system instead of building one yourself.

Think about it: creating your own payment infrastructure from scratch is a massive undertaking. It requires huge upfront investment, a team of specialized developers, and constant maintenance to keep it secure. With the SaaS model, you subscribe to a service that handles all of that heavy lifting for you.

If you're new to the concept, it's worth understanding the core concept of SaaS to see why it has become the go-to model for so many software tools. Your provider takes care of security patches, server uptime, and navigating the maze of financial regulations like PCI DSS, letting you focus on what you do best—running your business.

The Key Players in Every Transaction

A payment gateway doesn't operate in a silo. It's the central hub that connects four key players to make a single transaction happen. Knowing who's involved helps demystify how money gets from your customer's wallet into your bank account.

- The Merchant: That's you and your business. You're selling a product or service and need a way to get paid for it online.

- The Customer: The person on your website making a purchase. They kick things off by entering their payment info.

- The Issuing Bank: This is the customer's bank (think Chase, Bank of America, etc.). It's the bank that issued their credit card and has the final say on approving or declining the transaction based on the customer's funds.

- The Acquiring Bank: This is your business's bank. Its job is to receive the approved funds from the issuing bank and deposit them into your merchant account.

The gateway is the critical communication bridge, making sure information flows between all these parties securely and almost instantly.

The bottom line? A payment gateway is the central nervous system of your online store. It checks the card details, sends the payment request to the right banks, and reports back whether the transaction was approved or declined.

The Benefits of a Service-Based Approach

Choosing a SaaS payment gateway gives you immediate advantages, especially if you plan on growing. It’s a flexible approach that’s nearly impossible to match with a self-built system.

Here’s a quick look at the main perks:

| Benefit | Why It Matters |

|---|---|

| Lower Upfront Costs | You get to skip the crippling expense of building and certifying a payment system from the ground up. |

| Always-On Security | Your provider handles all security updates, fraud prevention, and PCI compliance, keeping you and your customers safe. |

| Effortless Scalability | As your sales grow, the gateway scales with you. No need to worry about upgrading servers or software. |

| Faster Time to Market | You can integrate a battle-tested payment solution in days, not months, and start accepting payments right away. |

By outsourcing this critical piece of your business to the experts, you get a world-class payment system without the headaches. This helps you build trust with your customers and, most importantly, cut down on abandoned carts.

How a Modern SaaS Payment Gateway Works

Ever wondered what happens in the split second after a customer clicks "Pay"? It’s not magic, but it’s close. A modern payment gateway kicks off a complex, high-speed process behind the scenes, acting as a digital go-between to make sure sensitive data is protected and money moves to the right place.

Think of it as the central nervous system for your online sales. This intricate sequence connects your website, your customer's bank, and your own bank, all while wrapping the data in layers of security.

The Transaction Journey: From Click to Confirmation

Every online purchase, whether it's for a coffee or a new car, follows a similar path. The payment gateway sits at the heart of this journey, managing the flow of information and making sure every step is validated and secure. It might feel instant to the customer, but several key stages are happening in the background.

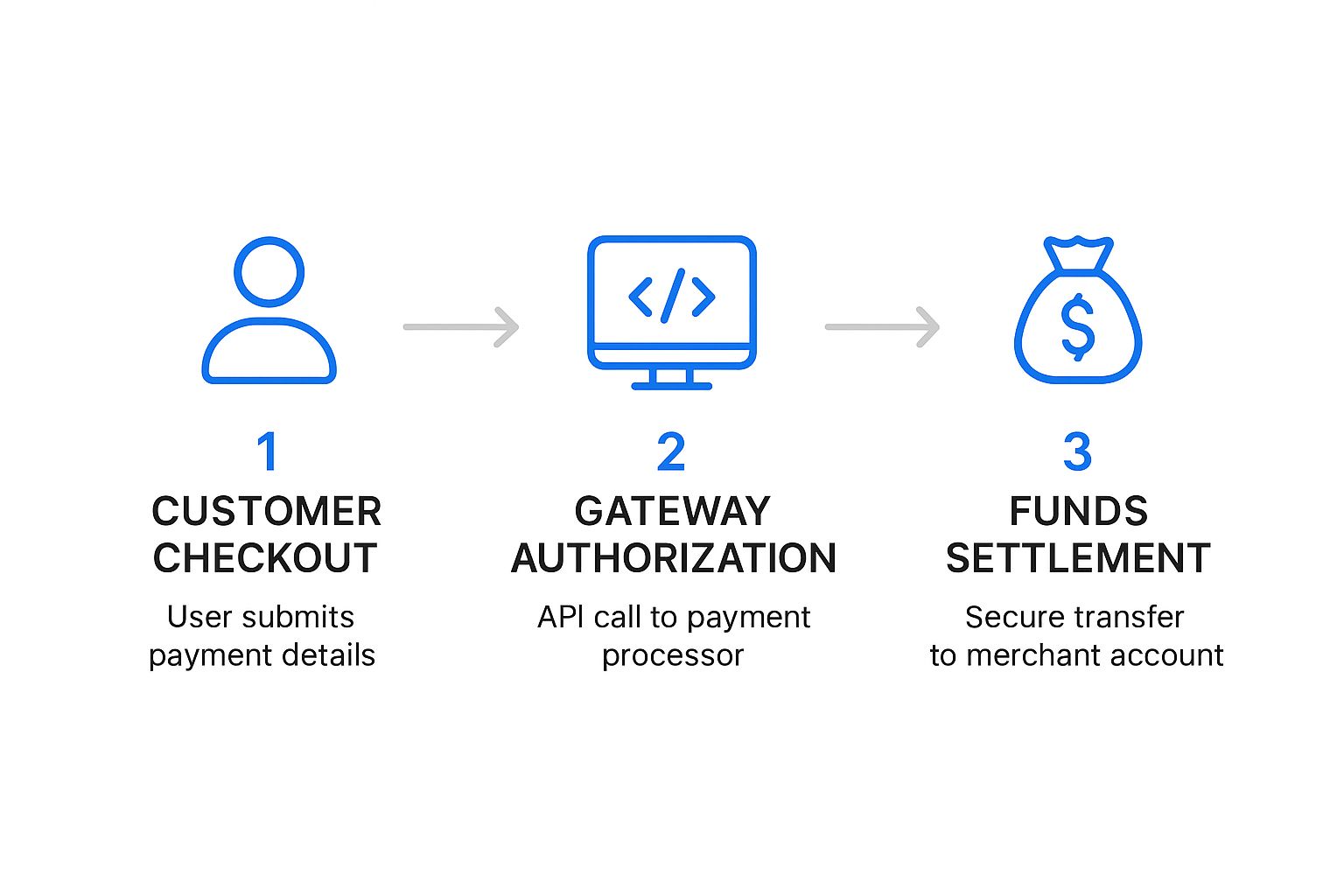

This infographic breaks down exactly what's going on from the moment the customer hits "checkout" to when the funds finally land in your account.

As you can see, the gateway’s first job is to lock down the customer’s data. Then, it contacts the banks to get the green light for the transaction, and finally, it confirms that the money has been successfully transferred.

Unpacking a Key Security Feature: Tokenization

One of the most important security tools in a gateway’s arsenal is tokenization. Instead of sending raw credit card numbers across the internet, the gateway swaps this sensitive information for a unique, non-sensitive string of characters—a "token."

This token is essentially a secure stand-in for the actual card number. It can be safely stored and used for things like recurring subscriptions without ever exposing your customer's real financial data. This simple swap dramatically reduces the risk of a data breach.

Hosted vs. Integrated Gateways: A Crucial Distinction

When you’re setting up payments, you’ll run into two main types of gateways: hosted and integrated. The biggest difference is where the actual transaction happens—on your website, or on a page controlled by the payment provider. Getting this choice right is fundamental to designing a checkout experience that your customers will trust and complete.

For a deeper dive into the technical side of things, it’s worth understanding the nuances of payment gateway integration and maintenance.

When you're choosing a payment gateway, one of the first decisions you'll make is whether to use a hosted or an integrated solution. Each has its own set of trade-offs that can impact your customer experience, development resources, and security responsibilities.

Let's break them down.

| Feature | Hosted Gateway | Integrated Gateway |

|---|---|---|

| User Experience | Customer is redirected to the provider's site (e.g., PayPal) to complete payment. | Customer stays on your website for the entire checkout process. |

| Security & PCI | The provider handles the bulk of PCI DSS compliance, reducing your burden. | You take on more responsibility for PCI compliance since you handle the data. |

| Brand Control | Limited. The checkout page is branded by the payment provider. | Full control. You can design a seamless, fully branded checkout experience. |

| Implementation | Generally simpler and faster to set up. | More complex, requiring developer resources to integrate via API. |

| Conversion Impact | The redirect can sometimes cause customer drop-off. | A smooth, integrated experience often leads to higher conversion rates. |

| Best For | Businesses wanting a quick, simple setup with minimal security overhead. | Businesses focused on brand consistency and optimizing the user journey. |

Essentially, a hosted gateway is the faster, simpler path, offloading much of the security work to a trusted third party. An integrated gateway, on the other hand, gives you complete control to build a professional, seamless flow that feels like a natural part of your brand.

The choice between these models has serious market implications. The global payment gateway industry was valued at an estimated $37.0 billion in 2024. Hosted gateways are still the larger slice of the pie, bringing in $15.34 billion in 2022 thanks to their simplicity. Meanwhile, integrated gateways generated $10.66 billion. Interestingly, large enterprises make up about 55% of the market, with SMEs accounting for the other 45%.

Here’s a fresh take on that section, written to sound like an experienced professional sharing their insights.

How a Modern Payment Solution Becomes Your Growth Engine

Let's move past the technical nuts and bolts for a minute. The real magic of a SaaS payment gateway isn't just about how it processes transactions—it’s about how it fundamentally fuels business growth. Think of it less like a utility and more like a strategic partner that opens up new revenue channels, strengthens customer trust, and makes your entire operation run smoother. When you adopt a modern payment solution, you're not just taking money; you're laying the groundwork for a business that can truly scale.

The numbers alone tell a powerful story. Payment gateways are on track to handle a staggering global transaction value of $2.78 trillion in 2025. That's a 16.4% leap from the previous year, with e-commerce being the primary driver. This trend underscores just how essential a rock-solid payment system is for anyone doing business online. You can dig deeper into these figures and get more insights into payment gateway market statistics to see where things are headed.

Fortify Security and Build Customer Trust

One of the first and most critical wins you get with a SaaS payment gateway is an immediate security upgrade. Let's be honest, handling sensitive financial data is a huge responsibility. The biggest headache is usually achieving and maintaining PCI DSS (Payment Card Industry Data Security Standard) compliance—a complex, expensive, and frankly, painful set of rules for protecting customer card information.

A good SaaS provider takes this entire burden off your shoulders. They've already poured millions into world-class security, from tokenization to sophisticated fraud detection, to make sure every transaction is locked down tight. This doesn't just shield you from the nightmare of a data breach; it sends a clear signal to your customers that their information is safe. And a checkout process people trust is a checkout process people complete.

By handing off PCI compliance to a dedicated SaaS provider, you're not just cutting costs. You're tapping into their deep expertise to create a more secure and trustworthy payment experience for your customers.

Unlock Global Markets Instantly

Thinking about selling beyond your local borders? A SaaS payment gateway is essentially your passport to the global marketplace. In the old days, expanding internationally meant getting tangled in a web of local banking rules, currency conversion headaches, and figuring out how people in different countries actually like to pay.

A modern gateway cuts through all that complexity.

- Multi-Currency Support: You can price your products and accept payments in dozens of local currencies without a second thought, making international customers feel right at home.

- Local Payment Methods: It’s not all about credit cards. A good gateway lets you offer popular regional options like direct debit or digital wallets, which can seriously boost conversion rates in certain markets.

- Automated Tax Calculation: Many of the best platforms can even help you navigate the tricky world of international sales tax and VAT, removing a major administrative burden.

With this kind of global infrastructure already built-in, you can start testing and selling in new markets with very little risk. What used to be a massive expansion project can now be as simple as flipping a switch.

Reduce Cart Abandonment and Boost Conversions

Nothing kills a sale faster than a clunky, slow, or sketchy-looking checkout. Every single extra click, every redirect to an unfamiliar page, and every unnecessary form field is another chance for your customer to get frustrated and leave. A seamless, integrated payment gateway is the direct antidote to this problem.

By keeping the entire payment flow on your own site and making it lightning-fast, you create a smooth, frictionless path from cart to confirmation. This isn't just about a better user experience; it's about building the confidence a customer needs to hit "buy." The result is refreshingly simple: more finished sales and more money in the bank.

Drive Operational Efficiency with Automation

Finally, let’s talk about efficiency. The whole point of the "SaaS" model is automation, and this is where you start seeing massive time and cost savings. Manually chasing down failed payments, sending invoices, and managing subscriptions are exactly the kinds of tasks that eat up resources that should be focused on growing the business.

A SaaS payment gateway puts all of that on autopilot.

- Recurring Billing: Set up subscription plans once and let the system handle the automatic charging on whatever schedule you need.

- Automated Invoicing: Generate and send professional invoices automatically, which means you get paid faster and your records are always clean.

- Dunning Management: The system can intelligently handle failed payments by retrying cards and sending automated reminders to customers, recovering revenue you might have otherwise lost for good.

When you automate these core financial tasks, you slash manual errors, stabilize your cash flow, and free up your team to focus on what they do best.

How to Choose the Right Payment Gateway SaaS

Picking a payment gateway isn't just a technical checkbox; it's a huge business decision. The right partner can make your operations sing and boost conversions. The wrong one? It can become a constant source of friction for both your team and, more importantly, your customers.

This choice has a direct line to your revenue, security, and your ability to grow.

To get it right, you need to look past the slick marketing and dig into the nitty-gritty details that actually matter for your business. Whether you’re running a subscription service, an international marketplace, or a straightforward online store, the fundamentals are the same.

Deconstruct the Pricing Models

First things first: let's talk about fees. What you pay on every single transaction can eat into your profit margins, so you have to get this part right. Don't let hidden costs sneak up on you.

You'll generally run into two main pricing structures:

- Flat-Rate Pricing: This is the simple, no-fuss model. The provider charges a fixed percentage plus a small fee for every transaction (think 2.9% + $0.30). It's predictable, easy to forecast, and a fantastic choice if you value straightforward accounting.

- Interchange-Plus Pricing: This model is more transparent but also a bit more complex. It passes the direct interchange fee from the card networks straight to you, adding the gateway's fixed markup on top. While it can be cheaper for businesses with a high volume of transactions, the rates will fluctuate with every single purchase.

Prioritize a Developer-Friendly Integration

A smooth, painless integration process is completely non-negotiable. The most feature-packed payment gateway is worthless if getting it to work is a nightmare. This is why you need to find providers who care about the developer experience.

Clear, well-organized documentation is the first clue you're on the right track. It should be easy to search and be full of clean code samples. Just as important is a powerful and flexible API (Application Programming Interface). A great API gives your developers the tools they need to build a custom, seamless checkout experience that feels like a natural part of your brand.

A clunky integration doesn't just burn through developer hours; it leads to a buggy checkout that will send your customers running for the hills.

Check for Pre-Built Integrations

Beyond a solid API, you also need to see what pre-built connections are available for the tools you already rely on. Your payment gateway isn’t an island; it needs to talk to your e-commerce platform, your CRM, and your accounting software.

Key Consideration: Does the gateway have plug-and-play integrations with platforms like Shopify, WooCommerce, or Magento? A pre-built connector can save you weeks of custom development work and ensure all your systems stay perfectly in sync.

This kind of compatibility is what automates your workflows. Think about it: a customer makes a purchase, their record is instantly updated in your CRM, and the sale is logged in your accounting software, all without anyone lifting a finger. Without these connections, you're stuck with manual data entry—a recipe for inefficiency and errors.

Scrutinize Security and Support

Finally, you have to be absolutely confident in the provider's security and their ability to help you when things go wrong. Your customers are handing over their most sensitive financial data, and that trust is incredibly fragile.

Before you sign on the dotted line, create a checklist of non-negotiable questions. Doing your due diligence here ensures you partner with a company that takes security and support as seriously as you do.

Your Essential Vetting Checklist:

- Security Measures: How do you handle PCI DSS compliance? What specific fraud prevention tools do you offer, like AVS, CVV checks, or risk scoring?

- Customer Support: What are your support channels and hours? If there's a critical issue, what's your guaranteed response time?

- Scalability: Can your system handle a massive traffic spike during a Black Friday sale? What is your uptime guarantee?

- Global Capabilities: Do you support multi-currency transactions and popular international payment methods?

By methodically working through these key areas—pricing, integration, compatibility, and support—you can confidently select a payment gateway SaaS that not only fits your needs today but is ready to grow with you tomorrow.

Picking the Right Payment Gateway Provider

Choosing a payment gateway SaaS isn't about finding the "best" one—it's about finding the right one for your business. The perfect solution for a scrappy, developer-led startup will look very different from what a massive, global retailer needs.

Let's break down a few of the major players. Think of this less as a ranking and more as a guide to understanding their unique personalities and who they serve best. Getting this choice right can make your operations sing, but the wrong fit can introduce a ton of headaches you just don't need.

Stripe: The Developer's Playground

If you talk to anyone in the tech world, Stripe is almost always the first name that comes up, and for good reason. Its superpower is its incredibly powerful and well-documented API. This gives developers the keys to the kingdom, letting them build a completely custom, on-brand checkout experience from the ground up.

Stripe is the champion for businesses that want total control over the payment flow without ever sending a customer to another page. It's a natural fit for SaaS companies managing complex subscriptions, marketplaces juggling payments between buyers and sellers, or any business that needs to handle sophisticated payment logic. Their tech-first mindset also means they’re usually at the forefront of supporting new payment methods as they emerge.

PayPal: The King of Conversion

PayPal's biggest asset is its name. It has built up an incredible amount of trust with hundreds of millions of people all over the globe. For many online shoppers, seeing that familiar blue button is a shortcut to feeling secure.

Simply adding PayPal as an option can give your checkout an instant credibility boost, which often translates directly to higher conversion rates. It’s an excellent choice for any business selling to a wide audience, especially if you're trying to reduce cart abandonment from shoppers who are wary of typing their credit card info into a site they've never used before.

The real secret is to look at these gateways from your customer's point of view. Stripe is for when you want the payment process to feel like an invisible, seamless part of your brand. PayPal is for when you want to borrow its brand trust to make your customers feel safe.

Major Payment Gateway SaaS Providers at a Glance

To help you map your needs to the right provider, it helps to see their core offerings side-by-side. Each one strikes a different balance between customizability, ease of use, and global reach.

This table provides a quick look at what some of the leading payment gateway SaaS providers are known for, so you can start to see which one aligns with your business goals.

| Provider | Best For | Pricing Model | Key Features |

|---|---|---|---|

| Stripe | Tech companies and businesses needing deep customization via APIs. | Flat-Rate | Powerful APIs, extensive developer tools, and broad support for modern payment methods. |

| PayPal | Businesses aiming to maximize conversions by offering a trusted, familiar option. | Flat-Rate & Custom | Massive global user base, strong brand trust, and simple setup for basic checkouts. |

| Adyen | Large, global enterprises needing an all-in-one platform for online, in-app, and in-store payments. | Interchange-Plus | Unified commerce, advanced risk management, and extensive international payment options. |

In the end, it all comes down to your priorities. Do you need ultimate flexibility to build something unique? Are you focused on squeezing every last conversion out of your checkout? Or do you need a single, unified system to manage sales across the globe? Once you answer that, you’ll have a much clearer idea of which payment gateway SaaS is the right partner for you.

Got Questions About Payment Gateways? We've Got Answers.

Jumping into the world of payment gateways can bring up a lot of questions. How does it actually work? What's it going to cost me? Let's clear up some of the most common things business owners ask when they're thinking about a new payment solution.

Think of this as your quick-start guide to understanding the practical side of things—setup, costs, and security—so you can make a smart choice.

How Long Does It Take to Set Up a Payment Gateway?

Honestly, it depends. The setup time for a payment gateway can range from a few hours to a few weeks, and it really comes down to the type you choose.

A hosted gateway is the quickest option. This is the kind that sends your customers to the provider’s secure page to complete their payment. You can usually get one of these up and running in an afternoon.

If you want customers to stay on your site the whole time, you’ll need an integrated, API-based solution. This gives you way more control over the user experience but also means more work for your developers. The timeline here could be a few days or a couple of weeks, depending on how complex your site is and how good the provider's instructions are. A gateway with solid, developer-friendly documentation will make this process much faster.

What Are the Typical Fees Involved?

Payment gateway fees can be a bit tricky, so it's super important to know what you're looking for to avoid any nasty surprises down the road. The fee everyone knows is the transaction fee, which is usually a small percentage plus a fixed amount per sale (a common one is 2.9% + $0.30).

But that's not the whole story. You need to dig a little deeper and ask about:

- Monthly Fees: Is there a flat fee you have to pay every month just to keep the service active?

- Setup Fees: Some providers will charge you a one-time fee just to get your account started.

- Chargeback Fees: What happens if a customer disputes a charge? If you lose the dispute, you’ll get hit with a penalty fee.

Always, always read the fine print. A good provider will be upfront about all their costs, not just the attractive transaction rate.

A common mistake is focusing only on the per-transaction percentage. Always calculate the total potential costs, including monthly fees and chargeback penalties, to understand the true financial impact on your business.

How Secure Is a SaaS Payment Gateway?

Security is everything for a payment gateway. It's their entire business. Reputable providers pour massive resources into protecting sensitive cardholder data, which means they take on the heavy lifting of PCI DSS compliance. That's the super-strict set of security rules for handling credit card info.

When you use a compliant gateway, you're essentially outsourcing a huge chunk of your security risk and responsibility. They use sophisticated tools like tokenization (which scrambles card numbers) and powerful fraud detection systems to keep every transaction safe. It’s about giving both you and your customers peace of mind.

Ready to accept crypto payments with a gateway that puts you in control? ATLOS offers a no-KYC, direct-to-wallet solution that lets you start processing payments instantly. Experience seamless integration and full ownership of your funds. Learn more and get started with ATLOS today.