Best Cryptocurrency Payment Gateways for Your Business

Picking the right crypto payment gateway often feels like a balancing act. You're juggling transaction fees, the coins you want to accept, and how easily it will plug into your existing setup. I've found that the top players—think Coinbase Commerce, BitPay, and NOWPayments—are popular for a reason. They offer solid, well-rounded solutions for businesses ready to dip their toes into digital currency. These platforms cut through the complexity, letting you tap into a worldwide market with lower fees and quicker payouts than you'd ever get from a traditional bank.

Why Your Business Should Accept Crypto Payments

Stepping away from traditional payment methods isn't just a tech upgrade; it's a strategic move that opens up a world of efficiency and global reach. When you integrate a crypto payment gateway, you're not just adding another button at checkout. You're fundamentally changing how you handle money and inviting a massive, growing market of tech-savvy customers to your door.

The upsides are hard to ignore. Let's start with the fees. Crypto transaction fees typically hover between 0.5% and 1%. Compare that to the 2-3% skimmed off the top by credit card companies, and the savings start to add up fast, especially if you're a high-volume business or working with tight margins.

Unlock Global Markets and Faster Funds

One of the biggest wins here is the ability to think and sell globally, without the usual headaches. A customer in Japan can pay a merchant in Brazil as easily as if they were standing in the same room. Gone are the frustrating delays and steep conversion fees that plague old-school banking.

Then there's the speed. You're not waiting days for money to clear. Crypto payments often settle in minutes. This is a game-changer for cash flow. It also pretty much eliminates the nightmare of chargebacks—once a transaction is confirmed on the blockchain, it's final.

Crypto gateways work by cutting out the middlemen, like banks and credit card networks. This creates a direct line between you and your customer. It’s not just faster; it’s more secure because every single transaction is permanently logged on a public ledger.

This isn't some fleeting trend. The market for these gateways is exploding. It's projected to grow from an estimated $2.5 billion in 2025 to around $15 billion by 2033. This surge is all about businesses and customers demanding more secure, transparent ways to pay. Diving into these market dynamics can give you a clearer picture of where things are headed.

Key Advantages for Merchants

When you get down to it, accepting crypto offers some seriously practical benefits that hit your bottom line and make life easier:

- Reduced Transaction Costs: Keep more of your money with fees that are a fraction of what credit cards charge.

- No More Chargebacks: Blockchain's finality means you're protected from fraudulent disputes and unexpected revenue loss.

- Access to a Global Customer Base: Sell to anyone, anywhere, without the friction of cross-border payments.

- Faster Settlement: Get your funds in minutes or hours, not days. Hello, better cash flow.

Adopting one of the best cryptocurrency payment gateways isn't just about keeping up. It's about setting your business up to succeed in a faster, more connected financial world.

Evaluating The Essential Gateway Features

When you're picking a crypto payment gateway, it's easy to get swayed by slick marketing. But what really matters are the features that work for your business—the ones that directly impact your operations, your customer experience, and your bottom line.

A feature that’s a game-changer for one merchant might be completely useless to another. It all comes down to your specific business model, who your customers are, and how much risk you're comfortable with.

Supported Currencies: It’s More Than Just Bitcoin

The first thing I always look at is the list of supported cryptocurrencies. Just accepting Bitcoin and Ethereum isn't enough anymore. The crypto world is incredibly diverse, and limiting options can mean turning away customers who prefer to pay with different altcoins.

Think about it this way: if you run a gaming platform, a good chunk of your audience might want to use gaming-specific tokens. Not accepting them is like leaving money on the table.

Why You Can’t Afford to Ignore Stablecoins

Beyond variety, make sure any gateway you consider supports stablecoins like USDT (Tether) and USDC (USD Coin). This is absolutely critical for protecting your revenue. Since these coins are pegged to fiat currencies, their value doesn't swing wildly like most other cryptocurrencies.

Imagine you sell a product for $100. A customer pays in a volatile coin that drops 10% in value before you can cash out. You just lost $10. Stablecoins get rid of that headache, ensuring the $100 you earned is still worth $100 tomorrow.

Digging Into the Real Cost: The Fee Structure

Transaction fees are often the first thing people see, with many gateways advertising a simple 0.5% to 1% processing fee. But the real cost is often buried in the details. You have to look at the entire fee structure to know what you'll actually be paying.

Keep an eye out for these other common costs:

- Network Fees: Also called "gas fees," these are what you pay to the blockchain miners to process a transaction. They can fluctuate a lot based on how busy the network is.

- Withdrawal Fees: Some platforms will charge you just to move your money out of their system and into your own wallet or bank account.

- Conversion Spreads: This is a sneaky one. When you convert crypto to fiat, gateways often build a small margin into the exchange rate, acting as a hidden fee.

A good, transparent gateway will be upfront about every single charge. Don't hesitate to ask their support team for a complete fee breakdown of a typical transaction, from the moment a customer pays to when the money is in your bank.

Recent data shows just how crucial it is to support a mix of assets. While Bitcoin still holds a 52% market share in crypto payments, stablecoins like USDT and USDC now make up about 76% of all crypto payments. This massive shift shows how much merchants value stability. On the tech side, 88% of gateways are now including Web3 wallets for a better user experience. You can see more of these crypto payment trends to get a feel for where things are headed.

Security and Usability: A Balancing Act

Rock-solid security is non-negotiable. The gateway you choose is responsible for protecting your funds and your customers' data. Look for essential security features like cold storage (which keeps most funds offline and away from hackers), mandatory two-factor authentication (2FA), and clear proof that they comply with financial regulations.

The user interface is just as important. A clean, intuitive dashboard makes it easy to manage your funds and track payments without needing a degree in computer science.

Finally, think about the practical tools that will make your daily life easier. Does the gateway have good invoicing tools? If you run a subscription service, automated recurring billing is a must. For an e-commerce store, a simple merchant dashboard can save you hours of accounting work every month. These are the features that separate a basic payment processor from a true partner for your business.

Figuring Out the Technical Details and User Experience

Picking a great crypto payment gateway is one thing, but getting it to actually work with your website or store is where the real work begins. A seamless integration means you're up and running quickly. A difficult one can turn into a months-long technical nightmare.

How you connect the gateway really comes down to what your business is built on and how tech-savvy your team is. For a lot of businesses, especially those already on major e-commerce platforms, the process can be surprisingly painless.

Choosing Your Integration Path

If your store runs on platforms like Shopify, WooCommerce, or Magento, your life is about to get a lot easier. Most of the top crypto gateways offer plug-and-play plugins for these systems. This is by far the simplest route. You're usually just installing an extension, plugging in your API keys, and tweaking a few settings. It’s not unheard of to be ready to go in under an hour.

But what if you have a custom-built platform? That’s when you need to dig into the gateway’s Application Programming Interface (API). An API gives you total control, letting you design a checkout experience that fits your brand perfectly. If you're going this route, having a solid grasp of modern API design best practices is non-negotiable for building a stable and secure payment system.

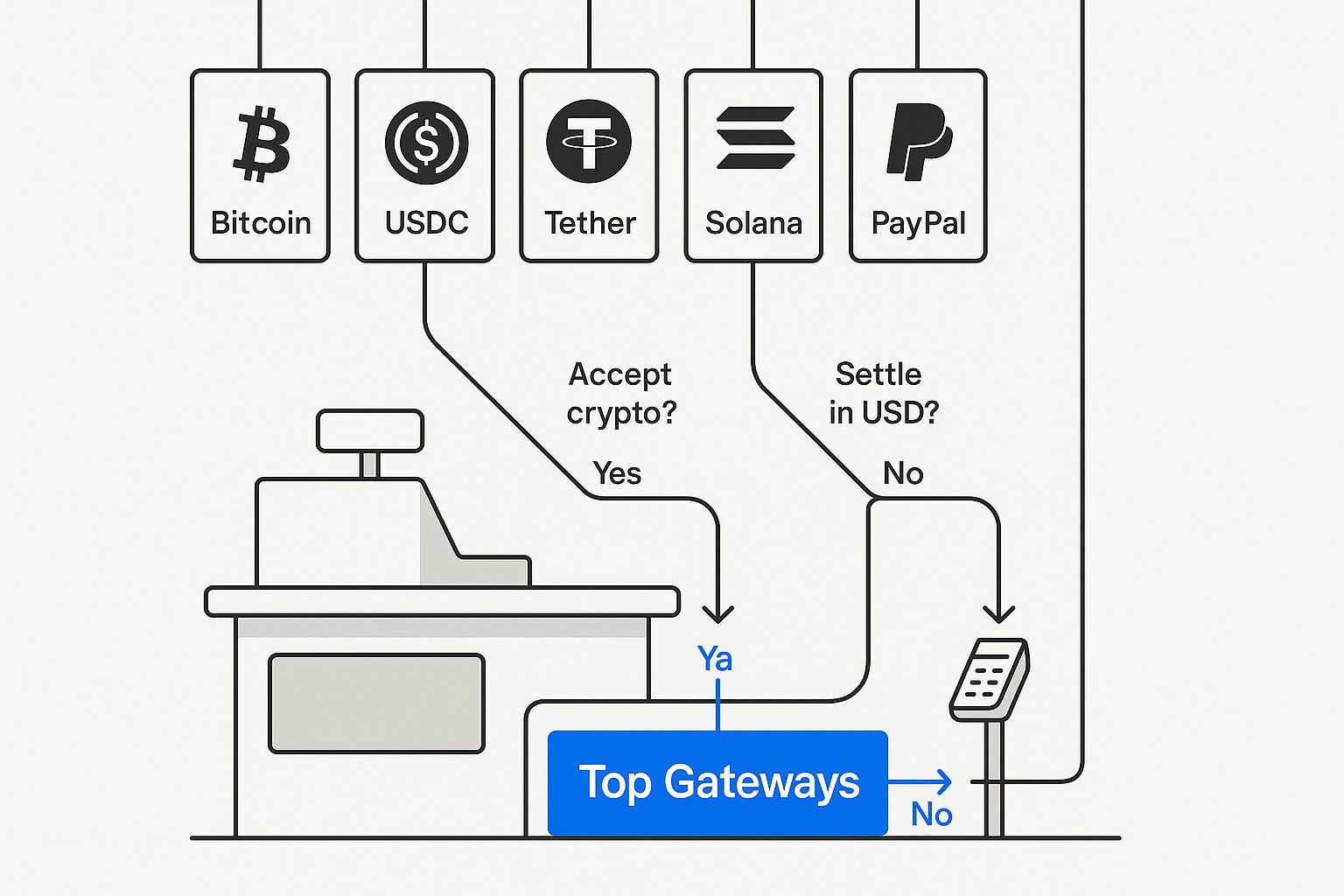

This visual gives a quick overview of some top gateways and where they might fit, depending on what you need.

As you can see, the "best" choice is less about the technology and more about your specific business model and who your customers are.

To help you decide, let's break down the common integration methods. Each has its pros and cons, and the right one for a small Shopify store is definitely not the right one for a large custom enterprise platform.

Integration Methods Compared

| Integration Method | Technical Skill Required | Best For | Pros | Cons |

|---|---|---|---|---|

| Plugins & Extensions | Low | E-commerce stores on platforms like Shopify, WooCommerce, Magento. | Fast and easy setup; no coding needed; often officially supported. | Limited customization; reliant on the plugin developer for updates. |

| Hosted Checkout Pages | Low to Medium | Businesses without a full e-commerce setup; services taking payments online. | Secure (PCI compliance is handled by the provider); simple integration. | Customer is redirected off-site, which can affect trust; branding options are limited. |

| Payment Buttons | Low | Small businesses, freelancers, accepting donations. | Extremely simple to add to any website; just copy-paste code. | Not suitable for managing inventory; basic functionality. |

| API Integration | High (Requires a developer) | Custom-built websites, SaaS platforms, businesses needing full control. | Complete control over the user experience; can be tailored to any workflow. | Complex and time-consuming; requires ongoing maintenance and security oversight. |

Choosing the right path from this table is your first major technical decision. It sets the stage for everything that follows, from the customer's experience to your own day-to-day management.

The Customer's Checkout Experience Is Everything

You can have the best product in the world, but a clunky or confusing checkout will send customers running for the hills. The top-tier payment gateways are obsessed with creating a smooth, intuitive journey for the buyer because they know it builds trust and brings people back.

Look for a gateway that makes paying with crypto feel simple. Tiny details make a huge difference:

- QR Code Payments: This is a must-have. It lets customers scan a code with their mobile wallet, which completely removes the chance of them mistyping a long wallet address.

- Real-Time Price Conversion: The checkout page should clearly show the price in both crypto and your local fiat currency, updating on the fly to reflect market rates. No one wants to do mental math.

- Clear Transaction Status: Customers need immediate feedback. A simple "Payment Sent" or "Processing" confirmation puts their minds at ease. Ambiguity creates anxiety and leads to support tickets.

I've seen businesses lose sales because their gateway had a confusing interface. A customer should never have to guess what to do next. The goal is a payment process so smooth they barely notice it.

Don't Forget About Your Own Experience

Usability isn't just for your customers. You're the one who has to live with the merchant dashboard every day. It's your command center for managing everything crypto-related, so it better be powerful and easy to navigate.

A well-designed backend saves you countless hours. Think about your needs. A retail shop owner needs a simple way to check the day's sales. A SaaS company needs powerful tools for handling recurring subscriptions. The gateway should provide clean reports, a simple way to look up transactions, and a straightforward process for cashing out.

Before you sign on the dotted line, get a demo. Poke around the documentation. Can you easily track a payment from start to finish? Is converting your crypto to cash and withdrawing it a simple, two-click process? A gateway that makes your daily financial admin easier is worth its weight in gold.

Fees, Settlements, and Volatility: The Money Side of Crypto Payments

Getting a crypto payment gateway up and running is one thing, but managing the money that flows through it is where the real work begins. If you’re not careful, you can get tripped up by complicated fee structures, settlement delays, and the wild price swings crypto is famous for.

That headline transaction fee of 0.5% or 1% might catch your eye, but it’s rarely the full story. To really understand what you'll be paying, you have to look under the hood and account for all the little costs that can add up.

Decoding the True Cost of a Transaction

Think of that advertised processing fee as just the base price of an airline ticket. By the time you’ve paid for your seat, bags, and everything else, the final cost looks quite different. The same goes for crypto gateways.

Here are the other costs you absolutely need to watch for:

- Network Fees (aka Gas Fees): These go to the miners who validate transactions on the blockchain. The gateway doesn’t control these, and they can spike when a network like Ethereum gets busy.

- Conversion Costs: If you're turning crypto into dollars or euros, there's a fee for that. It might be a percentage or a small spread built into the exchange rate.

- Withdrawal Fees: Some platforms will charge you just to move your money out, whether to a bank account or a private crypto wallet.

- Minimum Payouts: Pay close attention to this one. A high payout threshold can mean your money is locked up on the platform until you hit it, which can be a real headache for cash flow.

A trustworthy partner will be completely upfront about every single one of these costs. The best cryptocurrency payment gateways won't hide anything in the fine print.

Settlement Choices That Protect Your Bottom Line

How you get paid—your settlement—is probably the most critical decision you'll make. It directly impacts your exposure to market risk and the stability of your revenue. You basically have two choices: get paid in crypto or have it instantly converted to fiat currency.

Let’s walk through a quick example. Imagine you run an online store and sell a gaming laptop for $2,000.

- The Gambler's Approach: You decide to get paid and hold the Ethereum (ETH), hoping its value climbs. If ETH jumps 10% before you cash out, you just made an extra $200. Nice! But if it tanks 10%, you’ve lost $200. Your revenue is now a speculative bet.

- The Safe & Steady Path: You use a gateway with instant fiat conversion. The customer pays $2,000 worth of ETH, and it’s immediately converted to USD. You receive $2,000 (minus fees). Your revenue is secure and predictable, free from market drama.

For the vast majority of businesses, predictable revenue is non-negotiable. Instant fiat conversion takes the guesswork out of the equation and lets you treat crypto payments just like you would a credit card transaction.

This need for stability is a huge driver of the market’s growth. The global crypto payment gateway market is on track to hit $5.5 billion by the end of 2025. That growth is fueled by the 420 million people worldwide who own crypto and want to spend it. Stablecoins like USDC are making this a practical reality for everyday shopping. You can dig deeper into these market growth trends to see where things are headed.

Taming Volatility: Your Practical Playbook

Even if you decide to hold crypto, you aren't powerless against volatility. The smartest move is to encourage customers to pay with stablecoins. Since they're pegged to something stable like the U.S. dollar, you avoid the rollercoaster price action of coins like Bitcoin.

Another fantastic feature to look for is a price-lock guarantee. The best gateways will freeze the exchange rate for 10-15 minutes once a customer starts the checkout process. This is a win-win: it protects you from a sudden price drop and protects your customer from a price hike, ensuring the price they see is the price they pay.

Your Final Checklist For Choosing A Gateway

Alright, you’ve done the homework. You know the features, you've compared the fees, and you've narrowed down your options for a crypto payment gateway. Making that final decision can still feel like a big step, but it doesn't have to be a shot in the dark.

This checklist is your final sanity check. It's designed to help you line up your top contenders and see which one truly fits how your business operates day-to-day. The "best" gateway for a high-volume Shopify store is rarely the same one that’s perfect for a freelance consultant. Let’s make sure your choice is a true partner for growth.

Security and Compliance First

Before we talk about anything else, let's get serious about security. This is the absolute foundation. You're not just protecting your money; you're protecting your reputation.

- Fund Protection: Ask them directly: how do you secure your assets? The gold standard is a mix of offline cold storage for the vast majority of funds and a smaller, insured hot wallet for processing daily transactions. Anything less is a gamble.

- Account Security: At a minimum, they must offer mandatory two-factor authentication (2FA) for your merchant account. No excuses.

- Compliance: Is the provider properly registered and compliant with regulations like AML (Anti-Money Laundering) and KYC (Know Your Customer) policies? This isn't just red tape—it’s a strong signal that they’re a serious, long-term player.

Fee Transparency and Structure

Don't get lured in by a flashy 1% transaction fee only to be nickel-and-dimed on the backend. You need to understand the total cost of using the service, from the moment a customer pays to the moment the money hits your bank account.

I've seen it countless times: a seemingly cheap gateway becomes expensive once you factor in hidden withdrawal costs, high network fees, or unfavorable currency conversion rates. A trustworthy partner lays all their cards on the table. If their fee schedule is confusing or hard to find, walk away.

Look for a simple, all-inclusive pricing model. A single, clear fee for processing and settlement is ideal because it makes your accounting predictable.

Currency and Settlement Flexibility

Which coins can you accept? And more importantly, how do you get paid? These two questions will define your entire experience.

- Supported Cryptocurrencies: Does the gateway support the coins your customers actually want to use? Beyond Bitcoin and Ethereum, look for a solid selection of popular stablecoins like USDT and USDC. These are your best hedge against price volatility.

- Settlement Options: This is a big one. Can you choose to receive your funds in fiat currency (like USD or EUR) automatically? For 99% of businesses, instant fiat settlement is the way to go. It removes all the guesswork and risk from market swings.

- Payouts: How often can you access your money? Daily? Weekly? Check for minimum withdrawal amounts and make sure their payout schedule works with your cash flow needs.

Integration and User Experience

A technically superior gateway that’s a pain to use is a gateway you’ll end up hating. The entire process, from initial setup to the customer's final click, has to be smooth.

Think through these final points:

- Integration Effort: How easy is it to get this thing working? Do they have a simple plugin for your platform, like Shopify or WooCommerce, or will you need to hire a developer for a custom API integration?

- The Customer's View: What does the checkout process look like for your buyer? A clean, intuitive interface with a simple QR code and clear instructions will dramatically reduce cart abandonment.

- Your Dashboard: Once you’re set up, is the merchant dashboard actually useful? You should be able to track payments, pull reports, and manage funds without wanting to pull your hair out.

- Real Human Support: When something inevitably goes wrong—and it will—can you get a knowledgeable human to help you quickly? Check reviews and see what other merchants say about their support team.

Running through this checklist will give you the clarity you need to pick with confidence. You’re not just choosing a payment processor; you're choosing one of the best cryptocurrency payment gateways that will help you navigate this space and grow your business.

Frequently Asked Questions

Diving into crypto payments for your business can feel like stepping into a whole new world, and it's completely normal to have questions. In fact, it's smart. You're dealing with your company's revenue, so you need to be sure before you make a move.

Think of this as the final Q&A session before you flip the switch. We'll tackle the most common concerns I hear from merchants—things like security, day-to-day complexity, and price swings—so you can feel confident in your decision. Let's get these questions answered.

How Secure Are Cryptocurrency Payment Gateways?

This is usually the first thing people ask, and for good reason. The short answer? The good ones are incredibly secure, often more so than the traditional card systems you're used to. Their security isn't just one single feature; it's built in layers, starting with the blockchain itself.

Every single transaction is etched onto a public ledger that's practically impossible to tamper with. That's a huge built-in defense against fraud. But the gateways don't stop there. They add their own security protocols on top.

You'll almost always find:

- Cold Storage: The best platforms keep the lion's share of funds—often 95% or more—in offline wallets. These are completely disconnected from the internet, making them a dead-end for online hackers.

- Two-Factor Authentication (2FA): This should be non-negotiable. 2FA is a standard feature for logging into your merchant dashboard, ensuring only you can access your funds or change settings.

- Regular Security Audits: Reputable gateways don't just assume they're secure. They hire outside cybersecurity experts to constantly try and break their systems, finding and fixing potential weaknesses before they ever become a problem.

When you put it all together, you get a system that’s built from the ground up to be tough and trustworthy.

Do I Need To Understand Blockchain To Accept Crypto?

Absolutely not. This is probably the biggest myth that scares business owners away. The technology behind crypto is complex, but a good payment gateway is designed to completely hide that complexity from you.

From your perspective, accepting a crypto payment will feel a lot like using Stripe or PayPal. Your customer hits "pay with crypto," scans a QR code with their wallet, and confirms. That's it. The magic happens behind the scenes.

The entire point of a great payment gateway is to do all the technical heavy lifting for you. You don't need to know what a "gas fee" is or worry about "block confirmations." The gateway translates all that blockchain jargon into a simple, clean dashboard with the information you actually need.

You get to stay focused on running your business. The gateway handles the crypto, giving you straightforward reports and an easy way to manage your earnings. It’s genuinely a plug-and-play solution.

What If A Cryptocurrency's Price Changes Mid-Transaction?

This is a very real concern. We all know how much crypto prices can fluctuate. The last thing you want is for a customer to start a $100 payment, only for the coin's value to dip, leaving you with $95 in your account by the time it's all done.

Thankfully, the leading gateways solved this problem years ago with a feature often called a price-lock or locked-in exchange rate.

Here’s how it works in a real-world scenario:

- A customer is ready to buy a $50 product from your store.

- The payment gateway instantly calculates exactly how much Bitcoin (or whatever crypto they're using) is worth $50 at that very second.

- It then locks that exchange rate for a set amount of time, usually somewhere between 10 and 15 minutes.

- This creates a comfortable window for your customer to complete the payment without anyone worrying about the price changing.

- As long as they send the payment within that window, you are guaranteed to receive the full $50 value.

This simple mechanism completely removes the risk of market volatility during that critical payment window, making your crypto revenue just as predictable as your cash revenue.

What Happens If A Customer Pays The Wrong Amount?

It happens. Someone might get distracted and accidentally send a little too much or not quite enough to cover the invoice. A well-built gateway is designed to handle these human errors automatically and smoothly.

If a customer underpays, the system will typically alert both of you. It will then provide an easy way for them to send the small remaining balance to complete the purchase. No support ticket needed.

In the case of an overpayment, the process is just as elegant. The gateway processes the order as paid and then automatically triggers a refund for the extra amount, sending it right back to the customer's wallet (minus any small network fee). This kind of automated problem-solving is a huge time-saver and shows your customers you're using a professional system.

How Does Customer Support Work For These Gateways?

When money is involved, you need to know you can reach a real person who can help. The level of customer support is a huge factor that separates the good gateways from the great ones.

Most reputable providers will offer a few different ways to get help:

- A Deep Knowledge Base: Often, a well-written guide or FAQ can solve your problem in minutes without you having to talk to anyone.

- Email or Ticket Support: This is the standard for most platforms and works well for non-urgent questions.

- Live Chat: For those moments when you need an answer right now, live chat is a must-have.

- Dedicated Account Managers: This is usually reserved for larger businesses, but some gateways offer a dedicated point of contact to personally handle your account.

Here’s a pro tip: Before you sign up, test their support. Send them a question through their live chat or email. How quickly do they respond? Is their answer actually helpful? You can learn a lot about a company by how they treat you before you're even a customer.

Ready to unlock a global customer base and reduce your transaction fees? ATLOS Crypto Payment Gateway offers a seamless, no-KYC solution designed for instant onboarding. Start accepting crypto payments in minutes and maintain full control of your funds with our secure, user-friendly platform. Learn more and get started today at ATLOS.