Cryptocurrency vs Fiat Which is Right for You

When you peel back the layers of the cryptocurrency versus fiat debate, it really comes down to one thing: control. Fiat currency is government-issued money, like the US dollar. Its value isn't tied to a physical commodity like gold; instead, it's backed by the full faith and credit of the government that created it. On the other hand, cryptocurrency is a decentralized digital asset, secured by complex cryptography and operating completely outside the control of any central authority.

Understanding the Foundations of Fiat and Crypto

To really get a handle on this comparison, you have to appreciate just how different these two approaches to money are. They represent fundamentally opposing views on finance, value, and what it means to trust a system.

What Is Fiat Currency?

Think of the U.S. Dollar (USD) or the Euro (EUR). This is fiat money. Its value comes from a government's decree and our collective trust in that institution's stability.

Central banks, like the Federal Reserve in the United States, are the gatekeepers. They manage the money supply, tweaking inflation and interest rates to try and keep the economy on an even keel. Whether you're holding a physical bill or seeing a number in your bank account, fiat is the universally accepted medium for just about everything within a country's borders. It's the engine of the global economy as we know it.

What Is Cryptocurrency?

Cryptocurrency, which all started with Bitcoin, is a completely different beast. It's a digital token that relies on cryptography—not a central bank—for its security. It runs on a decentralized network known as a blockchain, which is essentially a public ledger of every transaction, copied and spread across thousands of computers.

This structure is what makes it so unique; no single person, bank, or government can dictate the rules.

And people are taking notice. This alternative financial system has seen explosive growth, with the number of identity-verified crypto users jumping by nearly 40 million in just the second half of this year. That’s part of a bigger trend that has seen the user base balloon from under 5 million to over 200 million in just a few years, and all signs point to more growth ahead. If you're curious, you can find more data on crypto user growth on Statista.

This radical decentralization is the true heart of the cryptocurrency vs. fiat discussion, and it’s the source of both its greatest strengths and its most significant challenges.

The Bottom Line: Fiat's value is built on trust in a central authority, giving it stability and universal acceptance. Cryptocurrency’s value comes from its secure, decentralized network, offering user autonomy and transactions that know no borders.

For a clearer picture, let's break down their core differences side-by-side.

At-a-Glance Comparison: Fiat vs. Cryptocurrency

This table gives a quick rundown of the fundamental differences between the money issued by governments and the digital assets powered by decentralized networks.

| Attribute | Fiat Currency (e.g., USD, EUR) | Cryptocurrency (e.g., Bitcoin, Ethereum) |

|---|---|---|

| Issuing Authority | Central Government & Banks | Decentralized Network (Miners/Validators) |

| Control | Centralized | Decentralized |

| Form | Physical (bills, coins) & Digital | Exclusively Digital |

| Transaction Record | Private Ledgers (Banks) | Public Ledger (Blockchain) |

| Value Basis | Government Decree & Public Trust | Supply, Demand, & Network Consensus |

As you can see, their entire architecture—from creation to control—is worlds apart, which has massive implications for how they're used in the real world.

Comparing Core Attributes of Each System

Definitions only get you so far. The real debate between cryptocurrency and fiat money unfolds when you look at how they actually work—the core attributes that dictate their control, security, transparency, and how transactions are finalized. These differences create unique trade-offs for everyone, from individual users to large businesses and even entire economies.

One of the most fundamental splits is in how each currency is controlled and issued. Fiat currency is centralized by design. A central bank, like the U.S. Federal Reserve, holds all the cards. They manage the money supply, print more to spur growth, or raise interest rates to cool down inflation, giving them immense control over the currency’s stability and value.

Cryptocurrency, on the other hand, is built to be decentralized. Its supply is usually hardcoded from the start. Take Bitcoin, for example—its code dictates a hard cap of 21 million coins. No one can just decide to make more. This creates a predictable and unchangeable monetary policy, which is a world away from the fiat system.

Security and Transparency Models

When we talk about security, the two systems come from completely different schools of thought. With fiat, you're trusting regulated middlemen like banks. They use advanced fraud detection and are often backed by government insurance, creating a safety net for consumers. The catch? You have to trust these institutions to keep your money and data safe.

Crypto’s security comes from its core technology: cryptography and the blockchain. Every single transaction is signed, sealed, and delivered onto a public, unchangeable ledger. This makes the system incredibly tough to cheat or counterfeit. It builds a "trustless" environment where security is based on pure math, not on an institution's reputation.

The transparency of the blockchain is a massive differentiator. While your real-world identity is hidden, every transaction is out there for anyone to see. This level of public accountability is something you simply don't get with the closed-door nature of traditional banking.

Transaction Speed and Finality

Another key battleground is how quickly transactions are processed and considered "done." Fiat systems have gotten faster, but final settlement, especially for international payments, can still drag on for days.

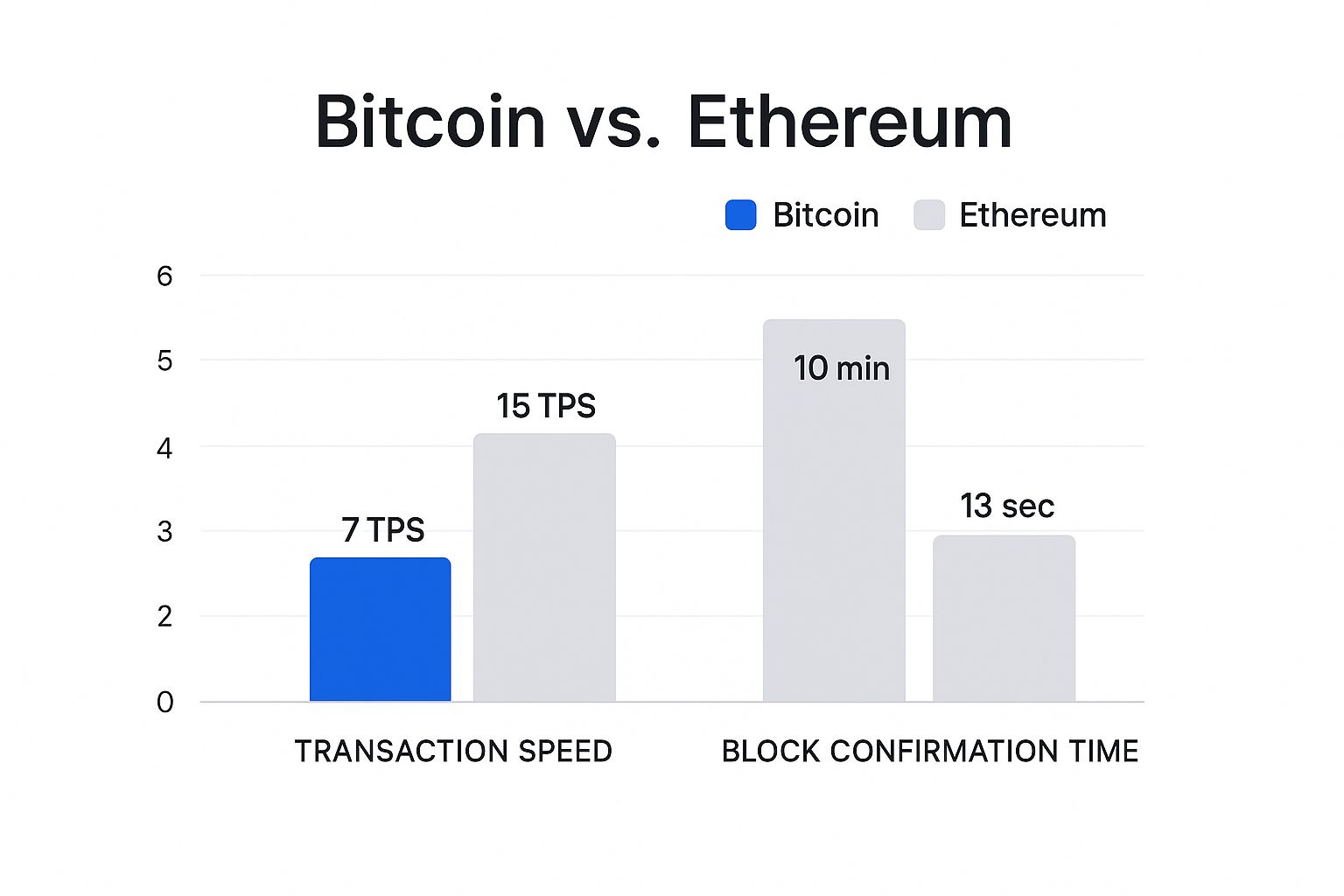

Crypto transaction speeds are all over the map, depending on the network. This infographic gives a great side-by-side look at the transaction speeds and confirmation times for two of the biggest players, Bitcoin and Ethereum.

As you can see, networks like Ethereum are already processing transactions much faster than Bitcoin, showing just how quickly the crypto world is evolving to get better and faster.

But for businesses, the real game-changer is transaction finality. Once a crypto transaction is confirmed on the blockchain, it’s set in stone. It cannot be reversed. This is a huge win for merchants because it wipes out the risk of chargebacks—a persistent and expensive headache in the fiat world. With the crypto market now valued over $1 trillion, this single feature is catching the attention of more and more businesses. You can find more details on why merchants are adopting crypto payments over on nowpayments.io.

Of course, that irreversibility is a double-edged sword. For consumers, it means if you send funds to the wrong address or get scammed, there’s no bank to call and no one to reverse the charge. The responsibility falls entirely on you, which is one of the biggest hurdles for people new to crypto.

Putting Fiat and Crypto to Work in the Real World

To really get a feel for the cryptocurrency vs. fiat debate, you have to look past the theory and see how they actually function day-to-day. For nearly everyone, fiat money is just the air we breathe financially. It’s what underpins our daily shopping, global trade, and government functions.

You're using fiat every time you buy groceries with a debit card, pay your taxes, or see your paycheck land in your bank account through a direct deposit. These familiar transactions are all handled by established financial networks like ACH (Automated Clearing House) or wire transfers. On a grander scale, massive international systems like SWIFT (Society for Worldwide Interbank Financial Telecommunication) are the plumbing that allows money to flow between countries, making global trade possible.

How We Use Fiat Every Day

Fiat’s power comes from its universal acceptance and official status as legal tender. It's so woven into our lives we barely notice it.

- Retail Purchases: That coffee you paid for by tapping your phone? That’s a fiat transaction, with a bank acting as the middleman.

- Paying Bills: Your mortgage, rent, and utility bills are all settled in government-issued currency moving through the banking system.

- Government Services: From taxes to public sector salaries, everything is handled in fiat. This cements its role as the foundation of the economy.

But while fiat is familiar and dependable, its underlying machinery can be surprisingly slow and expensive, especially when you need to send money across borders. This is exactly where crypto starts to look like a very interesting alternative.

Where Cryptocurrency Really Shines

Cryptocurrency finds its footing in the exact places where the traditional financial system shows its age—in speed, cost, and accessibility. Its advantages are clearest in borderless, digital-first situations.

Think about something as common as sending money to another country. A standard bank wire can easily take 3-5 business days to clear. It often bounces between several intermediary banks along the way, and each one shaves off a piece for itself. The fees can get out of hand quickly, often hitting $25-$50 or more for a single transfer.

Now, let's replay that scenario using a stablecoin, which is a type of crypto tied to a fiat currency like the U.S. dollar.

A Tale of Two Transfers: Sending $500 Internationally

- Fiat (Bank Wire): The money might not show up for several days. After intermediary bank fees and a less-than-ideal exchange rate, the amount the recipient actually gets could be noticeably smaller.

- Crypto (Stablecoin): The entire transfer can be done in minutes, often for a transaction fee under a dollar. The funds arrive almost instantly in the recipient's digital wallet—no traditional bank account needed.

That stark difference in speed and cost is precisely why crypto has become such a powerful tool for remittances. For someone sending money home to support their family, those savings are a game-changer.

Beyond that, crypto is opening the door to entirely new ways of managing money, like Decentralized Finance (DeFi). DeFi platforms offer services like lending, borrowing, and earning interest without needing a bank, which is a huge deal for people around the world who don't have access to traditional banking. It also provides a straightforward way to prove ownership of digital assets—something that’s becoming more and more important. At its best, crypto isn't trying to replace fiat; it's filling the gaps the old system can't quite reach.

Navigating Volatility Versus Stability

When we talk about cryptocurrency vs fiat, one of the most glaring differences is stability—or the lack of it. Fiat currencies, like the U.S. dollar, are built for predictability. Central banks are constantly pulling levers, managing the money supply to keep inflation in check and maintain a stable economic playing field. The whole point is to ensure a dollar today is worth roughly a dollar tomorrow.

This steadiness is what makes the world go 'round, economically speaking. It’s the foundation that allows businesses to price their products and people to save for the future without constant anxiety. Without this relative calm, basic financial planning would be a nightmare, which makes stability one of fiat’s biggest selling points.

The Double-Edged Sword of Crypto Volatility

Cryptocurrencies like Bitcoin live in a completely different world. Their value can swing wildly, sometimes in just a few hours. This isn't random chaos; it's driven by a powerful combination of factors that don't affect traditional money in the same way.

What makes crypto so jumpy? It boils down to a few key things:

- Market Sentiment: A single tweet, a viral Reddit thread, or a bit of news-driven hype can send prices soaring or crashing.

- Regulatory News: Even the hint of new government regulations or a potential ban can cause investors to panic or celebrate, moving the market dramatically.

- Technological Developments: A successful network upgrade can boost confidence, while a newly discovered security flaw can sink it.

- Limited Supply: Many cryptocurrencies have a fixed supply. When something is scarce, even a small change in demand can cause a huge price reaction.

This volatility is a two-sided coin. For everyday transactions, it’s a massive headache. Imagine getting paid in Bitcoin, only to find its purchasing power has dropped 20% by the time you need to buy groceries. But for traders, that very same volatility is the attraction—it’s where the potential for big profits comes from, if you have the stomach for the risk.

Volatility is the core reason cryptocurrency is often treated more like a speculative asset, similar to a stock, than a day-to-day currency. The risk of rapid devaluation makes it challenging for merchants to price goods or for individuals to use it as a stable store of value.

Stablecoins: The Search for Middle Ground

The crypto industry knew this volatility was a major barrier to wider adoption. The answer? Stablecoins. These are cryptocurrencies engineered to hold a steady value, usually by being pegged one-to-one to a major fiat currency like the U.S. dollar.

For every stablecoin like USDT or USDC floating around on the blockchain, there is supposedly a real dollar sitting in a bank reserve somewhere. This creates a token that has the price stability of fiat but still runs on the fast, global infrastructure of a blockchain. It’s an attempt to get the best of both worlds: the trusted value of traditional money with the modern efficiency of crypto.

What Businesses Should Consider for Payments

For a business owner, the crypto versus fiat debate isn't just theory—it's a practical decision about how you get paid. The choice you make will ripple through your entire operation, affecting everything from customer reach and transaction fees to how you handle accounting and fraud.

As businesses get more creative with their revenue streams, exploring things like the various subscription business models, the question of which currency to accept becomes foundational. It directly impacts your bottom line and how easy it is for customers to pay you.

The Case for Sticking with Fiat

There's a reason fiat is still king: universal customer adoption. Just about every customer who walks through your door (or visits your website) has a credit card, debit card, or bank account. This built-in familiarity makes the checkout process seamless, which is crucial for maximizing sales.

On top of that, the rules for handling fiat are clear and predictable. Your accountant knows exactly what to do with it, tax reporting is standardized, and compliance is a well-worn path. But that convenience isn't free.

- Payment Processing Fees: Expect to hand over between 2% and 3% of every transaction to credit card processors.

- Chargeback Fraud: Customers can dispute charges long after a sale, leaving you with lost revenue and extra fees. This risk falls squarely on your shoulders.

For many merchants, these costs—especially chargebacks—can be a constant drain on profits.

The Operational Realities of Accepting Crypto

Jumping into cryptocurrency payments presents a completely different set of pros and cons. The biggest draw for most businesses is the potential for dramatically lower transaction fees, often less than 1% with the right payment gateway. Those savings add up fast.

Another game-changer is the complete elimination of chargebacks. Blockchain transactions are final. Once a payment is confirmed, it's yours, which protects you from a significant source of fraud and financial loss. It’s also a way to tap into a new, tech-savvy customer base. In just one recent twelve-month period, over $4.6 trillion moved from fiat into Bitcoin alone, showing just how much capital is active in this space.

For merchants in high-risk industries or those with a global audience, crypto's lower fees and irreversible transactions can be a lifeline. It puts the control back in the business owner's hands.

Of course, it’s not without its hurdles. Price volatility is a legitimate concern, though many payment processors solve this by offering instant conversion to stablecoins or back to fiat. The accounting and tax reporting side is also more complex, often requiring specialized tools. And while the crypto user base is growing rapidly, it's still a niche market compared to fiat, so offering it exclusively could limit your customer pool.

Answering Your Key Questions

The whole cryptocurrency vs fiat debate can get confusing, especially as these two worlds start to overlap more and more. Let's cut through the noise and tackle some of the most common questions people have.

Is Cryptocurrency Considered Real Money?

That’s the million-dollar question, and the answer is a firm "it depends." On one hand, yes, you can absolutely use crypto as a form of digital money. It serves as a medium of exchange, you can store wealth in it, and it acts as a unit of account. A growing list of businesses will gladly take your crypto for goods and services.

But it’s not that simple. Its acceptance is still spotty, and the wild price swings make it a tough sell for your daily coffee budget. Because of this volatility, many people treat it more like a digital asset—think stocks or gold—rather than a direct substitute for something stable like the U.S. dollar.

Which Is Safer: Fiat or Cryptocurrency?

"Safer" really comes down to what kind of risk you're worried about. Money sitting in a bank account is incredibly safe from things like bank collapses, thanks to government-backed deposit insurance. The biggest risk you face with fiat is slow and steady erosion of its value due to inflation.

Cryptocurrency plays by a completely different set of rules. Its security comes from powerful cryptography that makes the network itself nearly impossible to shut down or tamper with. Here, the risk shifts from the institution to you, the individual user.

Your Keys, Your Responsibility: With crypto, you are your own bank. If you lose your private keys or fall for a scam, that money is probably gone for good. There's no one to call for a reset. Personal security isn't just a suggestion; it's everything.

Could Cryptocurrency Ever Replace Fiat Currency?

While anything is possible, a complete takeover by crypto seems very unlikely anytime soon. Fiat currencies are woven into the very fabric of our global economy—from how we pay taxes to how countries trade with each other. Governments and central banks aren't about to hand over the keys to that system.

What's far more likely is a future where both systems exist side-by-side. We might see crypto become the go-to for specific tasks like fast international payments, decentralized finance (DeFi), or in purely digital economies. Meanwhile, fiat will likely remain the foundation for everyday life: paying salaries, mortgages, and government expenses.

How Do Taxes Differ for Fiat and Crypto?

This is where things get really different. For most people, simply holding fiat currency in a bank account doesn't create a tax headache unless you're earning interest.

Cryptocurrencies are treated as property for tax purposes in many countries, including the U.S., which changes the game entirely.

- Capital Gains: Every time you sell, trade, or even buy something with your crypto, you could be triggering a taxable event.

- Calculating Profit: You're taxed on the profit—the difference between what you paid for the crypto and its value when you used it.

The rules are complex and constantly changing. It’s a smart move to talk to a tax professional who actually gets the digital asset space to make sure you're staying on the right side of the law.

Ready to bridge the gap between fiat and crypto for your business? ATLOS Crypto Payment Gateway makes it simple to accept cryptocurrency payments directly to your wallet, with no KYC and instant onboarding. Empower your business with the speed, security, and global reach of crypto by visiting https://atlos.io to get started today.