Custodial vs Non-Custodial Crypto Payment Gateways Guide

When you start accepting crypto payments, the first big decision you'll make is whether to use a custodial or non-custodial gateway. This isn't just a technical detail—it fundamentally changes who's in control of your money. A custodial gateway acts a lot like a bank, holding your private keys and managing your crypto for you. It's convenient, but it also means you're trusting a third party with your assets.

In stark contrast, a non-custodial gateway gives you the software to be your own bank. You hold your own keys, giving you complete control and much stronger security.

The Core Dilemma: Key Control and Responsibility

Choosing between these two models is really a strategic decision about financial sovereignty. The entire debate boils down to one thing: the private key. This isn't just some password; it's the digital equivalent of a bearer bond that proves ownership and gives you the power to spend your crypto.

A custodial gateway is a service where another company holds and manages your private keys for you. Think of it exactly like your traditional bank account. You deposit your money, trust the bank to keep it safe, and use their app or website to access it. This model is often a good fit for businesses that are new to crypto or simply want a hands-off, user-friendly experience.

On the other side of the coin, a non-custodial gateway operates on the core crypto principle of "not your keys, not your coins." The provider gives you the tools, but you—and only you—manage your private keys. This gives you unparalleled security against hacks or failures at the platform level, but it also places all the responsibility squarely on your shoulders.

Foundational Differences at a Glance

Before we get into the weeds, it helps to understand the high-level trade-offs. Your choice will have a direct impact on your security, the user experience for you and your team, and your day-to-day operational workflow.

| Feature | Custodial Gateway | Non-Custodial Gateway |

|---|---|---|

| Private Key Control | Held by the third-party provider (the "custodian") | Held exclusively by the user (the merchant) |

| Core Philosophy | Convenience and support, mirroring traditional finance | Self-sovereignty and direct control over assets |

| Security Model | Trust in the provider's security infrastructure | Responsibility rests entirely with the user |

| Recovery Options | Password resets and customer support are available | Relies on a self-managed seed phrase; no support |

| Primary Risk | Counterparty risk (provider failure, hacks, freezes) | Personal risk (losing keys, human error) |

This table makes the trade-off crystal clear: you're either choosing the convenience of a managed service or the absolute autonomy of self-sovereignty.

The essential difference in the custodial vs. non-custodial crypto payment gateway debate is trust. With a custodial solution, you trust a company. With a non-custodial solution, you trust yourself and the software.

Ultimately, your choice will shape your business's operations, security posture, and financial independence. Each model is built for different needs, risk tolerances, and levels of technical confidence.

How Custodial Crypto Payment Gateways Work

Think of a custodial crypto payment gateway as the Stripe or PayPal of the crypto world. These are third-party services built for one thing: simplicity. When a customer pays you, their crypto doesn't go directly into a wallet you control. Instead, it’s sent to a wallet owned and managed by the gateway provider.

Essentially, they act as a custodian for your funds. They hold the private keys, secure the assets, and handle all the technical heavy lifting. This model is a huge draw for businesses eager to accept crypto payments without diving into the complexities of blockchain technology. It dramatically lowers the barrier to entry.

The process is designed to feel familiar. A customer hits checkout, the gateway generates a unique payment address for that transaction, and the funds land in the provider's custodial wallet. From there, the gateway credits your merchant account, and you can see your balance on a simple dashboard.

The Appeal of a Managed Service

The primary reason merchants choose the custodial route is pure convenience. These providers bundle a suite of services that abstract away the gritty details of blockchain mechanics, making life much easier. This is a central point in the custodial vs non-custodial crypto payment gateways discussion.

These extra services often include:

- Automatic Fiat Conversion: Many gateways will instantly convert crypto payments into your local currency, like USD or EUR. This is a game-changer, as it shields you from crypto's notorious price volatility and guarantees you get the exact amount you invoiced.

- Simplified Reporting: You can expect detailed transaction histories, account statements, and tax-friendly reports. This takes the headache out of accounting and compliance, which can be a real minefield when dealing with crypto.

- Integrated Customer Support: If a payment goes wrong or a customer needs help, there’s a dedicated support team on standby. For businesses that can’t afford to troubleshoot payment disputes themselves, this is a critical safety net.

Understanding the Trade-Offs

That convenience, however, comes with a major trade-off: you give up control. By handing over your private keys, you're placing your trust in the gateway provider to keep your funds safe and accessible. It’s a relationship very similar to the one you have with a traditional bank.

The core bargain of a custodial gateway is this: you sacrifice direct control for operational simplicity. You’re banking on the provider's security, their uptime, and their terms of service, which can dictate how and when you access your money.

For instance, the provider is entirely responsible for protecting your assets from hackers. While top-tier custodians use institutional-grade security like multi-signature authentication and cold storage, a breach on their end could put your funds at risk. One report noted that custodial breaches cost the industry around $8 billion in 2022, a stark reminder of this counterparty risk.

You're also playing by their rules. This means complying with their Know Your Customer (KYC) requirements, adhering to withdrawal limits, and accepting potential transaction delays. They even have the right to freeze your account if they detect suspicious activity. Your access to your own revenue is ultimately mediated by a third party—a world away from the self-sovereign ethos of non-custodial solutions.

Understanding Non-Custodial Crypto Payment Gateways

When we talk about custodial vs. non-custodial crypto payment gateways, the non-custodial model is all about one thing: financial sovereignty. It puts merchants firmly in the driver's seat, making sure they are the only ones who hold the private keys to their funds. Think of it as being your own bank.

Transactions happen directly, peer-to-peer. When a customer pays you, the crypto goes straight from their wallet to yours. There’s no middleman holding the funds, which gets right back to the core philosophy of decentralization.

The Core Principle: Self-Sovereignty

The biggest draw of a non-custodial gateway is the censorship-resistant control you have over your money. Since you hold the keys, no third party can freeze your account, slap on withdrawal limits, or go belly-up with your assets. This completely eliminates counterparty risk.

From a security standpoint, this model is far more robust against the kind of platform-wide hacks that target centralized exchanges. A hacker would have to breach your personal security measures, not just a central honeypot storing funds from thousands of users.

The old crypto mantra, "not your keys, not your coins," perfectly captures the essence of the non-custodial approach. It puts both the power and the responsibility for asset security squarely on the merchant's shoulders, offering a level of control you just can't get anywhere else.

This independence is a massive plus for businesses that value privacy, security, and financial autonomy above all. It's a system built for a trustless world, where you rely on solid cryptography and your own diligence, not a corporation's promises.

The Responsibilities of Total Control

While the benefits are huge, this model also means the burden of key management rests entirely on you, the merchant. To make a non-custodial solution work, you need a solid grasp of wallet security and some serious operational discipline. If you lose your private keys or seed phrase, there's no central authority to call for help.

You're in charge of setting up and maintaining your own security protocols. This typically involves:

- Secure Key Storage: Using hardware wallets (often called cold storage) to keep your private keys completely offline and safe from hackers.

- Seed Phrase Management: Backing up your 12- or 24-word recovery phrase and storing it in multiple secure, offline locations. Never on a computer.

- Operational Security: Properly training your team on best practices to avoid phishing scams and other social engineering attacks that could put your funds at risk.

Losing access to your keys means losing your funds. Forever. There’s no password reset button or customer support hotline to bail you out.

Market Growth and Merchant Adoption

This demand for self-sovereignty isn't just a niche interest—it's a significant market trend. The outlook for non-custodial crypto wallets is incredibly strong, with some projections estimating a global market size of around $25 billion by 2033, growing at a compound annual rate of about 22%. This growth is being driven by more institutions getting into digital assets and a rising number of everyday users who want direct control over their crypto. You can dive deeper by exploring the market analysis of non-custodial crypto wallet trends.

This shift shows that more merchants are getting comfortable with the responsibilities that come with managing their own keys. As the tools and user interfaces get better, the technical barrier to entry is dropping, making non-custodial solutions like ATLOS more approachable for a wider variety of businesses. The trade-off remains as clear as ever: you get unparalleled security and control in exchange for complete self-reliance.

Comparing Custodial And Non-Custodial Gateways

When you're looking at custodial vs. non-custodial crypto payment gateways, the differences run much deeper than just who holds the private keys. This choice will ripple through your business, affecting everything from your security posture and day-to-day operations to your fee structure and compliance load. A quick glance can be misleading; what you really need is a detailed breakdown to make the right strategic call.

The fundamental split comes down to trust. Custodial solutions work on a trust-based model, a lot like a traditional bank, where you trust a third party to handle your funds. Non-custodial solutions, on the other hand, are built on a "trustless" foundation where you rely on cryptographic security and your own diligence. This core difference creates some very distinct pros and cons.

Security And Risk Exposure

For most merchants, security is non-negotiable. With a custodial setup, the provider takes on the heavy lifting of securing your funds. They use enterprise-grade measures like cold storage, multi-signature wallets, and round-the-clock threat monitoring. This is a huge plus for businesses that don't have a dedicated cybersecurity team.

But this model introduces a critical vulnerability: counterparty risk. You're putting your faith in the provider to not only fend off hackers but also to stay solvent and act ethically. If that custodian gets hacked or goes out of business, your funds could be frozen or, worse, gone for good.

A non-custodial gateway completely sidesteps this risk. Because payments go directly into a wallet that only you control, there's no central pot of gold for hackers to target. The security of your money is squarely in your hands—it all comes down to how well you protect your private keys. While this gives you superior protection from platform-level breaches, it also means the buck stops with you.

Fees And Cost Structures

The way you're charged for services also varies wildly between the two models. Custodial gateways usually roll everything into a single transaction fee, which is often a percentage of the payment total. This bundled fee typically covers:

- Payment Processing: The basic service of handling the transaction.

- Fiat Conversion: Automatically swapping crypto for your local currency.

- Customer Support: A team you can call when things go wrong.

- Security Infrastructure: The cost of maintaining their secure platform.

In contrast, non-custodial gateways tend to have a more straightforward—and often lower—fee structure. You'll generally pay the standard blockchain network fee (the "gas fee") for each transaction, plus a small software fee to the gateway provider. This unbundled approach can be much more cost-effective, particularly for high-volume businesses or those that don't need add-ons like automatic fiat conversion.

The core trade-off with fees comes down to convenience versus direct access. Custodial gateways charge a premium for a bundled, all-in-one service. Non-custodial gateways offer a lower-cost, direct-to-blockchain model where you handle the extra services yourself.

Operational Control And Flexibility

Who really controls the money is a central point in the custodial vs. non-custodial debate. With a custodial provider, your access to your funds is mediated by them. That means you're bound by their terms, which can include things like:

- Withdrawal Limits: Caps on how much you can take out daily or weekly.

- Settlement Times: Waiting periods before your funds are actually available.

- Account Freezes: They can lock your account if they flag suspicious activity.

- KYC/AML Requirements: You'll have to go through their identity verification process.

Non-custodial gateways give you immediate and absolute control. The moment a transaction is confirmed on the blockchain, the funds are in your wallet, ready to be used however you see fit. There are no withdrawal limits, no settlement delays, and often no mandatory KYC, giving you true financial autonomy.

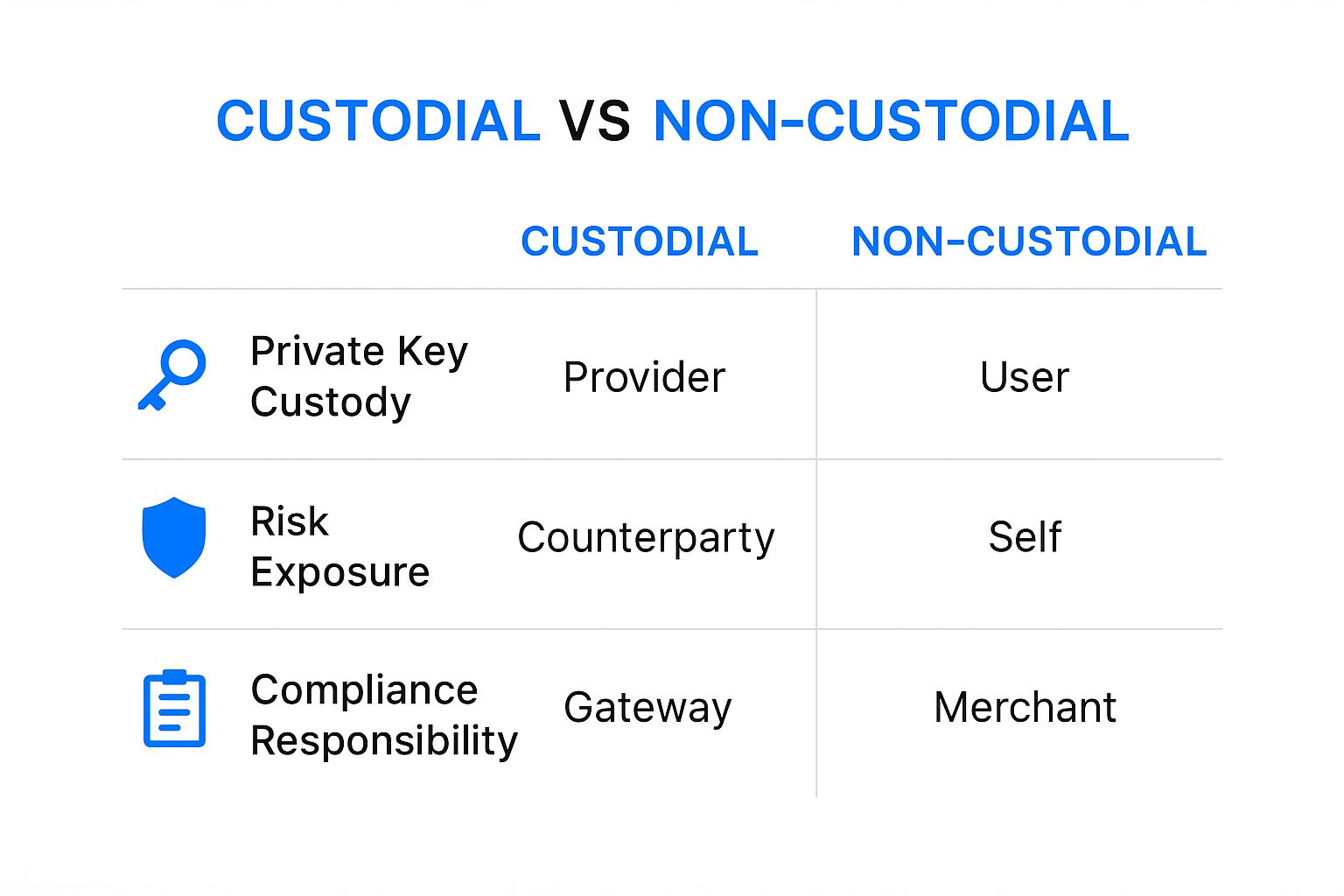

This image neatly lays out the core differences in custody, risk, and responsibility.

As you can see, non-custodial gateways put you in the driver's seat, making you responsible for both control and security. Custodial models, however, centralize those functions with the provider.

Recent market shifts really bring these differences into focus. In 2024, non-custodial gateways have gained serious momentum, largely fueled by security concerns around custodial services. After all, custodial breaches cost the industry an estimated $8 billion in 2022, a stark reminder of the risks of centralized key storage. On top of that, 18% of crypto users reported withdrawal delays from custodial platforms in 2024, chipping away at trust in these middlemen. You can dive deeper into the trends driving non-custodial payment adoption to learn more.

To make things even clearer, let's look at a direct, feature-by-feature comparison.

Feature Comparison: Custodial vs. Non-Custodial Gateways

| Feature | Custodial Gateway | Non-Custodial Gateway |

|---|---|---|

| Private Key Control | Provider holds keys; you trust them with your funds. | You hold your own keys; you have full, direct control. |

| Security Model | Centralized security managed by the provider. | Decentralized security managed by you. |

| Risk Exposure | High counterparty risk (e.g., hacks, insolvency). | No counterparty risk, but high personal responsibility for key security. |

| Fees | Bundled percentage-based fee (e.g., 1%-2.5%). | Lower software fee + blockchain network (gas) fees. |

| Fund Access | Subject to provider's withdrawal limits, settlement times, and potential freezes. | Instant access once confirmed on the blockchain; no third-party restrictions. |

| Fiat Conversion | Often built-in and automated. | Requires a separate step, either manually or via an integrated third-party service. |

| Onboarding | Simpler setup, but often requires KYC/AML verification. | More technical setup (wallet creation), but typically no mandatory KYC. |

| Best For | Merchants prioritizing convenience and who are less familiar with crypto security. | Merchants prioritizing control, lower fees, and self-sovereignty. |

This table highlights that your choice really hinges on what you value most: the hands-off convenience of a custodial service or the unparalleled control and lower fees of a non-custodial solution. Each has a clear place in the market, depending on a business's specific needs and technical comfort level.

Real-World Use Cases For Each Gateway Type

Talking about custodial vs. non-custodial gateways in theory only gets you so far. The right choice really clicks when you start mapping these models to actual business needs. A setup that’s perfect for a high-volume online store could be a total disaster for a consultant who values privacy above all else.

Let's move past a generic list of pros and cons. By looking at specific, practical examples, we can see exactly where each model shines and help you figure out which one fits your business like a glove.

When Custodial Gateways Are The Smart Choice

Custodial gateways are the go-to when you need convenience, simplicity, and want to keep risk at arm's length. They're the perfect on-ramp for any business that wants to start accepting crypto without getting bogged down in the technical weeds.

Think about these situations:

- Small E-commerce Retailers: Imagine an online shop selling handmade crafts. The owner wants to tap into a new, tech-forward customer base by accepting crypto but is nervous about price swings and doesn't have time to become a crypto expert. A custodial gateway is a lifesaver here, automatically converting crypto to cash so they get the exact dollar amount they invoiced, every single time.

- Subscription-Based Services: A SaaS company with a monthly subscription model needs a payment system that just works—no fuss. A custodial provider can handle all the recurring billing, deal with customer payment queries, and deliver clean financial reports for the accounting team. It takes the operational headache completely off their plate.

- Businesses Needing Traditional Integrations: Many merchants, especially in retail, rely on platforms like Shopify or WooCommerce. If you're deep in the world of e-commerce development, you know that custodial gateways often have smoother, ready-made API integrations that make setup a breeze.

Key Takeaway: If operational ease trumps direct control of your funds, a custodial gateway is the pragmatic choice. It lets you offload the technical burden and volatility risk, freeing you up to focus on running your actual business.

This model provides a familiar, almost bank-like experience, which flattens the learning curve for teams who are just dipping their toes into digital assets.

Where Non-Custodial Gateways Dominate

For businesses that prioritize self-sovereignty, rock-bottom fees, and censorship resistance, non-custodial gateways are the clear winner. They are built for merchants who are ready to cut out the middleman and take full command of their own finances.

Here’s where they really come into their own:

- Global Freelancers and Consultants: A consultant with clients all over the world is tired of getting hammered by cross-border wire fees and waiting days for payments to clear. With a non-custodial gateway, they can receive crypto directly into their own wallet. Funds settle in minutes, not days, for a tiny fraction of the cost, completely sidestepping the old-school banking system.

- Privacy-Focused Businesses: A VPN provider or any company in a politically charged environment needs a payment rail that protects user privacy and can't be shut down by a third party. A non-custodial solution like ATLOS offers a no-KYC process, keeping transactions private and ensuring the funds are always under the merchant's control.

- Non-Profits and DAOs: A charity or a Decentralized Autonomous Organization (DAO) needs to operate with absolute financial transparency to maintain trust. A non-custodial gateway guarantees that every donation and all treasury funds go directly into an organization-managed wallet, giving stakeholders a clear view of the financials.

This move toward self-sovereignty isn't just a niche trend; the data backs it up. Projections show that by Q3 2025, self-custodial wallets are set to handle an incredible 68% of all crypto transactions worldwide. What's more, recent surveys reveal that 59% of crypto users now prefer self-custody, driven by security concerns and the desire for true ownership of their assets. You can dive deeper into the rise of institutional-grade crypto wallets to see just how significant this market shift is.

How to Choose the Right Gateway for Your Business

Picking a crypto payment gateway isn't just a technical task—it's a core business decision. The whole custodial vs. non-custodial debate really comes down to one thing: are you looking for the convenience of a managed service, or do you want the total financial freedom that comes with controlling your own assets?

To figure this out, you need to ask yourself some honest questions. There’s no magic bullet here; your business priorities will show you the way.

Evaluating Your Business Needs

First things first, take a hard look at your team and your daily operations. A realistic view of what you can handle and what you want to achieve will make the right choice pretty obvious. Start with a simple question: how comfortable is your team with handling cryptocurrencies and managing private keys?

Next, think about your cash flow. Does your business need to swap crypto for cash immediately to pay the bills and dodge market volatility? Or are you in a position to hold digital assets on your balance sheet? Your answer here will heavily steer you toward one model or the other.

Ultimately, your choice says a lot about your brand. A company built around decentralization and privacy might naturally lean toward a non-custodial gateway. On the other hand, a business focused on making things easy for the mainstream customer will probably prefer the familiar feel of a custodial service.

A Decision-Making Framework

To pull all this together, here’s a straightforward framework to help you decide. Just weigh each point based on what matters most to your business and how much risk you’re willing to take on.

-

Technical Know-How: Do you have the skills and discipline on your team to securely manage your own private keys? If not, a custodial gateway provides a much-needed safety net. If you do, a non-custodial gateway gives you complete control.

-

Cash Flow Management: Is getting your money converted to fiat instantly a must-have for your operations? Custodial solutions are built for this and protect you from price swings. If you're okay with holding crypto, non-custodial gateways offer far more flexibility.

-

Security and Control: Is your top priority having maximum security by holding your own keys and cutting out any middleman risk? A non-custodial gateway like ATLOS is the undeniable choice here. If you'd rather hand off security to a company that specializes in it, a custodial service is the way to go.

-

Compliance and Regulation: Before you commit, it's critical to make sure your gateway choice aligns with all legal requirements. Using a detailed business compliance checklist will help you understand the responsibilities that come with each model.

By thinking through these points, you can confidently pick the gateway that truly fits your business goals and ensures you start accepting crypto payments securely and without a hitch.

Frequently Asked Questions

When you're deciding between a custodial and a non-custodial crypto payment gateway, a few key questions always come up. Let's break down the answers to help you get past the sticking points and choose the right path for your business.

A lot of the confusion boils down to security. Is one really safer than the other? Well, it depends on what you mean by "safe." Custodial gateways are run by companies that invest heavily in institutional-grade security, handling all the complex technical work to fend off hackers. The trade-off? You're trusting them to hold your money, which introduces counterparty risk—if they go down, your funds could be in jeopardy.

On the other hand, non-custodial gateways completely remove that counterparty risk. The funds go directly to a wallet only you control. This puts security squarely in your hands; your crypto is only as safe as your private key management.

Key Management and Recovery

"What happens if I lose my password?" This is where the two models diverge completely, and it's a critical point for any merchant.

If you're using a custodial provider, the process is familiar. You'd go through a password reset flow, just like with your bank account. Their support team is there to help you get back in.

With a non-custodial gateway, there's no one to call. You are 100% responsible for safeguarding your private keys or recovery phrase. If you lose them, the funds are gone forever. No exceptions.

This is the fundamental trade-off: custodial services give you a safety net but take control, while non-custodial gateways offer total autonomy but demand rigorous self-reliance.

Transaction Fees and Finality

Another question we hear all the time is about cost. Custodial gateways typically simplify this by charging a flat percentage fee, often around 1%, which bundles everything from processing to support. It's predictable and easy to understand.

Non-custodial gateways work differently. You'll usually pay a much lower software fee to the provider, but you're also responsible for the blockchain's network fee (or "gas fee") for each transaction. This can be more affordable, especially for high-volume businesses, but the costs can fluctuate with network congestion.

And what about when the money is actually yours? For both gateway types, once a crypto payment is confirmed on the blockchain, it’s final. The real difference is settlement. With a non-custodial gateway, the payment hits your wallet and is spendable almost instantly. Custodial providers, however, might hold the funds according to their own settlement schedules and withdrawal policies, which is a crucial detail for businesses needing immediate cash flow.

Ready to take full control of your crypto payments with a secure, no-KYC solution? ATLOS offers a powerful non-custodial gateway that puts you in charge of your funds from day one. Get started with ATLOS today and experience true financial sovereignty.