Accepting Cryptocurrency Payments a Guide to ATLOS

Accepting cryptocurrency payments has moved from a niche idea to a smart business decision. It's not just about being innovative; it's a practical way to reach a growing global audience and slash your operational costs. By getting on board with crypto, you're not just adding a payment option—you're future-proofing your business.

Why Your Business Should Accept Crypto Payments

Bringing digital currencies into your payment mix is a powerful way to make your business more efficient and expand its reach. This goes far beyond simply adding a new button at checkout. It represents a real shift that solves some of the biggest headaches for modern merchants, especially those selling online or internationally. The benefits, from lower fees to better fraud protection, are real and can make a difference right away.

When you step away from the old-school payment systems, you open the door to new markets and customer groups that might have been out of reach before. This isn't just a fleeting trend; it's a direct response to a worldwide change in how people handle their money.

Expand Your Customer Base Globally

One of the biggest wins when you start accepting crypto is immediate access to a massive, untapped global market. Millions of potential buyers, especially in places where traditional banking is a hassle, rely on crypto for their online purchases. For these customers, paying with Bitcoin or Ethereum is often easier and more dependable than using a local credit card.

Let's look at a real-world example. Imagine you run an online store that sells digital art. If you only take credit cards, you're limiting yourself to customers with traditional bank accounts. But as soon as you add a crypto payment option:

- You can suddenly sell to a customer in a country where international card payments are constantly blocked.

- You start attracting a younger, more tech-forward crowd that actively looks for businesses that accept their preferred currency.

- You could potentially boost your international sales by up to 30% just by removing that one payment hurdle.

This global reach is becoming more important every day. As of 2024, cryptocurrency ownership has reached about 6.8% of the world's population. That's over 560 million people holding digital assets. According to TripleA's crypto ownership data, the growth in this space is blowing past traditional payment methods, which clearly signals a major shift in how people spend.

Reduce Transaction Costs and Eliminate Chargebacks

Let's be honest��—traditional payment processing is expensive. Credit card companies typically hit merchants with fees ranging from 2-4% on every single transaction. Those fees come directly out of your profits. Cryptocurrency, on the other hand, runs on decentralized networks with much lower costs, often less than 1%.

A game-changing advantage of crypto is that transactions are final. Once a payment is confirmed on the blockchain, it’s done. It can't be reversed. This completely wipes out the risk of chargeback fraud, a major source of frustration and loss for anyone selling online.

This means you get to keep more of your hard-earned revenue and waste less time fighting fraudulent claims. As businesses look for new ways to grow, like building profitable membership business models from their online communities, cutting down these operational costs is essential for long-term success.

Cryptocurrency Payments vs Traditional Payments at a Glance

To put things in perspective, let's compare the two side-by-side. It quickly becomes clear why so many businesses are making the switch.

| Feature | Cryptocurrency Payments (via ATLOS) | Traditional Payments (Credit Cards/Banks) |

|---|---|---|

| Transaction Fees | Typically under 1% | 2-4% plus additional fixed fees |

| Chargeback Risk | None (transactions are irreversible) | High (merchants are often liable for fraudulent claims) |

| Global Access | Borderless, accessible to anyone with an internet connection | Restricted by country, banking systems, and regulations |

| Settlement Time | Near-instant to a few minutes | 2-3 business days or longer |

| Customer Privacy | Enhanced privacy, no sensitive financial data shared | Requires extensive personal and financial information |

The table really highlights the core differences. With crypto, you’re looking at a system that’s faster, cheaper, and more secure for the merchant. While traditional systems are familiar, they come with built-in costs and risks that simply don't exist in the world of digital currencies.

Choosing the Right Crypto Payment Gateway

Before you can actually accept crypto, you need a payment gateway. This is the essential piece of technology that connects your business to the blockchain, acting as the bridge for every transaction.

A good gateway does the heavy lifting for you. It lets customers pay in their preferred crypto while you can opt to receive funds in a stable currency like dollars or euros. This is a game-changer because it shields you from the day-to-day price swings that crypto is famous for.

Making the right choice here is absolutely critical. The market is flooded with options, and frankly, they're not all built the same. You need a solution that fits your business like a glove, making the entire payment process a breeze for both you and your customers.

Core Features Every Business Needs

As you start comparing platforms, there are a few non-negotiable features you should be looking for. Think of these as the foundation of a solid, reliable payment system. Skimping on these can lead to major headaches, security vulnerabilities, or a clunky checkout experience that sends potential customers running.

Here’s a practical checklist to keep handy:

- Rock-Solid Security: Does the provider use things like two-factor authentication and robust encryption? When you're dealing with digital assets, security isn't just a feature—it's everything.

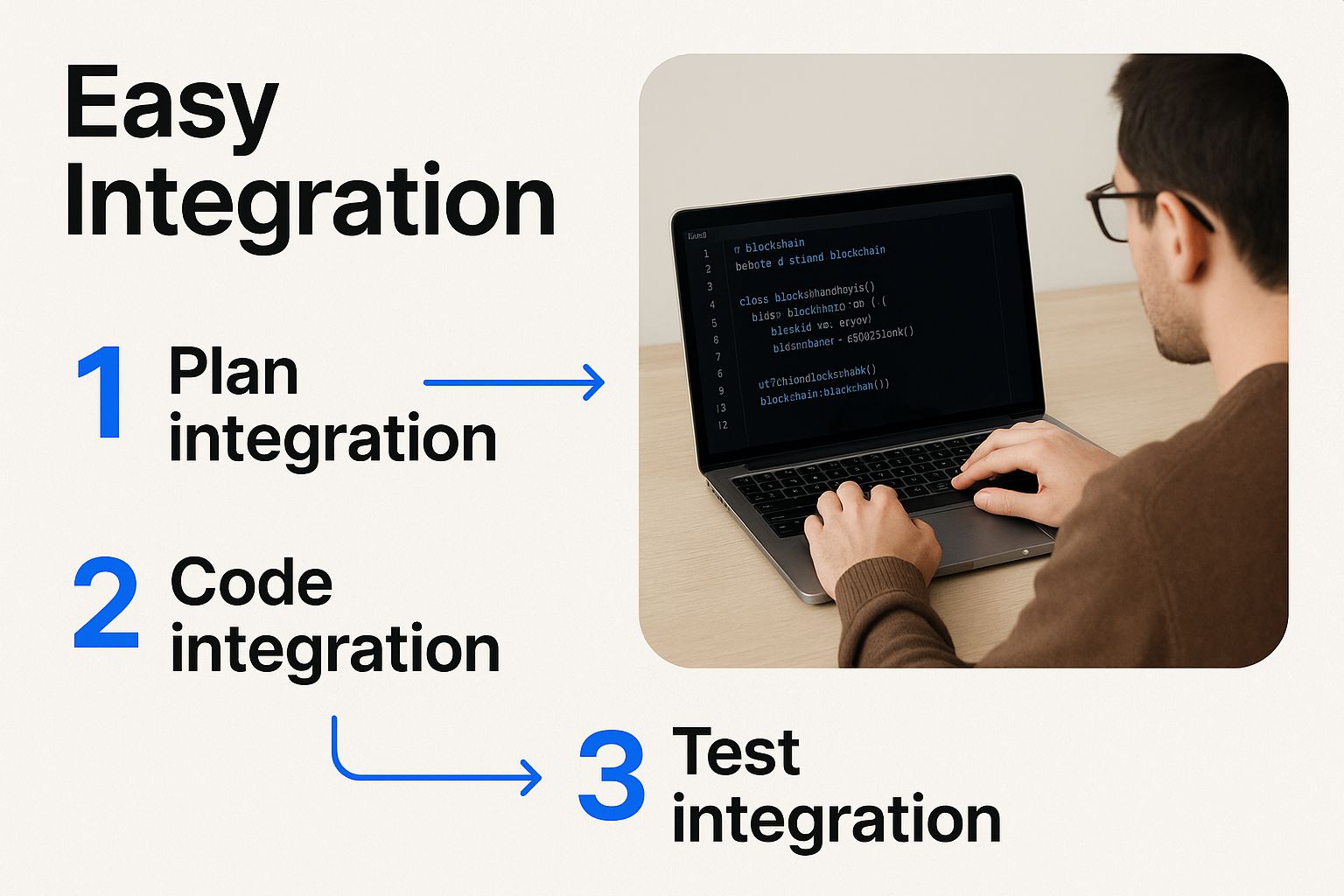

- Painless Integration: How hard is it to get this thing working with your existing setup? Look for ready-made plugins for platforms like Shopify or WooCommerce and clear, well-documented APIs for custom builds.

- Wide Coin Support: Can it handle the big names your customers are likely to hold, like Bitcoin and Ethereum? The more payment options you offer, the wider you cast your net for potential sales.

- Honest, Clear Fees: Are the transaction fees laid out in plain English? Sneaky hidden charges can slowly but surely chip away at your profit margins.

Why a Platform Like ATLOS Stands Out

This is where a purpose-built solution like ATLOS really shines. It was designed from the ground up to make crypto payments simple for businesses, focusing on an easy-to-use experience without cutting corners on functionality. I've seen small digital agencies use its straightforward API to start invoicing international clients in crypto within just a few hours.

The platform's dashboard gives you a clean, at-a-glance view of all your transactions. This shot of the ATLOS interface shows just how simple it is to see incoming payments and manage your funds.

You can see how the clean layout makes tracking payments intuitive, flattening the learning curve significantly. It's this dedication to simplicity that helps businesses get up and running with crypto quickly.

From my experience, the best payment gateway is one you can set up and almost forget about. It should just work, humming along in the background, processing payments reliably so you can stay focused on what you do best: running your business.

ATLOS also layers on multiple security protocols, which provides some much-needed peace of mind. And because it offers direct plugins for major e-commerce platforms, you don’t need an entire development team on standby. For any business that's serious about accepting cryptocurrency payments, picking a gateway that nails the trifecta of security, usability, and solid support is the first real step toward getting it right.

Getting Started with ATLOS Integration

Alright, let's roll up our sleeves and get this done. We've covered the "why," so now it's time for the "how." I'm going to walk you through the entire ATLOS setup, from creating your account to being ready for that first live crypto transaction. The goal here is to make it as painless as possible.

The whole point of a tool like ATLOS is to take the really complicated stuff—the blockchain code, the wallet management—and hide it behind a simple interface. You don't need to be a developer to get this working.

The big takeaway here is that you can start accepting cryptocurrency payments without a deep technical background. The right tools handle the heavy lifting for you.

Creating Your Account and Business Verification

First things first, you need an ATLOS account. Signing up is the easy part. The next piece is the business verification, often called KYB (Know Your Business), and this is where a little preparation goes a long way. If you have your documents ready ahead of time, you can often get this knocked out in a single day.

To make the approval process fly by, have these ready to upload:

- Business Registration Documents: This is your proof of existence, like your articles of incorporation.

- Proof of Address: A recent utility bill or bank statement with your business address on it will do the trick.

- Owner Identification: A standard government-issued ID for the primary owner.

This isn't just red tape. This verification is a standard security measure across the industry. It builds a foundation of trust and helps keep the ecosystem safe for everyone.

Configuring Your Settlement Options

Once you're verified, you'll need to make a key decision: how do you want to get paid? ATLOS gives you a couple of solid options, and the right choice really depends on your business's appetite for handling digital assets directly.

Your two main paths are:

- Receive Fiat Currency: ATLOS can instantly convert a customer's crypto payment into a stable currency like USD or EUR and deposit it into your bank account. This is the go-to option if you want to eliminate price volatility. You get all the benefits of accepting crypto without ever having to hold it.

- Hold Cryptocurrency: If you're more comfortable with crypto, you can choose to receive the payments directly into your wallet. This is great for businesses that believe in the long-term value of certain coins or want to use crypto to pay their own suppliers.

For most businesses just dipping their toes in the water, I always recommend starting with automatic fiat conversion. It’s a safety net. You get a feel for the process without worrying about a sudden price drop. You can always switch to holding crypto later once you’re more comfortable.

Integrating with Your E-commerce Platform

Now for the fun part—connecting ATLOS to your actual storefront. Let’s take a common platform like Shopify as an example. The process is pretty straightforward: you’ll generate API keys from your ATLOS dashboard and then pop over to the Shopify App Store to install the ATLOS plugin.

Think of an API key as a secure handshake between two apps. You copy the key from ATLOS, paste it into the plugin's settings on your Shopify admin page, and that’s it. The connection is made. That simple step is what makes the "Pay with Crypto" button magically appear on your checkout page.

But what if you don't run a big e-commerce store? Let's say you're a freelance consultant. You can use ATLOS to create a simple payment link for a specific invoice amount. Just email that link to your client. They click, pay with their crypto of choice, and you get the funds. No website integration needed. It’s incredibly versatile.

One last, crucial piece of advice: always run test transactions. Before you go live and tell the world you accept crypto, run a few small payments through the system yourself. This is your chance to make sure everything works smoothly, from the customer experience to the money actually landing in your account. A few minutes of testing can save you a world of headaches later.

From Setup to Daily Operations: Managing Payments and Risk

Once you've got ATLOS up and running, your focus will naturally shift from the initial setup to managing the day-to-day flow of crypto payments. This is where the real work begins. It’s not just about passively watching transactions roll in; it's about actively building a secure and smooth process around this new revenue stream.

Your ATLOS dashboard is now your home base. Think of it as your mission control for everything crypto. You'll be using it constantly to track incoming payments, check on transaction statuses (is it pending, confirmed, or did it fail?), and quickly pull up details when a customer has a question. This single, centralized view is absolutely vital for keeping your records straight.

Taming Crypto Volatility

Let's be honest: the number one reason businesses get nervous about crypto is its notorious price volatility. This is where ATLOS’s instant fiat conversion feature isn't just a nice-to-have—it's your most critical tool.

When a customer pays in, say, Bitcoin, ATLOS can immediately convert it into your preferred local currency, whether that's USD, EUR, or something else. This simple action completely sidesteps the risk that the coin’s value could plummet between the time of payment and when you actually move the funds.

Instant conversion is like a financial shield. It lets you tap into the massive global crypto market and get all the benefits—low fees, no chargebacks—without ever exposing your business to the wild price swings.

This isn't just a niche strategy; it's quickly becoming best practice for any smart company venturing into crypto. A recent Deloitte survey of North American CFOs found that while 23% plan to adopt crypto within two years, a significant 43% still point to volatility as the biggest roadblock. Using a tool that erases that primary concern is a no-brainer.

Locking Down Your Account and Keeping Clean Books

Beyond the market's ups and downs, your own account security is something you can't afford to neglect. Treat your ATLOS account with the same seriousness as your primary business bank account. The platform gives you the tools you need to build a fortress around your funds.

Here are the first two things you should do, right now:

- Make Two-Factor Authentication (2FA) Mandatory: This isn't optional. Turn it on for every single person who has access to your account. That extra code from a phone app is a simple but powerful barrier against unauthorized logins.

- Use Granular User Roles: Don't give everyone on your team the "keys to the kingdom." ATLOS lets you define specific roles. For example, a customer support rep can be given view-only access to transaction history without the ability to initiate withdrawals.

Lastly, meticulous record-keeping is non-negotiable for accounting and compliance. Every crypto payment is a sale, and it needs to be logged just like a credit card transaction. ATLOS makes this incredibly simple with detailed, exportable reports. Your accountant will thank you, and you'll be ready when tax season rolls around.

By combining sharp transaction monitoring, a smart strategy for volatility, and iron-clad security protocols, you’ll be able to manage your new crypto payment system with total confidence.

How Crypto Payments Unlock Global Markets

If you're looking to take your business international, accepting crypto is one of the fastest ways to get there. Digital currencies simply erase the usual headaches of cross-border commerce, giving you a direct line to new customers and markets that were once too complex or costly to enter.

Think about what this means in practice. You get to skip the painful friction points that plague traditional finance—the high foreign exchange fees, the maddeningly slow settlement times, and the tangled mess of international banking rules that can hold up a sale for days.

Accessing High-Growth Regions

Let's imagine you run a SaaS company. With a tool like ATLOS, you can start selling subscriptions to customers in places like Argentina or Nigeria without a hitch. These are markets where crypto adoption is surging, often because local payment systems are unreliable or make international purchases a nightmare.

For these customers, paying with crypto isn't just a cool feature; it's a practical solution. By accepting cryptocurrency payments, you're not just adding another payment method. You're providing the only viable one for a huge, and growing, part of the world. This move immediately unlocks revenue streams your competitors, still clinging to credit cards and bank wires, can't even touch.

The 2025 Global Crypto Adoption Index from Chainalysis backs this up with hard data. It shows countries like Ukraine, Moldova, and Georgia are leading the pack in adoption. Even places like Jordan and Venezuela are in the top 10, largely driven by economic realities that make digital currencies a more stable and accessible option.

Gaining a Competitive Advantage

The data from the index reveals an incredible diversity among crypto users, proving this is a truly global movement. This isn't about catering to a handful of tech bros. It's about connecting with entire economies that are starting to operate on a different financial rail.

By embracing crypto now, you gain a significant first-mover advantage. You are positioning your business to serve a borderless customer base, building loyalty in emerging markets before they become saturated.

To stay competitive, you have to meet customers where they are and adapt to how they want to pay. Offering crypto sends a clear message: your company is innovative, flexible, and built for the future of global commerce. It’s a powerful way to make your brand stand out and grab market share that others are simply leaving behind.

Got Questions About Crypto Payments? We’ve Got Answers.

Jumping into the world of cryptocurrency payments can feel like a big step. It’s a newer frontier for many businesses, so it's completely normal to have questions. Let's clear the air and tackle some of the most common things people ask.

We'll skip the heavy technical jargon and focus on the practical, day-to-day operational questions you’ll face once you add crypto to your checkout.

How in the World Do Taxes Work with Crypto?

This is, without a doubt, the number one question on every business owner's mind. The key thing to remember is that the IRS treats cryptocurrency as property, not as currency.

So, what does that mean for you? When a customer pays you with crypto, you report that transaction as gross income. The value you report is its fair market value in USD at the exact moment you received it.

Let's say a customer buys a $500 product and pays you 0.01 Bitcoin. You record $500 of income on your books. It doesn’t matter if Bitcoin’s price skyrockets or dips an hour later—the value is locked in at the time of the transaction. This is where a platform like ATLOS becomes invaluable; it automatically gives you detailed records with timestamps and the USD equivalent, which makes tax time a whole lot less stressful.

What About Customer Refunds?

Here’s a big difference from credit cards: crypto transactions on the blockchain are final. You can’t just “void” or “reverse” a payment. On one hand, this is a huge plus because it completely eliminates chargeback fraud. But when a customer needs a legitimate refund, you'll have to handle it manually.

The process is straightforward: you simply initiate a new transaction back to the customer. The crucial part is having a clear refund policy. You need to decide—and state upfront—whether you'll refund the original crypto amount (e.g., 0.01 BTC) or its USD value at the time of the refund. Most businesses choose the USD value to avoid getting caught out by price swings.

How Do You Handle Common Payment Mistakes?

Mistakes happen. A customer might send too little, too much, or even the wrong kind of cryptocurrency. A solid payment gateway is your best defense against these headaches.

Here’s how most situations play out:

- Underpayments: If a customer doesn't send the full amount, the system will usually flag the invoice and keep the order on hold. The customer is then prompted to send the remaining balance to complete their purchase.

- Overpayments: If someone sends more than they were supposed to, it’s a simple fix. You’d just refund the extra amount, following the same manual process you would for a standard return.

- Wrong Cryptocurrency: This is a surprisingly common fear, but a robust system like ATLOS pretty much solves it. It generates a unique, single-use address for every single invoice. This design makes it nearly impossible for a customer to accidentally send, say, Ethereum to a Bitcoin address.

By thinking through these scenarios ahead of time, you can set up clear procedures and keep your customers happy. Getting these practical details right is what separates a smooth crypto payment experience from a confusing one.

Ready to reach a global audience and slash your transaction fees? With ATLOS, you can start accepting cryptocurrency payments securely and with total confidence. Get started today and see just how easy it is.