12 Best Stripe Alternative Options for Your Business in 2025

Stripe has long been the gold standard for online payment processing, celebrated for its developer-friendly APIs and robust feature set. However, as the digital commerce landscape evolves, so do the needs of businesses. Whether it's due to account stability concerns, a search for lower transaction fees, a need for specialized features like non-custodial crypto payments, or simply a desire for more transparent pricing models, more merchants than ever are exploring what lies beyond Stripe's ecosystem. This guide is designed to be your definitive resource, cutting through the marketing noise to provide a clear, practical comparison of the top contenders. We'll dive deep into the real-world pros and cons, specific use cases, and critical implementation details you need to know to find the best Stripe alternative for your unique business goals.

For businesses in specialized or high-risk sectors such as hosting, VPNs, online gaming, and DAOs, finding the right payment processor is not just about fees-it's about survival. Account freezes and restrictive policies can halt operations without warning. This article directly addresses these challenges by evaluating each platform's suitability for specific industries, their stance on high-risk merchant accounts, and their ability to handle diverse payment models, including cryptocurrency. We provide a detailed analysis of 12 leading platforms, from established players like PayPal and Square to crypto-focused solutions like ATLOS and global powerhouses like Adyen. Each review includes screenshots, direct links, and an honest assessment of limitations to help you make an informed decision and secure a reliable payment infrastructure for your business.

1. ATLOS Crypto Payment Gateway

ATLOS Crypto Payment Gateway emerges as a powerful and distinct Stripe alternative, specifically engineered for businesses ready to embrace the future of decentralized finance. It sets itself apart by offering a permissionless, non-custodial framework that grants merchants complete and unwavering control over their funds. This model directly addresses a major pain point for businesses, especially those in high-risk sectors like hosting, VPNs, and gaming, by eliminating the risk of frozen assets or sudden account terminations that can occur with traditional payment processors.

The platform's core strength lies in its radical simplicity and speed. Unlike conventional gateways that require lengthy approvals and KYC verification, ATLOS allows businesses to start accepting crypto payments almost instantly. Integration is streamlined to just two lines of JavaScript or through dedicated plugins for major platforms like Shopify and WooCommerce, making the technical barrier to entry remarkably low.

Standout Features and Use Cases

ATLOS is more than just a simple payment button; it's a comprehensive crypto commerce toolkit.

- Non-Custodial Architecture: This is the cornerstone of ATLOS. By enabling direct peer-to-peer transactions to a merchant's own wallet, it embodies the "your keys, your crypto" principle, providing unparalleled security and autonomy.

- Broad Cryptocurrency Support: Merchants can accept a vast array of digital currencies, including Bitcoin, Ethereum, Solana, and assets on the Binance Smart Chain. For businesses delving into crypto payments, an initial step involves understanding leading cryptocurrencies. To learn more about understanding Bitcoin, a frequently used digital asset, you can find information here.

- Advanced Payment Flows: ATLOS supports complex business models with features like recurring payments for subscriptions and payout APIs, ideal for managing affiliate programs or contractor payments efficiently.

- White-Label Solution: Businesses can opt for a self-hosted, white-label version of the gateway, allowing for full branding control and a seamless user experience that aligns with their existing identity.

Website: https://atlos.io

| Feature Analysis | ATLOS Crypto Payment Gateway |

|---|---|

| Best For | High-risk industries, web3-native businesses, and merchants seeking full fund control. |

| Key Advantage | Instant, KYC-free onboarding and a non-custodial model that prevents fund freezes. |

| Pricing | Not publicly listed; requires direct contact for a quote. |

| Learning Curve | Minimal for those familiar with crypto wallets, but may require some initial learning for complete newcomers. |

2. PayPal Business

PayPal Business stands as a formidable Stripe alternative, primarily due to its unparalleled consumer recognition and trust. For businesses targeting a broad US consumer base, integrating PayPal is almost a necessity. The platform’s key advantage lies in offering PayPal, Venmo, credit/debit cards, and Pay Later options within a single, unified checkout experience. This familiarity can significantly boost conversion rates, as customers often prefer using a wallet they already know and trust over entering card details on an unfamiliar site.

It's a strong contender for e-commerce stores, subscription services, and businesses that need both online and in-person POS capabilities via its Zettle hardware integration. The platform's fast setup and extensive integrations with major e-commerce platforms like Shopify and WooCommerce make it incredibly accessible for merchants of all sizes.

Key Features and Considerations

The platform isn't just a simple "Pay with PayPal" button. It's a full-stack solution that includes invoicing, subscription management, and detailed reporting. However, its feature set can feel somewhat fragmented compared to Stripe’s unified dashboard.

- Pros:

- Massive consumer reach with PayPal and Venmo.

- High brand recognition builds buyer trust and can increase sales.

- Offers both online and in-person (POS) payment solutions.

- Cons:

- The blended rate for online transactions (currently 2.99% + $0.49) can be higher than interchange-plus models for high-volume merchants.

- The user interface can feel disjointed when navigating between different products.

Website: https://www.paypal.com/us/business

3. Square

Square excels as a Stripe alternative for businesses that need a unified system for both online and in-person sales. It's renowned for its robust Point of Sale (POS) hardware and software, making it an ideal choice for retailers, restaurants, and service providers who are expanding into e-commerce. The platform's strength lies in its simplicity; it provides an end-to-end ecosystem with flat, predictable pricing that simplifies financial planning for small to medium-sized businesses.

This omnichannel approach allows merchants to manage inventory, sales data, and customer relationships across all channels from a single dashboard. Whether you're sending invoices, selling through an online store, or accepting payments via a mobile terminal, Square offers a cohesive experience. Fast onboarding and features like next-day deposits and Cash App Pay support further enhance its appeal for businesses seeking operational efficiency.

Key Features and Considerations

Square’s all-in-one platform includes everything from payment links and e-commerce APIs to dispute management and basic fraud protection at no extra cost. This comprehensive offering is particularly valuable for businesses that don't have the resources to piece together multiple systems.

- Pros:

- Simple, predictable fees and incredibly fast onboarding.

- A rich in-person ecosystem with a wide range of POS hardware.

- No monthly fees or processing minimums are required.

- Cons:

- Flat-rate pricing can become more expensive than interchange-plus models at high transaction volumes.

- Rates have limited negotiability unless you are a very high-volume merchant.

Website: https://squareup.com

4. Shopify Payments

For businesses already committed to the Shopify ecosystem, Shopify Payments isn't just a convenient choice; it's the most powerful and cost-effective one. As Shopify’s native payment processor, it eliminates the need for a third-party gateway, offering a deeply integrated solution that simplifies everything from setup to reconciliation. Its standout feature, Shop Pay, provides a one-click accelerated checkout experience that significantly reduces friction and boosts conversion rates for returning customers.

This makes it the best Stripe alternative for any merchant using the Shopify platform, from small startups to large enterprises. The seamless integration means all your payments, orders, and customer data are managed within a single, unified dashboard. It also supports both online and in-person sales through Shopify POS, ensuring consistent reporting and inventory management across all channels.

Key Features and Considerations

Shopify Payments goes beyond simple credit card processing by including robust fraud analysis, chargeback management, and support for international selling with currency conversion and duty calculation tools. The platform’s pricing is transparent and tied to your Shopify plan, with rates improving as your business scales to higher tiers.

- Pros:

- Perfect integration with the Shopify admin and checkout process.

- Eliminates Shopify’s extra transaction fees for using a third-party gateway.

- Includes Shop Pay for a high-converting, one-click checkout experience.

- Cons:

- Exclusively available to merchants using the Shopify e-commerce platform.

- Additional fees apply for cross-border transactions and currency conversions.

Website: https://www.shopify.com/payments

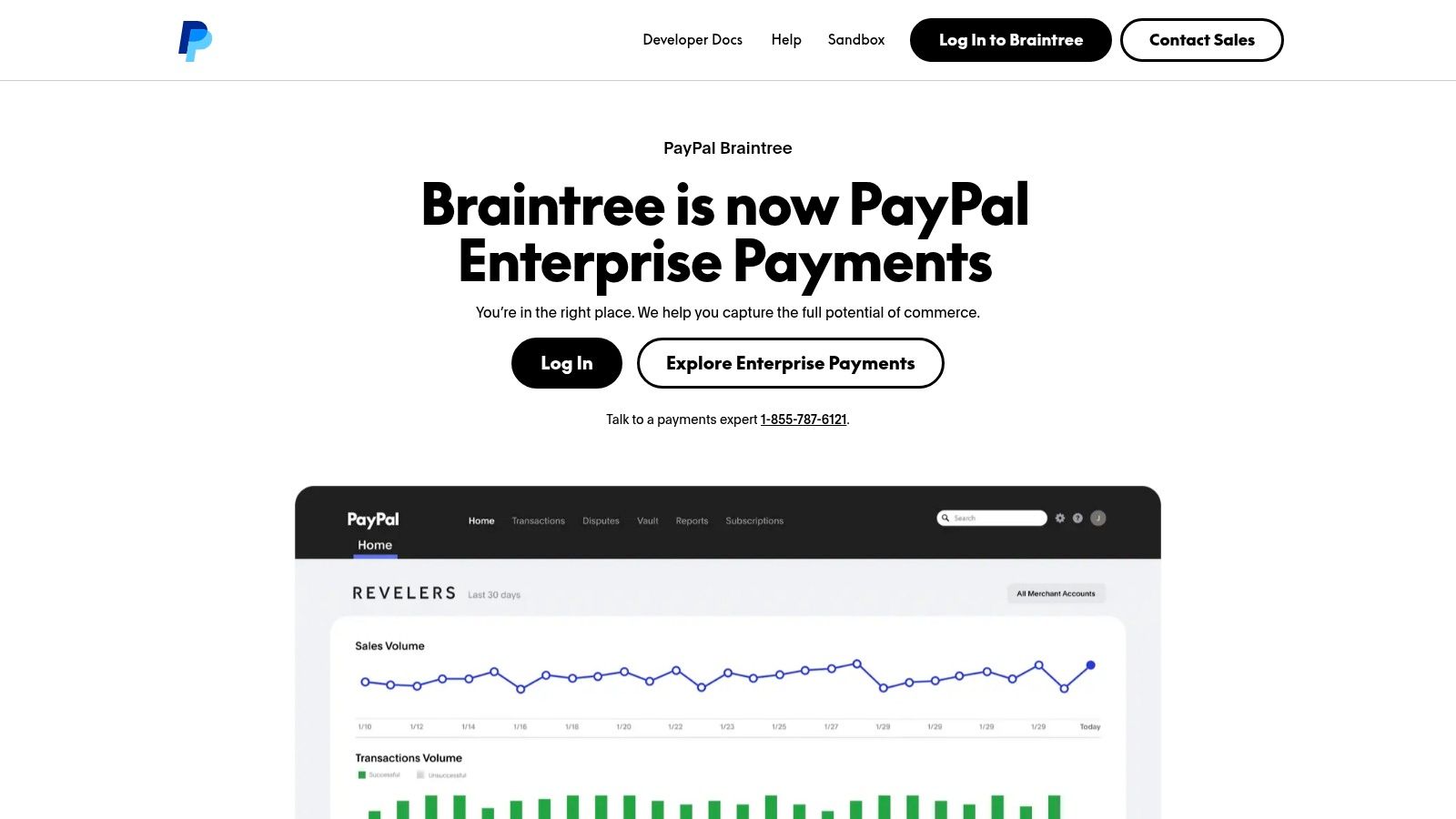

5. Braintree (a PayPal company)

Braintree operates as a powerful, developer-first Stripe alternative, owned by PayPal but distinct in its approach. It's designed for businesses that require more granular control over their payment stack, offering a single integration to accept credit/debit cards, PayPal, Venmo, and digital wallets. This platform excels for businesses with complex models, such as SaaS companies needing sophisticated recurring billing or marketplaces managing intricate payout structures, providing a robust API and extensive documentation.

It is a strong choice for established businesses prioritizing customization and access to the PayPal ecosystem's payment methods through a more technical gateway. Braintree’s advanced vaulting and tokenization features are a significant draw for companies focused on secure, repeat customer transactions. The platform provides a comprehensive sandbox environment, making it easier for developers to build and test complex integrations before going live.

Key Features and Considerations

Braintree functions as both a gateway and a full-stack processor, giving merchants flexibility in how they structure their payment operations. Its Recurring Billing add-on is particularly robust, though it comes with tiered monthly pricing based on the number of subscribers, which is a key difference from Stripe's integrated approach.

- Pros:

- Flexible APIs and strong support for complex subscription models.

- Single integration provides access to the full PayPal and Venmo payment ecosystem.

- Excellent sandbox environment and data migration support.

- Cons:

- Standard US pricing for cards (2.59% + $0.49) is not prominently listed and often leads to custom quotes.

- Support and underwriting experiences can be inconsistent, especially for smaller merchants.

Website: https://www.braintreepayments.com

6. Adyen

Adyen is a powerful, enterprise-grade Stripe alternative built for large-scale businesses that require a unified global payments infrastructure. It distinguishes itself by acting as a direct acquirer, processor, and gateway in one, giving merchants a single platform for online, in-app, and point-of-sale transactions worldwide. Its core strength lies in deep data insights and network-level optimizations that can significantly improve authorization rates and reduce processing costs through its Interchange++ pricing model.

This platform is ideal for mid-market and enterprise companies with substantial international sales volume. Adyen’s single integration provides access to over 100 payment methods, including local favorites like US Cash App Pay and Pay by Bank (ACH via Plaid), simplifying global expansion and reconciliation. Its advanced risk management tools and network tokenization also provide robust security for high-value transactions.

Key Features and Considerations

Adyen provides unparalleled visibility into the entire payment flow, from transaction costs to authorization data. This granular detail allows businesses to fine-tune their payment strategy for optimal performance, a level of control not always available with flat-rate providers.

- Pros:

- Excellent performance at scale with superior global coverage.

- Deep cost and authorization rate optimization through direct acquiring.

- Rich reporting and reconciliation tools for complex operations.

- Cons:

- Best suited for mid-market or enterprise businesses with high transaction volumes.

- Pricing complexity and setup can be more involved than flat-rate options.

Website: https://www.adyen.com

7. Checkout.com

Checkout.com has emerged as a powerful, enterprise-focused Stripe alternative for large-scale international businesses. Its primary advantage is offering flexible pricing models, including both predictable flat-rate and highly competitive Interchange++ options. This allows high-volume merchants to optimize payment processing costs as they scale, a key differentiator from Stripe’s standard blended rates for most users. The platform is engineered for global performance, supporting over 150 currencies and domestic acquiring in numerous countries.

It is particularly well-suited for businesses with complex, cross-border payment flows, such as global SaaS companies, marketplaces, and fintech platforms. The platform's unified API provides granular data and reporting, while its free Integration Health tooling helps developers monitor and improve payment performance. This focus on developer experience and performance optimization makes it a strong contender for tech-savvy organizations.

Key Features and Considerations

The platform is built around a single, unified API that contrasts with the multi-product approach of some competitors, simplifying integration for complex systems. However, its services are geared toward established businesses, and pricing isn't publicly listed, requiring direct engagement with their sales team to get started.

- Pros:

- Flexible and competitive pricing with Interchange++ for scalable merchants.

- Strong developer experience with robust API and extensive support.

- Excellent global coverage with domestic acquiring capabilities.

- Cons:

- Requires a sales conversation for pricing; no instant self-serve option.

- The setup process can be slower and more involved for smaller businesses.

Website: https://www.checkout.com

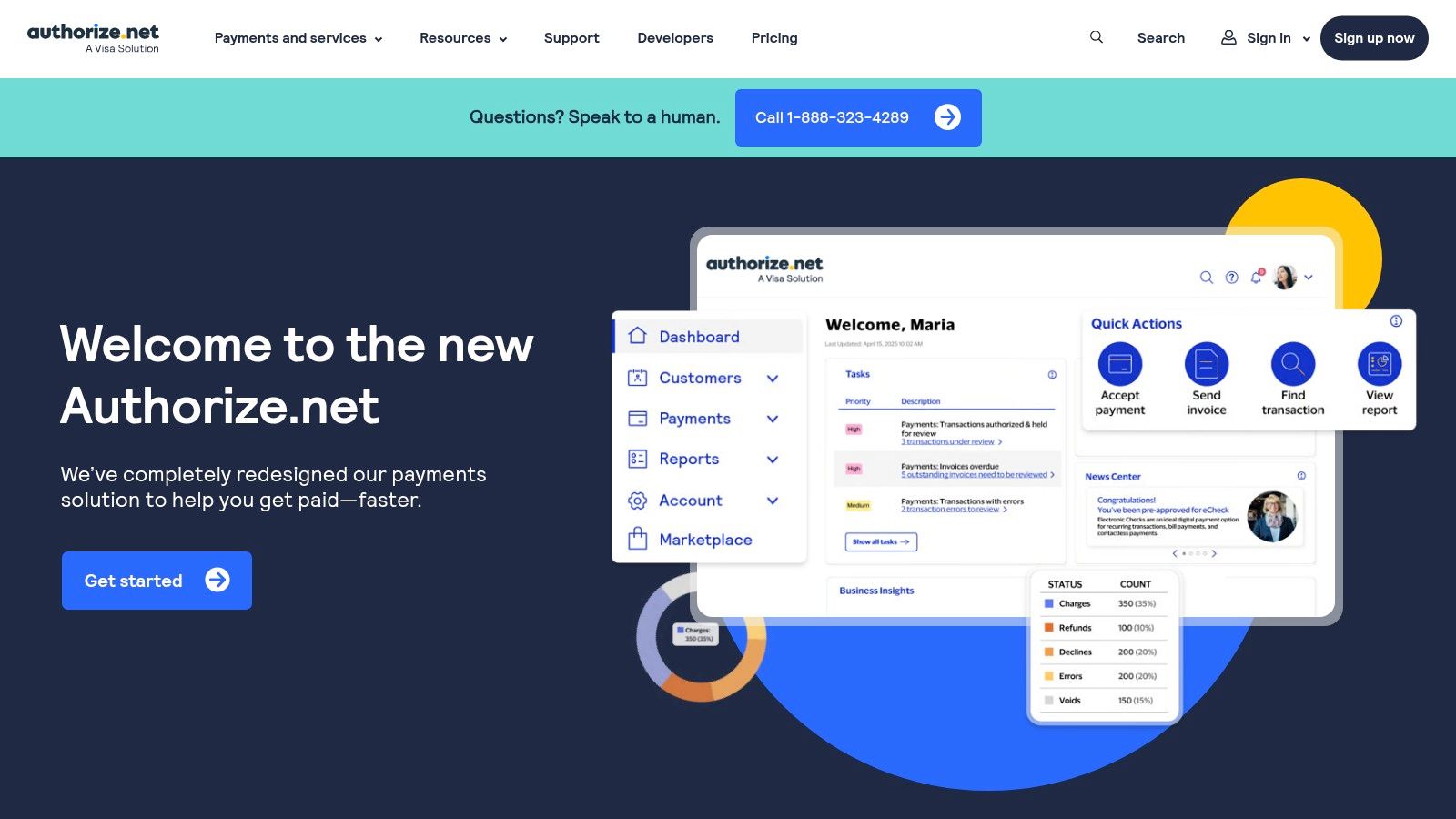

8. Authorize.net (Visa)

Authorize.net, a Visa solution, is one of the oldest and most trusted payment gateways, making it a powerful Stripe alternative for businesses that need flexibility. Its key differentiator is the ability to function as just a gateway, allowing merchants to connect their own pre-existing merchant account. This portability is a significant advantage for established businesses that want to switch processors without disrupting their front-end payment infrastructure. It provides a stable and reliable bridge between a website and a payment processor.

This platform is ideal for merchants who have already secured favorable processing rates with a specific bank or for those who prioritize processor independence. Authorize.net also offers an all-in-one solution that combines the gateway and a merchant account for newer businesses. Its feature set includes robust tools for invoicing, recurring billing (ARB), and secure customer data storage, making it a solid choice for subscription-based services and B2B companies.

Key Features and Considerations

While its interface may appear dated compared to modern solutions like Stripe, Authorize.net's strength lies in its reliability and deep integration support across a vast ecosystem of shopping carts and platforms. The platform also offers value-added services like an Account Updater to minimize failed recurring payments.

- Pros:

- Gateway-only option provides unmatched flexibility and processor portability.

- Excellent tools for recurring billing and invoicing.

- Widespread support and available human phone support.

- Cons:

- Requires a monthly gateway fee ($25/month), unlike pure pay-as-you-go models.

- Using the gateway-only plan means managing a separate merchant account relationship.

Website: https://www.authorize.net

9. Helcim

Helcim presents a compelling case as a Stripe alternative for businesses tired of opaque, flat-rate pricing. Its entire model is built on transparency, using an Interchange-plus pricing structure that becomes increasingly cost-effective as a business’s sales volume grows. This approach passes the direct cost of processing from card networks (like Visa or Mastercard) to the merchant, plus a small, clearly published markup. For businesses processing over $5,000 per month, this often translates to significant savings.

This makes Helcim an excellent choice for established e-commerce stores, B2B companies, and retailers seeking fair, predictable costs without monthly fees or long-term contracts. The platform bundles a full suite of free tools, including invoicing, a virtual terminal, recurring payments, and point-of-sale software, making it a comprehensive solution that scales with your revenue.

Key Features and Considerations

Helcim's strength is combining its transparent pricing with a robust, all-in-one feature set. It’s not just a payment gateway; it's a full commerce platform that also supports ACH payments with simple, capped fees, making it ideal for large B2B transactions.

- Pros:

- Transparent Interchange+ pricing with automatic volume discounts.

- No monthly fees, setup fees, or cancellation penalties.

- Includes a full suite of free tools like invoicing, POS, and recurring billing.

- Cons:

- Interchange+ statements can be more complex to analyze than flat-rate bills.

- May not be the cheapest option for very low-volume or micro-businesses.

Website: https://www.helcim.com

10. Stax Payments

Stax Payments introduces a disruptive pricing model that makes it an excellent Stripe alternative for businesses with significant processing volume. Instead of a percentage cut of each transaction, Stax operates on a flat-rate monthly subscription, passing the direct interchange costs from card networks to the merchant with a 0% markup. This predictable, membership-based approach can lead to substantial savings for scaling businesses where traditional percentage fees become a major expense.

This model is ideal for established e-commerce stores, professional services, and B2B companies processing over $10,000 per month. Its platform offers robust analytics, next-day funding, and the ability to bundle gateways like Authorize.net at a reduced cost. Furthermore, its compliant surcharging option via CardX allows merchants to legally pass on credit card fees to customers, further optimizing their payment processing costs.

Key Features and Considerations

The all-in-one platform provides more than just processing; it includes invoicing, recurring billing, and a comprehensive dashboard for tracking payments and customer data. While the initial monthly fee might seem high for new businesses, the potential savings at scale are its key selling point.

- Pros:

- Predictable, flat-rate monthly pricing with 0% markup over interchange.

- Significant cost savings for high-volume merchants.

- Integrated surcharging feature can eliminate credit card processing fees.

- Cons:

- The monthly subscription fee (starting at $99/mo) isn't cost-effective for very low-volume or seasonal businesses.

- Add-ons like ACH processing and specialized hardware come at an extra cost.

Website: https://staxpayments.com

11. Amazon Pay

Amazon Pay serves as a powerful Stripe alternative by leveraging the immense trust and user base of its parent company. For e-commerce businesses, especially those whose customers are likely to be frequent Amazon shoppers, it provides a familiar and frictionless checkout experience. The core advantage is allowing customers to use their existing Amazon login and stored payment and shipping information, which can dramatically reduce cart abandonment and increase conversions by removing the need to manually enter details.

This makes it an excellent choice for online retailers, subscription services, and non-profits seeking donations. Its seamless integration with major e-commerce platforms means merchants can add it as a payment option without a complex technical overhaul, offering customers a trusted wallet they already use daily.

Key Features and Considerations

While Amazon Pay is primarily a checkout accelerator, it also offers a merchant console with reporting and management tools. It functions best as an addition to an existing payment processor rather than a complete replacement, as it's not a full-stack acquiring solution.

- Pros:

- High consumer trust and familiarity with the Amazon brand.

- Streamlines checkout, potentially boosting conversion rates.

- Supports recurring payments for subscriptions and donations.

- Cons:

- More of a wallet add-on than a comprehensive payment gateway.

- Cross-border fees apply, and it may not be the sole processor for complex international businesses.

Website: https://pay.amazon.com

12. Worldpay (FIS)

Worldpay, now part of FIS, is a powerhouse in global payment processing, making it a robust Stripe alternative for established businesses and enterprises. It offers a comprehensive, all-in-one solution that covers online payments, point-of-sale systems, and traditional card terminals. This omnichannel capability is its primary strength, allowing merchants to unify their in-store and e-commerce transactions under a single provider, simplifying reconciliation and reporting significantly.

It’s an excellent choice for scaling retail businesses, restaurants, and international companies that require a processor with extensive global acquiring capabilities. Worldpay’s main appeal lies in its flexible and negotiable pricing structures, which can include interchange-plus models that are often more cost-effective for high-volume merchants than Stripe’s flat-rate fees. This ability to secure custom rates makes it a compelling option for businesses with significant transaction volume.

Key Features and Considerations

Worldpay provides a mature ecosystem with features like next-business-day settlement options and a detailed dashboard for managing payments and reconciliation. However, unlike Stripe’s transparent, self-service model, engaging with Worldpay often requires direct contact with a sales team to get a clear picture of pricing and contract terms.

- Pros:

- Comprehensive omnichannel solutions for online, in-person, and mobile payments.

- Negotiable pricing models that can be more economical for high-volume businesses.

- Extensive global reach and support for a wide range of currencies.

- Cons:

- Pricing is not transparent and requires direct sales engagement.

- Contracts and fee structures can be complex with potential hidden costs.

Website: https://www.worldpay.com

Top 12 Stripe Alternatives Comparison

| Payment Gateway | Core Features | User Experience & Quality | Value Proposition | Target Audience | Price Points / Notes |

|---|---|---|---|---|---|

| ATLOS Crypto Payment Gateway | Instant crypto payments, no KYC, supports many coins, white-label, recurring payments | Seamless, fast onboarding, non-custodial, user-controlled funds | Crypto-native, secure, permissionless, easy integration | Crypto-savvy businesses, high-risk sectors | Pricing not public; contact for details |

| PayPal Business | PayPal, Venmo, cards, invoicing, POS | Strong brand trust, fast setup | Wide consumer coverage, multi-product combo | SMBs & enterprises with standard payments | Variable, fees higher on blended rates |

| Square | POS hardware, invoicing, payment links | Simple fees, fast onboarding | Flat rates, good in-person ecosystem | SMBs needing omnichannel POS | Flat rate, can be costlier at volume |

| Shopify Payments | Native Shopify checkout, fraud tools | Seamless Shopify integration | No 3rd-party fees inside Shopify | Shopify merchants only | Tiered rates, extra for currency conversion |

| Braintree (PayPal) | Cards, wallets, recurring billing | Developer-friendly APIs | Flexible subscription and wallet support | SaaS, marketplaces | Custom pricing, varies by volume |

| Adyen | Global payments, Interchange++ pricing | Enterprise-grade, granular fees | Optimized costs, wide global payment methods | Mid-market to enterprise | Complex pricing, volume-based |

| Checkout.com | Flat or Interchange++, global support | Strong developer tools | Scalable pricing, advanced fraud prevention | Growing global merchants | Requires sales contact, no instant pricing |

| Authorize.net (Visa) | Gateway/all-in-one, invoicing, ACH | Solid recurring payments tools | Flexible, supports existing merchant accounts | US merchants needing flexibility | Monthly gateway fee applies |

| Helcim | Interchange+, volume discounts | Transparent pricing, no contracts | Cost-effective at scale, good ACH support | SMBs and volume processors | Clear markup, volume discounts |

| Stax Payments | Interchange+, membership pricing | Predictable costs, support | Low markup, surcharge options | High-volume merchants | $99/month membership + add-ons |

| Amazon Pay | Amazon account wallet checkout | Trusted checkout, easy setup | Familiarity, fits retail & donations | Retail & donation-focused merchants | Wallet-only, cross-border fees |

| Worldpay (FIS) | Online, POS, terminals, flexible pricing | Broad acquiring options | Negotiable pricing, omnichannel hardware | Scaling and multichannel merchants | Pricing by quote, complex contracts |

Making the Right Choice for Your Payment Stack

Navigating the landscape of payment processing can feel overwhelming, but moving beyond a default choice like Stripe opens up a world of specialized solutions. The journey to find the best Stripe alternative is not about discovering a single, perfect replacement. Instead, it’s about a strategic evaluation of your unique business requirements against the diverse strengths of the platforms we've explored. The right choice will feel less like a compromise and more like a custom-fit solution designed to support your specific operational and financial goals.

Recapping our findings, we've seen a clear divergence in strengths. For businesses operating in high-risk industries like gaming, online pharmacies, or adult entertainment, or for those simply seeking financial sovereignty, a non-custodial crypto gateway like ATLOS provides an essential layer of control and access that traditional finance often denies. In contrast, for omnichannel businesses that need to unify their online and physical sales channels, Square’s cohesive ecosystem of hardware and software presents a compelling, integrated solution.

How to Finalize Your Decision

Your selection process should be methodical. The ideal payment stack is one that not only meets your current needs but can also scale with your future ambitions. Before you commit, consider these critical final steps:

- Re-evaluate Your Core Needs: Look beyond just transaction fees. Do you prioritize international reach and multi-currency support like that offered by Adyen or Checkout.com? Or is your primary concern cost-efficiency for a high volume of domestic transactions, where interchange-plus models from Helcim or Stax shine?

- Scrutinize the Fine Print: Dive deep into the terms of service, especially concerning chargeback policies, fund holding periods, and account termination clauses. This is particularly crucial for VPN providers and other subscription-based models where recurring billing and disputes are common.

- Assess Technical Lift: How much development work is required? Platforms like PayPal Business and Shopify Payments offer near-instant integration within their ecosystems, while a more powerful API-first solution like Braintree or Authorize.net will require more technical resources to implement effectively.

- Engage with Sales and Support: Schedule demos with your top two or three contenders. Use this opportunity to gauge their responsiveness and expertise. Ask pointed questions related to your industry to see how well they understand your specific challenges and compliance needs.

Choosing your payment processor is one of the most critical decisions you'll make for your online business. It's the engine that drives your revenue, and any friction in this system can have significant consequences. Use the detailed comparisons in this guide as your roadmap, but let your own due diligence be your compass. By carefully weighing the pros and cons against your business model, you can select a partner that not only processes payments but actively fuels your growth.

Ready to break free from the limitations of traditional payment systems? If you're looking for a non-custodial solution that puts you in complete control of your funds, offers instant settlement, and welcomes high-risk industries, explore the ATLOS Crypto Payment Gateway. See how our self-hosted gateway can provide the financial sovereignty and security your business deserves by visiting ATLOS Crypto Payment Gateway today.