Finding Your Recurring Payment Solution

At its core, a recurring payment solution is a system that automatically handles customer payments on a regular schedule. It's the engine that powers any subscription-based business, whether you're selling monthly software access, weekly meal kits, or annual memberships.

This automation takes care of billing on time, every time. For the business, it creates a predictable and stable revenue stream. For customers, it’s a simple "set it and forget it" experience that just works.

How Recurring Payments Transform Your Business

Think about your revenue for a moment. Is it a series of unpredictable, one-off sales? Now, imagine it as a steady, reliable flow, like the way a utility company gets paid each month. That’s the real power of a recurring payment solution. It’s what’s fueling the entire subscription economy by automating billing, invoicing, and even customer communication.

And this isn't just for streaming giants or huge SaaS platforms. It's a strategic move that brings stability and predictability to businesses of all sizes. When you adopt a recurring payment model, you stop chasing down individual payments and start focusing on growth. Instead of tying up your team with manual invoices and payment reminders, you free them up to innovate and make your customer experience even better.

Fostering Stronger Customer Relationships

A smooth, invisible payment process is one of the most underrated parts of a great customer experience. When paying you is effortless, customers have one less reason to leave. An automated system gets rid of the friction that comes with manual payments, which is a surprisingly common reason for customers to churn.

Here’s how it helps build loyalty:

- It’s just easier. Customers love not having to remember due dates or dig out their credit card every single month. This creates a positive, hassle-free relationship with your brand.

- It builds trust. A reliable system that charges the right amount on the right day makes people feel secure. They know their service will continue without any surprises or interruptions.

- It cuts down on accidental churn. A lot of customers don't leave because they're unhappy—they leave because a payment failed due to an expired card. Good automated systems can get ahead of these issues, saving customers you would have otherwise lost.

The Foundation of Predictable Growth

Ultimately, a recurring payment solution gives you the financial stability you need to plan for the future. When you know roughly how much revenue is coming in each month, you can forecast more accurately, budget smarter, and make confident decisions about growing your business.

This predictability changes everything. It allows you to build a truly sustainable model, all while creating stronger, long-term customer relationships built on a foundation of convenience and trust.

Why Predictable Revenue is a Game Changer

Sure, a steady income is nice. But that’s just scratching the surface. When you dig deeper, you see how automated subscriptions completely reshape a business from the inside out. Putting a recurring payment solution in place isn't just about convenience; it gives you a crystal ball for your cash flow, making financial forecasting and long-term planning incredibly accurate.

It’s a fundamental shift from being reactive to proactive. You stop guessing what next month’s numbers will look like and start building from a reliable baseline of income you know is coming in.

Streamlining Operations and Reducing Overhead

One of the first things you'll notice is how much administrative bloat disappears. The old-school cycle of manually creating invoices, sending payment reminders, and chasing down late payments eats up a shocking amount of time—time that could be poured back into growing the business.

A recurring payment solution automates that entire headache. It’s like having a digital accounts receivable clerk who works 24/7, never calls in sick, and never makes a typo. That automation directly cuts your operational costs and frees up your team to focus on what actually matters: innovation and talking to customers.

By taking the billing process off your team's plate, you're not just saving time. You're shifting their focus from tedious, manual work to strategic projects that actually move the needle on growth and customer happiness.

This isn't just a niche idea; it’s a massive market shift. The global automated recurring billing sector is expected to grow from $15 billion in 2025 to a staggering $45 billion by 2033. That explosive growth shows just how many businesses, from software companies to local gyms, are turning to automation to stabilize their cash flow and cut down on busywork. You can see the full market research report on automated recurring billing for a deeper dive into the data.

Boosting Customer Retention and Loyalty

This might be the most powerful benefit, and it’s one that many people overlook: its direct impact on keeping your customers. A lot of customer churn isn't voluntary. People don't always leave because they're unhappy—they leave because a payment failed, usually due to something as simple as an expired credit card.

A smart recurring payment system gets ahead of this problem. It can proactively notify customers about cards that are about to expire and automatically retry failed payments a few times before giving up. This simple step prevents service disruptions and smooths over a major source of customer frustration.

When the payment process is invisible and effortless, customers don't have to think about it. They can just focus on the value they're getting from your service. That seamless experience builds a ton of goodwill and loyalty, creating the kind of long-term, stable growth every business owner dreams of.

Choosing a Platform with the Right Features

Picking a recurring payment solution isn't a one-size-fits-all kind of deal. The right platform really needs to click with your specific business model. It’s all about finding a system that not only handles what you need today but is ready to grow right alongside you. Making the wrong choice can cost you revenue and give you headaches with unhappy customers, while the right one can become a serious engine for growth.

The bedrock of any great platform is its flexible billing logic. Sure, a simple, fixed monthly fee might be all you need right now. But what happens next year? A truly solid solution should be able to handle all sorts of scenarios, from tiered pricing and promotional discounts to more complex usage-based models where customers only pay for what they use.

This kind of flexibility is what keeps you from outgrowing your own software. As your pricing strategy gets more sophisticated, your payment system should be able to keep up without forcing you to start from scratch. That means a smooth ride for both your internal team and your subscribers.

Protecting Your Revenue with Smart Automation

One of the most important features—and one that often gets overlooked—is dunning management. Think of it as your automated safety net for when a payment fails, which usually happens because of an expired card or not enough funds. Instead of your team manually chasing down these payments, the system automatically retries the charge and sends customized reminders to the customer.

This process is absolutely crucial for clawing back revenue that would otherwise just disappear. A smart dunning management setup can dramatically cut down on involuntary churn—that's when customers leave by accident because of a payment issue, not because they were unhappy with your service.

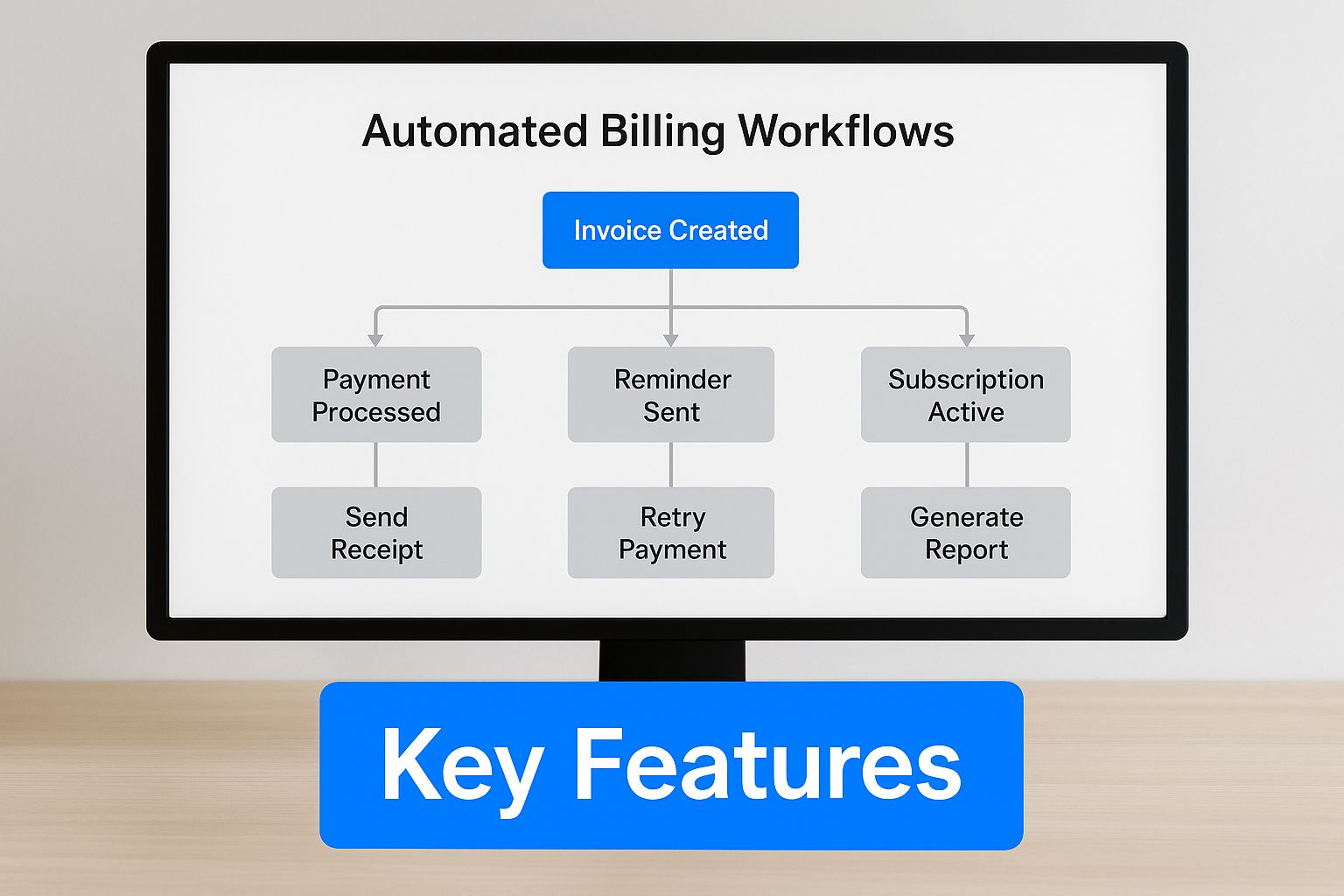

This visual guide breaks down the essential features that make up a dependable recurring payment solution.

As you can see, core functions like billing logic and security are the foundation for the features that really drive growth, like dunning management and customer self-service.

Empowering Customers and Driving Insights

A customer self-service portal is another non-negotiable feature in my book. When you give customers the power to manage their own subscriptions—whether it's upgrading a plan, updating their credit card, or just looking at their invoice history—you're doing more than just lightening the load on your support team. You're creating a much better, more transparent experience for them.

When customers feel like they're in control, their satisfaction and loyalty go way up. They don't have to wait around for a support ticket to be resolved just to make a simple change, which builds trust and gets rid of unnecessary friction.

Finally, you absolutely need robust analytics and reporting. Without good data, you’re just guessing. A top-tier recurring payment solution gives you a dashboard with all the key subscription metrics at a glance:

- Monthly Recurring Revenue (MRR): The predictable income you can count on every month.

- Customer Churn Rate: The percentage of subscribers who decide to cancel.

- Customer Lifetime Value (LTV): The total revenue you can expect from a single customer over time.

- Failed Payment Rate: The percentage of transactions that don't go through successfully.

These metrics are basically the vital signs for your subscription business. They tell you what’s working, what isn’t, and where you need to put your energy to build sustainable growth.

Let's look at how the feature sets can differ between a more basic system and an advanced one.

Comparing Recurring Payment Solution Features

| Feature | Basic Solution | Advanced Solution |

|---|---|---|

| Billing Logic | Fixed, flat-rate subscriptions only. | Supports complex models: tiered, usage-based, per-seat, and hybrids. |

| Dunning Management | Manual retries or very basic notifications. | Automated, multi-step retry logic with customizable email sequences. |

| Customer Portal | Limited or no self-service options. | Full-featured portal for upgrades, payment updates, and invoice history. |

| Analytics & Reporting | Basic transaction logs and revenue totals. | In-depth dashboards for MRR, churn, LTV, and cohort analysis. |

| Payment Methods | Credit/debit cards only. | Multiple payment options including digital wallets, ACH, and crypto. |

| Integrations | Few, if any, pre-built integrations. | Extensive API and native integrations with CRM, accounting, and helpdesk software. |

Ultimately, a basic solution might get you started, but an advanced platform provides the tools you need to not just manage payments, but to truly understand and grow your subscriber base.

When you're evaluating your options, look for platforms that come with integrated payment tracking software to keep a close eye on your recurring transactions. This kind of integration gives you the clarity you need to make smart decisions and keep your revenue cycle healthy.

Understanding the Global Subscription Economy

Setting up a recurring payment system isn't just a minor operational adjustment; it's a strategic move to tap into a massive global economic shift. We're witnessing a fundamental change in how people buy things, moving away from one-off transactions and into a new era built on access and ongoing customer relationships. The subscription economy is no longer just a trend—it's quickly becoming the standard.

This whole movement is powered by a major shift in what consumers want. People are choosing the ease and continuous value they get from subscriptions over the burden of ownership. This preference has completely reshaped entire industries, creating a new reality where predictable, recurring revenue is the most valuable asset a business can have.

The Industries Fueling the Subscription Boom

The appetite for subscription-based services is exploding everywhere. Across the board, industries are using recurring payment solutions to forge stronger, lasting connections with their customers and build a reliable income stream.

Here’s a quick look at who’s leading the charge:

- Software as a Service (SaaS): Instead of selling software in a box, companies offer continuous access for a monthly or annual fee. This means customers always have the latest, most secure version.

- Streaming and Digital Media: This is the one we all know. From Netflix and Spotify to online news and gaming, we pay for access to massive libraries of content on demand.

- E-commerce and Retail: Think subscription boxes. Whether it's meal kits, coffee, or grooming products, curated experiences are delivered right to the customer's doorstep on a regular basis.

- Health and Fitness: Gym memberships, wellness apps, and virtual coaching all run on recurring billing, encouraging people to stay engaged with their health goals over the long term.

The wide range of businesses jumping on board shows just how flexible this model is. It’s not just for digital products anymore; it’s a powerful way to deliver consistent value in almost any market.

At its heart, this economic shift is about one thing: businesses are no longer just selling products, they're selling outcomes. A recurring payment solution is the engine that makes this entire transition work, turning one-time buyers into loyal subscribers.

Market Growth and Future-Proofing Your Business

The numbers don't lie. They paint a crystal-clear picture of where the market is going. The global recurring payments market was recently valued at around $166.69 billion and is expected to grow to $182.94 billion, boasting a strong compound annual growth rate (CAGR) of 9.7%. Some forecasts even see the market hitting an incredible $262.58 billion in the near future. You can explore more insights on the recurring payments market to see just how big this opportunity is.

This data sends a loud and clear message. Bringing a recurring payment system into your business is more than just a way to handle today's billing. It’s a crucial step to set yourself up for long-term success in a world that is increasingly powered by subscriptions.

Thinking about rolling out a recurring payment system can seem like a huge task, but if you break it down into manageable steps, it’s much easier to tackle. A little strategic planning goes a long way toward a smooth launch.

First things first, you need to get your pricing tiers crystal clear.

This is all about defining exactly what each plan offers, any trial periods you might have, and how often you'll be billing customers. The simplest way to start is by mapping this out in a spreadsheet.

Just create columns for things like Tier Name, Price, Billing Frequency, and Included Services. This isn't just an internal tool; it’s the foundation of your entire subscription model.

Mapping Pricing and Plans

Having this kind of visual breakdown makes it incredibly simple to tweak your offerings later on. It also gets your finance and marketing teams on the same page from day one.

Here’s a common setup you might see:

- Starter Plan: Your entry-level option with basic features, usually billed monthly.

- Professional Plan: A step up, offering more services and maybe quarterly billing to provide a small discount.

- Enterprise Plan: Often includes custom terms, priority support, and sometimes usage-based billing for high-volume clients.

Once your tiers are locked in, you can start thinking about the technical side of things.

The next big decision is choosing between a direct API integration or using a hosted payment page. An API gives you total control over the checkout experience, letting you design it to perfectly match your brand. The trade-off is that it requires developer time and a sharp eye for security.

On the other hand, a hosted page is the fast track. It offloads a lot of the heavy lifting, especially around compliance, but you'll have less say over the look and feel.

Integration Methods Comparison

Deciding which path to take really depends on your resources and priorities.

| Method | Pros | Cons |

|---|---|---|

| API | Full customization and complete brand control. | Longer setup time and requires developer effort. |

| Hosted Page | Faster launch and built-in PCI compliance. | Limited UI control and branding constraints. |

No matter which route you choose, PCI compliance is an absolute must. You're handling sensitive customer data, so there's no room for error. This means encrypting data both in transit and at rest and using tokenization to avoid storing raw card details on your servers.

"Data security isn't just a technical requirement; it builds customer trust and reduces your compliance risk throughout the entire billing lifecycle."

If you already have existing subscribers, planning a seamless migration is your next critical step. You can't afford to have payments fail or customers get confused.

Start by communicating any upcoming changes well in advance. Be transparent and give them clear instructions. It's also a great idea to run some test transactions to make sure everything works as expected before you flip the switch.

- Start with an audit of your existing payment records to get a full list of active subscriptions.

- Export all the necessary customer data, including contact info and billing details.

- Import that data into the ATLOS Crypto Payment Gateway and carefully map the fields.

- Run a small pilot with a handful of trusted users to catch any issues before the full rollout.

- Finally, notify all users that the migration is complete and make sure your support channels are ready for questions.

Speaking of support, get your team looped in early. They'll be on the front lines, so arm them with an FAQ page and pre-written email responses.

Clear, proactive communication is your best tool for reducing confusion and building confidence in the new system. Use email campaigns, in-app messages, and even status updates on your site to keep everyone in the loop. Always take the opportunity to highlight the benefits of the new system, like better account management or clearer billing statements.

The ATLOS Crypto Payment Gateway is built to make this easier, especially if you're dealing with crypto. It supports automated subscriptions, doesn't require KYC, and most importantly, ensures funds are secured under your own wallet keys. Using ATLOS helps you handle recurring crypto billing without the usual compliance headaches.

By following this roadmap, you can confidently deploy a robust recurring payment system. The result? Predictable revenue for your business and a much better experience for your subscribers.

Best Practices for Customer Communication

- Send a welcome email immediately after a customer signs up. Confirm their subscription details and the first payment.

- Schedule reminder messages about a week before each renewal. This simple step can drastically reduce failed payments and customer churn.

Above all, make sure your updates are timely, helpful, and easy to understand. It shows you respect your customers' time and their business.

Got Questions About Recurring Payments? We've Got Answers.

Jumping into the world of subscription billing can feel a little overwhelming. If you're weighing your options, you've probably got a few questions buzzing around. That's perfectly normal. Getting the right answers is the key to figuring out how an automated payment system can really work for your business.

These systems are built to make your life easier, but knowing what's what is crucial before you commit. Let's break down the most common questions we hear from business owners just like you.

What's the Real Difference Between a Payment Gateway and a Recurring Payment Solution?

This is a big one. People often throw these terms around as if they mean the same thing, but they're fundamentally different. Getting this distinction right is the first step toward picking the right tool for the job. It's really about a single-purpose tool versus a complete system.

A payment gateway is like a digital cash register. Its one and only job is to securely process a single payment. It's the go-between that checks if a customer's card is valid and moves the money from their account to yours. Once that transaction is approved or denied, its work is done.

A recurring payment solution, on the other hand, is the entire operating system for your subscription business. It’s a full-blown management platform designed to handle the entire relationship with your subscriber.

Here’s an analogy: a payment gateway is the spark plug that fires once to start the engine for a single trip. The recurring payment solution is the whole car—complete with cruise control, a GPS for managing the journey, and a dashboard that warns you when there's trouble ahead.

This broader system does it all: setting up different subscription plans, managing customer accounts, automatically sending out invoices, and even chasing down failed payments. It’s built for building long-term revenue, not just making a one-off sale.

How Do These Systems Handle Failed Payments?

Failed payments are just a fact of life in any subscription business. But they don't have to mean lost customers and leaking revenue. This is where a smart recurring payment solution truly earns its keep, thanks to a process called dunning management.

When a payment fails—maybe a card expired or there weren't enough funds—the dunning process automatically springs into action. It doesn't just try once and give up.

Instead, the system is programmed to retry the charge at strategic intervals, often based on data that shows when a payment is most likely to go through (like right after payday). At the same time, it can send a series of friendly, automated emails to the customer, letting them know what’s happened and giving them an easy link to update their payment details.

Even better, many advanced platforms connect directly with services from major credit card companies that automatically update expired or reissued card information. The problem gets fixed behind the scenes, often before the customer even knows there was an issue. This automated recovery is a game-changer for protecting your revenue stream and stopping customers from churning out unintentionally.

Just How Secure Are Recurring Payment Solutions?

When you’re handling people’s payment information, security isn't just a feature; it's everything. Top-tier platforms are built from the ground up with security as the absolute priority, layering protections to keep both your business and your customers safe.

The starting point for any reputable recurring payment solution is PCI DSS (Payment Card Industry Data Security Standard) compliance. This is the global security standard for anyone handling credit card data, and it's non-negotiable.

But they don't stop there. These platforms use sophisticated technology to lock down sensitive data:

- Tokenization: This is a clever process that swaps a customer's actual credit card number for a unique, random string of characters—a "token." You can use this token for billing, but it's completely useless to a fraudster if it’s ever stolen because the real card details are stored away in a secure digital vault.

- Encryption: All data is scrambled and made unreadable, both when it's being sent over the internet (in transit) and when it's being stored on servers (at rest). So even in the worst-case scenario of a data breach, the information remains gibberish to anyone without the key.

By handing off these heavy-duty security tasks to a specialized platform, you drastically reduce your own risk and can tell your customers with confidence that their data is in safe hands.

Ready to bring predictable revenue and seamless billing to your business? With ATLOS Crypto Payment Gateway, you can easily manage recurring crypto subscriptions without the usual hurdles. Get started today with a no-KYC, direct-to-wallet solution that puts you in control. Learn more about ATLOS Crypto Payment Gateway.