Your Guide to High Risk Payment Processors

If you've ever been turned down by a big-name payment provider, you've stumbled into the often-confusing world of merchant risk. This is where high-risk payment processors come in. Think of them as specialized financial partners for businesses that companies like Stripe or PayPal just aren't built to handle.

These processors are the essential backbone for entire industries that have a higher-than-average potential for chargebacks or fraud, making it possible for them to take payments and stay in business.

What Exactly is High-Risk Payment Processing?

At its heart, a high-risk payment processor is simply a company willing to provide merchant accounts to businesses that banks see as having a greater chance of financial loss. It's not a moral judgment on your business. It's a pragmatic, data-driven assessment based on your industry, sales model, and typical transaction behavior.

A good analogy is car insurance. A 19-year-old with a new sports car is going to pay a much higher premium than a 45-year-old with a minivan and a spotless driving record. It’s the same principle. A business operating in an industry known for high chargeback rates represents a bigger financial gamble for the bank and processor.

These specialized processors are simply equipped to manage that extra risk.

Why Do Standard Processors Get Nervous?

Mainstream payment companies have a business model built for speed, volume, and simplicity. They make their money on millions of straightforward, low-drama transactions. Anything that introduces uncertainty—like high refund rates, potential fraud, or tricky regulations—throws a wrench in their highly automated systems.

A standard processor will usually back away for a few common reasons:

- High Chargeback Ratios: Any industry that consistently sees more than a 1% chargeback rate is an immediate red flag for them.

- Reputational Risk: Some industries are perfectly legal but are considered "brand-risky" for large, publicly-traded financial institutions.

- Regulatory Headaches: Businesses in heavily regulated fields require a level of compliance and underwriting that standard processors aren't staffed to manage.

A high-risk label doesn't mean your business is bad. It just means you need a more specialized and robust system for handling payments—one designed for industries that don't fit into a neat, low-risk box.

A Critical Service for Complex Businesses

This is precisely why high-risk payment processors are so vital. They focus on serving merchants in industries like travel, online gaming, CBD, subscription box services, and adult entertainment. These businesses are under a microscope because of the higher odds of fraud, customer disputes, and regulatory hurdles.

This reality is why securing a standard merchant account can feel impossible. If you want to dig deeper into the costs involved, you can find some great insights on high-risk account fees.

Ultimately, a good high-risk processor does more than just let you accept credit cards. They act as a partner who gets the unique pressures of your industry. They bring the right tools to the table, like sophisticated fraud-scrubbing technology and chargeback prevention services, to protect your bottom line and help you grow without fear of being shut down.

Understanding Why Your Business Is Considered High-Risk

Getting labeled "high-risk" can feel like a slap on the wrist, but it’s really just a financial assessment. It’s not a judgment on your business's quality or potential. Instead, think of it as a processor’s way of gauging the potential for financial bumps in the road, like chargebacks, fraud, or refunds.

Once you understand why you’ve been given this label, you're in a much better position. You can seek out high-risk payment processors who see your business not as a problem, but as a client who needs their specific skill set. It’s all about finding a partner who is built to handle the unique challenges your industry throws at them.

So, what exactly puts a business into this category? It usually boils down to a few key factors related to your industry, business model, and payment history.

Let's break down the common reasons a business might be classified as high-risk. The table below outlines these factors, giving you a clearer picture of where your business might fit.

Common Factors for High-Risk Classification

| Risk Factor | Description | Example Industries |

|---|---|---|

| Industry Type | Certain industries are automatically considered high-risk due to regulatory scrutiny, high fraud rates, or the nature of their products. | CBD, Online Gaming, Travel, Subscription Boxes, Adult Entertainment |

| Chargeback Ratio | A history of frequent chargebacks (customer-disputed transactions) is a major red flag for processors. A ratio above 1% is often problematic. | E-commerce with fulfillment issues, Digital Products, Coaching Services |

| Transaction Size | Consistently high average transaction values (ATV) increase the financial liability for the processor with every single chargeback. | Luxury Goods, High-End Electronics, Business Consulting |

| Billing Model | Recurring or subscription billing models are more prone to "friendly fraud," where customers forget about charges and dispute them. | SaaS, Membership Sites, Subscription-based Services |

| Business History | New businesses with no processing history are seen as an unknown variable, making them inherently riskier than established merchants. | Startups, Businesses new to online sales |

| Reputational Risk | Industries that face public scrutiny or are controversial can pose a reputational risk to the acquiring bank. | Firearms, Political Campaigns, Debt Collection |

Understanding which of these boxes you tick is the first step toward finding a payment solution that actually works for you, rather than one that works against you.

Why Your Industry Is Often the First Red Flag

Sometimes, the "high-risk" label has nothing to do with how you personally run your company. It's simply the industry you're in. Some sectors are flagged from the get-go because of historical data showing high rates of customer disputes or complex legal rules.

For example, businesses in these fields are almost always considered high-risk:

- Subscription Services: The recurring billing model is a magnet for "friendly fraud," where a customer disputes a charge they simply forgot about.

- Travel and Tourism: There’s often a long gap between when a customer pays and when they actually travel, leaving a wide-open window for cancellations and chargebacks.

- CBD and Nutraceuticals: With regulations constantly in flux and product effectiveness being subjective, customer complaints and disputes are common.

- Online Gaming and Gambling: These industries are heavily regulated and are prime targets for fraudulent activities, making processors extra cautious.

How Your Specific Business Model Adds to the Puzzle

Even within the same industry, two businesses can have totally different risk profiles. It all comes down to how you operate. This is where processors start looking at your company’s internal workings, much like a lender digs into your financials when you apply for a loan. In fact, many of the same principles behind strict business loan requirements apply here—it's all about assessing financial stability and predictability.

Here are a few operational factors that can increase your risk:

- Average Transaction Value: If you sell high-ticket items, each chargeback is a much bigger financial hit for the processor.

- Sales Volume and History: A brand-new business is a blank slate. Without any processing history, you're an unknown quantity, which inherently feels riskier than a business with a long, stable track record.

- Billing Method: As we saw with subscriptions, any kind of recurring or delayed billing model automatically raises your risk profile due to higher dispute rates.

At the end of the day, it's all about predictability. Anything that makes it harder for a processor to forecast your transaction patterns—be it expensive products, a new business, or a complex billing system—adds another layer to your risk profile.

Chargeback History: The Most Important Metric of All

When all is said and done, your chargeback history is the single most important piece of data a processor will look at. A high ratio of chargebacks to total transactions is the clearest possible signal of risk. It tells the processor that there might be underlying issues with your products, customer service, or fulfillment that could cost them money.

Even a chargeback ratio that creeps just a little over 1% can be enough for a standard, low-risk processor to shut down your account with little warning. This is why keeping disputes low is critical for any business, but for high-risk merchants, it's a matter of survival. Your best negotiation tool is always a clean, well-managed processing history.

Breaking Down the Costs of High Risk Processing

If you're operating in a high-risk industry, you need to know that accepting payments plays by a different set of financial rules. Getting a specialized merchant account isn't just a good idea—it's essential for survival. But that stability comes with a cost structure designed to shield the processor from the much higher potential for chargebacks and fraud.

This isn't your standard, low-fee merchant account. A high risk payment processor is looking at your business through a lens of potential liability, and their pricing directly reflects that. The costs are more than just a simple percentage per swipe; they often include setup charges, ongoing maintenance, and financial safety nets that can really impact your cash flow if you're not prepared.

Core Fees What to Expect Upfront

Right out of the gate, you'll likely encounter initial setup and recurring monthly fees. Low-risk processors often waive these to cast a wide net, but high-risk providers put a ton of work into underwriting your business from day one. That detailed vetting process is what allows them to support your business model without pulling the plug at the first sign of trouble.

Think of it as an investment in a stable, long-term partnership. These fees cover the heavy lifting—all the administrative and technical work needed to get your business approved and securely integrated.

The higher price tag of a high-risk merchant account isn't arbitrary. It's a calculated cost that buys your business stability, access to specialized fraud prevention tools, and the assurance that your processor won't drop you at the first sign of a chargeback.

Transaction Rates and Chargeback Penalties

The biggest difference you'll feel is in the per-transaction costs. The numbers can be jarring if you're used to standard rates.

On average, a high-risk merchant account might include:

- A setup fee from $100 to $500 (or more)

- Monthly fees up to $50-$100

- Per-transaction fees that are 1-3 percentage points higher than standard rates

- Chargeback fees reaching $20-$50 per incident

To put that in perspective, a typical low-risk merchant might pay around 1.5% to 2% per sale. Your high-risk business, on the other hand, could easily see rates pushing past 3.5%-4%. You can learn more about the nuances of high-risk credit card processing to see why.

These higher rates are the processor's way of compensating for taking on more financial risk. And those chargeback penalties aren't just a slap on the wrist—if you exceed the acceptable threshold, your entire merchant account could be on the line.

The Role of Rolling Reserves

One of the most misunderstood parts of high-risk processing is the rolling reserve. This isn't just another fee; think of it as a security deposit. Your processor will hold back a small percentage of your daily revenue—usually 5-10%—and keep it in a non-interest-bearing account for a set period, often around 180 days.

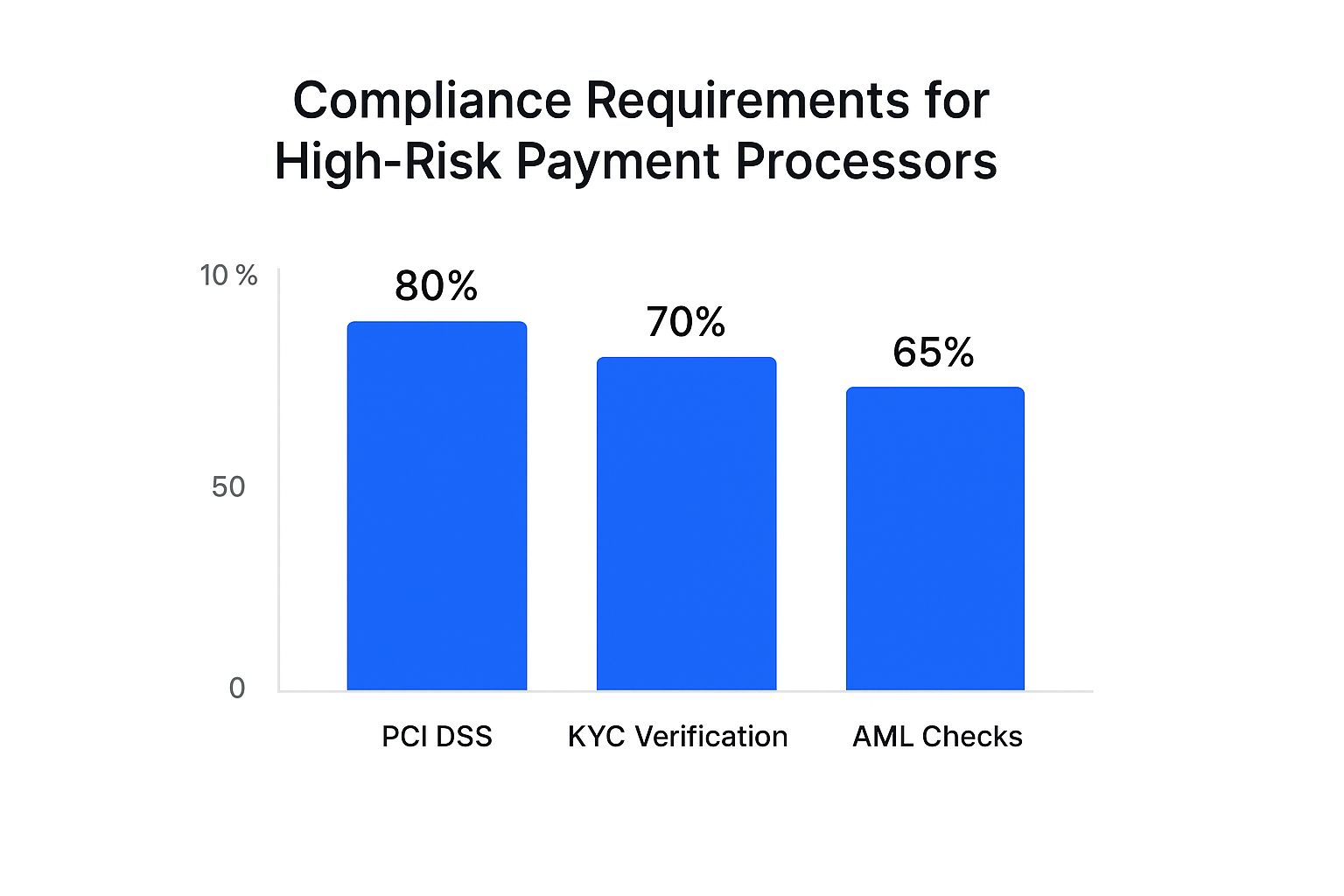

The infographic below really drives home why these safeguards are necessary. It shows the rigorous compliance standards high-risk processors have to meet.

As you can see, nearly all these specialized processors adhere to strict standards like PCI DSS, KYC, and AML. They operate in a high-stakes world, and things like rolling reserves are a direct result of that.

Once the holding period is over, the funds are released back to you on a "rolling" basis. It can definitely tighten your cash flow at first, but this is what protects the processor from getting hit with a sudden wave of chargebacks. It’s what gives them the confidence to keep supporting your business.

Strategies to Manage and Reduce Costs

While some of these costs are just the price of admission, you're not completely powerless. With some proactive management, you can absolutely bring your expenses down over time.

Here are a few practical strategies to get started:

- Invest in Fraud Prevention: Good fraud detection tools are your best friend. They can dramatically cut down your chargeback ratio, and a lower risk profile makes you a much more attractive client when it's time to talk rates.

- Maintain Excellent Customer Service: You’d be surprised how many chargebacks start with simple frustration. Make sure your contact info is easy to find, and respond to customers quickly. Resolving an issue before it becomes a dispute saves everyone time and money.

- Build a Strong Processing History: Nothing speaks louder than a long, stable record with a low chargeback rate. After a year or two of clean processing, you'll be in a much stronger position to ask your provider for better rates or a lower rolling reserve.

Must-Have Features in a High-Risk Processor

When you're in a high-risk industry, choosing a payment processor isn't just about getting approved. It's about finding a genuine partner who understands the unique pressures you face. A generic, off-the-shelf solution simply doesn't have the muscle to protect your business when revenue and reputation are on the line.

To find the right fit, you need to know exactly what to look for. Think of it as a checklist of non-negotiables that separate a basic processor from a strategic ally—one who can shield you from threats while paving the way for growth.

An Advanced Fraud Prevention Suite

For any high-risk merchant, a powerful fraud prevention suite is your first line of defense. It's not a nice-to-have; it's essential. The cost of a fraudulent transaction is more than just the lost sale—it directly inflates your chargeback ratio, putting your entire merchant account at risk.

A modern high-risk payment processor has to go far beyond simple address verification. You need a provider with a multi-layered security strategy.

Key features to demand include:

- AI and Machine Learning: Look for systems that can analyze transaction patterns in real-time. This tech is smart enough to spot and block shady activity before a fraudulent sale is even completed.

- 3D Secure 2.0: This is the modern standard for authenticating online card payments. It adds a crucial verification step that dramatically cuts down on unauthorized transaction risk and often shifts the liability away from you.

- Customizable Filters: You should be in the driver's seat. The ability to set your own rules—like blocking transactions from certain countries or limiting purchase velocity—is critical for tailoring your defense.

A proactive approach to security is what keeps your business safe and your chargeback rate from spiraling out of control.

Robust Chargeback Mitigation and Management

Even with the best fraud prevention tools, chargebacks are a fact of life in high-risk e-commerce. A top-tier processor knows this. Instead of just penalizing you for disputes, they give you the tools to fight back and win them. This directly protects your bottom line.

A comprehensive chargeback management system should include:

- Real-Time Alerts: You need to know the second a dispute is filed. This gives you the maximum window to gather evidence and respond effectively.

- Automated Evidence Submission: The best systems help you quickly pull together the necessary proof and submit it to the bank. No more manual scrambling.

- Dispute Data Analysis: Look for detailed analytics that reveal patterns in your chargebacks. This insight helps you fix the root causes, whether it’s a product description issue or a customer service gap.

A great high-risk partner acts like an extension of your team during a dispute. They should equip you with the technology and expertise to defend your legitimate revenue, not leave you to fend for yourself.

To better understand what to look for, here's a quick comparison of essential features that different processors might offer.

Essential Features Comparison for High-Risk Processors

A comparative look at critical features offered by specialized high-risk payment processors to help businesses prioritize their needs when selecting a partner.

| Feature | Why It's Critical for High-Risk | What to Look For |

|---|---|---|

| Advanced Fraud Tools | Your primary defense against financial loss and rising chargeback ratios. | AI/ML-based detection, 3D Secure 2.0, and customizable filtering rules. |

| Chargeback Alerts | Early warnings give you a fighting chance to dispute fraudulent claims successfully. | Real-time notifications via email or a dedicated dashboard. |

| Dispute Management | Streamlines the process of fighting chargebacks, saving time and recovering revenue. | Automated evidence gathering, templated responses, and a clear workflow. |

| Multi-MID Support | Spreads transaction volume to lower risk and prevent account holds or closures. | The ability to route payments across multiple merchant accounts seamlessly. |

| Global Currency Support | Essential for scaling internationally and providing a smooth customer experience. | Processing and settlement capabilities in major currencies (USD, EUR, GBP, etc.). |

Choosing a processor that excels in these areas is a strategic move that pays off by protecting your revenue and enabling stable growth.

Must-Have Operational and Growth Features

Beyond security, your payment processor has to support the day-to-day grind of running and growing your business. The right operational features ensure a smooth customer experience and allow you to scale without hitting technical walls. Staying competitive also means paying attention to broader digital innovations in the banking sector, which can influence security standards and payment methods.

Make sure your processor delivers on these key capabilities:

- Multi-Currency Support: If you have customers around the world, you absolutely need the ability to process payments and settle funds in their local currencies.

- Seamless Platform Integration: Your processor should plug directly into your existing setup, whether you're on Shopify, WooCommerce, or a custom-built site. A painful integration is a major red flag.

- Knowledgeable Customer Support: When something goes wrong, you need to talk to an expert who gets the nuances of high-risk industries, not a generic call center reading from a script.

Ultimately, the right high-risk payment processor provides a complete ecosystem of tools built for resilience. By making these features your priority, you’ll find a partner that not only protects your business today but actively helps it succeed tomorrow.

How to Choose the Right Payment Partner

Picking the right payment partner is probably one of the biggest decisions you'll make for your high-risk business. This isn't just about finding someone who will say "yes" to your account. It's about finding a long-term partner who genuinely gets the unique hurdles of your industry and is committed to keeping you stable.

Think of it this way: a good partner is the foundation of your house. With a solid one, you can grow your business without constantly worrying that your ability to take payments will suddenly get yanked out from under you. If you rush this decision or just go with the cheapest rate you see, you're setting yourself up for headaches like frozen funds or sudden account closures.

Navigating the Application and Underwriting Process

First things first, you have to get ready for the application. For high-risk merchants, this is a much deeper dive than it is for a typical low-risk business. The underwriters are going to put your business under a microscope to figure out their potential liability, so getting all your ducks in a row beforehand makes everything go a lot smoother.

Here’s a checklist of what you'll almost certainly need to provide:

- Business Formation Documents: This is your proof of existence, like articles of incorporation or your LLC operating agreement.

- Business Bank Statements: They'll want to see three to six months of statements to get a feel for your financial health and cash flow.

- Processing History: If this isn't your first rodeo, show them your past processing statements. A clean track record with low chargebacks is your best negotiating tool.

- Supplier Agreements: Especially for e-commerce, this proves you have a legitimate supply chain for your products.

Don't be surprised if the underwriting process takes a little while—anywhere from a few days to a few weeks is normal, depending on how complex your business is. Just be prepared for a thorough review and have your answers ready for their questions.

Scrutinizing the Merchant Agreement

Once you get an offer, it’s time for the most critical step: reading the merchant agreement. Every single word of it. This legal contract dictates your entire relationship, and what you don't know can and will hurt you. The fine print is where the real story is told, impacting everything from your daily operations to your bottom line.

Your merchant agreement isn't just a formality; it's the rulebook for how you get paid. If you skim over clauses about early termination fees or rolling reserves, you’re in for a very expensive surprise down the road.

Be on the lookout for these specific terms:

- Contract Length: Most high risk payment processors will want a commitment, often for one to three years. Make sure you know how long you’re signing up for.

- Early Termination Fees (ETFs): What happens if you need to leave early? The penalties can be brutal, sometimes running into thousands of dollars.

- Rolling Reserve Terms: Get the exact details. Will they hold 10% of your revenue? And for how long—180 days? This directly affects your cash flow, so you need to know the numbers.

- Fee Structure: Make sure every single fee is spelled out clearly. Transaction fees, monthly fees, chargeback penalties—leave no stone unturned.

Ultimately, choosing the right partner is a balancing act. You need to get approved, but you also need terms that are fair and sustainable. By taking your time with the application and dissecting the merchant agreement, you can find a processor who will actually help your business succeed for the long haul.

Frequently Asked Questions

When you're dealing with high-risk payment processing, a lot of questions pop up. Let's tackle some of the most common ones that merchants ask to help you get a clearer picture of what it all means for your business.

What’s the Real Difference Between a High-Risk and Low-Risk Account?

The simplest answer? It all comes down to the perceived financial risk. High-risk accounts are for businesses that, due to their industry or business model, have a higher chance of chargebacks or operate in a complex regulatory space. Think subscription boxes, travel agencies, or CBD products.

Because of this risk, the approval process is more intense, the fees are higher, and you’ll likely need a rolling reserve to protect the processor. On the flip side, low-risk accounts are for businesses with predictable sales and very few chargebacks—like your local coffee shop. This stability means they get simpler terms and lower costs.

What Is a Rolling Reserve? Is It Permanent?

Think of a rolling reserve as a kind of security deposit for your payment processor. It's a small percentage of your revenue, usually around 5-10%, that your processor holds for a short period. This creates a financial safety net to cover any potential chargebacks or refunds, giving them the confidence to support your business.

And no, it's not permanent. The funds are released back to you on a schedule, typically after about 180 days. While it does affect your cash flow in the short term, it's a standard and essential part of working with most high risk payment processors.

A rolling reserve is the tool that allows processors to take on the financial risk of certain industries. Getting a handle on how it works is fundamental to managing your business's cash flow.

What Happens If a Processor Like Stripe or PayPal Shuts Me Down?

Getting your account shut down by a low-risk provider can be a nightmare. When they flag you for risk violations, they often freeze your funds for months. Suddenly, you can't access your revenue, and worse, you have no way to accept new payments.

An unexpected shutdown like this can paralyze a business overnight. It really highlights why it's so critical for any business with high-risk traits to work with a specialist from day one. A processor built for your industry won't pull the rug out from under you.

Can My Business Ever Stop Being High-Risk?

It’s possible, but it’s tough and depends entirely on your business model. To be reclassified as low-risk, you’d need a long, squeaky-clean processing history with an incredibly low chargeback ratio—we’re talking well under the 1% mark.

But let's be realistic. If your business is in an industry that's automatically considered high-risk (like online gaming) or you rely on recurring billing, you'll probably always stay in that category. The silver lining is that a great track record can still give you the leverage to negotiate much better rates and terms down the line.

For businesses that want a reliable way to get paid without the headaches of traditional high-risk processing, the ATLOS Crypto Payment Gateway is a powerful alternative. You can start accepting crypto payments from customers worldwide, directly to your wallet, with no KYC and an instant setup. Find a better payment experience at ATLOS.io.