7 Best Payment Gateways for Online Dating in 2025

Choosing a payment gateway for an online dating site is far more complex than a standard e-commerce setup. The industry is classified as 'high-risk' due to its subscription-based models, higher chargeback rates, and specific content regulations from card networks like Visa and Mastercard. This classification means many mainstream providers like Stripe or standard PayPal accounts will outright reject or later terminate your account, leaving you scrambling. Finding the right partner isn't just about processing transactions; it's about ensuring business continuity, managing customer churn with seamless recurring billing, and navigating a complex web of compliance rules. A robust payment gateway is the financial backbone of your dating platform, directly impacting user trust, lifetime value, and your bottom line. In this guide, we'll dive deep into the top solutions specifically equipped to handle the unique challenges of the online dating world, ensuring you find a reliable and scalable partner for growth.

To make an informed decision, you need to understand the critical features that matter most. We're talking about sophisticated recurring billing engines that can handle trial periods and flexible subscription tiers, automatic card updaters that combat involuntary churn, and advanced fraud detection systems tailored to digital services. Furthermore, compliance with Visa's High-Risk Acquirer Program (HARP) and Mastercard's Registration Program is non-negotiable. This roundup cuts through the noise, evaluating each of the best payment gateways for online dating on its ability to meet these specific needs. We'll explore their underwriting processes for high-risk businesses, the flexibility of their APIs for custom integrations, and their support for global currencies to help you expand your reach. Beyond just selecting a payment gateway, consider how it fits into your broader revenue model. For a comprehensive guide, explore various mobile app monetization strategies to maximize your platform's potential. Whether you're a startup niche dating app or a large-scale platform, this analysis will provide the actionable insights needed to select the right financial partner. Each profile includes direct links and key details to simplify your decision.

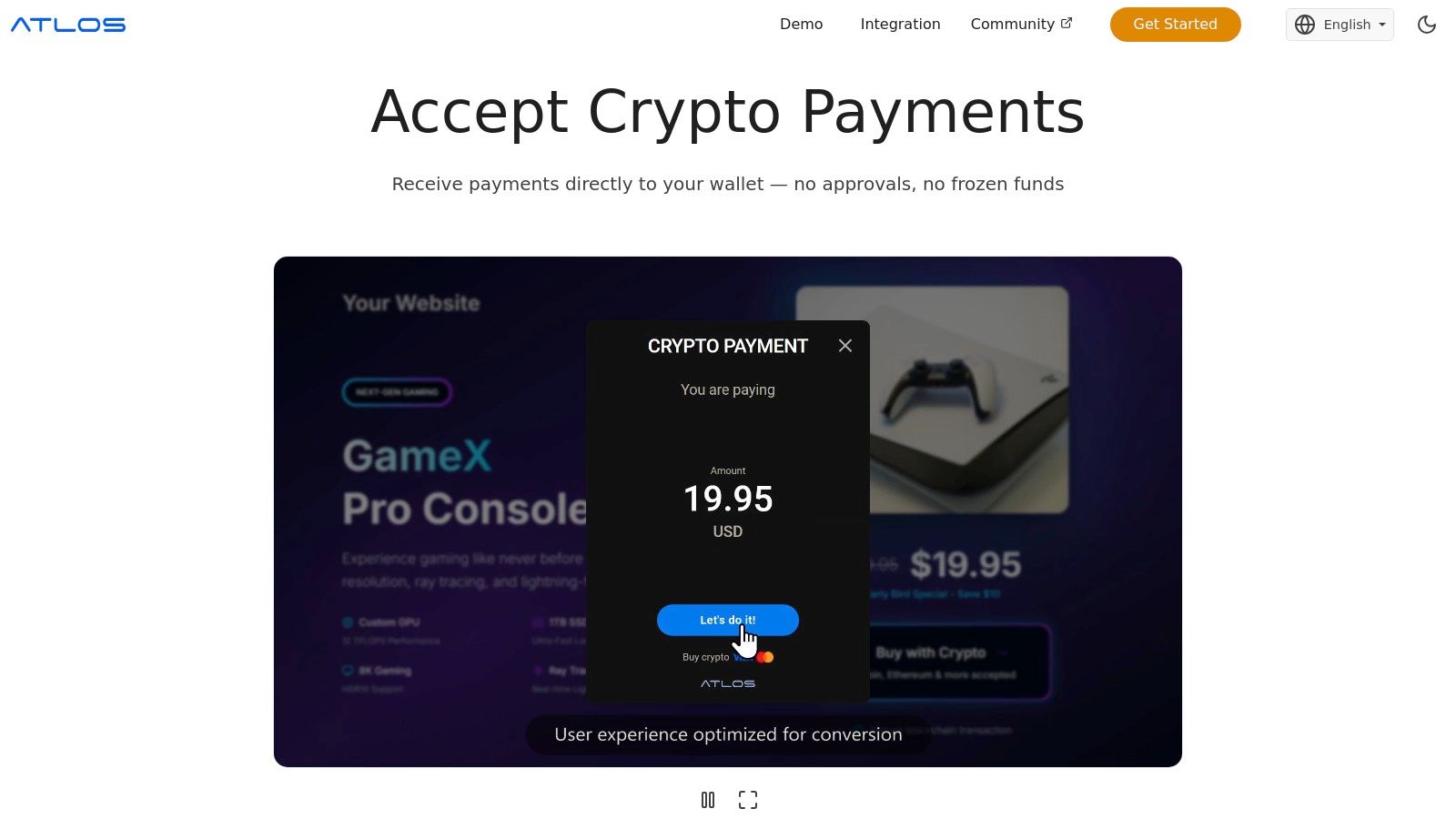

1. ATLOS Crypto Payment Gateway

ATLOS Crypto Payment Gateway emerges as a forward-thinking and powerful solution, positioning itself as one of the best payment gateways for online dating platforms seeking to innovate and cater to a privacy-conscious user base. By specializing exclusively in cryptocurrency transactions, ATLOS addresses several critical challenges inherent in the online dating industry, such as chargebacks, high transaction fees, and the need for user discretion. Its architecture is built on the principles of decentralization and user control, offering a modern alternative to traditional finance.

For dating sites, which are often categorized as high-risk by conventional payment processors, ATLOS provides a stable and reliable payment infrastructure. It sidesteps the lengthy approval processes and potential account freezes that plague the industry. By enabling direct, wallet-to-wallet transactions, it ensures that the platform maintains full custody of its funds, a principle encapsulated by the mantra 'your keys, your crypto'. This level of control is a significant departure from traditional gateways where funds are held by a third party.

Key Features and Strengths for Online Dating

ATLOS is engineered with features that directly benefit the operational needs and user experience of an online dating service.

- No KYC/Account Approval: This is a game-changer. ATLOS eliminates mandatory Know Your Customer (KYC) checks and lengthy account approval cycles. A dating platform can integrate and begin accepting payments almost instantly, a stark contrast to the weeks or months of underwriting required by traditional high-risk processors.

- Direct Fund Custody: Unlike gateways that hold your funds, ATLOS facilitates payments directly to your business wallet. This minimizes the risk of frozen assets and gives you immediate access to your revenue.

- Recurring Payments: For subscription-based dating models (e.g., monthly premium memberships), ATLOS supports recurring billing. This automates the revenue cycle and provides a seamless experience for subscribers, a crucial feature for maintaining a stable user base.

- White-Label Customization: The payment interface is fully customizable. This allows a dating site to maintain brand consistency throughout the user journey, from browsing profiles to upgrading a subscription. A branded checkout process builds trust and feels more integrated than a generic, third-party payment page.

- Broad Cryptocurrency Support: ATLOS accepts a wide range of cryptocurrencies, including major coins like Bitcoin (BTC) and Ethereum (ETH). This flexibility caters to a global and tech-savvy audience that values choice and financial privacy.

Practical Implementation for Your Dating Site

Integrating ATLOS can transform your payment model. Imagine a user wants to purchase a "Profile Boost" feature. With ATLOS, they can complete the transaction using their preferred cryptocurrency in a few clicks. The payment is processed peer-to-peer, and the funds appear directly in your platform’s designated crypto wallet.

This process offers a layer of privacy that is highly valued in the online dating space. Users can make payments without linking them to a personal bank account or credit card statement, which many find appealing. For the business, this significantly reduces the risk of fraudulent chargebacks, as crypto transactions are largely irreversible.

Pros and Cons Analysis

| Pros | Cons |

|---|---|

| Instant Onboarding: No KYC or approvals means you can start accepting payments fast. | Niche Audience: Primarily serves users comfortable with cryptocurrency. |

| Full Financial Control: Funds are sent directly to your wallet, ensuring full custody. | Learning Curve: May require staff to become familiar with web3 and crypto management. |

| Subscription-Ready: Built-in recurring payments support membership models. | Pricing Not Public: Requires direct contact with ATLOS to get specific fee information. |

| Enhanced User Privacy: Offers a discreet payment method for dating site members. | |

| Brandable Interface: White-label solution allows for a seamless user experience. |

Final Verdict

ATLOS Crypto Payment Gateway is a specialized yet exceptionally strong choice for online dating platforms ready to embrace the future of payments. It masterfully solves the industry's most persistent pain points: high-risk classification, chargebacks, and user privacy concerns. While it caters to a crypto-native audience, its streamlined integration and powerful features make it a compelling and strategic option for any dating service looking to innovate, enhance security, and secure its revenue stream.

Website: https://atlos.io

2. CCBill

CCBill has earned its reputation as a go-to payment gateway for online dating platforms by specializing in what many others avoid: high-risk industries. For over two decades, it has provided stable, reliable payment processing for verticals like online dating, which often face scrutiny from mainstream processors due to higher chargeback rates and reputational risk. This specialized focus means CCBill's entire infrastructure, from underwriting to risk management, is built to handle the unique demands of a subscription-based dating service.

This long-standing expertise makes CCBill a standout choice among the best payment gateways for online dating. Where others may suddenly terminate accounts or freeze funds, CCBill offers a predictable and supportive partnership, understanding the nuances of recurring revenue models common in the dating industry.

Key Features for Dating Platforms

CCBill's feature set is finely tuned for maximizing subscription revenue and minimizing operational headaches.

- Robust Subscription Billing: Manage complex recurring payment schedules with ease. CCBill supports variable pricing, free and paid trials, and rebill optimization tools that automatically retry failed payments to combat involuntary churn.

- Global Acquiring & Localization: Accept payments from users worldwide with support for over 100 currencies. Its hosted checkout pages, CCBill FlexForms, can be customized and localized to increase conversion rates in different regions.

- CCBill Pay Consumer Wallet: This feature provides a streamlined checkout experience for returning customers. Users can manage their subscriptions and payment methods (including cards and ACH) directly, reducing friction and support tickets.

- Developer-Friendly API and Integrations: A comprehensive API allows for deep customization. It also offers ready-made plugins for popular platforms like WooCommerce, enabling quick integration with WordPress-based dating sites.

Expert Insight: For a dating platform, user retention is paramount. CCBill's rebill optimization is not just a feature; it's a core revenue protection tool. By intelligently retrying failed transactions, it can recover a significant percentage of otherwise lost subscription renewals, directly impacting your bottom line.

Pricing and Onboarding

CCBill's pricing is transparent, a rarity in the high-risk space. While its rates are higher than low-risk processors like Stripe, they are competitive for the industry and clearly published on its website.

- Standard Pricing: Starts at 5.9% + $0.55 per transaction.

- High-Risk & Adult: Tiers can go up to 10.8% - 14.5%, depending on the specific business model and risk assessment.

The onboarding process is more involved than mainstream gateways but is designed to ensure long-term stability. Expect to provide detailed business information, as CCBill's underwriting is thorough.

Pros and Cons for Online Dating

| Pros | Cons |

|---|---|

| ✅ Built specifically for high-risk industries | ❌ Higher transaction fees than mainstream gateways |

| ✅ Transparent and published pricing structures | ❌ Some product limitations (e.g., subscription cycles) |

| ✅ Powerful recurring billing tools to reduce churn | ❌ Interface can feel less modern than newer competitors |

Ultimately, CCBill is an excellent choice for online dating businesses seeking a stable, long-term payment partner that understands their industry's complexities.

Website: https://www.ccbill.com

3. Segpay

Segpay positions itself as a robust payment partner for high-risk industries, including online dating, by combining gateway technology with deep expertise in compliance and fraud prevention. It provides a highly secure and flexible infrastructure designed to handle the complexities of subscription-based revenue models. For dating platforms facing challenges with payment approvals and regulatory scrutiny, Segpay offers a solution built on stability and advanced risk management, making it a strong contender among the best payment gateways for online dating.

What sets Segpay apart is its sophisticated multi-bank routing and cascading system. Instead of relying on a single acquiring bank, it can intelligently route transactions to the bank most likely to approve them, significantly boosting authorization rates. This capability is crucial for online dating businesses operating globally or serving diverse customer demographics.

Key Features for Dating Platforms

Segpay’s feature set is engineered to maximize revenue, ensure compliance, and provide operational flexibility for dating sites.

- Recurring Billing & Card Updater: It offers a comprehensive suite for managing subscriptions, including flexible trial periods and billing cycles. The automatic card updater service helps combat involuntary churn by proactively updating expired or replaced card details.

- Advanced Risk Management: Segpay integrates powerful tools like 3-D Secure, device fingerprinting, and geo-velocity rules to detect and block fraudulent transactions before they occur, protecting your business from chargebacks.

- Multi-Merchant ID Pooling: This smart routing technology enhances approval rates by distributing transaction volume across multiple merchant accounts and acquiring banks. If a transaction is declined at one bank, it can be automatically re-routed to another.

- Hosted Pay Pages & Virtual Terminal: Secure, customizable payment pages ensure a seamless checkout experience for users, while the virtual terminal allows for manual payment processing for phone-based or special offers.

Expert Insight: The Multi-Merchant ID pooling and cascading routing are game-changers for scaling a dating platform. Higher approval rates directly translate to more successful sign-ups and renewals. By diversifying your processing across multiple banks, you also mitigate the risk of having a single point of failure shut down your revenue stream.

Pricing and Onboarding

Segpay operates on a quote-based pricing model. This means fees are not publicly listed and are tailored to your business's specific risk profile, transaction volume, and industry vertical. While this can lead to higher rates compared to low-risk processors, the price reflects the specialized risk management and approval optimization services provided.

The onboarding process involves a thorough underwriting review, where Segpay assesses your business model and compliance standards. This diligence is designed to establish a stable, long-term processing relationship.

Pros and Cons for Online Dating

| Pros | Cons |

|---|---|

| ✅ Explicit support for high-risk dating merchants | ❌ Pricing is quote-based and can be higher |

| ✅ Smart routing technology boosts approval rates | ❌ Requires careful integration to maximize benefits |

| ✅ Strong compliance credentials (PCI Level 1, FCA) | ❌ Interface may be less intuitive than modern gateways |

For online dating platforms prioritizing payment success rates and long-term stability, Segpay provides a powerful and highly compliant solution.

Website: https://www.segpay.com

4. Epoch

Epoch has carved out a crucial niche as a payment facilitator with deep roots in subscription-based digital content, making it a seasoned player for online dating platforms. With a history stretching back decades, Epoch’s primary strength lies in its specialized infrastructure for managing recurring revenue and high-risk transactions. Its longstanding presence and A+ BBB accreditation signal a level of stability and business integrity that is invaluable in an industry where payment processor relationships can be volatile.

This experience means Epoch understands the entire lifecycle of a dating site subscriber, from initial signup to potential cancellations and disputes. They are not just a processor but a partner in managing the complex billing scenarios inherent to dating services. This specialization makes Epoch one of the best payment gateways for online dating businesses prioritizing customer billing support and long-term operational stability over cutting-edge features.

Key Features for Dating Platforms

Epoch’s feature set is built around the core needs of subscription merchants, focusing on billing management and customer support to minimize churn and administrative overhead.

- Third-Party Subscription Management: Epoch provides a comprehensive system for handling recurring payments. It includes consumer self-service tools, allowing users to look up their purchases, manage their subscriptions, and process cancellations directly, which significantly reduces the support burden on the dating platform.

- Experienced High-Risk Dispute Handling: The company has well-established workflows for managing the high volume of chargebacks and disputes common in the dating industry. Their experience helps protect merchant accounts from excessive chargeback ratios.

- 24/7 Consumer Billing Support: A key differentiator is Epoch's round-the-clock consumer support for billing inquiries. This direct line for users to resolve payment issues helps prevent misunderstandings from escalating into chargebacks and improves overall customer satisfaction.

- Global Payment Processing: Epoch facilitates payments from an international customer base, a critical requirement for any dating platform looking to scale beyond its local market.

Expert Insight: For a growing dating site, the operational cost of handling billing inquiries can be surprisingly high. Epoch's 24/7 consumer support acts as an extension of your own team, directly addressing payment questions. This not only frees up your resources but also prevents many disputes from turning into costly chargebacks.

Pricing and Onboarding

Epoch does not publicly list its pricing or technical integration details, which is common for specialized high-risk processors. Rates are determined on a case-by-case basis following a thorough underwriting process.

- Custom Pricing: Expect to engage with their sales team to receive a quote tailored to your business model, transaction volume, and perceived risk level.

- Onboarding: The application process is more rigorous than with mainstream gateways. Businesses will need to provide detailed documentation to demonstrate legitimacy and a solid business plan.

Pros and Cons for Online Dating

| Pros | Cons |

|---|---|

| ✅ Deep experience with dating/adult subscription models | ❌ Limited publicly available pricing and technical info |

| ✅ 24/7 consumer support reduces merchant support load and disputes | ❌ Mixed consumer reviews, typical for third-party high-risk billers |

| ✅ BBB accredited with a long, stable business history | ❌ Interface and feature set may not be as modern as newer platforms |

Epoch is an ideal choice for established online dating businesses that need a reliable, hands-off billing management partner and value expertise in high-risk subscription handling.

Website: https://www.epoch.com

5. PaymentCloud

PaymentCloud operates less like a direct payment gateway and more like a high-risk merchant account matchmaker. This unique model makes it an invaluable ally for online dating businesses that have been declined or shut down by mainstream processors. Instead of offering a one-size-fits-all solution, PaymentCloud leverages its relationships with numerous acquiring banks that are willing to underwrite high-risk industries, including online dating. They act as your advocate, navigating the complex application process to find a stable banking partner for your business.

This hands-on approach is what distinguishes PaymentCloud as one of the best payment gateways for online dating. Their expertise lies in preparing your application, managing underwriting, and pairing you with a payment gateway that integrates seamlessly with your new merchant account. This ensures you not only get approved but are set up for long-term processing stability.

Key Features for Dating Platforms

PaymentCloud's features are centered around securing and maintaining high-risk merchant accounts.

- Dedicated Online Dating Merchant Accounts: They offer a specialized program for dating platforms, providing crucial compliance guidance to help you meet the stringent requirements of high-risk acquiring banks.

- Gateway Integration Flexibility: Rather than locking you into a proprietary system, PaymentCloud integrates your merchant account with industry-standard gateways like Authorize.Net, NMI, and Braintree. This gives you access to robust, familiar features and APIs.

- Chargeback Mitigation Tools: Understanding the high chargeback risk in dating, they provide access to fraud prevention and chargeback alert systems. This helps you manage disputes proactively and protect your merchant account standing.

- Personalized Underwriting Support: Each merchant is assigned a dedicated account manager who assists with the entire application process, from gathering documents to negotiating terms with the partner bank.

Expert Insight: The biggest hurdle for a new dating site is getting a merchant account approved. PaymentCloud's greatest value is its role as an intermediary. They know what underwriters look for and will help you present your business in the best possible light, dramatically increasing your chances of securing a reliable, long-term payment processing relationship.

Pricing and Onboarding

Pricing with PaymentCloud is customized and not publicly listed. It is determined by the underwriting bank based on your business's specific risk profile, processing history, and business model.

- Custom Pricing: Rates and fees depend entirely on the partner bank's assessment.

- No "Junk" Fees: PaymentCloud is well-regarded for its transparency, often setting up accounts without application fees or annual PCI compliance fees.

The onboarding process is thorough and can be longer than with low-risk providers. You will need to submit comprehensive business documentation, as your application is being prepared for a formal bank review.

Pros and Cons for Online Dating

| Pros | Cons |

|---|---|

| ✅ Personalized help securing a high-risk account | ❌ Approval process can be lengthy and intensive |

| ✅ Integrates with well-known, reliable gateways | ❌ Pricing is not transparent and varies by risk |

| ✅ Strong focus on chargeback and risk management | ❌ Potential for holds or delays common to high-risk |

For online dating businesses struggling to find a processing home, PaymentCloud offers a tailored, expert-guided path to approval and stability.

Website: https://paymentcloudinc.com

6. Authorize.Net

Authorize.Net stands as one of the oldest and most respected names in the payment gateway industry. While not a direct high-risk processor, its true power for an online dating business lies in its architecture as a gateway-only solution. This means you can pair its robust, reliable technology with a specialized high-risk merchant account from a provider that understands the dating vertical, giving you the best of both worlds: stability and specialized underwriting.

This separation of gateway and merchant account is a strategic advantage. If your merchant account provider ever needs to be changed, you can do so on the backend without having to rip out and recode your entire payment integration. For a dating platform, this flexibility makes Authorize.Net one of the best payment gateways for online dating by providing long-term operational resilience.

Key Features for Dating Platforms

Authorize.Net offers a suite of tools perfectly suited for the subscription-based nature of online dating sites.

- Automated Recurring Billing (ARB): This core feature is designed to manage subscription plans effortlessly. It handles complex schedules for monthly, quarterly, or annual memberships, which is essential for dating platform monetization.

- Customer Information Manager (CIM): CIM securely tokenizes and stores customer payment information on Authorize.Net's servers. This facilitates seamless one-click rebilling for returning users and powers subscription renewals without storing sensitive card data on your servers, reducing PCI compliance scope.

- Account Updater: To combat involuntary churn from expired or replaced credit cards, the Account Updater service automatically updates card-on-file information. This ensures a higher success rate for recurring subscription payments, directly protecting revenue.

- eCheck/ACH Processing: Broaden your payment options by accepting electronic checks (eChecks). This provides an alternative for users who prefer not to use credit cards, potentially increasing your total addressable market.

Expert Insight: The ability to swap merchant accounts without changing your gateway integration is a massive, often overlooked, benefit. Should your acquiring bank change its risk appetite, you can find a new high-risk partner and simply plug it into your existing Authorize.Net setup, avoiding costly development work and downtime.

Pricing and Onboarding

As a gateway-only provider, Authorize.Net's pricing is separate from your merchant account fees. Its own fees are often bundled by the reseller or ISO (Independent Sales Organization) that sets you up with the merchant account.

- Gateway Fee: Typically includes a monthly fee (around $25) and a small per-transaction fee (e.g., $0.10).

- Merchant Account Fees: These are set by your chosen high-risk processor and will be significantly higher than the gateway fees.

Onboarding involves a two-step process: first, securing a high-risk merchant account, and second, connecting it to your Authorize.Net gateway. Your merchant account provider will usually handle this entire process.

Pros and Cons for Online Dating

| Pros | Cons |

|---|---|

| ✅ Mature, well-documented API and broad support | ❌ Gateway only; requires a separate high-risk merchant account |

| ✅ Supports multiple acquirers, allowing easy swaps | ❌ Pricing is determined by the reseller, leading to variability |

| ✅ Robust recurring payment infrastructure | ❌ The interface can feel dated compared to newer platforms |

Ultimately, Authorize.Net is a powerful and flexible choice for established dating businesses that want enterprise-grade reliability paired with the specialized underwriting of a dedicated high-risk merchant account.

Website: https://www.authorize.net

7. NMI

NMI operates differently from an all-in-one processor; it's a "processor-agnostic" payment gateway. This means NMI provides the technology layer-the gateway-that connects your dating site to a separate high-risk merchant account. This model offers incredible flexibility, allowing you to choose the best backend processor for your needs while benefiting from NMI's advanced, retention-focused technology. For online dating platforms, this separation is a strategic advantage, providing stability and powerful tools specifically designed to manage recurring revenue.

This processor-agnostic design makes NMI one of the best payment gateways for online dating because it future-proofs your business. If your merchant account provider changes its terms or is no longer a good fit, you can switch processors behind the scenes without having to re-integrate your checkout, disrupt user subscriptions, or lose saved card data.

Key Features for Dating Platforms

NMI's feature set is laser-focused on optimizing approval rates and minimizing churn for subscription-based businesses.

- Automatic Card Updater: This is a crucial tool for dating sites. It proactively communicates with card networks (Visa, Mastercard) to update expired or replaced card details in your vault automatically, preventing failed recurring payments and involuntary churn.

- Customer Token Vault & Network Tokenization: NMI's secure vault stores customer payment data as tokens. It goes a step further with network tokenization, which replaces sensitive card data with a unique identifier that improves security and significantly increases authorization approval rates with issuers.

- Broad Processor Compatibility: The gateway integrates with over 200 processor options globally. This wide network makes it easier to find and connect with a high-risk merchant account provider that understands and supports the online dating industry.

- Flexible Integrations: NMI supports popular shopping carts and offers a robust API, allowing for seamless integration into custom-built dating platforms or those running on systems like WordPress.

Expert Insight: The combination of NMI's Automatic Card Updater and Network Tokenization is a powerhouse for member retention. A dating site can lose 10-15% of its members monthly to involuntary churn from failed payments. NMI's tools directly combat this, preserving your recurring revenue stream and customer lifetime value.

Pricing and Onboarding

NMI itself does not sell directly to merchants. Instead, its gateway services are offered through a vast network of resellers, Independent Sales Organizations (ISOs), and merchant service providers.

- Variable Pricing: Pricing is not standardized. Each reseller sets their own rates, which typically include a monthly gateway fee, a per-transaction fee, and potentially other service charges. You must get quotes from different providers.

- Merchant Account Required: You must first secure a separate high-risk merchant account that is compatible with NMI. The ISO or provider you work with will often bundle the gateway and merchant account together.

The onboarding process involves setting up both your merchant account and your NMI gateway account, which is handled by your chosen sales partner.

Pros and Cons for Online Dating

| Pros | Cons |

|---|---|

| ✅ Purpose-built tools to increase approval rates | ❌ Gateway only; requires a separate high-risk merchant account |

| ✅ Processor-agnostic design provides flexibility | ❌ Pricing is not standardized and varies by reseller |

| ✅ Network tokenization improves retention and reduces churn | ❌ Direct support comes from the reseller, not NMI |

Ultimately, NMI is an ideal choice for established online dating businesses that prioritize flexibility and want access to best-in-class tools for maximizing subscription revenue and security.

Website: https://www.nmi.com

Top 7 Payment Gateways Comparison

| Product | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| ATLOS Crypto Payment Gateway | Moderate (web3 and crypto knowledge needed) | Low onboarding time, no KYC required | Fast crypto payments directly to merchant wallets | High-regulatory or payment-challenged businesses (VPN, casinos, adult) | No KYC, full crypto custody, broad crypto support, white-label customization |

| CCBill | Low to Moderate | Transparent pricing, some product constraints | Reliable recurring billing and global payments | High-risk verticals (dating, adult), subscription models | Strong recurring tools, global support, transparent pricing |

| Segpay | Moderate to High | Careful integration for routing/fraud | Enhanced approval rates with multi-bank routing | High-risk dating subscriptions, multi-region | Advanced risk management, PCI Level 1, multi-bank routing |

| Epoch | Low | Minimal technical setup; third-party billing | Reduced disputes with 24/7 consumer support | Subscription, digital content, dating/adult sites | Deep high-risk experience, 24/7 support, BBB accredited |

| PaymentCloud | Moderate | Personalized underwriting, longer approval times | Access to high-risk merchant accounts with compliance | High-risk dating merchants needing underwriting | Personalized underwriting, no junk fees, multiple gateway support |

| Authorize.Net | Moderate | Requires compatible high-risk merchant account | Robust subscription billing infrastructure | Dating subscriptions with existing merchant accounts | Mature API, tokenization, supports multiple acquirers |

| NMI | Moderate | Requires high-risk merchant accounts | Improved approval and reduced fraud in subscriptions | High-risk merchants needing flexible gateway | Processor-agnostic, network tokenization, extensive integrations |

Making the Final Connection: Key Takeaways for Your Dating Platform

Choosing your payment infrastructure is one of the most consequential decisions you'll make for your online dating business. It's not merely about accepting payments; it's about establishing trust, ensuring user privacy, and building a scalable revenue model in a sector often categorized as 'high-risk'. The right partnership will feel like a seamless extension of your platform, while the wrong one can lead to frozen funds, high decline rates, and a frustrated user base. This decision requires a careful assessment of your business's unique needs against the specialized offerings of providers who understand the nuances of the online dating industry.

We've explored a range of powerful options, from all-in-one high-risk specialists to flexible gateway-only solutions and forward-thinking crypto processors. The central takeaway is that a one-size-fits-all approach doesn't work here. Your selection of one of the best payment gateways for online dating must be a strategic choice, aligning with your operational capacity, target audience, and long-term growth ambitions.

Synthesizing Your Options: A Final Decision Framework

To crystallize your decision, consider your business model through three critical lenses: your user base, your business stage, and your technical expertise. Each factor will point you toward a different type of solution.

1. Aligning with Your User Base and Geographic Reach:

- Global & Privacy-Focused Users: If your platform targets a global audience or a user demographic that values privacy and anonymity above all, a crypto-native solution like ATLOS is a game-changer. It bypasses traditional banking hurdles, international transaction fees, and KYC requirements, offering a borderless and discreet payment experience.

- Traditional & North American/EU Users: For platforms focused on markets where credit cards are king, providers like CCBill, Segpay, and Epoch are battle-tested. They offer localized payment methods and currencies, which are essential for maximizing conversion rates in these regions.

2. Matching the Provider to Your Business Stage:

- Startups & New Platforms: An all-in-one solution from CCBill or Segpay can be invaluable. They provide the high-risk merchant account and payment gateway in a single package, simplifying the complex underwriting process and getting you to market faster.

- Established & Scaling Platforms: If you have an established user base and processing history, you have more leverage. A gateway-only solution like NMI or Authorize.Net, paired with a dedicated high-risk merchant account from a specialist like PaymentCloud, offers greater flexibility, potentially lower processing fees, and the ability to build a more customized payment stack.

3. Assessing Your Technical Resources:

- Limited Development Team: Look for providers with robust documentation, pre-built shopping cart integrations, and exceptional technical support. Providers that offer a more managed, all-in-one service can significantly reduce the integration burden.

- In-House Development Expertise: If you have a strong technical team, a gateway with a powerful and flexible API, like NMI or ATLOS, gives you the freedom to create a deeply integrated, fully branded checkout experience that is perfectly tailored to your platform's user flow.

Ultimately, the best payment gateway for your online dating site is one that acts as a true partner. It should provide robust tools for subscription management, intelligent chargeback prevention, and a deep understanding of the regulatory landscape. This partnership ensures your payment infrastructure becomes a powerful asset for growth, not a constant operational headache. Finally, remember that the success of your dating platform hinges on more than just payments; consider exploring leading API integration platforms to ensure all your critical services, including payment gateways, work together seamlessly. Your goal is to create a frictionless, secure, and trustworthy experience from signup to subscription, making that final connection with both your users and your revenue goals.

Ready to embrace the future of payments for your dating platform? Explore the ATLOS Crypto Payment Gateway for a decentralized, no-KYC solution that offers instant, direct-to-wallet settlements and unparalleled user privacy. Visit ATLOS.io to see how you can bypass the complexities of high-risk fiat processing and empower your global user base.