High Risk Merchant Account Providers Guide

If your business has been slapped with the 'high-risk' label, finding a reliable way to process payments can feel like a constant struggle. This guide is here to pull back the curtain on why mainstream processors often say "no" to certain industries and, more importantly, how specialized high risk merchant account providers can become your greatest ally. Think of them less as gatekeepers and more as strategic partners who understand the unique hurdles you face.

Getting to Grips With The High Risk Merchant World

First things first: being called "high-risk" isn't a knock against your business ethics or your chances of success. It’s simply a technical term banks and payment processors use to flag businesses that carry a bit more financial liability. This tag can come from your industry, your sales model, or even the way you process transactions.

Instead of hitting a brick wall, it's better to see this as a lane with its own rules of the road. For instance, traditional processors are notoriously shy about industries with a high likelihood of chargebacks, like online gaming or any kind of subscription box service. They also tend to run from sectors with heavy government oversight, such as CBD or nutraceuticals. This is precisely where a good high risk merchant account provider steps in to fill the gap.

Why Do Some Businesses Get a "High Risk" Label?

So, what actually gets a business flagged? It usually boils down to a few core reasons. Knowing what they are helps you understand exactly why you need a specialist in your corner.

- Your Industry: Some industries are considered high-risk from the get-go. Think adult entertainment, online dating, credit repair, or travel agencies. These fields often have higher rates of customer disputes, which makes traditional banks nervous.

- A High Chargeback Rate: This is a big one. Any business that consistently sees more than a 1% chargeback-to-transaction ratio is waving a giant red flag. This often catches e-commerce businesses with long shipping times or subscription models where customers forget they signed up for recurring payments.

- Big-Ticket Sales: If you're selling high-value items like luxury watches or expensive coaching packages, the financial hit from a single fraudulent sale or chargeback is much greater.

- Card-Not-Present (CNP) Sales: Running an online business is inherently riskier than a physical store. It's just harder to confirm someone is who they say they are when you can't see them or their card.

The Financial Side of High Risk Processing

Let's talk money. The most immediate difference you'll see is in the fees. These higher rates aren't pulled out of thin air; they're a direct reflection of the increased financial risk the processor is taking on for you. High-risk accounts come with steeper processing fees and often have more stringent contract terms.

To put it in perspective, high-risk processing fees can run anywhere from 3% to 10% per transaction. That’s a significant jump from the typical 1.5% to 3% you see with standard, low-risk accounts. If you want to dive deeper into the nuts and bolts, this in-depth guide on high-risk merchants is a great resource.

For a clearer picture, here’s a quick rundown of how the two account types stack up.

Key Differences Between Standard and High Risk Accounts

| Feature | Standard Merchant Account | High Risk Merchant Account |

|---|---|---|

| Processing Fees | Typically 1.5% - 3% | Can range from 3% - 10%+ |

| Chargeback Threshold | Strict; often below 1% | More lenient; accepts higher ratios |

| Contract Terms | More flexible; shorter terms | Often longer terms with stricter clauses |

| Rolling Reserve | Uncommon | Common; a percentage of sales is held |

| Fraud Prevention | Basic tools included | Advanced, specialized tools required |

Ultimately, a high-risk provider is doing much more than just moving money from point A to point B.

The key takeaway is that high-risk providers aren't just processing payments; they're actively managing risk. They invest in advanced fraud detection tools, offer robust chargeback mitigation support, and navigate complex compliance requirements on your behalf.

Evaluating High Risk Merchant Account Providers

Choosing a partner from the crowded field of high risk merchant account providers isn't just about getting an approval. It's about finding a stable foundation for your business to grow on, not just a utility you're forced to use. I've seen too many businesses make a snap decision only to end up with frozen funds, surprise fees, and a support team that ghosts them the second there's a problem.

The first thing you need to do is get under the hood of their pricing models. Many providers will lure you in with a low introductory rate, but the real costs are buried deep in the fine print. You have to look past the simple transaction percentage and dig into every single fee: monthly account charges, gateway fees, steep chargeback penalties, and early termination costs.

Don't be shy. Ask for a complete, itemized fee schedule right from the start. A provider that's confident in their value will have zero problem breaking it all down for you. If they get dodgy or evasive, that’s your cue to walk away.

Scrutinizing Pricing and Contract Terms

One of the oldest tricks in the book is the tiered pricing model. It's designed to be confusing and, ultimately, expensive. They'll sort your transactions into vague buckets like "qualified" or "non-qualified," and that amazing rate they advertised? It usually only applies to a tiny fraction of card types.

What you should be looking for is an Interchange-Plus pricing model. It's hands-down the most transparent option. It’s made of two simple parts: the non-negotiable interchange fee that Visa or Mastercard sets, plus a fixed, predictable markup from your provider. No more guessing games.

The single most important thing you can do is demand total transparency. A good provider will give you a detailed proposal that outlines every single potential fee. This lets you actually forecast your costs accurately and avoid nasty surprises.

Before you even think about signing, zoom in on the contract length and the terms of the rolling reserve. It's standard practice for a provider to hold a percentage of your revenue—usually 5% to 10%—as a safety net against chargebacks. But the terms, like how long they hold it and when you get it back, need to be crystal clear and fair for your specific business.

Assessing Chargeback Support and Integrations

For a high-risk business, solid chargeback management isn't a "nice-to-have"—it's a survival tool. Your entire operation can be jeopardized if your chargeback ratio creeps over that dreaded 1% threshold. A great provider does more than just process payments; they give you the tools and support to fight fraud and manage disputes effectively.

Here's what a top-tier provider should offer:

- Advanced Fraud Suites: These aren't just basic filters. They should use real-time analytics and custom rules to spot and block shady transactions before they can turn into a chargeback.

- Chargeback Alerts: Getting an early warning is huge. These alerts give you a chance to refund a customer or resolve an issue directly, sidestepping a formal chargeback that dings your record.

- Dispute Resolution Support: Some of the best providers will actually help you build your case when fighting a chargeback. Their expertise in gathering evidence and responding properly can dramatically improve your win rate.

Finally, think about how it all connects. Your payment gateway has to play nicely with your e-commerce platform, CRM, or accounting software. Check if the provider has ready-made integrations or a flexible API you can work with. And don't underestimate the value of industry experience. A provider who genuinely gets the ins and outs of your business vertical can offer much smarter risk management and more relevant support.

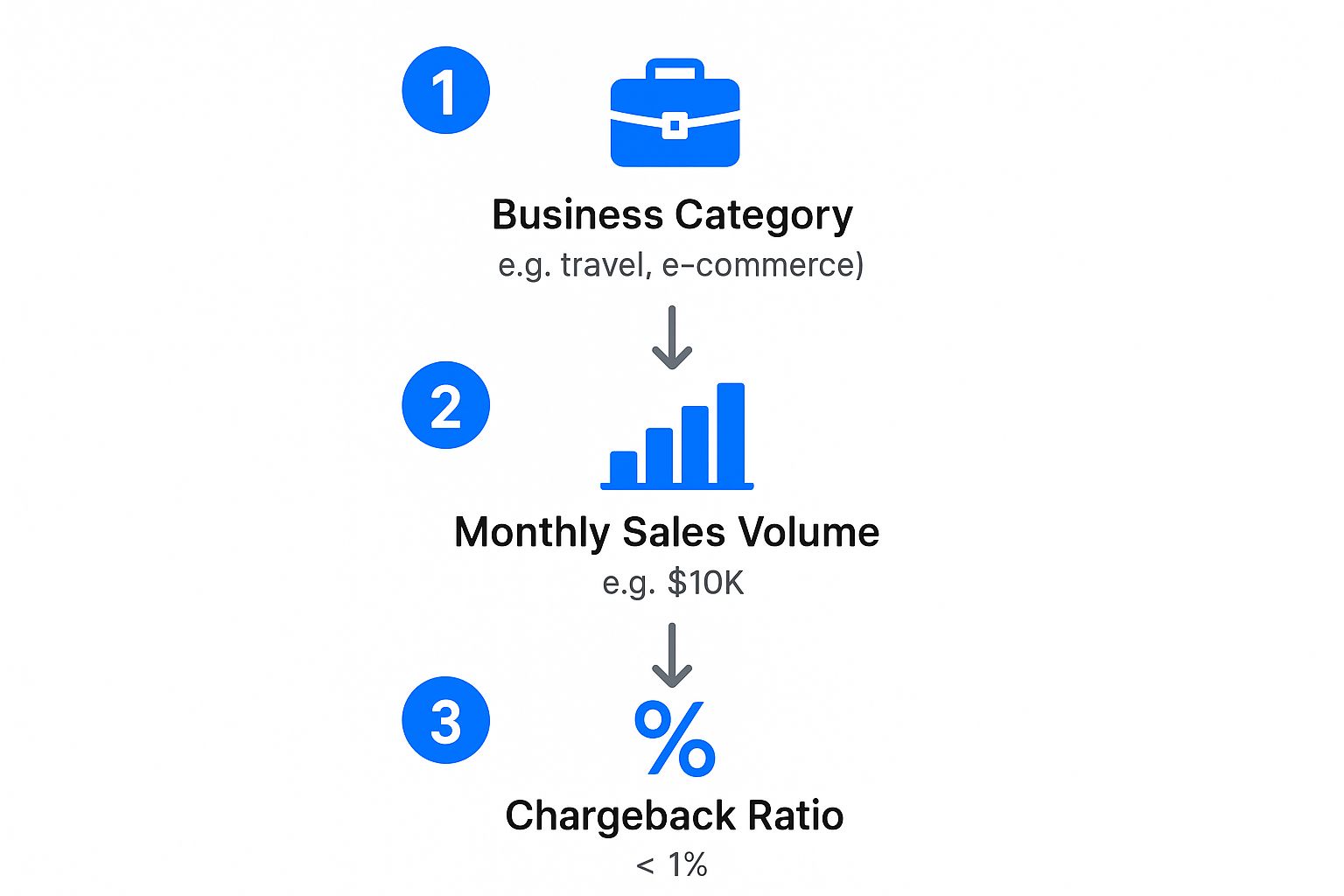

This infographic breaks down the typical flow an underwriter follows when they're figuring out a business's risk level.

As you can see, the main things they're looking at are your business category, how much you sell, and your chargeback history. These are the core factors that build your risk profile.

How to Prepare a Winning Application

Think of your application as the first interview you'll have with potential high risk merchant account providers. It’s your one shot to tell a clear story about your business and prove you're a partner they can trust. A rushed or incomplete application is the fastest way to get a rejection, so spending the time to get this right is absolutely essential.

The whole underwriting process boils down to one thing: risk assessment. Underwriters are paid to find inconsistencies, liabilities, and any sign that your business might bring them a tidal wave of chargebacks. Your job is to answer their questions before they even ask and present a complete, professional package right from the start.

Gathering Your Essential Documents

Before you even think about filling out a form, get your paperwork in order. Having a complete file ready to go shows an underwriter you’re organized and serious. Honestly, it’s the easiest way to speed up the whole approval process.

Here’s a quick checklist of what pretty much every provider is going to ask for:

- A Voided Business Check or Bank Letter: This is simple proof that you have a real business bank account for them to deposit your funds into.

- A Government-Issued ID: A clear copy of your driver’s license or passport is standard for verifying who you are.

- Recent Bank Statements: Plan on providing the last three months of statements. This gives them a snapshot of your business's financial health and cash flow.

- Processing Statements: If you're not new to this, you'll need three to six months of your past processing statements. This history is gold for underwriters—it shows your sales volume and, most importantly, your chargeback ratio.

- Business Formation Documents: This means your Articles of Incorporation or whatever official paperwork proves your business is a legitimate legal entity.

Pro Tip: Don't just scan these documents on the corner of your desk. Make sure every page is crisp, clear, and up-to-date. A professional presentation sends a subtle but powerful message that you run a tight ship, which can genuinely influence an underwriter's final decision.

Proactively Addressing Red Flags

Let's be blunt: high-risk underwriters are trained to look for reasons to say "no." It's your job to give them every possible reason to say "yes" by getting out in front of potential problems.

The biggest red flag of all? A high chargeback ratio.

Don't try to hide from it—tackle it head-on. The single best thing you can do is include a chargeback mitigation plan right alongside your application. This doesn't have to be a 50-page thesis. It just needs to clearly outline the real-world steps you take to prevent and manage disputes.

For instance, your plan could show how you use specific fraud detection tools, that you personally call to confirm large orders, or detail your customer service process for resolving issues before they turn into chargebacks. Showing this level of foresight demonstrates you understand the risks and are already managing them. This one proactive step can often be the deciding factor that gets you approved.

Waiting for Approval: What's a Realistic Timeline?

After you've pulled together all your paperwork and sent your applications off to different high risk merchant account providers, the real test of patience begins. You’re left waiting, and it can be a nerve-wracking time. It’s hard not to wonder what’s happening on the other end.

You’ll quickly notice that timelines are all over the map. One provider might dangle the promise of a 48-hour decision, while another tells you it could take a week or more. So, what gives? The difference almost always boils down to how deep their underwriting process goes. A faster approval isn't always a better one; it might just mean they ran your application through an automated system without much human oversight.

A slightly longer wait can actually be a good sign. It often means a real person is doing their homework—digging into your business model, looking at your processing history, and understanding your strategies for handling chargebacks. They're trying to build a partnership that lasts, not just tick a box. This is the kind of thoroughness that keeps your account from getting shut down unexpectedly later on.

The Deal with High Approval Rates

In the high-risk world, you’ll see some providers advertising incredibly high approval rates. For a business that’s been turned down elsewhere, this can feel like a lifeline. Some of these specialists will even work with merchants who’ve landed on the MATCH (Member Alert to Control High-Risk Merchants) list, which is a total non-starter for most banks.

This willingness to take on bigger risks is what defines their business.

Top-tier providers have fine-tuned their underwriting to serve industries that traditional processors won't touch. For example, PaymentCloud is well-known for its 98% approval rate, often getting merchants approved in just 48 hours. Likewise, HighRiskPay boasts a 99% approval rate (95% even for businesses with shaky credit), with many approvals also landing within a couple of days. If you want to dig deeper, you can get more details on the best high risk merchant account providers to see how they stack up.

The bottom line is this: high approval rates and quick turnarounds aren't magic. These companies have built their entire operation around understanding and managing specific risks. They have the experience to back businesses that scare everyone else away.

What to Actually Expect Day-to-Day

So, what does a realistic timeline look like? While a 24-48 hour approval is possible, it's more common for a comprehensive review to take anywhere from three to seven business days. This gives the underwriters enough time to actually verify your documents, check your financial health, and make sure your business practices fit their risk profile.

Here’s a rough sketch of what’s happening during that week:

- Initial Check (Days 1-2): The provider’s team makes sure your application is complete and all the required documents are there. If anything is missing, you’ll hear from them now.

- Deep Dive Underwriting (Days 2-4): This is where the heavy lifting happens. Risk analysts scrutinize every detail of your business.

- The Final Word (Day 5+): Once the review is complete, you’ll get the decision. If you're approved, they'll send over a merchant agreement outlining your specific rates and terms.

Honestly, a little patience here can save you a lot of headaches down the road. A provider who takes the time to vet you properly is far more likely to stick with you for the long haul, giving you the stability you need to grow.

It’s easy to think of your high-risk merchant account as just another utility bill—a necessary evil you have to pay. But that’s a huge mistake. Your payment provider shouldn't just be a processor; they should be a strategic partner that actively helps you grow.

When you're in a high-risk industry, just getting approved for an account can feel like a major victory. But once you've got that initial stability, the real work begins. The right partner helps you shift from simply surviving to actually thriving by offering tools and expertise that turn your industry’s unique challenges into opportunities.

Real-World Success Stories

The impact of having the right partner among high risk merchant account providers isn't just theoretical. I've seen it firsthand.

Take a nutraceutical company that was drowning in chargebacks and constantly having transactions blocked. It felt like they were fighting a new fire every day. After they moved to a provider with a sophisticated fraud prevention suite, their sales jumped by 30%. Why? Because legitimate transactions were no longer getting flagged, and the system intelligently weeded out the bad actors.

Another great example is an online gaming platform that wanted to go global but kept hitting a wall with declined international payments. By partnering with a specialist who understood multi-currency processing, they successfully expanded their player base across several new countries. You can discover more insights about these high-risk payment solutions to see just how powerful a well-matched account can be.

These aren't one-off stories. They show a clear pattern: the right features directly fuel business growth. It's about more than just taking money; it's about making the entire process smoother, safer, and more successful.

From Defense To Offense

A great high-risk provider helps you stop playing defense and start playing offense. You move from constantly worrying about account stability and chargeback ratios to confidently focusing on expansion and sales. This is where the magic happens, and it's all about aligning their features with your goals.

Just think about these common scenarios:

- Breaking into New Markets: A subscription box company wants to start selling in Europe. A provider who offers seamless multi-currency support and knows the ins and outs of regional payment preferences (like SEPA or iDEAL) can make that happen. The biggest hurdle is suddenly gone.

- Unlocking Cash Flow: An e-commerce business selling high-ticket furniture is stuck with a massive rolling reserve, tying up cash they desperately need for inventory. A better provider might offer a more flexible reserve policy after seeing a few months of solid processing history, freeing up that capital.

- Recovering Lost Sales: An online coach keeps losing clients because their fraud filter is overly aggressive, resulting in frustrating false declines. A provider with customizable fraud tools lets them dial in the settings, instantly capturing legitimate sales they were previously turning away.

The ultimate goal is to get to a place where your payment processing is no longer a bottleneck. Instead, it becomes a well-oiled machine that supports your ambitions, letting you focus on what you do best—running your business.

To help you connect the dots, I’ve put together a table that shows how specific provider features translate into real-world business growth.

Connecting Provider Features to Business Impact

This table links specific high-risk provider features to the tangible outcomes they create for your business. Use it to figure out which features should be at the top of your list based on your industry and growth plans.

| Provider Feature | Potential Business Impact | Ideal For Which Industry? |

|---|---|---|

| Advanced Fraud Prevention Suite | Reduces chargebacks, lowers processing fees, and increases approved transactions. | E-commerce, Gaming, Subscription Services |

| Multi-Currency Processing | Unlocks international markets, increases global customer base, and boosts overall revenue. | Travel, SAAS, Digital Products |

| Chargeback Alerts & Management | Lowers chargeback ratio, protects your merchant account, and saves time on disputes. | Nutraceuticals, Coaching, Adult |

| Flexible Rolling Reserve Policy | Improves cash flow, allowing for reinvestment in marketing, inventory, and growth. | High-Ticket E-commerce, Furniture, Electronics |

| High Volume Processing Capacity | Prevents transaction interruptions during peak sales periods and supports rapid scaling. | Dropshipping, Event Ticketing, Online Retail |

Ultimately, choosing a provider is about more than just rates and fees. It’s about finding a partner who understands your business model and provides the tools you need to not just survive, but to scale successfully.

Common Questions About High-Risk Accounts

Diving into the world of high-risk merchant accounts can feel a bit overwhelming. There's a lot of jargon and plenty of concerns about costs, approvals, and what it all means for your business. Let's clear up some of the most common questions we get from business owners just like you.

What’s a Rolling Reserve? And Why Do I Need One?

Think of a rolling reserve as a safety net held by your payment processor. It's a small percentage of your revenue, usually between 5% to 10%, that gets set aside in a separate, non-interest-bearing account. This money is typically held for a fixed period, often around 180 days, before it’s released back to you.

The whole point is to manage risk. For businesses in industries with a higher likelihood of chargebacks, this fund protects the processor (and you) from sudden, large financial hits from disputes or refunds. It's a standard practice in the high-risk space.

The good news? It's not permanent. Once you've built up a solid processing history—say, 6-12 months with very few chargebacks—you're in a great position to talk to your provider. You can often renegotiate to lower the percentage or shorten the holding time, which frees up your cash flow.

Can I Get an Account if I Have Bad Credit?

Absolutely. While a traditional bank might shut the door based on a low personal credit score, specialized high-risk merchant account providers look at the bigger picture.

They care far more about the health and viability of your business itself. Underwriters will dig into your recent processing statements (if you have them), your business bank statements, and your chargeback history. A strong business with a clear path to success often matters much more than old personal credit issues.

The trick is to show them you're a stable, well-managed operation. Come prepared with a solid business plan, bank statements that show healthy cash flow, and a clear strategy for preventing chargebacks. That's how you build a powerful case for approval, even if your personal credit isn't perfect.

How Can I Get My Processing Fees Lowered?

High-risk accounts do start with higher rates, but those rates aren't carved in stone. Your goal is to prove you're less of a risk than they initially thought. Over time, you can earn your way to better pricing by showing you’re a reliable and stable partner.

Give it about six to twelve months of steady processing, then ask for an account review. You'll need to come to the table with proof of your good performance. Here’s what they'll want to see:

- A Low Chargeback Ratio: Keeping your chargeback rate consistently under the 1% industry threshold is the most powerful argument you can make.

- Consistent Sales: Showing predictable revenue demonstrates that your business is sustainable and not just a flash in the pan.

- A Clean History: A record without a lot of refunds, fraud alerts, or other headaches shows you run a tight ship.

When you have this data on your side, your provider has every reason to offer you more competitive rates. They want to hold on to good clients, and a strong processing history proves you're one of them.

Ready to accept crypto payments without the hassle of traditional approvals or KYC? ATLOS Crypto Payment Gateway offers a seamless, no-KYC solution that puts you in control. Get started today and receive payments directly to your wallet. Explore your options at https://atlos.io.