7 Best Payment Gateways for Adult Sites in 2025

Navigating the world of online payments can be challenging, especially for businesses in the adult industry. Mainstream payment processors like Stripe and PayPal often have strict policies against high-risk ventures, leaving merchants searching for reliable, secure, and compliant alternatives. Choosing the right payment gateway isn't just a technical decision; it's a critical business move that impacts your revenue, customer trust, and operational stability. A robust gateway ensures smooth transactions, manages subscriptions effectively, and mitigates the unique risks associated with the adult market, from chargebacks to regulatory hurdles.

This guide cuts through the complexity by rounding up the seven best payment gateways for adult sites available today. We provide a detailed breakdown of each solution, covering their specific features for high-risk industries, pricing structures, integration capabilities, and unique advantages. Whether you're running a subscription-based content platform, a VOD service, or an e-commerce store, this curated list will help you identify a payment partner that not only accepts your business but actively helps it thrive. We will explore both traditional high-risk processors like CCBill and PaymentCloud alongside innovative crypto solutions such as ATLOS, which offer new levels of privacy and autonomy. Each option reviewed includes direct links to help you get started quickly.

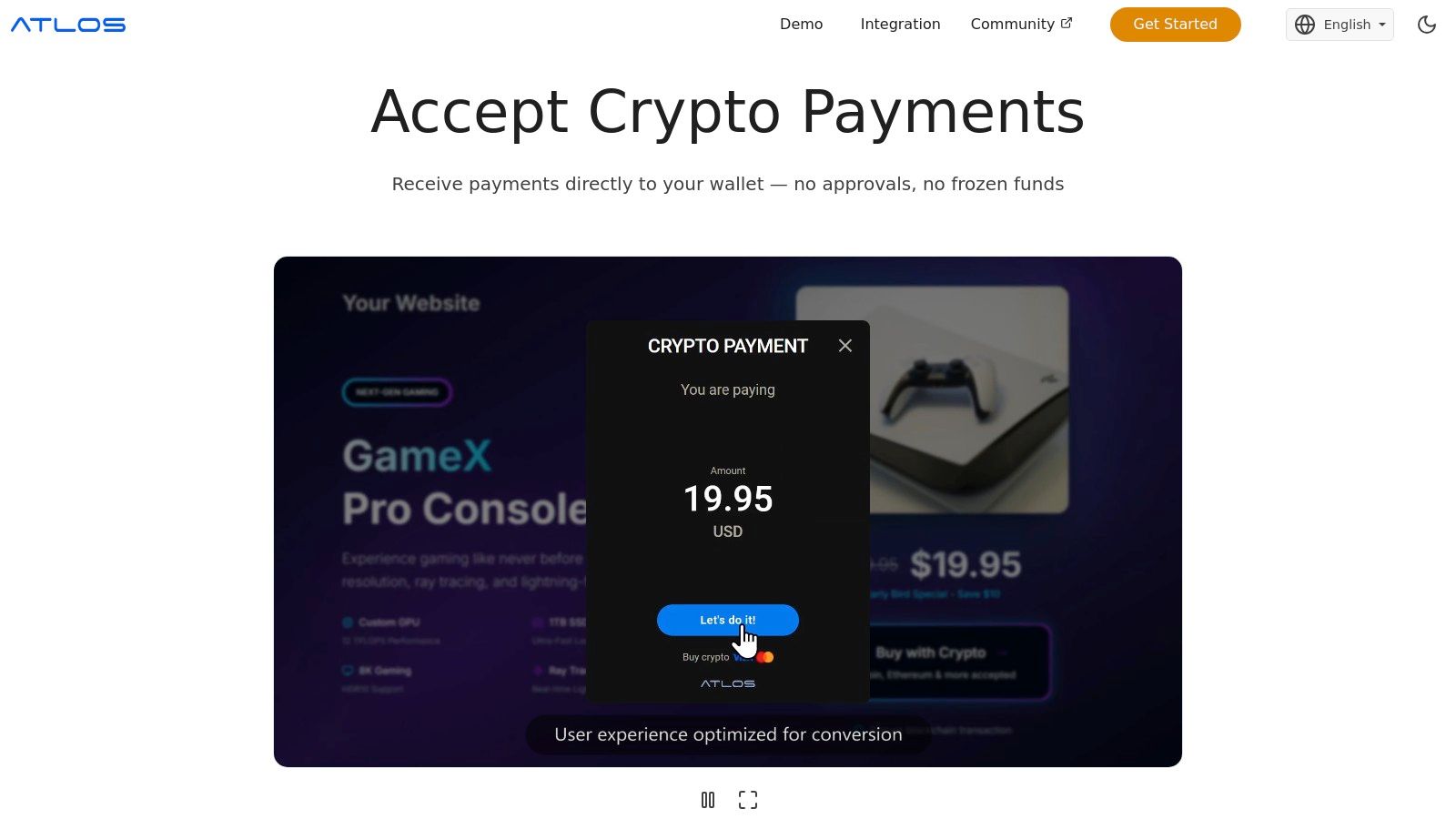

1. ATLOS Crypto Payment Gateway

ATLOS emerges as a formidable solution for adult industry businesses seeking a modern, decentralized, and censorship-resistant payment infrastructure. As a no-KYC, non-custodial crypto payment gateway, it directly addresses the most significant pain points faced by high-risk merchants: account freezes, de-platforming, and excessive transaction fees. By operating on a "your keys, your crypto" philosophy, ATLOS ensures that you maintain full control over your funds at all times, eliminating the risk of a third party seizing your revenue.

This platform is particularly well-suited for businesses that prioritize privacy and immediate operational readiness. The instant onboarding process is a game-changer; without the need for lengthy account approvals or invasive KYC procedures, a merchant can connect their Web3 wallet and begin accepting cryptocurrency payments within minutes. This speed and autonomy make it one of the best payment gateways for adult sites that need to adapt quickly and avoid traditional banking hurdles.

Key Features & Benefits for Adult Merchants

ATLOS provides a robust feature set designed for scalability and user experience. Its self-hosted, white-label solution allows for complete brand customization, ensuring your payment page aligns perfectly with your site's aesthetic.

- No KYC & Instant Setup: Bypass traditional gatekeeping. Connect your wallet and immediately start accepting payments without intrusive background checks.

- Non-Custodial Security: Funds are sent directly to your wallet. ATLOS never holds your crypto, making your revenue immune to freezes or seizures.

- Wide Cryptocurrency Support: Accept payments in major cryptocurrencies like Bitcoin, Ethereum, Solana, and assets on Binance Smart Chain, catering to a global, crypto-savvy audience.

- Advanced Payment Models: Easily implement recurring subscription payments for membership sites or premium content. The platform also includes a Payout API, perfect for managing payments to affiliates, performers, or contractors.

- Seamless Integration: The user interface integrates directly into your existing checkout flow. This prevents jarring redirects and provides a smooth, trustworthy experience for your customers. It offers minimal-code integrations for popular platforms like WooCommerce and WHMCS.

Practical Implementation

Integrating ATLOS is designed to be straightforward. For a membership-based adult content site using WordPress, you would use the ATLOS WooCommerce plugin. During checkout, customers select the crypto payment option, connect their wallet, and approve the transaction directly on your site. The funds are settled instantly in your self-custody wallet, ready for you to use.

Expert Insight: The true power of ATLOS for the adult industry lies in its decentralized nature. By removing the central authority that judges business models, it provides a stable and reliable payment channel where traditional processors often fail.

Pricing and Availability

ATLOS does not publicly list its pricing structure, which is common for specialized, high-risk solutions. Merchants are required to contact their team or request a demo to receive a customized quote based on their business needs and transaction volume. While this requires an extra step, it allows for a tailored solution that fits your specific operational scale. The lack of a built-in fiat gateway means you will need a separate off-ramp solution to convert crypto to cash, but for crypto-forward businesses, this is often a non-issue.

Website: https://atlos.io

2. CCBill

CCBill has been a cornerstone in the high-risk payment processing industry for over two decades, establishing itself as one of the most reliable and comprehensive payment gateways for adult sites. It offers an all-in-one solution that bundles a payment gateway, merchant account, and sophisticated subscription management tools into a single, cohesive platform. This integrated approach simplifies operations for businesses in the adult entertainment, online dating, and camming sectors by eliminating the need to manage multiple vendors for processing and billing.

What makes CCBill a top choice is its deep-seated expertise in handling the specific compliance and risk challenges of the adult industry. The platform ensures merchants are set up with the correct high-risk Merchant Category Codes (MCCs), a critical step for long-term account stability. Its robust system is designed to optimize recurring revenue, featuring one-click payments and automated rebilling tools that help maximize customer lifetime value. Furthermore, CCBill supports global expansion with multi-currency processing, ACH payments for US customers, and full compliance with European regulations like PSD2 and 3-D Secure.

Key Features and Pricing

CCBill’s feature set is tailored for high-volume, high-risk e-commerce, offering tools that directly address common pain points for adult businesses.

- Comprehensive Account Setup: Provides adult merchant accounts with no minimum or maximum processing volume requirements.

- Subscription Optimization: Advanced tools for managing recurring payments, trials, and customer retention.

- Global Payment Acceptance: Accepts payments in multiple currencies and offers localized payment methods to cater to an international audience.

- Advanced Fraud Prevention: Utilizes proprietary tools like VScrub and Web Verify to mitigate fraud and reduce chargebacks.

- Dedicated Support: Offers 24/7/365 support for both merchants and their end-users, which is vital for resolving consumer billing issues promptly.

Pricing is higher than mainstream processors, reflecting its high-risk specialization. Rates can vary based on business model, volume, and risk profile, and merchants may be subject to a rolling reserve.

| Feature | Details |

|---|---|

| Merchant Account | Specialized for adult MCCs |

| Global Reach | Multi-currency, ACH, and localized methods |

| Security | PSD2 & 3-D Secure compliant |

| Support | 24/7/365 for merchants and consumers |

Pros:

- Extensive experience and compliance expertise in the adult industry.

- End-to-end platform reduces the complexity of managing multiple vendors.

- Well-documented integrations with popular adult CMS and shopping cart software.

Cons:

- Pricing is higher compared to low-risk payment processors.

- Some third-party reviews mention issues with consumer disputes.

For more information, visit the official website: https://www.ccbill.com/

3. Segpay

Segpay has carved out a niche as a specialized payment processor for digital content merchants, with a strong focus on the adult, cam, and online dating industries. It operates as both a payment facilitator and gateway, providing US and EU-based merchants with a streamlined solution that includes underwriting, subscription billing, and robust fraud prevention tools. Segpay's strength lies in its deep understanding of high-risk business models, ensuring merchants are correctly set up to handle recurring revenue and manage the complex compliance requirements of the adult sector.

What distinguishes Segpay is its commitment to rapid onboarding and transparency. The platform boasts approval timelines of just 24-72 hours after KYC submission, a significant advantage for businesses eager to start processing. It manages all necessary card brand registrations and leverages multiple acquiring relationships to ensure payment stability. Segpay’s system is fortified with 3-D Secure and sophisticated fraud history checks, providing a secure environment for transactions. This combination of speed, compliance, and security makes it one of the best payment gateways for adult sites seeking a reliable, long-term partner.

Key Features and Pricing

Segpay’s feature set is designed to support the operational needs of high-risk online businesses, emphasizing compliance, security, and merchant support.

- High-Risk Onboarding: Specialized adult and dating merchant accounts with comprehensive onboarding support and compliance checklists.

- Advanced Security: Full implementation of 3-D Secure and internal fraud history checks to minimize risk and chargebacks.

- Reliable Payouts: Offers weekly settlements with short payout delays, ensuring consistent cash flow for merchants.

- Global Licensing: Holds both US and EU licenses (including FCA and CBI authorizations), backed by multiple acquiring bank relationships for redundancy.

- Transparent Support: Provides a dedicated merchant helpdesk and a portal with clear, accessible information on fees and reserves.

Pricing is custom-quoted based on the merchant's specific business model, processing volume, and risk profile. Merchants should anticipate a rolling reserve (typically 5% held for six months) and high-risk registration fees from Visa and Mastercard.

| Feature | Details |

|---|---|

| Merchant Account | Specialized for adult, dating, and cam models |

| Onboarding Speed | Fast approvals, typically within 24–72 hours |

| Security | 3-D Secure and advanced fraud screening |

| Payouts & Reserves | Weekly settlements, transparent reserve policy in portal |

Pros:

- Purpose-built for the high-risk profiles of the adult and dating industries.

- Strong regulatory and compliance posture with both EU and US authorizations.

- Clear and upfront communication regarding reserves and settlement schedules.

Cons:

- A rolling reserve and high-risk card scheme registration fees are standard.

- Pricing is not standardized and is quoted on a per-merchant basis.

For more information, visit the official website: https://segpay.com/

4. Epoch

Epoch has carved out a significant niche as an Internet Payment Service Provider (IPSP) and third-party facilitator, making it a go-to choice for adult content creators, membership sites, and video-on-demand platforms. For over two decades, it has specialized in managing payments for high-risk businesses, offering a streamlined solution that combines a payment gateway and processing under one roof. This model simplifies the onboarding process, as merchants often don't need to secure a separate high-risk merchant account, making it one of the best payment gateways for adult sites just starting out.

Epoch's strength lies in its deep understanding of subscription-based revenue models, which are prevalent in the adult industry. The platform is engineered to handle recurring billing, one-click payments, and complex membership tiers with ease, helping merchants maximize customer retention and lifetime value. Its global infrastructure supports multi-currency pricing and localized payment options, allowing businesses to cater to an international audience seamlessly. By acting as the merchant of record, Epoch also handles many of the complexities of consumer billing support and compliance.

Key Features and Pricing

Epoch’s feature set is built to support the high-volume, recurring transaction models common in the adult entertainment space, providing essential tools for sustainable growth.

- Simplified Onboarding: As a payment facilitator, Epoch provides a faster and simpler setup process compared to traditional merchant account applications.

- Robust Subscription Management: Advanced tools for managing recurring and one-click billing, trials, and membership plans.

- Global Payment Processing: Offers multi-currency pricing and localized payment methods to capture a worldwide customer base.

- Flexible Payouts: Provides merchants with reliable biweekly or weekly payout schedules and detailed reporting tools.

- Consumer Self-Service: Includes tools for customers to manage their own subscriptions, look up transactions, and handle cancellations, reducing merchant support load.

Pricing is provided on a quote-based model and is not publicly listed. Rates will depend on the business model, processing volume, and overall risk profile.

| Feature | Details |

|---|---|

| Account Type | Payment Facilitator (IPSP) |

| Primary Focus | Subscriptions, Memberships, VOD |

| Payouts | Weekly or Biweekly schedules |

| Consumer Support | Self-service portal & direct billing support |

Pros:

- Longstanding reputation and extensive experience in the adult industry.

- The facilitator model simplifies the onboarding process for new or smaller businesses.

- Excellent tools for managing subscriptions and recurring revenue streams.

Cons:

- Pricing is not transparent and requires direct consultation.

- Some online consumer reviews mention disputes related to trial periods and renewals.

For more information, visit the official website: https://www.epoch.com/

5. Verotel

Verotel stands out as a pioneering Internet Payment Service Provider (IPSP) specializing in high-risk industries since 1998. With an official Electronic Money Institute (EMI) license from the Dutch Central Bank, it offers a secure and regulated environment for over 50,000 adult merchants. Verotel simplifies payment processing by acting as a third-party aggregator, meaning merchants don't need their own high-risk merchant account. This model is particularly beneficial for businesses that struggle to secure traditional banking relationships.

What makes Verotel one of the best payment gateways for adult sites is its transparent approach and broad acceptance criteria. Unlike many competitors that have opaque pricing, Verotel publicly lists its rates, allowing merchants to forecast costs accurately. Its platform is designed for global reach, supporting multi-currency transactions and offering weekly payouts to help businesses maintain healthy cash flow. By handling all PCI compliance requirements within its fee structure, Verotel removes a significant technical and financial burden from its clients, allowing them to focus on content and marketing.

Key Features and Pricing

Verotel’s feature set is built to support the diverse needs of the adult entertainment industry, from one-time purchases to complex subscription models.

- Hosted Payment Solutions: Offers secure, PCI-compliant hosted payment forms and dynamic payment options like FlexPay for flexible billing.

- Subscription & Affiliate Tools: Includes integrated subscription management and robust affiliate marketing tools to help merchants scale their operations.

- Global Payouts: Provides weekly settlements in multiple currencies, ensuring merchants around the world get paid quickly and reliably.

- EU Regulatory Compliance: As a licensed EMI, it provides a high level of security and fund safeguarding under strict European financial regulations.

Pricing is transparently published on its website, a rarity in the high-risk space. Rates are higher than dedicated merchant accounts, but there are no long-term contracts. A typical rolling reserve of 10% held for six months is applied, which can impact initial cash flow for new merchants.

| Feature | Details |

|---|---|

| Merchant Account | Third-party aggregator model (no MID needed) |

| Global Reach | Multi-currency processing with weekly payouts |

| Security | PCI compliance included; EMI licensed in the EU |

| Support | Specialized support for high-risk merchants |

Pros:

- Transparent, published pricing plans uncommon among high-risk peers.

- Can onboard hard-to-place adult business models.

- No long-term contracts and typical weekly settlements.

Cons:

- Higher transaction rates and rolling reserves compared to dedicated merchant accounts.

- Rolling reserve often 10% for 6 months impacts cash flow for new merchants.

For more information, visit the official website: https://www.verotel.com/

6. NETbilling

NETbilling stands out in the high-risk processing space by offering a flexible, PCI-certified payment gateway that can be paired with a dedicated merchant account. Since 1996, it has provided a robust solution for adult e-commerce businesses that need greater control over their payment infrastructure. Unlike all-in-one providers, NETbilling allows merchants to own their customer data and have direct relationships with acquiring banks, offering more autonomy over fraud rules, payment descriptors, and overall cost management. This model is ideal for established businesses wanting to optimize their processing strategy.

What makes NETbilling a powerful choice among payment gateways for adult sites is its blend of a sophisticated gateway with merchant account sourcing. The platform’s strength lies in its customizable fraud-scrubbing technology, which allows businesses to fine-tune rules to match their specific risk tolerance, thereby reducing chargebacks without sacrificing sales. It also supports modern payment methods like ACH, Apple Pay, and Google Pay, ensuring a seamless checkout experience for a diverse customer base. With detailed real-time reporting and optional 24/7 consumer support, NETbilling equips merchants with the tools needed for scalable growth.

Key Features and Pricing

NETbilling's feature set is designed for merchants who require granular control and comprehensive reporting to manage their adult business effectively.

- Gateway & Merchant Account Combo: Provides a payment gateway compatible with hundreds of shopping carts and helps secure direct merchant accounts with global partner acquirers.

- Customizable Fraud Tools: Advanced fraud scrubbing allows merchants to set their own rules and thresholds for transaction screening.

- Modern Payment Options: Supports ACH, Apple Pay, and Google Pay in addition to standard credit card processing.

- Comprehensive Support: Offers 24/7/365 merchant support and optional inbound call center services for end-user customer service.

- In-Depth Reporting: Real-time reporting tools give merchants deep insights into transaction data and sales performance.

Pricing is not publicly listed as it depends on the combination of the gateway and the specific acquiring bank's rates. However, NETbilling typically has no setup or application fees, with volume-based and tiered discounts available.

| Feature | Details |

|---|---|

| Merchant Account | Direct relationships with global acquiring banks |

| Customization | Full control over fraud rules & payment descriptors |

| Compatibility | Integrates with hundreds of shopping carts |

| Support | 24/7/365 merchant and optional consumer support |

Pros:

- Greater control over data, descriptors, and fraud management than many all-in-one providers.

- Typically no setup or application fees, with discounts for higher volume.

- Flexibility to use the NETbilling gateway with a dedicated merchant account for cost control.

Cons:

- Requires underwriting approval from an acquiring bank, which is not guaranteed.

- Pricing details are not fully public and vary based on the merchant's bank and gateway setup.

For more information, visit the official website: https://www.netbilling.com/

7. PaymentCloud

PaymentCloud operates as a specialized merchant account provider, carving out a niche in the high-risk payment processing landscape. Instead of being a direct processor, they act as an essential matchmaker, connecting adult businesses with a broad network of acquiring banks and payment gateways that are willing to underwrite their specific business models. This approach is invaluable for merchants in ecommerce, streaming, online dating, and creator platforms who have struggled to find stable processing through mainstream channels. Their service focuses on securing dedicated merchant accounts tailored to the unique compliance and risk profiles of the adult industry.

What distinguishes PaymentCloud is its personalized, high-touch approach to account placement. They don't offer a one-size-fits-all solution; instead, their team provides hands-on assistance throughout the underwriting process, from document submission to integration. This includes pairing merchants with compatible payment gateways and providing access to sophisticated chargeback and fraud prevention tools. By leveraging their extensive banking relationships, PaymentCloud successfully places businesses that are often automatically declined elsewhere, making them a critical ally for navigating the complexities of high-risk payment processing.

Key Features and Pricing

PaymentCloud’s service is built around providing customized and stable payment solutions for high-risk merchants, ensuring they get the right tools for long-term growth.

- High-Risk Underwriting Expertise: Specializes in securing merchant accounts for various adult business models, including ecommerce, streaming, and dating sites.

- Omnichannel Payment Support: Facilitates online, retail, and MOTO (Mail Order/Telephone Order) payments, along with modern options like ACH/eCheck and cryptocurrency.

- Integration and Compliance Guidance: Offers personalized assistance for integrating with popular shopping carts and CRM systems and provides guidance on regulations like 2257.

- Fast Approval Turnaround: Aims for an approval timeframe of 2–7 business days after all necessary documentation has been submitted.

Pricing is entirely quote-based and depends heavily on the specific business model, processing history, and perceived risk. Merchants should also anticipate potential card-brand registration fees for high-risk accounts.

| Feature | Details |

|---|---|

| Merchant Account | Custom placement with adult-friendly banks |

| Payment Options | Omnichannel including crypto and ACH/eCheck |

| Integration | Personalized support for carts and CRMs |

| Support | Dedicated account management |

Pros:

- High approval rates due to a broad network of partner banks and processors.

- Personalized integration support and account management tailored to adult niches.

- Potential for lower effective rates as the business grows and establishes a positive processing history.

Cons:

- Pricing is not transparent and is determined on a case-by-case basis.

- High-risk accounts often come with additional costs, like annual card-brand registration fees.

For more information, visit the official website: https://paymentcloudinc.com/adult/

Top 7 Payment Gateways Comparison

| Item | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| ATLOS Crypto Payment Gateway | Low to moderate; minimal coding, web3 wallet integration | Basic development resources; self-hosted option | Instant crypto payment acceptance, no KYC delays | Crypto payments for hosting, VPN, gaming, casinos | No KYC, wide crypto support, white-label, recurring payments |

| CCBill | Moderate; integrates with shopping carts and CMS | Merchant account setup, ongoing management | Reliable adult industry payments, subscription billing | Adult, cam, dating, subscription services | Established adult experience, all-in-one platform, fraud tools |

| Segpay | Moderate; requires underwriting and KYC | Onboarding support, compliance resources | Fast approval, secure high-risk payments | Adult, cam, dating merchants | High-risk specialization, strong compliance, clear fees |

| Epoch | Low; facilitator model simplifies onboarding | Minimal upfront technical setup | Recurring and one-time billing for adult sites | Adult subscriptions, memberships, VOD | Easy onboarding, subscription tools, global coverage |

| Verotel | Moderate; hosted checkout solution | Compliance efforts, PCI, EU regulations | Secure payments with weekly settlements | High-risk adult content and subscriptions | Transparent pricing, PCI compliance, no long contracts |

| NETbilling | Moderate; requires underwriting approval | Merchant account and gateway setup | Control over fraud, payment descriptors | Adult ecommerce needing customizable gateway | Fraud customization, strong reporting, merchant bank links |

| PaymentCloud | Moderate to high; underwriting and account placement | Dedicated account management and integration | Approved high-risk merchant accounts | Adult ecommerce, streaming, dating, creators | Wide bank network, personalized support, high-risk approvals |

Making Your Final Decision: Key Factors to Consider

Navigating the landscape of payment processing for high-risk industries can feel complex, but selecting the right partner is the cornerstone of a sustainable and profitable adult business. Throughout this guide, we’ve explored a curated list of the best payment gateways for adult sites, from established industry players like CCBill and Segpay to innovative crypto solutions like ATLOS. The key takeaway is that there is no one-size-fits-all answer; the optimal choice depends entirely on your specific business needs, technical setup, and long-term vision.

Your journey to finding the perfect payment partner begins with a clear internal audit. A subscription-based platform has vastly different requirements than a live cam site or a pay-per-view content store. By defining your core business model first, you can immediately narrow down the options and focus on providers that excel in your specific niche.

Final Checklist for Choosing Your Gateway

Before signing any contract, run through this final checklist to ensure you've covered all critical angles. This systematic approach will help you compare options objectively and make an informed decision that aligns with your operational goals.

- Business Model Alignment: Does the gateway specialize in your model? For instance, Segpay and Epoch are known for their robust recurring billing engines, making them ideal for subscription services.

- Compliance and Risk Management: Verify that the provider explicitly supports adult merchant category codes (MCCs). Inquire about their specific procedures for handling industry regulations like 2257 and their approach to chargeback mitigation.

- Pricing and Fee Structure: Look beyond the advertised rates. Ask for a complete fee schedule, including setup fees, monthly minimums, and reserve requirements. Furthermore, a clear understanding chargeback fees and its causes is essential to avoid unexpected costs and select a partner with transparent policies.

- Integration and Technical Support: Evaluate the gateway’s API documentation and available plugins. If you lack in-house development resources, a solution like PaymentCloud with pre-built integrations can save significant time and money.

- Autonomy and Financial Control: For businesses seeking to escape the volatility of traditional high-risk processing, a decentralized option is paramount. A crypto gateway like ATLOS puts you in direct control of your funds, eliminating the risk of holds, freezes, and sudden account terminations that plague the industry.

Ultimately, the best payment gateway for your adult site is a true partner, one that provides the stability, features, and support you need to thrive. By carefully weighing these factors, you can build a resilient payment infrastructure that scales with your success and protects your revenue in a demanding market.

Ready to take full control of your revenue and eliminate the risks of traditional high-risk processing? Explore the ATLOS Crypto Payment Gateway to see how our non-custodial, censorship-resistant solution can empower your adult business. Visit the ATLOS Crypto Payment Gateway website to learn more and get started today.