Fiat Currency vs Cryptocurrency A Definitive Guide

This guide cuts through the noise to directly compare fiat currency—the government-issued money in your wallet, like the US Dollar—with cryptocurrency, its decentralized digital counterpart. Fiat’s value is pinned to government trust and economic stability, while crypto’s worth comes from cryptographic security and the power of its distributed network.

We're going to unpack the fundamental differences between these two systems, exploring the classic clash between centralized control and decentralized innovation. By the end, you'll have a much clearer picture of which system is better suited for different financial situations.

Understanding the Battle for Your Wallet

The entire global financial system is built on fiat currency, a model where money has value simply because a government says it does. The cash in your pocket or the balance in your bank account isn't backed by a physical commodity like gold; it's backed by the full faith and credit of the government that issued it.

This system isn't new. Governments have long created currencies disconnected from physical assets to give them more control over their economies. The U.S. dollar, for instance, became a full-fledged fiat currency in 1971 when it officially abandoned the gold standard, a decision driven by the need for a more flexible monetary policy. You can find more details on this historic shift over at 101blockchains.com.

Cryptocurrency, on the other hand, operates on a completely different philosophy. It’s a digital or virtual asset that uses cryptography to secure transactions, making it almost impossible to counterfeit or double-spend. Unlike fiat, which is managed by central banks, cryptocurrencies like Bitcoin and Ethereum are decentralized.

This is the crux of the matter: The fiat vs. crypto debate really boils down to who is in control. Fiat is centralized and managed by government bodies, while cryptocurrency is decentralized and governed by its community through technology.

This decentralization is made possible by blockchain technology, which is essentially a shared, immutable ledger maintained by a global network of computers. This design removes the need for a traditional middleman, like a bank, to verify transactions or print new money.

Foundational Differences at a Glance

To really get a handle on how these two systems work, it helps to see them side-by-side. One is a physical and digital system run by human institutions; the other is a purely digital one run by code. This table breaks down their most critical distinctions.

| Feature | Fiat Currency | Cryptocurrency |

|---|---|---|

| Control | Centralized (Governments & Central Banks) | Decentralized (Distributed Network) |

| Issuance | Unlimited, controlled by monetary policy | Often limited and algorithmically defined |

| Form | Physical (cash) and Digital (bank balances) | Exclusively Digital |

| Value Basis | Government trust and economic stability | Network adoption and cryptographic security |

| Transaction Validation | Financial institutions (banks, processors) | Network participants (miners/validators) |

Comparing Core Mechanics and Control

The biggest difference when you pit fiat currency vs cryptocurrency against each other comes down to a single word: control. Fiat currencies, like the U.S. dollar or the Euro, are built on a centralized, top-down model. Governments and their central banks call the shots, managing the money supply and green-lighting transactions.

Cryptocurrencies completely flip that script. They run on decentralized networks where power is spread out among all the users. Instead of institutional rules, the system is governed by code. This fundamental split creates two totally different financial worlds, and understanding how they work is key to seeing their real-world impact on all of us.

Centralization Versus Distributed Ledgers

Fiat currency is all about centralization. A central authority, like the U.S. Federal Reserve, has the power to create new money, adjust interest rates, and steer the economy. Your local bank acts as a middleman, holding your money and recording your transactions on their private ledgers.

This setup provides clear accountability, but it also concentrates immense power within a few key institutions. Their decisions can stabilize an economy, but they can also trigger inflation that erodes the value of your savings.

Cryptocurrency, on the other hand, is built on decentralization. It uses distributed ledger technology—usually a blockchain—which is just a shared, tamper-proof transaction record maintained by computers all over the world. No single person or group owns it, which makes it incredibly resistant to censorship or manipulation.

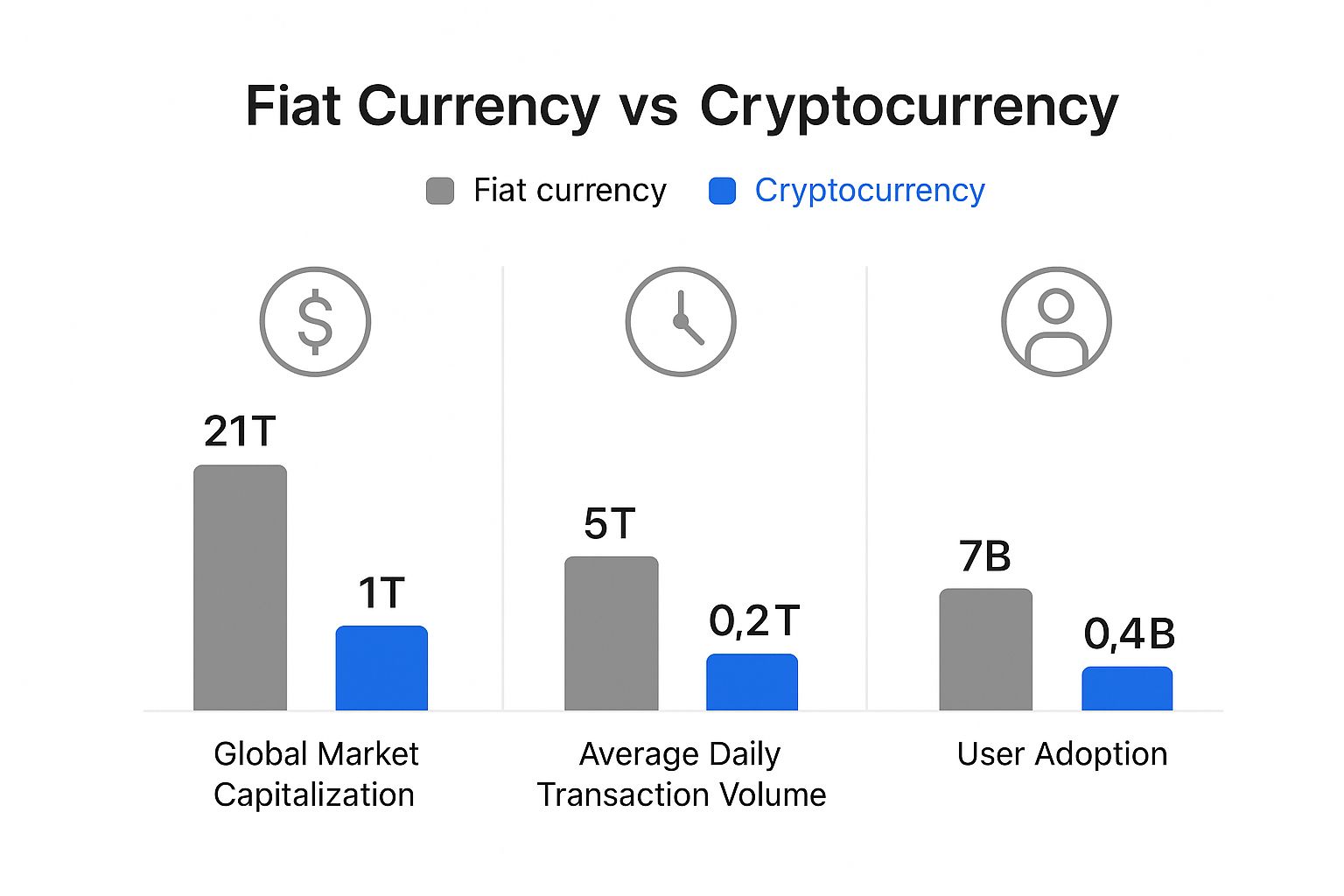

The infographic below gives a great visual of the scale of these two systems, stacking them up by market size, transaction volume, and user base.

While fiat clearly has a massive head start, the data shows that cryptocurrency has carved out a significant and expanding niche in global finance.

To boil it down, here’s a quick look at the core differences.

Fiat vs. Cryptocurrency At a Glance

| Attribute | Fiat Currency | Cryptocurrency |

|---|---|---|

| Control | Centralized (Governments & Central Banks) | Decentralized (Distributed Network) |

| Issuance | Unlimited, set by policy decisions | Often finite, controlled by algorithms |

| Form | Physical (cash/coins) & Digital (bank balances) | Exclusively Digital (entries on a ledger) |

This table simplifies the high-level distinctions, but the real impact is in how these currencies are created and managed day-to-day.

Issuance: Government Printing vs. Algorithmic Scarcity

The way new money is born is another major dividing line. With fiat, central banks can essentially "print" more money or create it digitally out of thin air to fund government programs or stimulate the economy. There’s no hard limit, making it subject to political winds and policy shifts.

For instance, during a recession, a government might pump billions of new dollars into the system. The goal is to help, but a major side effect is that it can devalue the money already in circulation, which we feel as inflation.

Most cryptocurrencies are designed with algorithmic scarcity. Their supply is baked into the code from day one. Bitcoin is the classic example, with its hard-coded cap of 21 million coins. New bitcoins are released at a predictable and decreasing rate through a process called mining. This makes its supply transparent and immune to a last-minute policy change.

Form: Physical Notes vs. Digital Keys

Fiat currency is tangible. You can hold cash in your hand or access a digital version through your bank. Even when it’s digital, however, a financial institution is always in the middle, controlling your access to it.

Cryptocurrency is purely digital. It doesn't exist as a physical coin or bill but as an entry on the blockchain. Your ownership isn't tied to a bank account; it's proven by your digital keys. To dig a bit deeper into the mechanics, it’s helpful to understand what constitutes a cryptocurrency token and its distinction from a coin. This model of "self-custody" puts you in direct control of your money, no bank required.

Navigating Volatility and Value Stability

When you pit fiat currency vs cryptocurrency, one of the starkest contrasts comes down to stability. Fiat money, like the U.S. Dollar or the Euro, is designed for predictability. Its value doesn't typically swing wildly overnight.

This relative calm isn't an accident. It’s the direct result of central banks actively managing monetary policy. By tweaking interest rates and controlling the money supply, these institutions work to keep inflation in check and maintain a steady economic course, giving people and businesses the confidence to make long-term financial plans.

The Wild Swings of Crypto

Cryptocurrencies operate in a completely different world. They are famous—or infamous—for their dramatic price movements. Without a central authority to act as an anchor, their value is at the mercy of raw market supply and demand, which makes for a very bumpy ride.

So, what fuels these price swings? It boils down to a few key things:

- Speculative Trading: A huge portion of crypto trading is driven by speculation. Traders are betting on future price changes, which can create massive, sentiment-driven shifts in value in a short amount of time.

- Regulatory News: Even a rumor of a government crackdown or a new regulation can send shockwaves through the market, causing prices to plummet or surge.

- Technological Updates: A successful network upgrade can boost confidence and price, while a security flaw can have the opposite effect, often instantly.

We saw this play out with Bitcoin in its early days. Back in late 2013, a frenzy of speculative interest pushed its price to around $1,200 a coin. But that peak came with breathtaking volatility, prompting China’s central bank to declare it wasn't legal tender and warn everyone of the risks. Dealing with this kind of volatility requires smart financial planning; for instance, a good crypto tax loss harvesting guide can be invaluable for managing your portfolio.

The Exceptions to the Rule

But the story isn't quite that simple. We can't just say "fiat is stable, crypto is not." History has shown us plenty of fiat currencies that have collapsed under the weight of hyperinflation, often due to government mismanagement. Just look at the Venezuelan Bolívar, a recent and tragic example of a national currency becoming nearly worthless.

On the flip side, the crypto world has engineered its own solution to volatility: stablecoins. These are digital assets designed to maintain a stable value by pegging themselves to a fiat currency, like the U.S. dollar, effectively creating a bridge between the two financial systems.

Transaction Speed, Security, and Cost: A Head-to-Head Comparison

When you're trying to send money, what really matters? How fast it gets there, how safe the process is, and how much it’s going to cost you. This is where fiat and crypto really start to show their differences. The right choice often comes down to what you're trying to accomplish, as both systems have their own unique mix of strengths and weaknesses.

Think about fiat for a moment. Sending money can be lightning-fast or frustratingly slow. If you’re using a modern payment app like Zelle or India's UPI network, your transfer is practically instant and costs next to nothing. But if you’re trying to send an international wire transfer, you're back in the slow lane—it can easily take 3-5 business days to clear as it bounces between intermediary banks, each one adding its own delay and fee.

The Real Speed of a Transaction

Cryptocurrency operates on a completely different clock. We don't talk about business days; we talk about block confirmation times. This is the time it takes for a new "block" of transactions to be permanently added to the blockchain ledger. For Bitcoin, that's about 10 minutes per block. For a transaction to be considered truly secure, most exchanges wait for six confirmations, which means you're looking at an hour for final settlement.

Of course, not all crypto is created equal. Newer networks like Solana or Polygon were built for high throughput and can often confirm transactions in just a few seconds. The catch? Even these super-fast networks can get bogged down when demand spikes.

Network congestion is the crypto world's version of rush-hour traffic. When everyone piles in at once, the network slows to a crawl, and fees can spike as users start bidding against each other to get their transactions processed first.

What Does It Actually Cost to Send Money?

Transaction costs are another area where these two financial systems are worlds apart. With fiat, the fees are usually straightforward. A domestic wire transfer might have a flat $25 fee, and when you swipe your debit card, the merchant typically absorbs the processing cost.

In crypto, transaction fees (known as "gas") are completely dynamic. They aren't based on how much money you send but on how busy the network is at that moment. This can lead to some pretty strange outcomes:

- Large International Transfers: You could send $100,000 across the globe for just a few dollars in crypto fees. A traditional bank might charge you a percentage, potentially costing hundreds or even thousands.

- Small, Everyday Payments: On the flip side, during peak congestion on the Ethereum network, a simple $10 transaction could temporarily cost $50 or more in gas fees, which makes it totally impractical for buying a cup of coffee.

A Tale of Two Security Models

At their core, the security approaches for fiat and crypto are fundamentally different. One relies on institutions to protect you, while the other puts the responsibility squarely on your shoulders.

Fiat Security:

- The Institutional Safety Net: Banks and credit card companies pour massive resources into fraud detection and security systems to protect their customers.

- Consumer Protection Laws: Regulations like the Electronic Fund Transfer Act in the U.S. give you a legal framework to dispute fraudulent charges and get your money back.

- The Centralized Honey Pot: While well-protected, this system relies on centralized databases that are prime targets for large-scale data breaches.

Cryptocurrency Security:

- You Are Your Own Bank: Your security is entirely in your hands. It's up to you to protect your private keys, because if they're lost or stolen, your funds are gone for good.

- Final and Irreversible: Once a transaction is confirmed on the blockchain, it cannot be reversed. There’s no customer service line to call if you make a mistake or get scammed.

- The Strength of Decentralization: Because the ledger is distributed across thousands of computers worldwide, it's incredibly difficult for any single person or group to compromise the entire network.

Ultimately, fiat provides a familiar sense of security and convenience backed by regulated institutions, making it the go-to for most daily transactions. Crypto, however, shines in situations where you need to move money across borders quickly and cheaply, but it demands a much higher degree of personal vigilance.

When we step away from the technical specs and look at how these currencies are used in the real world, the stories of fiat and crypto couldn't be more different.

Fiat currency is, without a doubt, the bedrock of the global economy. Its adoption isn't just a matter of being widely accepted; it's a fundamental, deeply integrated part of our lives.

Think about it: every time you get a paycheck, pay your taxes, or just buy a carton of milk, you're operating within the fiat system. This universal acceptance is its killer feature, giving us a stable and predictable foundation for everything from international trade to our personal finances. It's so essential that we rarely even think about it.

Where Crypto Is Gaining Ground

Cryptocurrency, on the other hand, is a different beast entirely. Its adoption is far more deliberate and niche. While you probably aren't buying your morning coffee with Bitcoin just yet, crypto is making serious inroads in areas where it offers a clear advantage over the old guard.

For many, crypto's main role is as a high-risk, high-reward investment. People all over the world are putting money into assets like Bitcoin and Ethereum, speculating on their future value and the potential of their underlying technology. This investment activity is a huge driver of the crypto market.

But it's not just about speculation. Crypto has become a lifeline for cross-border remittances, particularly in countries with limited banking infrastructure. Sending money overseas through a bank can be painfully slow and surprisingly expensive. Cryptocurrencies provide a much faster, and often cheaper, way for people to send funds directly to one another, cutting out the middlemen.

The key thing to understand is that crypto isn't trying to replace the dollar for your everyday spending. Right now, its strength lies in solving specific problems the traditional financial system can't—or won't—address efficiently.

Unpacking DeFi and Regional Trends

Perhaps the most exciting application is crypto’s role as the engine for Decentralized Finance (DeFi). This whole new ecosystem is using blockchain to build an alternative to traditional financial services—think lending, borrowing, and trading, all without a bank. These DeFi platforms run entirely on cryptocurrencies, creating a parallel financial universe.

What's really fascinating is how adoption varies from one place to another. In emerging markets, you often see much higher trading activity relative to their GDP than in developed nations. A deep dive into Bitcoin transactions revealed that over 70% of volume on peer-to-peer exchanges involved parties using the same local fiat currency, pointing to a strong connection between local economic pressures and crypto adoption.

You can check out the full study on global Bitcoin trading patterns for yourself. It shows that crypto’s appeal isn't a one-size-fits-all phenomenon; it's shaped by the unique economic needs and challenges people face around the world.

When to Use Fiat vs. When to Use Crypto

Choosing between fiat and crypto isn't a zero-sum game. It's not about picking an absolute winner in the fiat currency vs cryptocurrency debate. Instead, think of it like choosing the right tool for a specific job. Each financial system has its own set of strengths, tailored for different goals and situations.

The real question isn't "which is better?" but rather, "which is better for this specific task?" This framework helps turn a complex comparison into simple, practical advice. Knowing when to rely on the stability of traditional money versus when to tap into the unique power of digital assets is a critical skill. For the foreseeable future, these two systems will coexist, so understanding how to use both effectively is key.

When Fiat Remains the Smart Choice

For the vast majority of your daily financial life, fiat currency is still king. Its stability, universal acceptance, and the safety net of government regulation make it the go-to for situations where you can't afford any surprises.

Here are a few common-sense scenarios where sticking with fiat is the way to go:

- Daily Spending and Budgeting: When you're buying groceries, paying rent, or just trying to stick to a monthly budget, the predictable value of a currency like the U.S. dollar is essential. You don’t want the value of your paycheck to drop by 10% before your bills are due.

- Tax Payments and Official Obligations: This one's non-negotiable. Governments demand taxes in their official fiat currency. There’s no way around it; it's the required medium for all your civic financial duties.

- Low-Risk Savings and Emergency Funds: If you need your money to be safe, secure, and ready at a moment's notice, nothing beats a traditional, insured bank account. Your emergency fund is protected from wild market swings, giving you peace of mind that it will be there when you actually need it.

Where Cryptocurrency Offers a Compelling Alternative

Cryptocurrency really comes into its own in areas where the old-school financial system is clunky, expensive, or just plain slow. Its biggest advantages are its borderless design, potential for incredible growth, and its role as the fuel for a new generation of financial tools.

Cryptocurrency isn't trying to replace your debit card for buying coffee. Its true power lies in doing things fiat simply can't—like sending money across the globe for a few cents or building financial systems that run entirely on code.

Here’s when it makes a lot more sense to turn to crypto:

- High-Growth Investment: If you have a high tolerance for risk and are looking for returns you just can't find in traditional markets, cryptocurrencies offer that potential.

- International Remittances: Sending money to family or colleagues overseas can be a game-changer with crypto. It often sidesteps the slow, expensive process of wire transfers and intermediary banks, making it both faster and cheaper.

- Engaging with Decentralized Finance (DeFi): Want to experiment with the future of finance? To get involved in DeFi applications for lending, borrowing, or earning yield on your assets, you’ll need cryptocurrency to participate.

Frequently Asked Questions

When you dig into the whole fiat vs. cryptocurrency conversation, a few questions always seem to pop up. Let's tackle some of the most common ones head-on.

Is Cryptocurrency Really Going to Replace Fiat Money?

It’s a long shot, at least anytime soon. While crypto brings some incredible ideas to the table, like decentralization and cheap international payments, its wild price swings and current technical hurdles make it a tough sell for your daily coffee run. Stability is king for everyday transactions, and that's where fiat still wins.

Most experts don't see an "either/or" future. Instead, they imagine a world where both systems operate side-by-side, playing to their strengths. Fiat will probably stick around for daily commerce and government operations, while crypto carves out its niche as a serious investment asset and the plumbing for new financial technologies.

The real endgame for crypto might not be about replacing fiat at all. It’s more likely about integration—creating a new set of financial tracks that run parallel to the old system, offering a powerful alternative.

Where Do Stablecoins Fit Into All of This?

Stablecoins are the bridge between these two worlds. Think of them as a fascinating hybrid: they're cryptocurrencies, but their value is tied—or "pegged"—to a stable asset, most often a major fiat currency like the U.S. dollar. This simple trick gives them the best of both worlds: the speed and global reach of crypto, without the gut-wrenching volatility of something like Bitcoin.

Because they hold a steady value, stablecoins have become the lifeblood of the crypto ecosystem. They're essential for trading on exchanges and are a cornerstone of decentralized finance (DeFi). In short, they deliver on one of money's most critical jobs—being a reliable unit of account—that most other cryptos just can't.

Which Is Safer: My Bank Account or My Crypto Wallet?

This is a great question because their security models are polar opposites. Your bank account is wrapped in layers of institutional protection. You've got passwords and 2FA, sure, but behind that are bank security teams, federal insurance (like the FDIC in the U.S.), and consumer protection laws. If fraud happens, there's a clear process to get your money back. The bank shoulders most of the risk.

With a crypto wallet, you are the bank. The security of the blockchain itself is incredibly robust, but the responsibility for safeguarding your assets is 100% on you. You alone control your private keys. If you lose them, get hacked, or send funds to the wrong address, there's no customer service line to call. In most cases, those funds are just gone for good.