7 Best Companies Similar to Stripe for Payments in 2025

Stripe has long been a go-to for online payment processing, celebrated for its developer-friendly APIs and solid infrastructure. However, as digital commerce matures, many businesses are seeking alternatives that better fit their specific needs, whether that means lower transaction fees, faster onboarding, better global reach, or support for emerging payment methods like cryptocurrency. If you're searching for companies similar to Stripe, you need a solution that not only matches its reliability but also provides distinct advantages tailored to your operations. This guide is designed for businesses, including hosting providers, VPNs, and high-risk merchants, that are ready to explore powerful payment processing alternatives.

We will break down the top contenders, comparing them on crucial factors like pricing structures, feature sets, onboarding speed, and their approach to crypto payments. Our goal is to help you identify the perfect fit for your business, whether you operate a DAO, gaming platform, or another specialized online service. Each review offers a detailed analysis to move beyond the marketing claims, providing practical insights, screenshots, and direct links to help you make an informed decision. This roundup will pay special attention to ATLOS, a crypto-native gateway offering a compelling proposition for businesses ready to embrace the future of finance. We'll delve into seven leading payment platforms, giving you the clarity needed to choose a payment partner that fuels growth instead of creating friction.

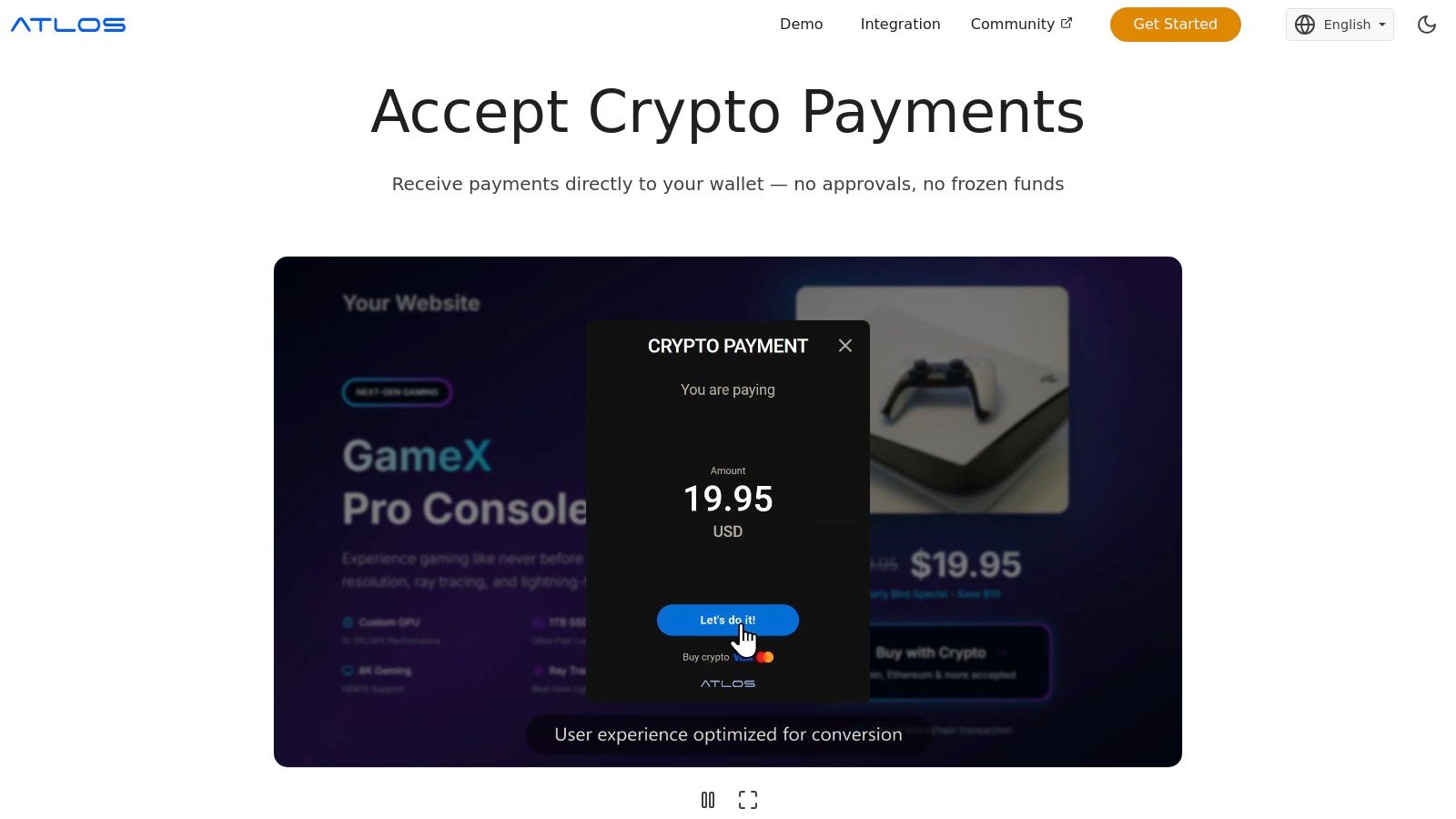

1. ATLOS Crypto Payment Gateway

ATLOS Crypto Payment Gateway emerges as a powerful and highly specialized alternative for businesses looking to integrate cryptocurrency payments seamlessly. While many companies similar to Stripe are expanding into crypto, ATLOS is a native web3 solution built from the ground up to prioritize decentralization, merchant autonomy, and rapid deployment. It is particularly compelling for merchants in high-risk sectors, digital services like hosting and VPNs, and any business that values immediate access to funds without the friction of traditional financial intermediaries.

Key Differentiators and Use Cases

What truly sets ATLOS apart is its non-custodial, permissionless architecture. Unlike platforms that hold your funds, ATLOS facilitates direct peer-to-peer transactions from the customer's wallet to the merchant's wallet. This aligns with the core web3 ethos of "your keys, your crypto," ensuring you maintain full control over your assets at all times.

This model eliminates the need for lengthy KYC verification or account approvals, allowing businesses to start accepting payments almost instantly. For industries often scrutinized by traditional payment processors, such as online gaming, casinos, or adult entertainment, this frictionless onboarding is a game-changer.

In-Depth Feature Analysis

ATLOS provides a robust suite of tools designed for modern commerce:

- Self-Hosted White-Label Solution: Businesses can host the payment gateway on their own domain, fully customizing the interface to match their brand identity for a seamless user experience.

- Broad Cryptocurrency Support: It supports major cryptocurrencies like Bitcoin and Ethereum, plus tokens across various blockchains including Solana, Binance Smart Chain, and more, catering to a diverse customer base.

- Effortless Integration: A simple two-line JavaScript snippet enables integration, with dedicated plugins available for platforms like WooCommerce, Shopify, and WHMCS. It even supports Telegram Messenger mini-apps.

- Versatile Payment Tools: Beyond simple checkouts, ATLOS offers recurring payments for subscriptions, shareable payment links, and professional invoicing capabilities, all without requiring any integration.

A significant aspect of integrating crypto payments involves navigating the complexities of financial reporting. Merchants must be diligent in their bookkeeping, and understanding the nuances of dealing with cryptocurrency tax effectively is crucial for long-term compliance and financial health. While ATLOS simplifies the payment process, a solid accounting strategy remains a key business responsibility.

| Feature | ATLOS Crypto Payment Gateway | Traditional Fiat Gateways (e.g., Stripe) |

|---|---|---|

| Onboarding Speed | Instant (No KYC Required) | Days to Weeks (Requires Approval) |

| Fund Control | Non-Custodial (Direct to Wallet) | Custodial (Funds Held by Processor) |

| Chargebacks | No Chargeback Risk | Chargeback Risk Present |

| Fees | Low Transaction Fees | Percentage + Fixed Fee per Transaction |

| Global Access | Permissionless & Borderless | Region-Locked & Regulated |

Pros:

- No KYC or account approval for instant onboarding

- Direct, non-custodial payments to your wallet

- Extensive multi-chain cryptocurrency support

- Fully customizable white-label solution for brand control

- Simple integration and versatile payment tools

Cons:

- Pricing information requires direct inquiry

- As a crypto-only gateway, merchants must manage volatility and accounting internally

For businesses ready to embrace the future of decentralized finance, ATLOS provides an exceptionally strong, secure, and empowering payment infrastructure.

Website: atlos.io

2. Square (Block, Inc.)

Square, developed by Block, Inc., is a powerful end-to-end payment platform particularly suited for businesses that operate both online and in-person. It stands out among companies similar to Stripe for its seamless integration of software and hardware, making it a go-to choice for omnichannel merchants. Businesses can sign up online in minutes and immediately begin accepting payments, a key advantage for those needing a rapid launch.

Square’s biggest differentiator is its comprehensive ecosystem that supports everything from point-of-sale (POS) transactions to sophisticated online stores. While Stripe is developer-first, Square is merchant-first, offering an intuitive interface that requires minimal technical expertise.

Key Features and Pricing

Square is known for its transparent, flat-rate pricing structure, which eliminates the complexity of gateway fees, PCI compliance costs, and monthly charges for basic services. This predictability is ideal for small to midsize businesses.

| Transaction Type | U.S. Processing Rate |

|---|---|

| Card-Present | 2.6% + 10¢ |

| Online Payments | 2.9% + 30¢ |

| Keyed-In Card | 3.5% + 15¢ |

| ACH Bank Transfer | 1% (minimum $1 fee) |

A notable offering is its robust invoicing system. Even on the free plan, you can send unlimited invoices and accept ACH payments at a low 1% fee. For businesses like hosting providers or VPN services that handle recurring billing, this built-in subscription management is a significant asset.

Pros and Cons

Pros:

- Rapid Onboarding: Sign up and start processing payments almost instantly, perfect for quick-to-market businesses.

- Omnichannel Excellence: Its hardware ecosystem (Register, Stand, readers) integrates perfectly with its online payment tools, unifying sales channels.

- Predictable Costs: Flat-rate pricing simplifies financial planning, especially for businesses with fluctuating sales volumes.

Cons:

- Cost at Scale: High-volume businesses may find interchange++ pricing models more cost-effective than Square's flat rates.

- Limited Customization: While user-friendly, it offers less API flexibility for developers needing deep, custom payment integrations compared to Stripe.

For businesses that require a turnkey solution for both physical and digital sales without a heavy development lift, Square provides an unmatched, integrated experience.

Website: https://squareup.com

3. Braintree (by PayPal)

A subsidiary of PayPal, Braintree is a full-stack payment platform designed for businesses that want a developer-centric solution with built-in access to a massive consumer network. As one of the more established companies similar to Stripe, it excels at providing a single, streamlined integration for accepting cards, digital wallets, and popular payment methods like PayPal and Venmo. This makes it a powerful choice for merchants targeting a broad, mobile-first audience.

Braintree’s biggest differentiator is its native integration with PayPal’s ecosystem. Through one API, businesses can tap into PayPal's 400 million+ active users and, for U.S. merchants, Venmo's socially-driven customer base. This unified approach simplifies the checkout process and can significantly boost conversion rates by offering trusted, familiar payment options.

Key Features and Pricing

Braintree offers a clear, flat-rate pricing model for its standard services, with no monthly fees for basic accounts. For high-volume businesses, it provides custom interchange++ and enterprise pricing options that can be more cost-effective at scale.

| Transaction Type | U.S. Processing Rate |

|---|---|

| Cards & Digital Wallets | 2.59% + 49¢ |

| PayPal/PayPal Credit | 3.49% + 49¢ |

| Venmo (U.S. Only) | 3.49% + 49¢ |

| ACH Direct Debit | 0.75% (capped at $5) |

A key feature is its advanced fraud protection tools, which leverage PayPal’s extensive global risk data to help merchants identify and prevent fraudulent transactions. Its robust SDKs, comprehensive developer documentation, and dedicated sandbox environment make it a strong contender for tech-savvy businesses that require deep customization and testing capabilities before going live.

Pros and Cons

Pros:

- Access to PayPal/Venmo: A single integration unlocks access to two massive consumer payment networks, enhancing customer choice and trust.

- Developer-Focused: Offers strong developer tools, SDKs, and a flexible API for building custom payment experiences.

- Scalable Pricing: Starts with simple flat rates but offers interchange++ and custom pricing for high-volume merchants, providing long-term value.

Cons:

- Longer Onboarding: The account approval and underwriting process is more involved than instant-approval aggregators like Stripe or Square.

- Regional Limitations: Venmo acceptance is currently restricted to U.S.-based merchants, limiting its appeal for some international businesses.

For businesses that prioritize developer flexibility and want to leverage the immense reach of PayPal and Venmo, Braintree offers a compelling, unified payment solution.

Website: https://www.braintreepayments.com

4. Adyen

Adyen is an enterprise-grade payment platform built for global businesses and large-scale marketplaces. Among companies similar to Stripe, it distinguishes itself by offering a unified, end-to-end infrastructure that combines a payment gateway, risk management, and acquiring services into a single system. This consolidation provides merchants with rich, unified data across all payment channels and regions, a crucial advantage for optimizing authorization rates and understanding customer behavior.

Adyen’s primary differentiator is its global reach and direct connections to card schemes, which minimize dependencies on third parties and reduce processing costs. While Stripe offers a broad suite of tools for businesses of all sizes, Adyen is laser-focused on serving complex, high-volume enterprises that require granular control over their international payment operations, from multi-currency settlements to marketplace split payments.

Key Features and Pricing

Adyen operates on a transparent Interchange++ pricing model, which is often more cost-effective for large merchants than flat-rate pricing. This structure passes the direct interchange, scheme, and acquirer fees to the merchant, plus a fixed processing fee. While pricing for U.S. transactions often requires a sales consultation, Adyen publishes its fees for many global payment methods.

| Payment Method | U.S. Processing Fee |

|---|---|

| Visa / Mastercard | Interchange++ (Varies) + $0.12 |

| American Express | Interchange++ (Varies) + $0.12 |

| ACH Direct Debit | $0.27 + $0.12 |

| Apple Pay / Google Pay | Depends on the underlying card |

Its built-in risk management suite, RevenueProtect, uses machine learning to block fraud without sacrificing legitimate transactions, a key feature for high-risk industries. Furthermore, its support for over 200 local payment methods and multi-currency payouts makes it a powerful solution for platforms like global hosting providers or online casinos needing to operate across borders seamlessly.

Pros and Cons

Pros:

- Cost-Effective at Scale: The Interchange++ model provides significant cost savings for businesses processing millions in transactions.

- Unified Global Commerce: A single integration provides access to global acquiring and a vast library of local payment methods.

- Data-Rich Insights: Consolidated data from all channels helps optimize revenue and reduce fraud with unparalleled accuracy.

Cons:

- Not for Small Businesses: The platform is designed for large enterprises and may have high volume requirements for onboarding.

- Complex Onboarding: Unlike Stripe’s instant setup, Adyen involves a more detailed, consultative onboarding process.

For established, global enterprises seeking a powerful, data-driven payment infrastructure with transparent, volume-based pricing, Adyen offers a robust and highly scalable alternative to Stripe.

Website: https://www.adyen.com

5. Checkout.com

Checkout.com is a modern, API-first global payment processor designed for large-scale digital businesses that prioritize performance and granular data. As one of the more sophisticated companies similar to Stripe, it excels in providing unified solutions for international payments, fraud detection, and payment optimization. It is particularly well-suited for enterprises requiring detailed reporting and transparent interchange-based pricing models to manage costs effectively at scale.

The platform’s core differentiator is its unified global acquiring network, which allows businesses to process payments in over 150 currencies directly without relying on a web of third-party gateways. This single-platform approach simplifies international operations, boosts acceptance rates, and gives merchants a complete view of their payment data, a critical advantage for data-driven companies like VPN providers or global SaaS platforms.

Key Features and Pricing

Checkout.com offers flexible pricing structures, including interchange++ and tailored flat-rate models, designed to become more cost-effective as transaction volume grows. While specific rates are quote-based, there are no setup fees, monthly charges, or long-term contracts, providing significant flexibility.

| Feature | Description |

|---|---|

| Pricing Model | Interchange++ and custom flat-rate options. Requires contacting sales. |

| Global Coverage | Process payments in 150+ currencies with domestic acquiring in major markets. |

| Unified API | A single API provides access to payment processing, fraud tools, and reporting. |

| Fraud Prevention | Utilizes machine learning-based tools ("Fraud Detection Pro") for advanced security. |

Its educational resources are a standout feature, offering deep dives into interchange fees and transaction components. This empowers businesses, especially high-risk merchants or hosting providers, to understand and optimize their payment processing costs instead of just accepting a bundled rate.

Pros and Cons

Pros:

- Transparent Cost Structure: Interchange++ pricing provides full transparency, making it ideal for high-volume merchants aiming to minimize costs.

- Superior International Processing: Its unified acquiring network improves cross-border transaction success rates and simplifies global expansion.

- Flexible Agreements: Typically offers month-to-month contracts without early termination fees, reducing vendor lock-in.

Cons:

- Quote-Based Pricing: No publicly listed rates for the U.S., which requires a sales consultation and may not be ideal for smaller businesses.

- Volume-Dependent Value: The platform’s full cost and feature benefits are best realized by businesses with significant transaction volumes.

For established digital businesses looking to optimize international payments and gain deep insights into processing costs, Checkout.com offers a powerful and scalable alternative.

Website: https://www.checkout.com

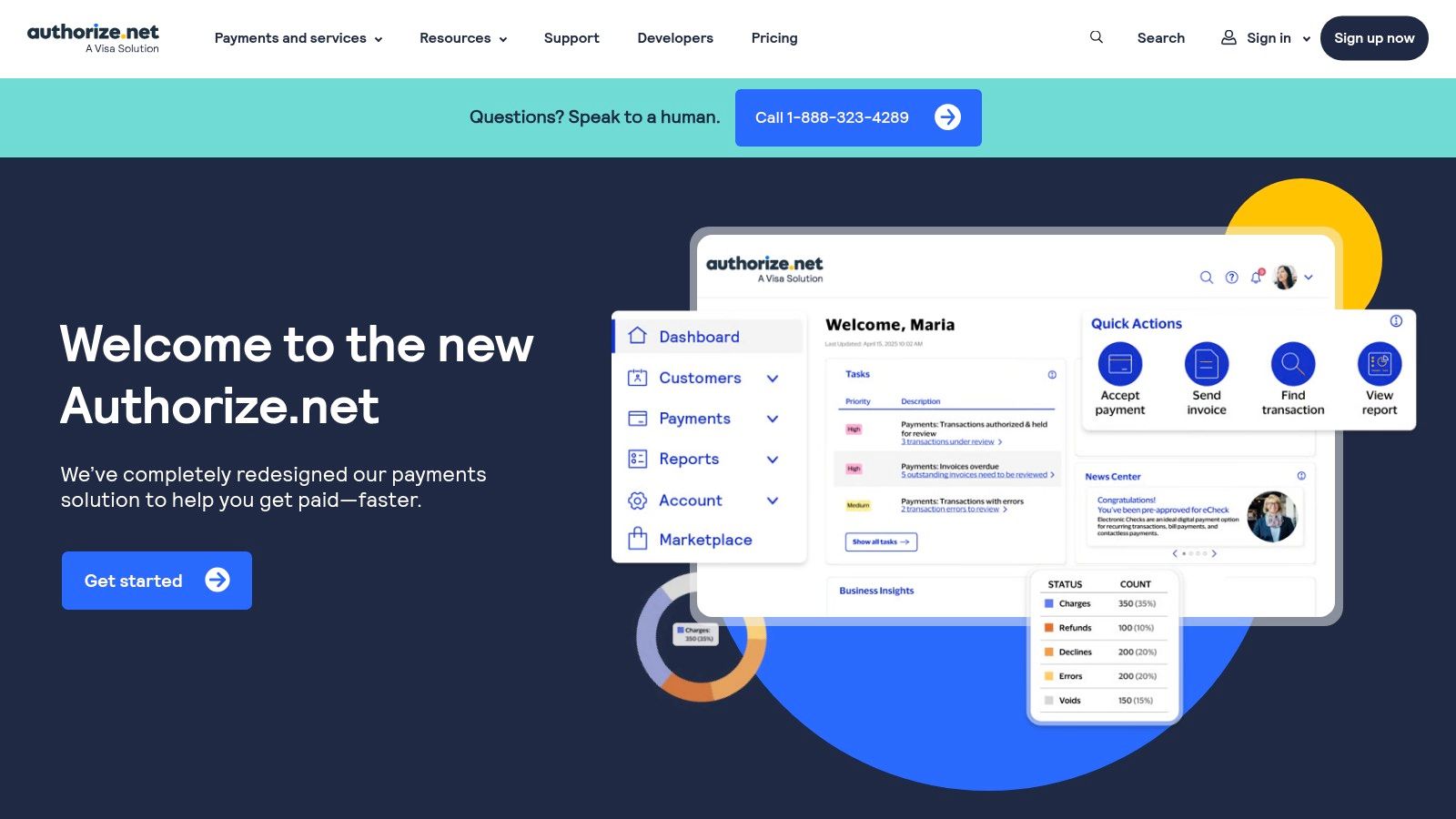

6. Authorize.net (a Visa solution)

Authorize.net, a long-standing payment gateway now owned by Visa, serves as a reliable and flexible alternative for businesses that need more control over their payment stack. It is one of the few companies similar to Stripe that clearly separates the payment gateway from the merchant account, allowing businesses to bring their own processor or opt for an all-in-one solution. This model is ideal for merchants who have established banking relationships or require specific processing capabilities not found in integrated platforms.

Authorize.net’s primary differentiator is its role as a universal translator for payments. It connects to virtually any merchant account provider and integrates with a vast ecosystem of shopping carts and CRMs. This broad compatibility gives businesses the freedom to build a custom payment solution without being locked into a single provider’s ecosystem, a crucial advantage for complex or high-risk business models.

Key Features and Pricing

Authorize.net offers transparent pricing for its gateway services, although the transaction rates themselves are set by the chosen merchant account provider. This unbundling provides clarity on gateway costs versus processing fees.

| Plan Type | U.S. Pricing Details |

|---|---|

| All-in-One | No setup fee, $25/month, 2.9% + 30¢ per transaction |

| Gateway Only | No setup fee, $25/month gateway fee, 10¢ per transaction + 10¢ daily batch fee |

The platform includes a powerful suite of tools even in its standard plans. Its Advanced Fraud Detection Suite (AFDS) allows merchants to set highly specific rules to screen transactions, which is vital for high-risk industries like gaming or online pharmacies. It also provides customer information management for secure card-on-file storage and recurring billing, essential for subscription-based services like VPN or hosting providers.

Pros and Cons

Pros:

- Broad Compatibility: Integrates with nearly any merchant account and a huge variety of e-commerce platforms, offering unparalleled flexibility.

- Transparent Gateway Fees: The monthly gateway fee is predictable, making it easy to budget for gateway costs separately from processing fees.

- Powerful Fraud Tools: The included Advanced Fraud Detection Suite provides granular control for mitigating risk.

Cons:

- Dated Interface: Some users find the administrative user interface less modern and intuitive compared to newer platforms like Stripe.

- Monthly Gateway Fees: Unlike many all-in-one solutions, there is a recurring monthly fee just for using the gateway.

- Third-Party Merchant Account: The all-in-one option uses a third-party processor, which can add a layer of complexity to support and account management.

For businesses that want to decouple their payment gateway from their merchant account or need a proven, highly compatible solution, Authorize.net remains a top-tier choice.

Website: https://www.authorize.net

7. Worldpay

Worldpay is a veteran in the payment processing space, operating as a full-stack merchant acquirer with a strong foothold in both online and in-store transactions. As one of the more established companies similar to Stripe, it appeals to a wide range of businesses from small enterprises to large corporations, particularly those who prefer a traditional, relationship-based acquiring model over a purely self-service, API-driven platform.

Worldpay stands apart through its scale and its consultative, sales-assisted approach. Unlike the instant onboarding offered by many modern processors, Worldpay tailors its solutions, providing custom quotes based on a business’s specific industry, average transaction volume, and typical card mix. This makes it a compelling option for high-volume or higher-risk merchants who need specialized support and underwriting.

Key Features and Pricing

Worldpay's pricing is not publicly listed and is determined through a negotiation process. This allows for more flexible pricing models, such as interchange-plus, which can be more cost-effective for large businesses than the flat-rate fees common with platforms like Stripe.

| Feature/Service | Description |

|---|---|

| Processing Models | Offers interchange-plus, tiered, and blended pricing models. |

| Settlement Speed | Provides next-day funding options for improved cash flow. |

| Merchant Support | Delivers 24/7 customer and technical support, essential for high-risk businesses. |

| Hardware Solutions | Often includes promotional hardware bundles for point-of-sale setups. |

The platform’s strength lies in its robust infrastructure, capable of handling significant transaction volumes with stability. For businesses in sectors like gaming, online pharmacies, or hosting, Worldpay's experience in managing complex compliance and risk profiles is a major advantage.

Pros and Cons

Pros:

- Negotiable Pricing: Custom interchange-plus and blended rate models can offer significant savings at scale.

- High-Risk Appetite: More accommodating of industries that newer platforms often decline, such as online dating or adult entertainment.

- Comprehensive Support: Extensive 24/7 support infrastructure provides a reliable safety net for mission-critical payment operations.

Cons:

- Opaque Pricing: Requires a direct sales inquiry to get a quote, which can be a slow process.

- Complex Contracts: Agreements may include monthly minimums, PCI compliance fees, and long-term commitments that require careful review.

For businesses that have outgrown simple flat-rate models and need a processor that can provide customized rates and dedicated support for complex or high-risk operations, Worldpay is a powerful and reliable choice.

Website: https://www.worldpay.com

Top 7 Stripe Alternatives Comparison

| Payment Solution | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| ATLOS Crypto Payment Gateway | Low - simple JS integration, no KYC | Low - self-hosted, no custodian | Instant settlement, control over funds | Merchants needing crypto-only payments, high-risk sectors | No KYC, direct wallet payments, wide crypto support, customizable |

| Square (Block, Inc.) | Low - fast setup, POS hardware ready | Moderate - hardware optional | Immediate payment acceptance, omnichannel | Small to midsize businesses across sales channels | Transparent pricing, hardware ecosystem, easy omnichannel support |

| Braintree (by PayPal) | Moderate - developer-focused SDKs | Moderate - developer resources | Multi-wallet acceptance, fraud protection | Merchants leveraging PayPal, Venmo, digital wallets | Single integration for cards and wallets, strong fraud tools |

| Adyen | High - enterprise onboarding | High - enterprise-scale support | Scalable global payments, multi-currency | Large merchants, marketplaces needing global coverage | Interchange++ pricing, extensive payment methods, marketplace support |

| Checkout.com | High - API-first, detailed setup | High - API & cost management | Transparent fees, international scale | Digital-first, scaling merchants with global needs | Negotiable pricing, strong fraud tools, wide currency support |

| Authorize.net (Visa) | Moderate - gateway or all-in-one | Moderate - integration & support | Flexible setups, recurring billing | Merchants wanting flexible gateway or retaining accounts | Broad compatibility, transparent pricing, advanced fraud detection |

| Worldpay | Moderate to High - custom setup | High - sales-assisted onboarding | Broad acceptance, negotiable pricing | SMB to enterprise needing traditional acquiring | Wide acceptance, 24/7 support, customizable pricing |

Choosing the Right Stripe Alternative for Your Business

Selecting the right payment processor is a critical decision that impacts your revenue, customer experience, and operational efficiency. While Stripe offers a powerful and versatile platform, the companies we've explored present compelling reasons to consider a switch. For businesses prioritizing global scale and cost optimization, Adyen and Checkout.com provide enterprise-grade solutions with transparent interchange++ pricing.

For those needing a simple, all-in-one system for both online and offline sales, Square remains a top choice with its fast setup and predictable fees. However, for forward-thinking businesses aiming to tap into the rapidly growing world of digital currencies, ATLOS stands in a class of its own. Its no-KYC, non-custodial approach empowers merchants with instant onboarding, direct control over funds, and access to a global customer base without the complexities of traditional finance. By carefully evaluating your specific needs, you can choose a partner that not only processes payments but also accelerates your growth.

Final Takeaways and Actionable Next Steps

The search for companies similar to stripe ultimately comes down to aligning a provider’s strengths with your business model’s unique demands. To make the best choice, you must move beyond a surface-level comparison of transaction fees and dig into the operational realities of each platform.

Here is a practical checklist to guide your decision-making process:

- Assess Your Risk Profile: Be honest about your industry. If you operate in a high-risk sector like gaming, VPN services, or online dating, platforms with stricter underwriting processes like Stripe or Square may not be sustainable long-term. In this case, a crypto-native solution like ATLOS or a high-risk specialist like Worldpay should be at the top of your list.

- Map Your Customer Base: Where are your customers located? If you serve a global audience, especially in regions with underdeveloped banking infrastructure, crypto payments can be a game-changer. Platforms like ATLOS eliminate cross-border transaction friction entirely, opening up new, untapped markets.

- Calculate Your True Cost of Ownership: Look beyond the advertised rates. Factor in potential costs from chargebacks, account holds, and currency conversion fees. For example, the non-custodial nature of ATLOS means you have immediate access to your funds, eliminating the cash flow interruptions that can plague merchants on traditional platforms.

- Evaluate Onboarding Speed and Complexity: How quickly do you need to start accepting payments? If speed is critical, the instant, no-KYC onboarding offered by ATLOS provides a significant advantage over the multi-day verification processes of Adyen, Braintree, or Checkout.com.

Choosing a payment gateway is not just a technical integration; it's a strategic partnership. The right provider can unlock new revenue streams, reduce operational headaches, and future-proof your business against the evolving landscape of global commerce. Whether you need the robust, enterprise-level features of Adyen or the decentralized freedom of ATLOS, the perfect Stripe alternative is out there waiting to power your next phase of growth.

Ready to embrace the future of payments and eliminate the restrictions of traditional finance? Explore the ATLOS Crypto Payment Gateway and discover how our non-custodial, no-KYC solution can provide your business with instant global access and complete financial control. Visit ATLOS Crypto Payment Gateway to start accepting crypto payments in minutes, not days.