Blockchain for Payments A Revolution in Finance

Ever sent money overseas? You probably remember the waiting, the surprise fees, and the nagging uncertainty of it all. It’s a process that feels broken because, in many ways, it is. The traditional payment networks we rely on were built for a different era. They’re slow, expensive, and about as clear as mud—a winding road with countless toll booths, each one adding cost and delay. That system is long overdue for an overhaul.

Moving Beyond Outdated Payment Systems

This is where blockchain for payments comes in. It’s not just a small tweak or a minor upgrade; it's a complete reimagining of how we send value from point A to point B. Think of it as a direct, secure, and transparent superhighway for money, built to change the fundamental rules of the game.

In this guide, we'll get into the nuts and bolts of how this technology actually works and why it represents such a massive step forward. We'll look at the real-world financial headaches it’s already solving for businesses and people just like you.

The Core Problems with Traditional Finance

Before we get to the solution, let's really dig into the problems. Old-school payment systems are bogged down by a few key issues that create frustrating experiences and eat into everyone's bottom line.

- Too Many Middlemen: A single international transfer can bounce between several "correspondent" banks. Each one takes its own cut and slows the process down, creating a complex chain where errors can happen and costs pile up.

- Glacial Settlement Times: It's not uncommon for cross-border payments to take 3-5 business days to actually clear. That’s because the system relies on batch processing, an old method that only works during weekday banking hours.

- Sky-High Transaction Costs: When you add up all the fees from intermediaries, currency conversions, and processing, the total cost can be staggering. For small businesses and individuals sending money home, these fees are a serious burden.

- A Total Lack of Transparency: Once you hit "send," your money often disappears into a black box. You and the recipient have almost no visibility into where it is or when it will show up, leading to a lot of stress and follow-up work.

This clunky setup doesn't just slow down business; it also locks millions of people out of the global economy. The high costs and complexity make it incredibly difficult for underserved populations to send and receive money efficiently.

While blockchain is a game-changer, it's part of a bigger trend. We're also seeing innovations like contactless payment systems chipping away at these old inefficiencies and making daily transactions smoother. It all points to a massive industry-wide push for faster, simpler, and more transparent financial tools.

Now, let's explore how blockchain's core benefits—speed, lower costs, and ironclad security—pave the way for this new financial future.

How Blockchain Powers Modern Payments

So, how does this all actually work under the hood? The easiest way to think about it is like a shared digital checkbook. This checkbook isn't held by one person or bank; instead, it's copied and spread across thousands of computers all over the world.

Every time a transaction happens, it’s recorded as a new 'block' of information and added to this public chain. That's the core idea of a blockchain.

Instead of one bank controlling the ledger, everyone on the network has a copy. This makes the whole system transparent and incredibly difficult to cheat. It's this shared, public ownership that makes blockchain for payments such a departure from old-school finance. To really get it, let's break down the three core concepts that make the magic happen.

Decentralization: A Network Without a Center

The first big idea is decentralization. In the traditional banking system, every single payment has to go through a central authority—think a bank or a payment processor like Visa. This setup creates a single point of failure and a natural bottleneck that slows things down and adds costs.

Blockchain completely flips this model around. There’s no central server and no single company in charge. The network is kept running by a global community of users, which means it can operate 24/7 without needing anyone's permission.

This structure is what removes the need for so many intermediaries. When you send a payment on a blockchain, you're dealing directly with the recipient. That’s a huge reason why these transactions can be so much faster and cheaper.

This isn't just a small tweak; it's a fundamental change that makes all the other benefits possible. The financial industry has certainly been paying attention. As far back as 2016, reports showed that 90% of major banks in the U.S., Europe, and Canada were already exploring blockchain. Fast forward to 2025, and 30% had moved to advanced stages of adoption, with giants like JPMorgan and Mastercard building real payment systems on this tech. You can dig deeper into these blockchain adoption statistics and trends.

Cryptographic Security: An Unbreakable Digital Seal

Next up is the security that makes this decentralized system trustworthy: cryptography. It’s basically an incredibly complex digital lock-and-key system that protects every transaction.

Each payment is digitally "signed" using a unique cryptographic key that only the sender has access to. This signature proves ownership and makes sure the funds can only be sent by the person who actually owns them. Once signed, the transaction is sent out to the entire network.

From there, it gets bundled with other recent transactions into a 'block'. This new block is then cryptographically linked to the one before it, forming that famous 'chain'. Trying to alter an old transaction would mean changing every single block that came after it—on thousands of computers at the same time. It's a practically impossible task.

Consensus: How Everyone Agrees

Finally, we have the consensus mechanism. If there’s no central boss to approve transactions, how does the network agree on which ones are valid? This is where consensus protocols come in.

Think of these as the rules of the road that everyone on the network agrees to follow. Before a new block of transactions can be added to the chain, a majority of the network has to verify and agree that everything in it is legitimate. This process ensures a few critical things:

- No Double-Spending: It stops someone from trying to spend the same digital money twice.

- Transaction Validity: It confirms the sender actually has the funds they’re trying to send.

- Ledger Integrity: It keeps a single, undisputed history of every transaction that has ever happened.

Once the network reaches consensus, the new block is locked in, the payment is complete, and the chain grows longer. This entire cycle—from a cryptographic signature to network-wide consensus—is what lets blockchain process payments securely and efficiently, all without the slow, expensive middlemen of the traditional financial world.

The True Advantages of Blockchain Payments

Okay, so we know how blockchain works in theory, but why should anyone actually care? This is where the rubber meets the road. The reasons for switching to blockchain for payments aren't just minor tweaks; they represent a fundamental redesign that fixes some of the biggest headaches in traditional finance.

The most obvious win is the massive cost reduction. Think about a typical international bank transfer. Your money bounces between several intermediary banks, and each one takes a cut. It's an expensive, layered process that eats into the amount that actually arrives. Blockchain just gets rid of the middlemen.

By creating a direct, peer-to-peer line between sender and receiver, it dramatically cuts down the fees. For a small business operating on tight margins or a person sending money home to family, those savings are a big deal.

Slashing Wait Times from Days to Seconds

After cost, the next game-changer is speed. We've all been there—waiting 3-5 business days for an international wire to clear. That's because the old-school banking system runs on batch processing, mostly during business hours. It's slow, clunky, and can seriously disrupt cash flow.

Blockchain, on the other hand, never sleeps. It runs 24/7/365, no holidays, no bank hours. Transactions are often confirmed and settled in minutes, sometimes even seconds.

This isn't just a convenience; it's a completely new way of doing business. A freelance developer in Argentina can finish a project for a client in Germany and get paid almost instantly, instead of waiting the better part of a week. That's the kind of efficiency we're talking about.

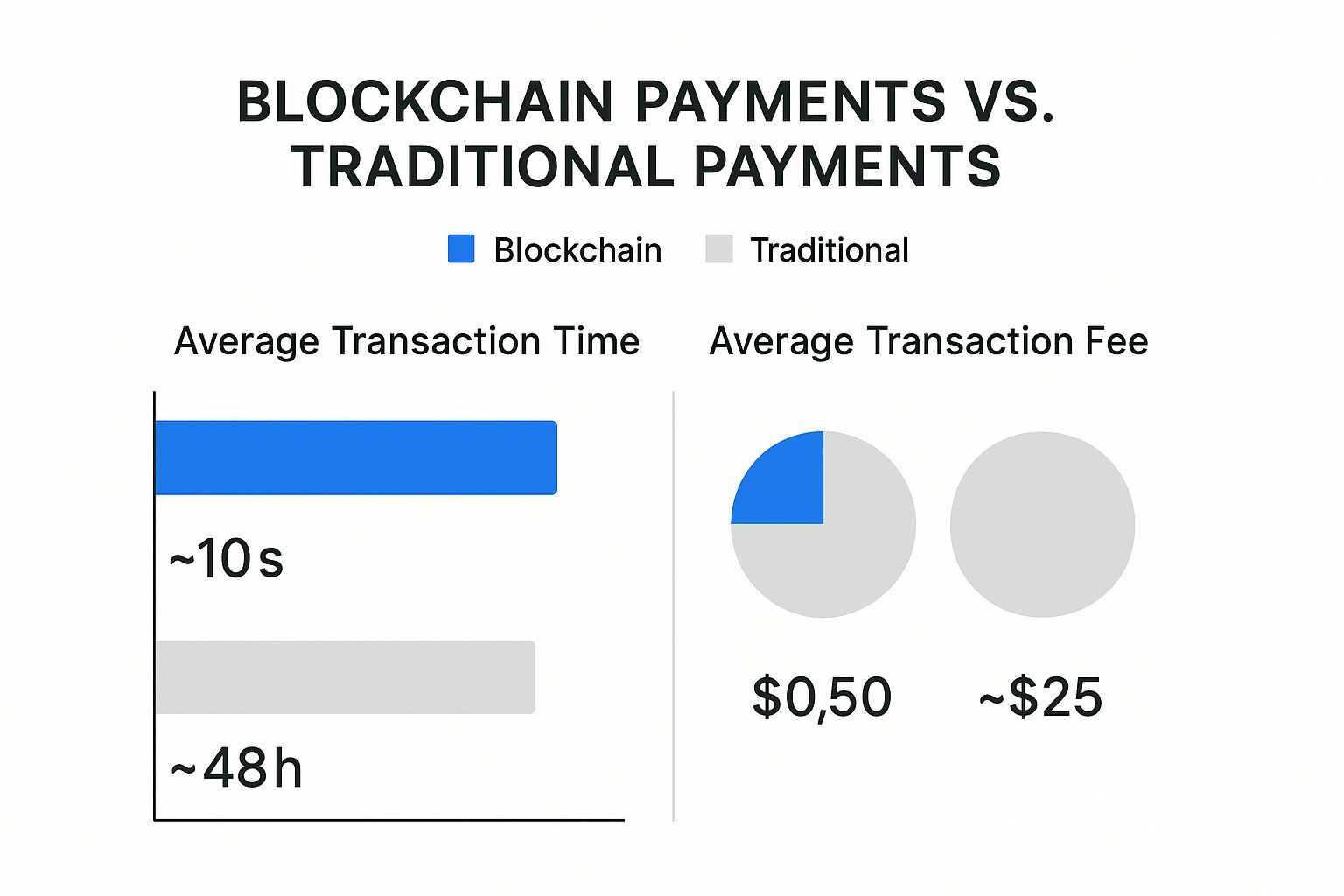

To really see the difference, a side-by-side comparison is helpful.

Traditional Payments vs Blockchain Payments

This table breaks down how the two systems stack up on the most important features.

| Feature | Traditional Payment Systems | Blockchain Payment Systems |

|---|---|---|

| Transaction Speed | 3-5 business days, especially for international transfers. | Minutes or even seconds, settled in near real-time. |

| Transaction Costs | High, due to multiple intermediary banks and fees. | Significantly lower, with minimal network fees. |

| Security | Centralized servers are vulnerable to single-point-of-failure attacks. | Decentralized and cryptographically secured, making it extremely difficult to alter records. |

| Transparency | Opaque; limited visibility into transaction status. | Transparent; all transactions are recorded on an immutable public ledger. |

| Accessibility | Requires a bank account, often with strict documentation and geographic limitations. | Open to anyone with an internet connection and a digital wallet. |

The gap between the two isn't small—it's a massive leap forward in how we can move value around the globe.

The image below gives you a clear visual of just how different these two worlds are when it comes to speed and cost.

As you can see, the improvements aren't just incremental. They're transformative.

Fortifying Security Through Decentralization

Security is probably the most critical advantage, and it’s where blockchain truly shines. Traditional financial systems store everything in centralized databases—basically a giant honeypot for hackers. One successful breach can expose the sensitive data of millions.

Blockchain’s design is fundamentally more secure. Because the ledger is copied and spread across thousands of computers all over the world, there's no single point of failure to target. To fake a transaction, a criminal would have to hack a majority of the computers on the network at the same time. It’s a near-impossible task, making blockchain payments incredibly resistant to fraud.

Promoting Greater Financial Inclusion

When you combine lower costs, better security, and instant access, you get something really powerful: financial inclusion. Right now, an estimated 1.4 billion adults worldwide don't have a bank account. They're shut out of the global economy because traditional banking is too expensive, too far away, or requires documents they just don't have.

Blockchain knocks down those barriers. All you need is a basic smartphone and an internet connection to get started. This simple fact opens the door for millions of people to:

- Receive payments directly: A coffee farmer in a remote village can sell beans to a buyer in another country and get paid without ever stepping into a bank.

- Access financial services: Anyone can tap into lending and savings platforms through Decentralized Finance (DeFi) apps.

- Send money affordably: A migrant worker can send more of their hard-earned money home to their family, instead of losing a huge chunk to transfer fees.

Ultimately, blockchain for payments is about more than just slick technology. It's about building a fairer, more efficient, and more accessible financial system for everyone, no matter where they live.

Blockchain Payments in the Real World

The idea of using blockchain for payments has officially moved out of the lab and into the real world. It's no longer just a theoretical concept debated by developers; it's actively solving some of finance's most stubborn problems for global corporations and everyday people alike.

We’re seeing this technology make the biggest splash where the old systems are most broken. By looking at a few key examples, you can see how blockchain is already changing how money moves around the globe. The most powerful applications are popping up in cross-border remittances, business-to-business payments, micropayments, and even everyday retail.

Each of these areas plays to a unique strength of blockchain, whether that's cutting out the slow banking networks, untangling complex supply chains, sparking new creator economies, or just giving shoppers another way to pay at the checkout.

Revolutionizing Cross-Border Remittances

Anyone who’s ever sent money to family abroad knows the sting of high fees and frustrating delays. Traditional remittance services can skim 5-7% right off the top, and it can take days for the money to actually arrive. That wait creates real uncertainty for families counting on that income.

This is exactly the kind of problem blockchain was built to solve. By using stablecoins—digital currencies pegged to something stable like the U.S. dollar—a person can send money across borders in minutes, and for a tiny fraction of the cost.

The process completely bypasses the old-school correspondent banking system. Instead of the payment getting handed off between multiple banks, it goes directly from the sender's digital wallet to the recipient's. It's a straight line, which means more of the money gets to the people who actually need it.

Streamlining B2B Payments and Supply Chains

The corporate world isn't immune to payment headaches. International business-to-business (B2B) deals are often a mess of complicated invoices, currency conversions, and settlement periods that can stretch for days, tying up critical working capital.

Blockchain brings automation and transparency to the table with smart contracts and a shared ledger. Companies can set up payments to be released automatically the moment goods are confirmed as delivered.

Think about a coffee importer in Europe buying from a farmer in Colombia. A smart contract could execute the payment the instant the shipment's arrival is logged on the blockchain. This eliminates delays, cuts down on manual paperwork, and builds a ton of trust between trading partners.

This kind of efficiency helps businesses run smoother and manage their cash flow with far more certainty. What used to be a multi-day waiting game becomes an instant, verified exchange of value.

Enabling the Micropayment Economy

Many online business models just don't work with traditional payment systems. It’s simply not cost-effective to charge someone a few cents to read an article or tip a streamer when the credit card fee is higher than the payment itself.

This is where blockchain unlocks something entirely new: micropayments. Because transaction fees on certain blockchains can be as low as a fraction of a penny, it suddenly becomes practical for creators and platforms to earn revenue from tons of tiny transactions.

This opens up a whole new world for creators to get paid directly by their audience. Instead of just relying on ads or monthly subscriptions, they can get immediate compensation for every single piece of content someone enjoys, completely changing the economics of being a creator.

The Rise of Retail Crypto Payments

While it's still early days, paying for everyday things with crypto is becoming more common. A growing number of online and physical stores are starting to accept digital assets, giving their customers more choice. This shift is often pushed by shoppers who hold crypto and want to use it directly, rather than cashing out to traditional currency first.

Merchant adoption is gaining serious momentum, especially in tech-focused markets. In the U.S., for example, the use of crypto for payments by merchants is expected to see 82.1% growth between 2024 and 2026. Industries like online gaming and software are at the forefront, since their digital-first nature is a perfect fit for digital currencies. You can dive deeper into these trends with these cryptocurrency payment adoption statistics.

These real-world cases prove that blockchain payments aren't just hype. The technology is here, it works, and it's already delivering real value across the global economy.

So, What's Holding Blockchain Payments Back?

For all its promise, blockchain isn't a magic bullet for payments just yet. There are some real, practical hurdles to clear before it can truly compete with the systems we use every day. Think of it less as a finished product and more as a powerful engine that's still being fine-tuned. The industry is actively working through these growing pains, focusing on performance, regulation, and simply making it easier for everyone to use.

The road ahead is all about making the technology faster, fitting it into global financial rules, and ensuring it’s not just for the tech-savvy.

The Scalability Dilemma

One of the biggest conversations in the blockchain world is about scalability. Let’s be frank: early blockchains like Bitcoin are slow. They can only handle a handful of transactions per second. Compare that to a network like Visa, which breezes through tens of thousands in the same amount of time. That's a massive performance gap.

Imagine your local coffee shop trying to run every single latte sale on a network that slow. The whole system would grind to a halt, with payments taking forever to confirm and fees skyrocketing. That’s the scalability problem in a nutshell, and it’s been a major roadblock for using blockchain in busy retail settings.

But the good news is that developers are tackling this head-on with some clever solutions:

- Layer 2 Networks: Think of these as express lanes built on top of the main blockchain highway (the "Layer 1"). They bundle up tons of small transactions, process them quickly and cheaply off to the side, and then record a single, simple summary back on the main chain. It's a game-changer for speed and cost.

- Sharding: This approach is like breaking a massive database into smaller, more manageable pieces, or "shards." By splitting the work, the entire network can process transactions in parallel, dramatically boosting its overall capacity.

These kinds of innovations are what will finally make blockchain fast enough for the real world.

Navigating the Regulatory Maze

Another challenge is that the rulebook for crypto and blockchain is still being written. Governments and financial watchdogs across the globe are trying to figure out how to handle this new technology. This lack of clear, consistent regulation makes big companies and banks nervous about jumping in with both feet.

For a major corporation, operating in a regulatory gray area is just too risky. They need clear answers on everything from anti-money laundering (AML) and customer verification (KYC) to how taxes are handled before they can fully embrace blockchain payments.

The fog is starting to lift, though. We're seeing regulators provide more concrete guidance, often treating blockchain payment systems as a natural next step for finance. This shift is slowly lowering the barrier to entry for the big, established players.

Making It User-Friendly

Let's face it: for most people, using crypto feels complicated. You have to worry about private keys, long, confusing wallet addresses, and figuring out which network you're on. It's a far cry from the simplicity of tapping your credit card. This complexity—what we call user experience (UX) friction—is a huge barrier to getting everyday people on board.

If blockchain is going to move from a niche hobby to an everyday payment tool, it has to be as easy and intuitive as Venmo or Apple Pay. The industry gets this. We're now seeing a new wave of user-friendly wallets and services designed to hide the complexity, making it simple for anyone to send and receive money securely without needing a degree in computer science.

The Interoperability Puzzle

Finally, there’s the challenge of interoperability. Right now, the blockchain world is a collection of islands. The Bitcoin network doesn't naturally talk to the Ethereum network, and moving value between them often requires using a clunky, sometimes risky, third-party "bridge." It’s like having several different internets that can’t link to each other.

For a truly global payment system to work, money needs to flow seamlessly between any blockchain, anywhere. That’s why so many projects are now focused on building cross-chain protocols—think of them as the bridges and tunnels that will finally connect these separate islands. Solving the interoperability puzzle is the key to creating a truly interconnected and powerful web of value.

What’s Next for Global Transactions?

The world of blockchain payments isn't standing still; it's accelerating. We're on the cusp of a financial system that's more connected, efficient, and even automated. Several key trends are already taking shape, moving from abstract ideas to real-world applications that will define how money moves tomorrow.

One of the biggest waves on the horizon is the emergence of Central Bank Digital Currencies (CBDCs). Imagine a digital dollar or a digital euro, issued directly by a country's central bank and powered by blockchain. This isn't just theory anymore—governments around the globe are actively exploring this concept, aiming to merge the rock-solid trust of national currency with the speed and transparency of a digital ledger.

Building Faster, More Stable Networks

While governments explore CBDCs, stablecoins are already filling a crucial gap. These are digital currencies pegged to a stable asset, like the U.S. dollar, which removes the wild price swings often associated with crypto. They act as a reliable bridge, giving people the speed of a digital transaction without the volatility, making them perfect for day-to-day use.

The need for stable and scalable options is exploding. As of early 2024, the number of cryptocurrency users hit an estimated 560 million worldwide. To put that in perspective, this user base grew at a compound annual rate of 99% between 2018 and 2023. Traditional payment methods? They grew by about 8% in the same period. You can dig into more of the data behind this explosive growth in cryptocurrency ownership.

This massive growth creates a new problem: network congestion. That's where Layer 2 scaling solutions come in. Think of them as express lanes for a blockchain. They are technologies built on top of a main blockchain to make transactions incredibly fast and cheap.

Layer 2 solutions bundle transactions together off the main chain, solving the scalability puzzle. This makes it practical to use blockchain for everything from your morning coffee to processing millions of tiny micropayments instantly.

A Future of Automated Finance

Looking even further ahead, we see blockchain merging with the Internet of Things (IoT), paving the way for a fully automated economy. It sounds like science fiction, but the foundation is being laid today.

Picture this: your electric car finishes charging and automatically pays the station on the spot. Or your smart fridge notices you're out of milk, orders more, and pays for it without you lifting a finger. This machine-to-machine world needs a payment rail that is instant, secure, and built to handle a staggering volume of small transactions. Blockchain is perfectly suited for the job.

Taken together, these trends aren't just incremental improvements. They point toward a smarter, more seamless financial future for everyone.

Frequently Asked Questions

It's completely normal to have a lot of questions when you're exploring a new technology, especially one that deals with money. Let's tackle some of the most common ones about using blockchain for payments to clear things up.

We’ll dig into security concerns, untangle some common terms, and look at the practical side of getting started. The goal here is to give you the solid information you need, whether you're a business owner weighing your options or just curious about where payments are headed.

Are Blockchain Payments Truly Secure?

Yes, at its core, the technology is incredibly secure. Think of it this way: instead of one single ledger in one place (like a bank's server), the transaction record is copied and spread across thousands of computers worldwide. This decentralized nature makes it practically impossible for a bad actor to cheat the system—they'd have to hack a majority of the computers at the exact same time. On top of that, every transaction is sealed with powerful cryptographic encryption, which is like a digital lock that proves it's authentic and hasn't been tampered with.

But there's a catch. The security of the blockchain itself doesn't protect you from simple mistakes. The responsibility is still on you to protect your own access. That means keeping your private keys safe and only using reputable wallets and payment gateways.

What Is the Difference Between Crypto and Blockchain Payments?

This is a great question, and it's easy to get these two mixed up. An analogy might help here.

Imagine blockchain is the internet itself—the underlying network and infrastructure. A crypto payment is like sending an email. The email (the payment) uses the internet (the blockchain) to get from point A to point B.

- Blockchain Payment: This is the big-picture term. It refers to any transaction that happens on a blockchain network. It could be a payment made with a cryptocurrency, a stablecoin (which is pegged to a real-world currency like the US dollar), or even a digital version of a stock.

- Crypto Payment: This is much more specific. It means a payment made using a cryptocurrency like Bitcoin or Ethereum as the actual money being sent.

So, you can think of it like this: all crypto payments are blockchain payments, but not all blockchain payments are necessarily crypto payments.

How Can a Small Business Accept Blockchain Payments?

You might be surprised by how simple it is to get set up. You don't need to be a tech wizard. The easiest way for any business to jump in is by using a crypto payment gateway or processor. These services do all the complicated work for you.

A good payment gateway will plug right into your website's checkout, just like adding PayPal or Stripe. It handles the transaction, lets your customers pay with their preferred digital currency, and—this is the important part—usually gives you the option to convert the payment into your local currency (like USD or EUR) instantly. This completely removes the headache of worrying about price swings.

Essentially, it makes accepting crypto as straightforward as adding any other payment method you're already familiar with.

Ready to unlock the speed, security, and global reach of cryptocurrency for your business? ATLOS Crypto Payment Gateway makes it simple. Start accepting payments directly to your wallet with no KYC and no account approvals. Integrate seamlessly and take full control of your funds today. Learn more and get started at ATLOS.io.