Choosing a Payment Gateway for Gambling

Picking the right payment gateway for gambling is one of the most important—and difficult—decisions an iGaming operator has to make. This isn't like setting up a standard e-commerce shop. The online gambling world is a 'high-risk' industry, which means your average payment processor won't touch it.

A specialized gateway is so much more than a tool for taking deposits. It's the very foundation of your security, your compliance, and the trust you build with your players.

Why Gambling Payments Are a High-Stakes Game

Running the financial side of an online casino is a whole different beast than your typical online store. A retail business worries about things like shipping. An iGaming operator has to deal with a tangled mess of global regulations, a much higher risk of fraud, and a constant barrage of chargebacks. All of these factors put the industry into a special financial category.

One of the biggest issues is simply how high-risk industries struggle with banking. Standard banks and processors see gambling as a huge reputational and financial risk. They'll either flat-out refuse to work with you or hit you with sky-high fees, forcing you to find a specialized payment solution.

The Core Challenges for Operators

For a gambling business, payment processing is about more than just moving money. It's a strategic defense against threats that could shut you down if you don't get it right.

Here’s what operators are up against:

- Higher Fraud and Chargeback Rates: Online gambling is a magnet for fraud and disputed transactions (chargebacks). This can lead to massive financial losses and even bigger penalties from card networks like Visa and Mastercard.

- A Maze of Regulations: Gambling laws are a patchwork that changes from country to country, and sometimes even state to state. Your payment gateway has to be smart enough to block payments from places where you aren't licensed, keeping you out of legal trouble.

- Earning Player Trust: Nothing scares off a customer faster than a clunky or unreliable payment system. Players need to feel absolutely certain their money is safe and that they can withdraw their winnings quickly and easily.

The global gambling industry is a financial giant. We're talking estimated revenues of $347 billion in 2024 from an incredible $4.2 trillion in wagers. But even with that kind of money flowing, operators are constantly fighting payment processing battles because of that high-risk label, which fuels more fraud and chargebacks. You can find more insights on the shifting payments landscape in gambling over at edgardunn.com.

At the end of the day, a dedicated payment gateway for gambling is your first line of defense. Think of it as a vital partner that keeps your finances stable, handles compliance automatically, and builds the player confidence you need to survive in this cutthroat market.

Must-Have Features for Your Payment Gateway

Picking a payment gateway for gambling is a lot like hiring a head of security for a high-end casino. You're not just looking for someone to handle the money; you need a partner who can manage the unique pressures and risks of the iGaming world. Your average, off-the-shelf payment solution simply isn't built for this high-stakes environment.

A top-tier gateway has to be smart, vigilant, and globally-minded. It's a combination of sophisticated tech and a real, ground-level understanding of what makes this industry tick. These features aren't just bells and whistles—they're the absolute foundation for a secure, profitable, and trustworthy online gambling platform.

Advanced Security and Fraud Prevention

In online gambling, security isn't just a feature; it's the entire game. The sheer volume of money changing hands makes iGaming sites a massive target for all kinds of fraud. Your payment gateway is your first, and most important, line of defense.

Think of it this way: your gateway needs more than just a simple firewall. It needs an intelligent, AI-driven system that watches transaction patterns in real-time. This kind of tech learns what normal player behavior looks like and can spot suspicious activity instantly, stopping fraud before it ever hits your balance sheet.

You should be looking for a gateway armed with:

- AI-Powered Fraud Detection: This isn't just a buzzword. It means the system can identify and block fraud by recognizing strange patterns—like a flurry of deposits from different locations or unusual betting amounts.

- Comprehensive Chargeback Management: You need proactive tools that help you fight and manage chargebacks. Without this, you're left exposed to high fees and penalties that can threaten your entire merchant account.

- Strict Compliance Protocols: Built-in Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are non-negotiable. They're essential for verifying player identities and keeping you on the right side of regulations, wherever you operate.

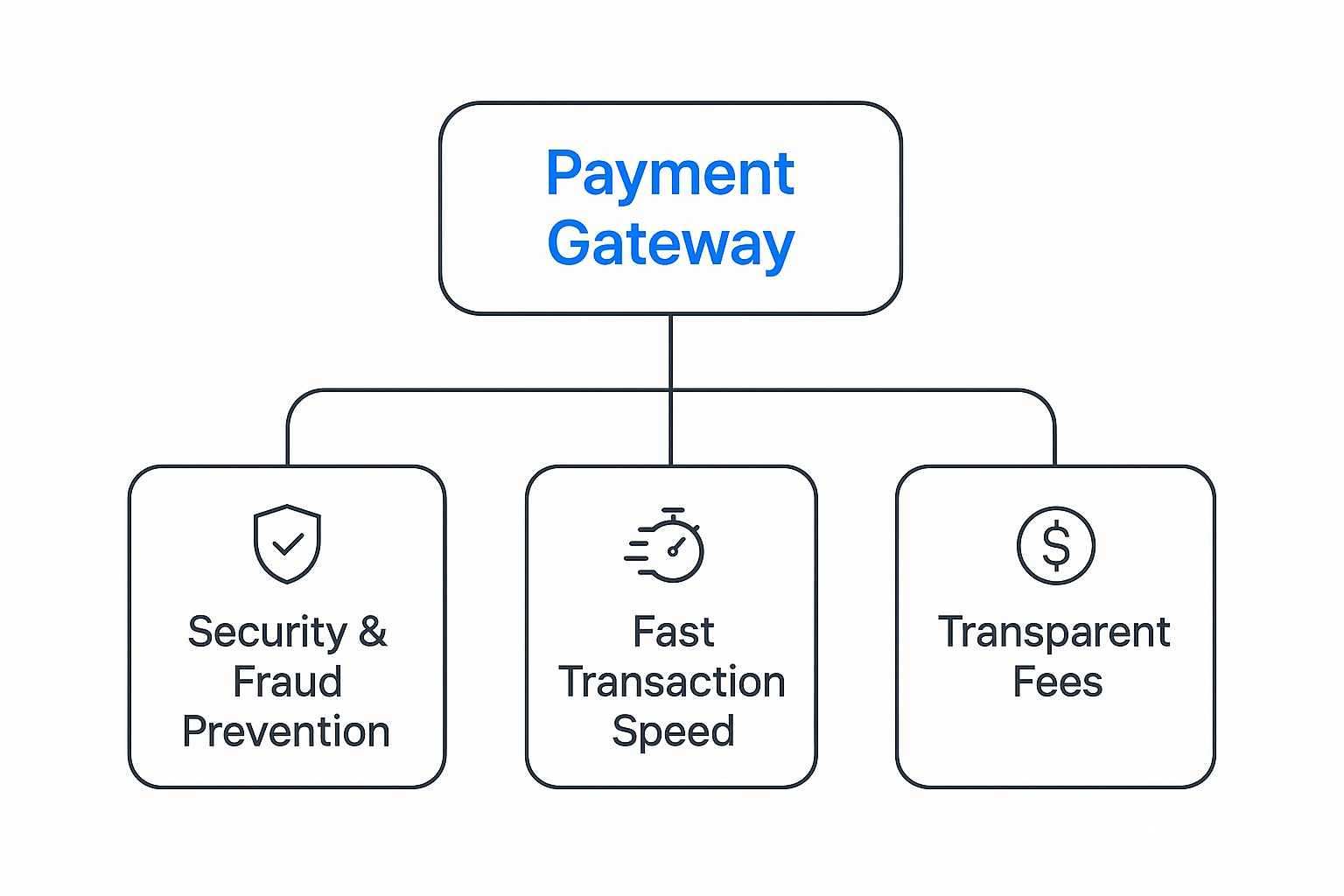

This diagram really breaks down the core pillars of a solid payment gateway for a gambling operation, zeroing in on security, speed, and transparency.

As you can see, while fast transactions and clear fees are vital, it's that robust security and fraud prevention system that forms the bedrock of any payment solution you can truly rely on in the iGaming space.

High Approval Rates and Smart Routing

A declined deposit is so much more than a failed transaction—it’s very often a lost customer. A player who runs into a payment failure is incredibly likely to just give up and head straight to one of your competitors. This is where intelligent transaction routing becomes your secret weapon.

Smart routing is a system that automatically directs a transaction to the acquiring bank most likely to approve it. If the first bank says no, the system instantly reroutes it to another, and another, until it goes through. This all happens in milliseconds, totally behind the scenes.

A gateway with high transaction approval rates isn't just a nice-to-have; it's a direct driver of your revenue. Getting more deposits over the line is fundamental to keeping players on your site and growing your profits, especially during major betting events when transaction volumes go through the roof.

The player never knows anything went wrong. They just get a smooth, successful deposit experience that builds their confidence in your platform. A gateway that consistently nails high approval rates gives you a massive advantage.

Global Reach with Multi-Currency Support

The iGaming market is a global one, and your payment gateway has to be, too. Players from around the world expect to deposit and cash out in their own local currency without having to think twice about exchange rates or hidden fees. If you can't offer that, you're creating friction and shutting the door on huge segments of your potential audience.

A capable payment gateway for gambling must provide:

- Broad Currency Acceptance: The ability to process payments in dozens, if not hundreds, of different currencies is a baseline requirement.

- Dynamic Currency Conversion (DCC): This feature lets players see the exact transaction amount in their home currency right at the point of deposit. It’s all about transparency and making them feel comfortable.

- Localized Payment Methods: It goes beyond just currencies. The best gateways also support the payment methods people actually use in different regions, like local e-wallets or specific bank transfer systems that are more popular than credit cards in certain countries.

When you cater to a global audience with payment options that feel local to them, you're sending a clear message: your platform is accessible, trustworthy, and built for them, no matter where they live. That kind of global capability is absolutely essential for scaling your business and breaking into new markets.

Navigating the Maze of Global Compliance

For any online gambling business, compliance isn't just a box to tick—it's the bedrock of your entire operation. Trying to navigate the tangled web of global regulations on your own is a surefire way to get hit with massive fines, lose your license, and ruin your reputation for good. This is exactly where a specialized payment gateway for gambling proves its worth, acting as a crucial partner.

Think of it less as a simple processor and more as a legal expert hardwired into every transaction. This system doesn't just move money around; it actively enforces the rules, shielding your platform from the heavy hand of regulators. It's the gatekeeper that makes sure you're playing by the book, no matter where your customers are.

The Cornerstones of iGaming Compliance

Staying on the right side of the law means you have to master a few key protocols. These aren't suggestions—they're non-negotiable requirements for any legitimate operator. A solid payment gateway is designed to automate these critical checks and make your life a whole lot easier.

The three main pillars of compliance you'll encounter are:

- Payment Card Industry Data Security Standard (PCI DSS): This is the gold standard for protecting credit card information. Every business that takes card payments needs to be PCI DSS compliant, but the scrutiny is dialed up to eleven for high-risk industries like gambling. Your gateway must encrypt and securely store all sensitive data, protecting both you and your players from costly breaches.

- Know Your Customer (KYC): Regulators demand that you know who your players are. This isn't about being nosy; it's about verifying identities by collecting documents like government-issued IDs and proof of address. It confirms a player is who they claim to be and is of legal age to gamble.

- Anti-Money Laundering (AML): This is all about monitoring transactions to spot and report anything that looks shady. Gambling sites can be a tempting target for criminals looking to wash dirty money, and robust AML procedures are your first line of defense against being used as a pawn in their schemes.

A gateway built for the iGaming world handles these checks behind the scenes. It can flag suspicious deposits and verify identities without making legitimate players jump through a bunch of hoops.

Managing a Patchwork of Jurisdictional Rules

The real headache begins when you start operating across borders. The rules laid down by the UK Gambling Commission (UKGC) can look completely different from those of the Malta Gaming Authority (MGA). One country might ban credit card deposits entirely, while another has incredibly specific age verification mandates.

A top-tier payment gateway for gambling acts as a dynamic rule engine. It automatically figures out where a player is and applies the correct local regulations on the fly. This is the secret to scaling your business and entering new markets without constantly looking over your shoulder.

Trying to manage this manually would be a nightmare of spreadsheets and human error. The right payment partner simplifies it all. It uses geo-location data to block players from prohibited countries and enforce local payment rules, ensuring you stay compliant everywhere you do business.

A key piece of this puzzle involves understanding the different rules around taxes on sports betting winnings, which can vary wildly from one country to the next. Your gateway should provide clean, detailed transaction records to help you and your players manage these obligations.

The Cost of Getting Compliance Wrong

Make no mistake, the penalties for non-compliance are brutal. They can easily sink an otherwise thriving operation. Fines can soar into the millions, licenses get revoked, and executives can even face legal trouble. In recent years, regulators have handed out penalties exceeding $100 million to operators for failing on AML and social responsibility grounds.

Beyond the immediate financial hit, the damage to your reputation can be permanent. Players simply won't trust a platform that’s been caught breaking the rules, and they'll leave in droves. This is why choosing a payment gateway for gambling with a proven track record in compliance isn’t just another business decision—it’s a strategic move for your long-term survival.

How Payments Shape the Player Experience

For a player, the thrill of a big win doesn't feel real until the cash is sitting in their bank account. The payment process isn’t some boring technical step—it’s the final, make-or-break moment of their entire experience. A slow, clunky, or unreliable payout is one of the quickest ways to lose a player for good.

We live in a world of instant everything, and today's players bring those expectations with them. They want the same speed and simplicity when handling their money. A clunky deposit flow or a withdrawal that drags on for days creates friction, breeds frustration, and plants a seed of doubt.

This is where a modern payment gateway for gambling becomes more than just a tool for moving money; it's a powerful way to keep your players happy. It’s all about building trust and showing them you value their time and money as much as they do.

Why Frictionless Transactions Are Non-Negotiable

Think of a player's first deposit as their first handshake with your platform. If that first touch is awkward—a declined card, a confusing interface, a drawn-out verification process—it immediately sours their entire perception. In fact, this initial friction can cause abandonment rates of over 25% before a player even places a single bet.

On the other hand, a seamless deposit that takes just a couple of clicks builds instant confidence. When players can fund their accounts without a second thought, they feel secure and are far more likely to stick around and explore your games. The goal is to make the payment process so smooth it’s practically invisible.

The core principle is simple: the easier it is for players to deposit and withdraw, the more likely they are to stay and play. A positive payment experience is a direct investment in customer loyalty and lifetime value.

This is even more true for withdrawals. Let's be honest, this is where the trust is truly tested. Delayed payouts are a massive source of anxiety and a top driver of customer churn. A gateway that delivers fast, reliable withdrawals proves your platform is legitimate and reinforces the idea that you’re a brand players can count on.

Catering to Player Preferences with Diverse Options

There's no such thing as a one-size-fits-all payment method. A player in Germany might prefer an instant bank transfer, while someone in Canada might reach for their credit card by default. Limiting your payment options is like telling a huge chunk of your potential market you’re not interested in their business.

A top-tier payment gateway for gambling fixes this problem by bundling a wide range of payment choices into a single, cohesive checkout.

Essential Payment Categories to Offer:

- Cards and E-Wallets: These are the classics for a reason. Offering Visa, Mastercard, and popular e-wallets like Skrill or Neteller is the absolute baseline.

- Instant Bank Transfers: Powered by Open Banking, these are becoming incredibly popular. They're fast, secure, and let players pay directly from their bank accounts without sharing card details.

- Alternative Payment Methods (APMs): This broad category covers everything from prepaid cards to local mobile payment apps that are dominant in specific countries or regions.

By offering this kind of variety, you let players use the method they already know and trust. It’s a simple gesture, but it goes a long way in reducing friction and building a solid foundation for brand loyalty.

A critical factor here is the availability of instant withdrawals. Players want quick, easy access to their winnings, and as we've noted, slow payouts are a major reason they leave. Platforms that nail both instant payouts and flexible deposits are the ones that win on player retention. You can find more insights on payment processing industry stats and trends over at PayCompass.

In the end, the payment experience is every bit as important as the quality of your games. It’s the final touchpoint that decides whether a player feels valued and secure—and whether they’ll be coming back for more.

The Future of iGaming Payment Technology

The payments world moves fast. For any iGaming operator who wants to stay competitive, simply keeping up isn't enough—you have to be one step ahead. Offering the standard credit card and e-wallet options is now just table stakes. The real edge comes from embracing technology that delivers what modern players truly crave: instant, secure, and cheap transactions.

These aren't just small tweaks to the old system; they're a complete overhaul of how money moves online. By getting on board, you can slash your operational costs while giving players the kind of frictionless payment experience that keeps them coming back. It’s time to stop thinking of your payment gateway for gambling as just a cashier and start seeing it as a strategic weapon.

The Rise of Open Banking and Pay by Bank

One of the biggest game-changers we’ve seen in years is Open Banking. Forget the technical jargon. Think of it as a secure handshake between a customer's bank and a trusted third party, giving that third party permission to initiate a payment directly. This simple idea has given birth to "Pay by Bank" solutions, and they're quickly becoming the go-to for deposits and withdrawals in the iGaming world.

Instead of fumbling for a credit card and typing in all 16 digits, a player can approve a payment straight from their bank account with a couple of taps, usually right inside their bank’s own app. The advantages over traditional card payments are huge:

- Lower Transaction Costs: You get to bypass the expensive card networks, which means the fees are a fraction of what you’d normally pay.

- Enhanced Security: No sensitive card details are ever shared, which drastically cuts down the risk of fraud and data breaches.

- Higher Success Rates: Direct bank payments are far less likely to get blocked by issuing banks, so more of your players’ deposits go through the first time.

You don't have to take my word for it—the numbers speak for themselves. The big players in this space are already handling massive volumes, which tells you the market is more than ready for direct bank payments. A modern payment gateway for gambling isn't complete without this option.

Take Trustly, for example. In 2024, they solidified their spot as a powerhouse in iGaming payments by processing a mind-boggling $100 billion in instant Pay by Bank transactions. Their tech, backed by a smart AI data engine, makes customer verification a breeze and gets deposits credited almost instantly. It's so smooth that many returning players can log in and top up their accounts in under 20 seconds. If you want a deeper look at these trends, the latest iGaming payments report is well worth a read.

Cryptocurrencies: A New Frontier for Gambling Payments

Another trend that's impossible to ignore is the role of cryptocurrency in online gambling. For a long time, currencies like Bitcoin and Ethereum felt like a niche hobby, but they've now become a mainstream payment method on a growing number of platforms. Because they're decentralized, they offer some unique perks that really appeal to a certain type of player.

Adding a crypto-friendly payment gateway for gambling can open your doors to a whole new audience and offer a solid alternative to the old-school banking system. But it’s not a decision to be taken lightly—you need to weigh the good against the bad.

Weighing the Pros and Cons of Crypto Payments

| Aspect | Advantages of Crypto | Challenges to Consider |

|---|---|---|

| Anonymity & Privacy | Players love that they can make transactions without handing over their life story or banking details. | This privacy can be a headache for KYC and AML compliance, forcing you to use specialized transaction monitoring tools. |

| Transaction Speed | Crypto transfers can be incredibly fast, often settling in just a few minutes, no matter where your player is located. | Sometimes, popular blockchains get congested, which can cause frustrating delays and spike transaction fees. |

| Volatility | Accepting crypto can be a goldmine if its value shoots up. | The flip side is that crypto values can also plummet, creating a significant financial risk for both you and your players. |

| Global Access | Cryptocurrencies don't care about borders. They're perfect for reaching players in countries with clunky banking infrastructure. | The rules and regulations around crypto are a patchwork quilt, changing drastically from one jurisdiction to the next. |

Jumping on these new technologies is no longer optional for operators who want to do more than just survive. Whether it's the raw efficiency of Pay by Bank or the borderless reach of crypto, the future of the payment gateway for gambling is all about giving players more choice, better security, and a faster, more enjoyable experience.

How to Choose the Right Payment Partner

Picking a payment gateway for your gambling business is a huge decision, one that goes way beyond a simple tech hookup. This is about finding a long-term strategic partner. Get it right, and you've got a partner fueling your growth. Get it wrong, and you're in for a world of operational nightmares. This final step is all about seeing past the slick sales pitch and really digging into what a provider can do for you.

Think of it like you're scouting a star player for your team. You wouldn’t just glance at their basic stats; you'd want to see how they perform in high-stakes, championship games. It's the exact same principle here. A provider's proven track record in the high-risk iGaming world isn't just a "nice-to-have"—it's an absolute deal-breaker.

Vetting Your Potential Gateway Provider

To get past the marketing fluff, you need to be armed with the right questions. Any payment partner worth their salt will have clear, direct answers for everything on this checklist. If they get shifty or vague, that’s a massive red flag.

Here's a simple framework to run your evaluation:

- Industry Specialization: Don't beat around the bush. Ask them how much experience they have with iGaming merchants. How many gambling operators are they currently serving? Do they actually get the unique headaches that come with chargebacks and compliance in this industry?

- Transparent Fee Structure: Demand a full, line-by-line breakdown of their fees. Be on the lookout for sneaky costs like setup charges, monthly minimums, or extra penalties for chargeback disputes. A good partner has nothing to hide and offers pricing you can actually predict.

- Integration and Tech Support: How good is their API documentation, really? What kind of technical support can you expect, both during the integration process and after you go live? You need 24/7 access to experts who know the gambling space inside and out.

Choosing a payment partner is about more than just technology; it's about trust. The provider you select will handle every dollar that flows through your business, so their reliability and expertise are paramount to your success.

Key Questions for Your Shortlist

Once you've narrowed it down to a few serious contenders, it's time to drill down with more specific questions. How they answer these will tell you everything you need to know about their real-world capabilities and whether they can truly handle the intense demands of an online gambling platform.

Essential Questions to Ask:

- What is your average transaction approval rate for gambling merchants? A high approval rate is everything. It directly impacts your revenue and keeps your players happy and in the game.

- How do your fraud prevention tools specifically tackle iGaming risks? You want to hear more than just generic buzzwords. They should be talking about features and algorithms built specifically to spot and stop fraud patterns unique to online gambling.

- Can you provide case studies or references from other online gambling operators? This is the ultimate test. Actually talking to their existing clients is the single best way to find out how a provider really performs when the pressure is on.

Frequently Asked Questions

Stepping into the world of iGaming finance can feel a bit like learning a new language. To clear things up, we've put together some straight-to-the-point answers to the questions we hear most often from operators.

What Makes a Gambling Payment Gateway "High-Risk"?

A payment gateway for gambling gets the 'high-risk' label because the industry, by its very nature, deals with more chargebacks, fraud, and tricky regulations than your average online store. It's not a reflection on your business's stability; it's all about the unique challenges of the transactions themselves.

This high-risk status isn't a bad thing—it just means you need specialized gear. These gateways are built with sophisticated fraud filters, airtight KYC/AML compliance tools, and dedicated systems to manage the volume of disputes common in iGaming.

It’s like the difference between a family sedan and an armored truck. Both get you from A to B, but one is specifically designed to handle a much tougher environment.

What Are the Typical Fees for a Gambling Gateway?

Fees can swing pretty wildly from one provider to the next, but the basic structure is usually the same. You'll want to get a crystal-clear picture of all potential costs before you commit to anything.

Here’s what you’ll typically encounter:

- Discount Rate: This is the percentage they take from every single transaction.

- Per-Transaction Fee: A small, flat fee tacked onto each payment.

- Monthly or Setup Fees: Some providers charge a one-time setup fee or a recurring monthly cost for using their service.

Because of the higher risk profile, expect to pay more per transaction than a standard e-commerce business would. My advice? Insist on a complete, transparent fee schedule. Hidden costs are profit killers.

How Difficult Is It to Integrate a New Payment Gateway?

Thankfully, this has gotten much simpler over the years. Most modern gateways are designed for developers, offering well-documented APIs (Application Programming Interfaces) that make the whole process relatively painless.

The exact difficulty really depends on your current tech stack and your team's expertise. But here’s the key: a provider's support is just as important as their technology. You should partner with a gateway that offers hands-on technical support and clear integration guides. It makes all the difference in getting you up and running quickly and without headaches.

Ready to offer seamless, secure, and instant crypto payments on your platform? ATLOS Crypto Payment Gateway provides a no-KYC, direct-to-wallet solution designed for the unique demands of the iGaming industry. Start accepting crypto payments today by visiting https://atlos.io.