How to Accept Bitcoin Payments for Your Business

Thinking about accepting crypto payments can feel like a big leap, but the upside for your business is too good to pass up. When you start accepting Bitcoin, you're not just adding another payment option; you're opening the door to a new global audience, slashing your transaction fees, and saying goodbye to fraudulent chargebacks for good.

Getting started is actually quite straightforward. You just need a digital wallet to hold your funds and a payment gateway, like ATLOS, to handle the nuts and bolts, making the checkout process smooth for everyone.

Why It's a Game-Changer to Accept Bitcoin

Beyond saving money, taking Bitcoin payments sends a clear message: your brand is modern and ready for what's next. It shows you're not stuck in the past, which can be a huge draw for a tech-savvy crowd. This is about more than just a new icon on your website; it’s a fundamental upgrade to your business operations.

Think about it this way: traditional credit card payments chip away at your profits with fees that can be anywhere from 2% to 4%. With Bitcoin, especially on efficient networks like Lightning, you’re looking at fees that are often just a fraction of a cent, no matter how big the sale.

Go Global in an Instant

One of the biggest wins here is the ability to sell to anyone, anywhere, without the usual headaches. Bitcoin is borderless—no single bank or government controls it. That means all the old friction of international business just melts away.

Here’s what that looks like in practice:

- Zero Cross-Border Fees: Sell something to a customer halfway across the world, and you won't lose a dime to currency conversion or ridiculous international wire fees.

- Reach Untapped Markets: Millions of people around the globe don't have access to traditional banking but are actively using crypto. By accepting Bitcoin, you can finally reach them.

- Attract a Loyal Community: You immediately tap into a passionate base of crypto users who go out of their way to support businesses that accept their preferred currency.

And this isn't some tiny niche market. By 2025, global crypto ownership is hovering around 12.4%. The Asia-Pacific region is a powerhouse, with 6 of the top 10 countries for adoption. Europe sits at 8.9%, Latin America at 15.2%, and Africa is the one to watch, with a massive 19.4% jump in users. The customer base is already there, waiting for you. You can dive deeper into these global cryptocurrency adoption statistics to see the full picture.

Kiss Chargebacks and Fraud Goodbye

If you run an online business, you know the sting of a fraudulent chargeback. A customer disputes a perfectly valid transaction, and you're forced to issue a refund and often pay a penalty. With Bitcoin, that whole problem vanishes.

Bitcoin transactions are final. They work just like digital cash. Once a payment is sent and confirmed on the blockchain, it’s done. The sender can't pull it back. This built-in finality is your shield against chargeback fraud, protecting every dollar you earn.

This is a massive relief, especially for businesses in high-risk sectors that are prime targets for this kind of fraud. When you process your payments through a gateway like ATLOS, you get the ironclad security of Bitcoin without complicating the checkout experience for your customers. It's truly the best of both worlds.

Setting Up Your Crypto Foundation

Before you can start accepting Bitcoin payments, you need a place for the funds to land. Think of a digital wallet as your business's bank account for crypto. Getting this first step right is crucial, as it lays the groundwork for a secure and hassle-free payment system.

You’re looking at two main paths here: custodial or non-custodial wallets. They each have their place, and the best one for you really depends on your business goals.

A custodial wallet is handled for you by a third party, which is often your payment gateway. For the vast majority of online merchants, this is the way to go. A service like ATLOS builds a wallet right into its platform, taking care of all the technical heavy lifting behind the scenes. It's a straightforward approach that lets you focus on your business, not on managing private keys.

On the other hand, a non-custodial wallet puts you in the driver's seat. You hold the private keys—the string of characters that proves ownership of your funds—and you are 100% responsible for them. This option is popular with businesses that intend to hold large amounts of Bitcoin as a long-term asset, since it provides the ultimate level of personal control.

Fortifying Your Wallet Security

No matter which type of wallet you choose, security isn't just a feature; it's a necessity. From the moment you set it up, you need to lock it down to protect your business.

First things first: turn on two-factor authentication (2FA) everywhere you can. This is a simple but powerful security layer. It requires a second code, usually from an app on your phone, to log in or approve a transaction. Honestly, it’s one of the single most effective deterrents against unauthorized access.

Next up is your recovery phrase (sometimes called a seed phrase). This is a unique list of words that acts as a master backup for your entire wallet. If you ever lose your device, this phrase is the only way to get your funds back.

Treat your recovery phrase like the keys to your business safe. Write it down physically, store it in a few different secure, offline places, and never, ever take a screenshot or save it as a digital file.

Managing Bitcoin Price Volatility

Let's talk about the elephant in the room: volatility. The fluctuating price of Bitcoin makes many business owners nervous, and for good reason. It can feel like a risk to your bottom line, but a smart strategy can completely remove that risk from the equation.

The big question you need to answer is: do you want to keep the Bitcoin you receive, or do you want to convert it to your local currency (like USD or EUR) immediately?

- Hold Bitcoin (HODL): This strategy is for businesses that see Bitcoin as a long-term asset and are willing to ride out the market's ups and downs. It's a way to diversify your company's treasury into a new asset class.

- Instant Conversion: This is the safest and most common approach for merchants. Payment gateways like ATLOS offer an auto-conversion feature that instantly swaps incoming Bitcoin payments for fiat currency at the moment of the transaction.

By choosing instant conversion, you sidestep the volatility problem entirely. You get paid the exact invoice amount in your preferred currency, making your revenue just as stable and predictable as if you were accepting credit cards. This gives you the best of both worlds: the benefits of Bitcoin payments—like low fees and no chargebacks—without any of the price risk. It's why most merchants see it as just a better payment rail.

Choosing Your Bitcoin Integration Method

When you decide to accept Bitcoin, you’re at a crucial fork in the road. You really have two main paths: handling everything yourself with direct wallet-to-wallet payments or using a specialized crypto payment gateway like ATLOS to automate the whole shebang. This isn't just a technical decision; it fundamentally impacts how you manage your money, what your checkout looks like, and how you deal with the day-to-day realities of crypto.

Going the direct route gives you ultimate control. You just share your wallet address, a customer sends over the Bitcoin, and that’s it. No third-party fees, and you hold the keys from the moment the transaction is confirmed. Honestly, this can work just fine for someone with super low volume—maybe a freelance consultant who sends out a few invoices a month.

The catch? You're on the hook for everything. That means manually checking every single payment, confirming it on the blockchain, and taking on all the risk if the price of Bitcoin decides to take a nosedive an hour after you get paid.

Why a Payment Gateway Is the Go-To for Most Businesses

For the vast majority of businesses, especially anyone in e-commerce or with a steady stream of customers, that manual approach just doesn't scale. This is precisely where a payment gateway becomes a game-changer. It's the difference between trying to sort and deliver all your mail by hand versus plugging into a modern logistics network.

A gateway puts the entire process on autopilot, from creating an invoice to confirming the payment has landed. It plugs right into the checkout you already use on platforms like Shopify or WooCommerce, giving your customers the smooth, professional experience they expect. If you're running a store with dozens or hundreds of orders a day, the automation from a service like ATLOS isn't a "nice-to-have"—it's an absolute must to keep your operations from grinding to a halt.

But the real magic of a gateway is how it manages risk. Features like instant conversion to fiat currency mean you can accept Bitcoin without ever losing sleep over its price swings. The gateway locks in the exchange rate the moment your customer clicks "pay," guaranteeing you receive the exact dollar amount you invoiced. Every single time.

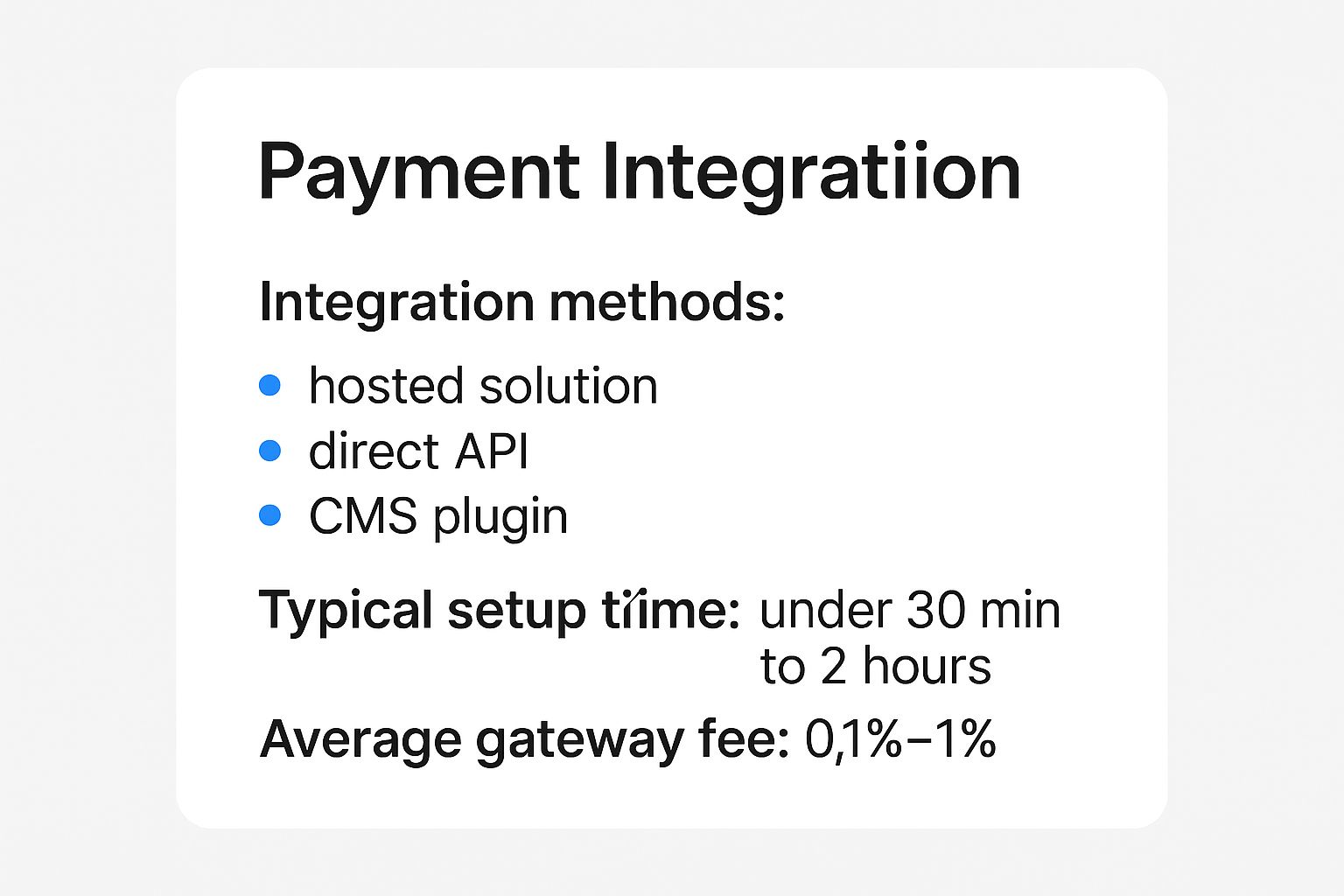

This image gives a great overview of what integrating a modern gateway actually looks like.

As you can see, today's gateways are built for flexibility and speed. We’re talking about remarkably fast setups and low fees, which makes this technology truly accessible for businesses of all shapes and sizes.

Making the Right Call for Your Business

So, how do you pick the right path? It all boils down to your business model, your transaction volume, and how much hands-on work you're willing to do. To make it crystal clear, let's look at the core differences.

Payment Method Comparison Direct vs Payment Gateway

This table lays out the practical trade-offs you're making between the two methods. Think of it as a cheat sheet to help you see where your business fits best.

| Feature | Direct Wallet Payments | Crypto Payment Gateway (e.g., ATLOS) |

|---|---|---|

| Transaction Fees | Only Bitcoin network fees (usually low) | A small processing fee (e.g., 0.1%–1%) |

| Setup & Integration | Simple wallet setup; manual integration | Automated plugins, custom APIs |

| Customer Experience | Manual; customer copies address & amount | Professional, integrated checkout with QR codes |

| Volatility Risk | Full exposure to price fluctuations | Eliminated with instant fiat conversion |

| Record Keeping | Manual tracking of all invoices/payments | Automated financial reports & transaction logs |

In the end, while direct payments have that pure, decentralized appeal, a payment gateway provides the professional toolkit needed to actually run and grow a business. It perfectly bridges the gap between the seamless e-commerce experience your customers already know and the powerful, global reach of the Bitcoin network. For any merchant serious about growth, it's the clear winner.

Getting Hands-On: A Practical Walkthrough with ATLOS

Alright, let's get into the nuts and bolts. The idea of integrating a payment gateway like ATLOS can sound intimidating, but I've found it's surprisingly straightforward. I'll walk you through the entire process, from signing up to creating your first payment link, so you can see just how quickly you can start accepting Bitcoin—no developer needed.

First Things First: Account Setup and Verification

Your journey begins, as you'd expect, by creating an account. Head over to the ATLOS website, sign up with your email, and set a strong password. Once you're in, you'll land on the main dashboard, which will become your mission control for all things crypto payments.

Before you can start accepting real payments, there’s a quick verification step. This is standard practice for any legitimate financial service and is all about security and compliance. You'll need to provide some basic details about your business. My advice? Have digital copies of your business registration and a government-issued ID ready to go. It’ll make the whole process fly by.

Connecting ATLOS to Your Online Store

If you're running a store on a platform like WooCommerce or Shopify, this is where things get really easy. ATLOS has dedicated plugins that do all the heavy lifting for you.

You just need to:

- Find the ATLOS plugin in your platform’s app or plugin marketplace.

- Install it with a single click.

- Activate it.

The final piece of the puzzle is linking your store to your ATLOS account. This is done with API keys, which are just secure credentials that let the two systems talk to each other. You’ll generate these keys in your ATLOS dashboard and then just copy and paste them into the plugin’s settings on your website. That’s it. A one-time setup and you've officially added Bitcoin as a checkout option for your customers.

Dialing in Your Payment and Payout Settings

With the technical connection made, it's time to customize the settings to match how you want to do business. The biggest decision you'll make here is what to do with the Bitcoin you receive. Do you want to keep it as BTC or cash it out to your local currency right away?

Inside the ATLOS dashboard, you can easily set your payout preferences. From my experience, most business owners opt to enable automatic conversion to USD or another fiat currency.

Why is this so popular? This feature completely eliminates the risk of crypto price swings. If you invoice for $100, you get $100—period. The customer pays in Bitcoin, but you receive the exact fiat amount you charged.

Here's a look at the ATLOS dashboard where you manage these settings. It's clean and intuitive.

As you can see, finding your wallet settings, checking transaction history, or tweaking your conversion rules is simple and doesn't leave you guessing.

Payment Options for Every Kind of Business

But what if you don't run a traditional e-commerce store? Many of us don't. Think freelancers, consultants, or any service-based business. ATLOS is built for these scenarios, too, with custom payment links and buttons.

The process is incredibly slick. You simply define the amount you need to charge in your currency of choice—say, $150 USD. ATLOS then generates a unique, shareable payment link for that specific invoice. You can pop this link into an email, a PDF invoice, or even send it in a text message.

When your client clicks it, they’re taken to a secure ATLOS payment page. The system instantly calculates the current Bitcoin equivalent and provides a simple QR code to scan and pay. It brings a professional, automated payment experience to service invoicing that was once only available to large online retailers.

Navigating Tax and Legal Requirements

Adding a new way for customers to pay you always comes with a bit of homework, and Bitcoin is no different. While diving into the legal and tax side of things isn't the most exciting part of this process, getting it right from the very beginning is absolutely essential. I always advise clients to chat with a professional for advice specific to their local laws.

The single most important thing to understand is how tax authorities see Bitcoin. In most places, it’s treated as property, not currency. This distinction is everything, as it completely changes how you report your income.

What this means in practice is that you have to record the fair market value of every transaction in your local currency (like USD or EUR) at the exact moment the sale happens. So, if you sell a shirt for $50, you book $50 in revenue—even though the payment arrived as Bitcoin.

This is exactly where a payment gateway like ATLOS becomes a lifesaver. Can you imagine manually looking up the precise exchange rate for every single sale? It would be an absolute nightmare. A good gateway handles all of that for you, generating the detailed reports you'll need when tax time rolls around.

Understanding Key Compliance Rules

Beyond taxes, you’ll run into two acronyms pretty quickly: KYC (Know Your Customer) and AML (Anti-Money Laundering). These are standard regulations designed to prevent fraud and illegal financial activity.

The good news is that established payment processors are built to handle this for you. They manage the heavy lifting on compliance, making sure your business operates within the rules without forcing you to become a legal expert.

Think of your payment gateway as a compliance partner. It’s working in the background, handling the complex verification and monitoring so you can stay focused on running your business.

We've seen a huge improvement in regulatory clarity over the past few years. A perfect example is from the 2025 Global State of Crypto Report, which found that crypto ownership in the United States shot up to nearly 24% of adults surveyed. This kind of mainstream adoption gives more and more customers the confidence to actually spend their crypto.

Staying Informed and Prepared

The crypto rulebook is always being updated, so keeping yourself in the loop is key. It’s smart to pay attention to how your local tax agencies are treating digital assets.

For instance, if you're running a business in Australia, you’d want to be aware of the ATO's new cryptocurrency audit focus to make sure you’re prepared.

At the end of the day, the rules might seem a bit complex, but they are entirely manageable with the right tools and a proactive approach. By using a dedicated payment processor and staying on top of your obligations, you can accept Bitcoin with confidence, knowing you�’ve got all your bases covered.

Thinking about accepting Bitcoin for your business? You probably have a few questions. That's a good thing. Jumping into crypto payments is a big step, and it's smart to get a handle on the practical side of things first.

Let's walk through some of the most common questions I hear from merchants just like you.

"Isn't Bitcoin Risky or Insecure?"

Security is always the first thing people ask about, and for good reason. The good news is, Bitcoin itself is incredibly secure. Its decentralized design, the blockchain, is built to resist the kind of fraud that's so common with credit cards.

The real key to security for your business isn't the Bitcoin network itself, but how you connect to it. This is where a trusted payment gateway comes in. Using a service like ATLOS means you're not managing the raw, technical side of things alone. They build security right into the platform, protecting your funds and your customers' data from the get-go.

"I've Heard Bitcoin Transactions are Slow and Expensive. Is That True?"

That’s a common misconception, usually based on how Bitcoin worked years ago. Back then, yes, transactions could be slow and fees could get high. But the technology has evolved dramatically.

Today, we have solutions that make Bitcoin payments fast and cheap enough for any type of sale.

- The Lightning Network: This is the big game-changer. It's a second layer built on top of Bitcoin that allows for lightning-fast transactions. We're talking nearly instant.

- Minimal Fees: With the Lightning Network, transaction fees are often less than a single penny. This makes Bitcoin a viable option for everything from a $2 coffee to a $2,000 product.

When you use a modern gateway, it automatically uses these advanced networks. Your customer gets a quick, cheap payment experience, and you don’t have to worry about the technical details.

"How Do Refunds Work if Bitcoin Transactions are Final?"

It's true—you can't just "reverse" a Bitcoin transaction like a credit card charge. But that doesn't mean refunds are a problem. The process is just different, and honestly, a lot more straightforward.

To issue a refund, you simply create a new, separate transaction back to the customer. You're not reversing the original payment; you're sending them a new one for the refund amount.

A quality payment gateway makes this easy. From your merchant dashboard, you can typically initiate a refund in just a few clicks. You often get the choice to refund in crypto or your local currency, which keeps the whole process professional and simple for everyone involved.

Ready to unlock a global customer base and eliminate chargeback fraud? ATLOS Crypto Payment Gateway makes it simple to accept Bitcoin and other cryptocurrencies instantly, with no KYC and seamless integration. Start accepting crypto payments today at https://atlos.io.